Automotive Start-Stop System Market by Component (Engine Control Unit, 12V DC Converter, Battery, Neutral Position Sensor, Wheel Speed Sensor, Crankshaft Sensor, Alternator), Fuel Type (Gasoline, Diesel, CNG, Electric), Vehicle Type (Motorcycles, Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), Distribution Channel (Original Equipment Manufacturer (OEM), Aftermarket), and Region 2025-2033

Market Overview:

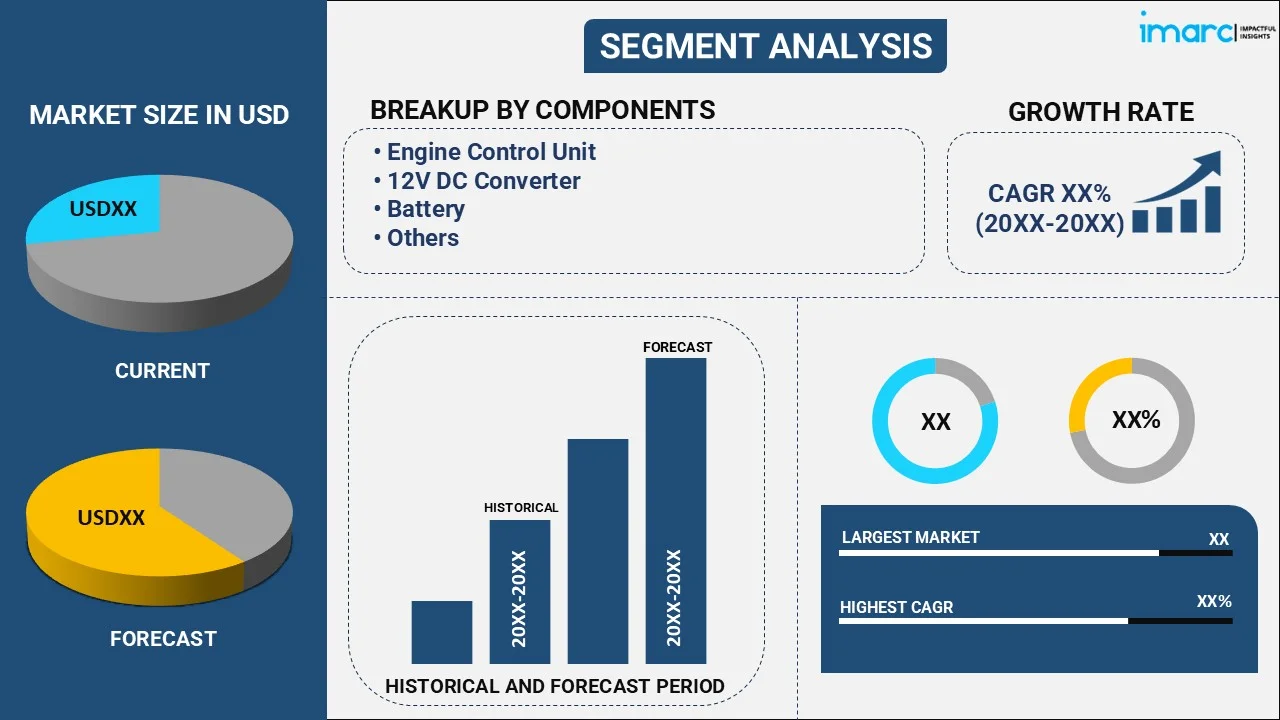

The global automotive start-stop system market size reached USD 75.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 119.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. Significant growth in the automotive industry, increasing demand for fuel-efficient vehicles, and extensive research and development (R&D) activities represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 75.6 Billion |

|

Market Forecast in 2033

|

USD 119.2 Billion |

| Market Growth Rate 2025-2033 | 5.2% |

An automotive start-stop system is a feature that automatically turns off the engine when the vehicle is stationary and then restarts it when needed. It consists of a battery, control module, sensors, transmission system, and starter motor. It uses sensors to detect when the vehicle is stationary or in motion. An automotive start-stop system is an innovative feature that helps to improve the efficiency of modern cars and reduce their environmental impact. It also helps to reduce fuel consumption by turning off the engine when the vehicle is idling, reduce emissions of harmful pollutants, such as carbon dioxide and nitrogen oxides, improve overall efficiency, and provide a comfortable driving experience. As a result, the automotive start-stop system is widely used in motorcycles, passenger cars, light commercial vehicles, and heavy commercial vehicles.

