Automotive Thermal System Market Report by Component (Compressor, HVAC, Powertrain Cooling, Fluid Transport), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Others), and Region 2025-2033

Global Automotive Thermal System Market:

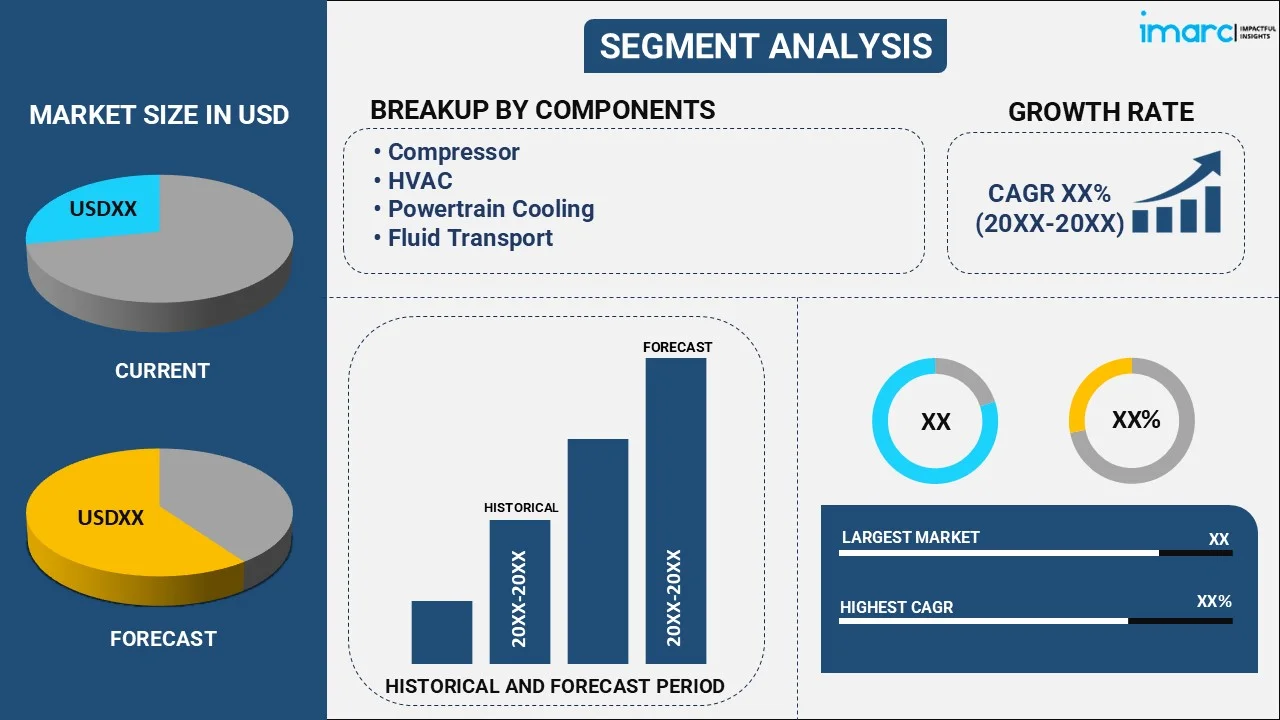

The global automotive thermal system market size reached USD 38.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 52.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.41% during 2025-2033. The rising demand for fuel efficiency, escalating trend towards lightweight vehicles for improved fuel efficiency, and rapid growth in the automotive industry are some of the major factors propelling the market demand. In addition, advancements in materials, sensors, and electronics are opportunistic for market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.4 Billion |

| Market Forecast in 2033 | USD 52.7 Billion |

| Market Growth Rate 2025-2033 | 3.41% |

Automotive Thermal System Market Analysis:

- Major Market Drivers: The rising demand for fuel efficiency coupled with the continuous focus of manufacturers on improving fuel efficiency in traditional internal combustion engine (ICE) vehicles is propelling the automotive thermal system market growth. Moreover, advancements in materials, sensors, and electronics have enabled the development of more efficient and precise thermal management systems, thereby adding to the market demand.