To get more information on this market, Request Sample

Automotive Start-Stop System Market Trends:

Rising Demand for Fuel Efficiency

The surge in demand for fuel efficiency is one of the key growth drivers in the automotive start-stop system market. With the volatility of global fuel prices and a growing awareness of the environment, customers are increasingly looking for cars with improved mileage and reduced emissions. Start-stop technology helps toward achieving this goal by turning off the engine at periods of idling, like in a traffic jam or during signals, thus preventing unnecessary fuel consumption. The technology is especially useful in urban areas with constant stop-and-go traffic where wastage of fuel is prevalent. Due to increasingly stringent emissions regulations and increased regulatory pressure, manufacturers are now implementing start-stop technology across all vehicle classes to ensure environmental standards without compromising performance. Aside from minimizing end users' fuel expenses, the systems also enable decreased carbon emissions, thus gaining popularity among developed and emerging economies. With governments and consumers focusing on sustainable mobility, fuel-efficient technologies such as start-stop systems are in greater demand.

Engine Management Breakthroughs

Continued improvements in engine management systems are increasing the efficiency and reliability of vehicle start-stop systems. Contemporary start-stop technology relies considerably on accurate cooperation between the engine control unit (ECU), battery, alternator, and sensors in providing smooth functioning without harming vehicle performance. Advances like intelligent battery management systems (BMS), sophisticated ECUs, and low-noise starter motors have enhanced the responsiveness and reliability of start-stop mechanisms substantially. These technologies resolved initial customer issues about engine component wear and tear as well as possible delays upon restarting. In addition, producers are creating systems that would be capable of adjusting to different driving habits and environmental conditions, making it easier to integrate them in lower-end as well as higher-end vehicle classes. More advanced engine management capabilities also facilitate greater compatibility with other efficiency-oriented systems like regenerative braking and energy recovery. Consequently, technological advances in engine management are contributing significantly towards widening the applicability and efficiency of start-stop systems to a broad range of vehicles.

Hybrid and Electric Vehicle Expansion

The growth of hybrid and electric vehicles (EVs) is revolutionizing the automotive industry and shaping the evolution of start-stop systems. Although EVs don't need conventional start-stop systems because they are electrically driven, hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs) utilize the same functions to maximize fuel economy and efficiency. Hybrid vehicle start-stop systems are combined with intricate powertrain architectures in these vehicles to control the transition between internal combustion engines and electric motors smoothly. This integration assists in reducing fuel consumption during driving under low loads and idling while not compromising the performance of the vehicle. As carmakers around the world are heavily investing in electrification plans, demand for hybrid cars remains on the upswing, particularly in markets where full electric vehicle adoption is still in the process of transition. Therefore, the start-stop system market enjoys its essential position in hybrid platforms. The increasing popularity of hybrids as a stepping-stone between traditional and fully electric vehicles guarantees continued demand for high-end, integrated start-stop solutions.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive start-stop system market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on component, fuel type, vehicle type, and distribution channel.

Component Insights:

- Engine Control Unit

- 12V DC Converter

- Battery

- Neutral Position Sensor

- Wheel Speed Sensor

- Crankshaft Sensor

- Alternator

The report has provided a detailed breakup and analysis of the automotive start-stop system market based on the component. This includes engine control unit, 12V DC converter, battery, neutral position sensor, wheel speed sensor, crankshaft sensor, and alternator. According to the report, wheel speed sensor represented the largest segment.