- Key Market Trends: The growing automotive industry, including the production of both passenger and commercial vehicles, coupled with continuous research and development efforts by automotive manufacturers and suppliers leads to the creation of more efficient and innovative thermal management solutions, further proliferating the market demand.

- Competitive Landscape: Some of the prominent companies in the market include Borgwarner Inc., Continental Aktiengesellschaft, DENSO Corporation, General Motors Company, Gentherm Incorporated, Grayson Automotive Services Limited, Lennox International Inc., MAHLE GmbH, Modine Manufacturing Company Inc., and Visteon Corporation, among many others.

- Geographical Trends: Asia Pacific exhibits a clear dominance in the market. The region is a hub for automotive manufacturing. The growth in the production of vehicles, including passenger cars, commercial vehicles, and electric vehicles, has directly driven the demand for automotive thermal systems.

- Challenges and Opportunities: Regulatory compliances, emissions standards, and continuous innovation in technology are hampering the market growth. However, EVs require sophisticated thermal management systems for battery cooling and maintaining optimal operating temperatures. This represents a significant growth opportunity as the EV market expands.

Automotive Thermal System Market Trends:

Stricter Emission Regulations and Efficiency Demands

Governments and environmental bodies are imposing stricter norms to curb vehicle emissions and promote cleaner air quality. For instance, in May 2024, the European Union adopted strict CO2 emissions regulations for new heavy-duty vehicles. According to the new rules, carbon emissions from heavy trucks and buses, including vocational vehicles, must be cut by 45% by 2030, 65% by 2035, and 90% by 2040. New urban buses would need to lower emissions by 90% by 2030 and be zero-emission vehicles by 2035. As a result, automakers are under immense pressure to develop vehicles that are more fuel-efficient and emit fewer pollutants. Automotive thermal systems play a pivotal role in achieving these goals. Manufacturers are also incorporating thermal management solutions for electric and hybrid vehicles to optimize battery performance and extend their lifespan. For instance, in February 2024, Geely's Zeekr, an electric vehicle maker, unveiled its latest model, the Zeekr 001. The vehicle is integrated with a cutting-edge "full-stack 800V high-voltage system" and thermal management system. The Zeekr 001 offers a choice between two powerful batteries: 95kWh and 100kWh. With claims of setting new standards in charging speed. With 22 working modes, the PTM 2.0 global thermal management system in the vehicle improves energy consumption. These factors are further contributing to the automotive thermal system market share.

Rising Adoption of Electric Vehicles

The rising adoption of electric vehicles (EVs) is one of the significant factors driving the automotive thermal system market growth. There's been a significant increase in the sales of cars. For instance, according to an article published by IEA, almost 14 million new electric cars were registered globally in 2023, bringing the total number on the road to 40 million. Electric vehicle sales in 2023 were 3.5 million greater than in 2022, representing a 35% year-on-year growth. This figure is more than six times greater than in 2018. EVs generate heat not only from the powertrain but also from high-capacity batteries during charging and discharging cycles. Efficient thermal management is crucial to maintaining optimal operating temperatures for these components, which directly impacts battery life, safety, and performance. Automotive thermal systems in EVs involve advanced cooling solutions, such as liquid cooling systems and thermal interface materials, to ensure consistent and safe operation of the battery pack and electric drivetrain. Moreover, various manufacturers are developing liquid cooling batteries in order to reduce the load on the battery. For instance, in April 2024, Bounce Infinity, an electric two-wheeler company collaborated with Clean Electric to launch liquid-cooled battery technology in India. It ensures a longer battery life, faster charging times, and increased range. This technology caters to the critical need for more efficient thermal management in EVs. These factors are further positively influencing the automotive thermal system market forecast.