Fuel Type Insights:

- Gasoline

- Diesel

- CNG

- Electric

A detailed breakup and analysis of the automotive start-stop system market based on the fuel type has also been provided in the report. This includes gasoline, diesel, CNG and electric. According to the report, gasoline accounted for the largest market share.

Vehicle Type Insights:

- Motorcycles

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

The report has provided a detailed breakup and analysis of the automotive start-stop system market based on the vehicle type. This includes motorcycles, passenger cars, light commercial vehicles, and heavy commercial vehicles. According to the report, passenger cars represented the largest segment.

Distribution Channel Insights:

- Original Equipment Manufacturer (OEM)

- Aftermarket

A detailed breakup and analysis of the automotive start-stop system market based on the distribution channel has also been provided in the report. This includes original equipment manufacturer (OEM) and aftermarket.

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for automotive start-stop system. Some of the factors driving the Asia Pacific automotive start-stop system market included extensive research and development (R&D) activities, rising expenditure capacities of consumers, and significant growth in the automotive industry.

Key Regional Takeaways:

Asia Pacific Automotive Start-Stop System Market Analysis

Asia Pacific is a leading region in the automotive start-stop system market due to the presence of a huge automotive production base, growing fuel prices, and the adoption of stricter emission regulations in nations such as China, Japan, South Korea, and India. China, in turn, is pushing very strongly towards lower carbon emissions and improved fuel efficiency, leading to extensive start-stop system adoption in passenger and commercial vehicles. Within India and Southeast Asia, increasing urban traffic congestion and increased consumer concern over fuel savings are favoring market expansion. Furthermore, government subsidies for fuel-saving technologies and increasing middle-class vehicle ownership also drive demand. Japan and South Korea, where high levels of automotive technology are prevalent, are leaders in implementing smart engine management systems, driving the adoption of advanced start-stop solutions. The location of large global and regional car manufacturers supports technological diffusion, while sustained investment in hybrid and compact vehicle platforms keeps Asia Pacific as a long-term growth driver for the adoption of start-stop systems.

Europe Automotive Start-Stop System Market Analysis

Europe is an established market for automotive start-stop systems driven primarily by the continent's robust regulation of vehicle emission reduction and fuel efficiency improvement. The European Union's strict CO₂ goals and green regulations have pushed manufacturers to include start-stop technologies as standard equipment on new model cars, especially in Germany, France, and the UK. Diesel car sales, which previously dominated European markets, have traditionally used start-stop technology to ensure emissions compliance. The continent also paces the adoption of hybrid and plug-in hybrid cars, which further supports combined start-stop capabilities. Secondly, consumers in Europe are more inclined towards being sustainable, and this fuels the demand for green driving technologies. Leading European-based automotive OEMs are proactively developing engine management as well as energy recovery systems, advancing the start-stop system market. In spite of continued efforts towards electrification, start-stop systems will be essential in hybrid platforms, making Europe continue to remain a developed, innovation-driven region in this market.

North America Automotive Start-Stop System Market Analysis

North America is witnessing consistent growth in the automotive start-stop system market owing to growing concerns about fuel efficiency, changing regulations, and a growing desire for eco-friendly vehicles among consumers. Though early adoption trailed Europe's, the recent improvements in battery management, integrated ECUs, and the durability of auto components have fast-tracked adoption in the U.S. and Canada. Automakers are now fitting start-stop systems in mid- to high-end models, especially in city markets where fuel savings are most pronounced. The trend towards hybrid cars and mild hybrid electric vehicles (MHEVs) is also driving the market. State-level emission regulations and incentives for cleaner technologies for vehicles also support adoption. While the market is regionally dominated by electrification, start-stop systems are still a bridging technology in gasoline and hybrid platforms. With consumers continuing to value both performance and efficiency, North America offers solid prospects for further adoption of intelligent engine technologies, such as advanced start-stop systems.