Consumer Demand for Comfort and Connectivity

Modern vehicle buyers not only demand efficient and eco-friendly solutions but also prioritize comfort and connectivity. Automotive thermal systems directly influence cabin climate control, enhancing passenger comfort during both extreme weather conditions and daily commutes. Advanced heating, ventilation, and air conditioning (HVAC) systems with zone-wise temperature control, air purification, and smart connectivity features are becoming standard in many vehicles. Various manufacturers are integrating such features. For instance, in March 2024, BMW, a luxury car manufacturer based in Germany launched the new 620d M Sport Signature in India. This luxury vehicle is equipped with a 12.3-inch dual screen, including a digital instrument cluster and infotainment system. Other key features include Apple CarPlay, Android Auto, Park Assist, rearview camera, panoramic sunroof, wireless charger, and auto air conditioning with four-zone control. These systems not only ensure personalized comfort but also contribute to driver alertness and overall road safety, further positively influencing the automotive thermal system market value. Apart from this, automotive manufacturers differentiate their vehicles based on comfort features and connectivity options. Enhanced thermal management capabilities contribute to vehicle comfort and battery performance. For instance, in November 2023, Hyundai unveiled its all-new 2025 IONIQ 5 N electrified sports vehicle to North American media during a pre-show event for AutoMobility LA. IONIQ 5 N is equipped with thermal control on the racetrack. The expanded thermal management system employs greater cooling surface and volume, improved motor oil cooling, and a battery chiller. The battery thermal management system's performance is also improved by reducing the heat transfer path from the battery cells to the cooling channel and introducing a novel gap filler with excellent thermal conductivity. These factors are further bolstering the automotive thermal system market revenue.

Global Automotive Thermal System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive thermal system market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our automotive thermal system market report has categorized the market based on component and vehicle type.

Breakup by Component:

- Compressor

- HVAC

- Powertrain Cooling

- Fluid Transport

Compressor dominates the market

The report has provided a detailed breakup and analysis of the market based on the component. This includes compressor, HVAC, powertrain cooling, and fluid transport. According to the report, compressor represented the largest segment.

According to the report, automotive thermal system market outlook, the compressor plays a pivotal role in managing the temperature and comfort of a vehicle's interior environment. Essentially acting as the heart of the air conditioning system, the compressor is responsible for circulating and pressurizing the refrigerant, which facilitates the transfer of heat from the cabin to the outside environment. This transfer of heat enables the cooling of the cabin air, ensuring a comfortable temperature even in the scorching heat of summer. The compressor's operation is a delicate interplay of mechanical and thermodynamic principles. As the refrigerant flows through the system, the compressor compresses it into a high-pressure, high-temperature gas. This gas is then condensed, releasing heat, and transformed back into a liquid. The liquid refrigerant then expands, absorbing heat and causing the air around it to cool down. This cooled air is then directed into the cabin, providing occupants with a pleasant driving experience, regardless of external weather conditions. For instance, in February 2024, Cummins Engine Components (CEC) launched its first E-compressor for fuel cell engine in Wuxi, China

Breakup by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

Passenger cars dominate the market

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, heavy commercial vehicles, and others. According to the report, passenger cars accounted for the largest automotive thermal system market share.

According to the automotive thermal system market overview, passenger cars encompass a wide spectrum of vehicles designed primarily for the transportation of individuals and small groups. This category includes sedans, hatchbacks, coupes, and even certain types of crossover vehicles. The sheer volume of passenger cars on the roads is immense, reflecting the widespread use of these vehicles for personal transportation. This high demand necessitates sophisticated thermal management systems to ensure not only optimal engine performance but also cabin comfort, especially as passengers spend considerable time inside the vehicle. As consumers increasingly prioritize comfort, convenience, and advanced features, the role of efficient automotive thermal systems becomes more crucial. Moreover, the technological advancements in passenger car design have propelled the integration of cutting-edge thermal technologies. Advanced air conditioning systems, climate control mechanisms, and innovative thermal insulation techniques are all tailored to enhance the driving experience for passengers. For instance, in May 2024, BYD introduced the new Sea Lion O7, an all-electric SUV. It employs a 16-in-1 high-efficiency thermal management integrated module, resulting in an estimated 20% reduction in thermal management power usage.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest automotive thermal system market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada), Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, and others), and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

According to the automotive thermal system market statistics, Asia Pacific's escalating manufacturing ecosystem fosters a high demand for advanced thermal management solutions that cater to the diverse needs of vehicles produced in these markets. Moreover, the expanding middle class in many Asia Pacific countries has fueled an increase in automobile ownership. As disposable incomes rise and urbanization continues, there is a growing appetite for vehicles equipped with advanced features and technologies, including efficient thermal systems that enhance driving comfort and efficiency. Moreover, the region's climatic diversity, ranging from tropical to temperate, accentuates the need for reliable thermal management solutions. Efficient air conditioning and climate control systems are essential for maintaining passenger comfort across a wide spectrum of environmental conditions. Furthermore, the Asia Pacific region has become a hotbed for electric vehicle (EV) adoption and innovation. Battery cooling systems and climate control mechanisms for EVs are crucial for ensuring optimal battery performance and maintaining driving range in various weather conditions. For instance, in June 2023, ZF, a technology corporation, unveiled its self-developed thermal management system for electric cars (EVs) at its annual Global Technology Day event in India.

Competitive Landscape:

Automotive thermal system companies are investing significantly in research and development to create innovative solutions. This includes developing advanced cooling technologies, more efficient heat exchangers, and smart climate control systems. Companies are working on materials with better thermal conductivity and exploring novel designs to optimize heat dissipation and management. With the rise of electric and hybrid vehicles, companies are tailoring their thermal systems to suit the specific needs of these platforms. This involves designing thermal solutions for battery cooling and temperature management, as well as optimizing thermal efficiency in electric drivetrains to enhance overall performance and longevity. Moreover, leading players are placing a strong emphasis on improving energy efficiency and reducing the environmental impact of their solutions. This includes developing systems that consume less power while delivering optimal performance, as well as integrating waste heat recovery systems to utilize excess heat for improved efficiency.

The automotive thermal system market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Borgwarner Inc.

- Continental Aktiengesellschaft

- DENSO Corporation

- General Motors Company

- Gentherm Incorporated

- Grayson Automotive Services Limited

- Lennox International Inc.

- MAHLE GmbH

- Modine Manufacturing Company Inc.

- Visteon Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Automotive Thermal System Market Recent Developments:

- July 2024: TI Fluid Systems, a developer of thermal management and fluid handling systems, unveiled its new e-Mobility Innovation Center (eMIC) in Auburn Hills, Michigan.

- July 2024: Modine, a diversified thermal management technology provider, launched the Cabin Climate System (CCS), a comprehensive thermal management solution specifically designed for commercial, off-highway, and specialty electric vehicles (EVs).

- April 2024: Vitesco Technologies partnered with Sanden International, an automotive thermal management technology provider to develop an Integrated Thermal Management System for Battery Electric Vehicles (BEVs).

Automotive Thermal System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Compressor, HVAC, Powertrain Cooling, Fluid Transport |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Borgwarner Inc., Continental Aktiengesellschaft, DENSO Corporation, General Motors Company, Gentherm Incorporated, Grayson Automotive Services Limited, Lennox International Inc., MAHLE GmbH, Modine Manufacturing Company Inc., Visteon Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive thermal system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive thermal system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive thermal system industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global automotive thermal system market was valued at USD 38.4 Billion in 2024.

We expect the global automotive thermal system market to exhibit a CAGR of 3.41% during 2025-2033.

The rising demand for Hybrid Electric Vehicles (HEVs), along with the increasing integration of thermal sensors with automotive thermal systems that sense the temperature in real-time and provide necessary solutions to the user, is primarily driving the global automotive thermal system market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous automobile manufacturing units, thereby negatively impacting the global market for automotive thermal systems.

Based on the component, the global automotive thermal system market has been divided into compressor, HVAC, powertrain cooling, and fluid transport. Among these, compressor currently exhibits a clear dominance in the market.

Based on the vehicle type, the global automotive thermal system market can be categorized into passenger cars, light commercial vehicles, heavy commercial vehicles, and others. Currently, passenger cars account for the majority of the global market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global automotive thermal system market include Borgwarner Inc., Continental Aktiengesellschaft, DENSO Corporation, General Motors Company, Gentherm Incorporated, Grayson Automotive Services Limited, Lennox International Inc., MAHLE GmbH, Modine Manufacturing Company Inc., and Visteon Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)