Latin America Automotive Start-Stop System Market Analysis

The Latin American market for automotive start-stop systems is in a development phase, with growth mostly concentrated in leading economies such as Brazil, Mexico, and Argentina. Increasing fuel prices and urbanization are prompting consumers to look at cars with improved fuel economy. Although regulatory requirements on emissions are less stringent than in Europe or North America, governments in the region are slowly embracing global sustainability objectives, and hence increasing interest in start-stop technology. As a regional automotive powerhouse, Brazil has been moderately integrating start-stop systems into vehicles targeting urban commuters. Nevertheless, scarce awareness, infrastructure constraints, and cost sensitivity have deterred mass take-up. As local economic stability is enhanced and emissions regulations get stricter, demand for fuel-efficient technology is forecast to increase. Also, as OEMs increase local production and ship start-stop-equipped vehicles, the market is poised to gain from enhanced consumer exposure to energy-efficient vehicle choices in Latin America in the next few years.

Middle East and Africa Automotive Start-Stop System Market Analysis

The Middle East and Africa (MEA) market is a nascent opportunity for the automotive start-stop system market, with high dependence on vehicle imports, fuel subsidies in some nations, and weak regulatory enforcement on emissions keeping uptake relatively low. Nevertheless, there are more important markets like South Africa, the United Arab Emirates, and Saudi Arabia where cleaner technologies are now being implemented in alignment with wider sustainability and energy diversification policies. In urban and high-income markets, increasing traffic jams and increasing environmental awareness of fuel-efficient automotive technologies are compelling luxury car buyers to opt for fuel-saving models with start-stop systems. With governments enforcing stricter emission regulations and attempting to cut oil usage domestically, auto companies are likely to enhance the prevalence of start-stop systems in foreign models. In the long run, increased awareness, finance for vehicles, and regulatory frameworks will be essential in developing MEA into a developing rather than a nascent market for advanced engine management technologies.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global automotive start-stop system market. Detailed profiles of all major companies have also been provided. Some of the companies covered include Continental AG, Denso Corporation, Hitachi Astemo Ltd. (Hitachi Ltd.), Maxwell Technologies Inc. (UCAP Power Inc.), Robert Bosch GmbH (Robert Bosch Stiftung GmbH), Schaeffler Technologies AG & Co. KG, Valeo, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Latest News and Developments:

- In June 2025, Bosch released its modular start-stop electronic control units (ECUs), created to deliver scalable integration across a broad range of vehicle classes. The development enables automakers to introduce versatile engine management systems that aid fuel economy improvement and reduction of emissions in global fleets.

- In May 2024, Robert Bosch GmbH launched the iBoost intelligent alternator, a next-generation energy management technology designed to optimize battery regeneration during braking. The system is suitable for both conventional and mild hybrid vehicles and promotes better fuel efficiency and energy saving in line with global sustainability and powertrain efficiency standards.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Components Covered | Engine Control Unit, 12V DC Converter, Battery, Neutral Position Sensor, Wheel Speed Sensor, Crankshaft Sensor, Alternator |

| Fuel Types Covered | Gasoline, Diesel, CNG, Electric |

| Vehicle Types Covered | Motorcycles, Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Distribution Channels Covered | Original Equipment Manufacturer (OEM), Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Continental AG, Denso Corporation, Hitachi Astemo Ltd. (Hitachi Ltd.), Maxwell Technologies Inc. (UCAP Power Inc.), Robert Bosch GmbH (Robert Bosch Stiftung GmbH), Schaeffler Technologies AG & Co. KG, Valeo, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global automotive start-stop system market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global automotive start-stop system market?

- What is the impact of each driver, restraint, and opportunity on the global automotive start-stop system market?

- What are the key regional markets?

- Which countries represent the most attractive automotive start-stop system market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the automotive start-stop system market?

- What is the breakup of the market based on the fuel type?

- Which is the most attractive fuel type in the automotive start-stop system market?

- What is the breakup of the market based on the vehicle type?

- Which is the most attractive vehicle type in the automotive start-stop system market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the automotive start-stop system market?

- What is the competitive structure of the global automotive start-stop system market?

- Who are the key players/companies in the global automotive start-stop system market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive start-stop system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive start-stop system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive start-stop system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)