Baby Food Packaging Market Report by Product (Liquid Milk Formula, Dried Baby Food, Powder Milk Formula, Prepared Baby Food), Material (Plastic, Paperboard, Metal, Glass, and Others), Package Type (Bottles, Metal Cans, Cartons, Jars, Pouches, and Others), and Region 2026-2034

Baby Food Packaging Market Size:

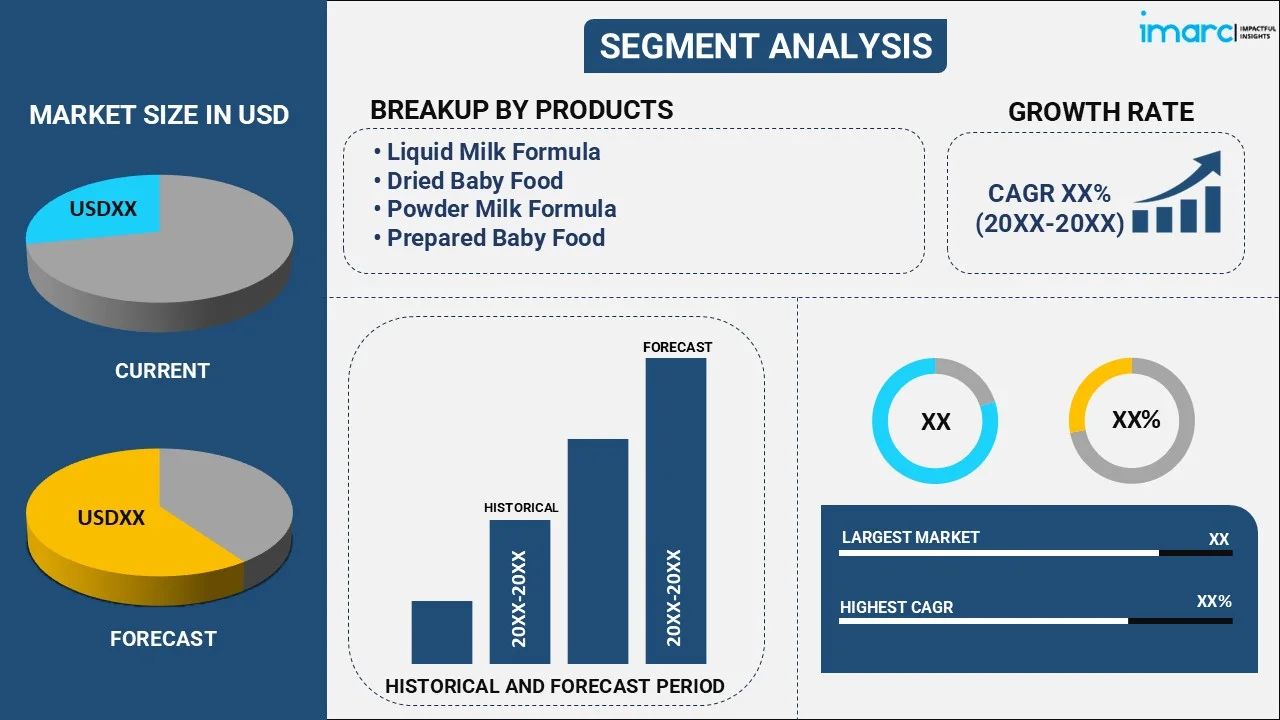

The global baby food packaging market size reached USD 9.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 13.1 Billion by 2034, exhibiting a growth rate (CAGR) of 3.33% during 2026-2034. The market is experiencing steady growth driven by the growing global birth rates, increasing health-conscious parenting trends, significant technological advancements in packaging, increasing disposable incomes, and regulatory compliance and safety concerns.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 9.6 Billion |

|

Market Forecast in 2034

|

USD 13.1 Billion |

| Market Growth Rate 2026-2034 | 3.33% |

Baby Food Packaging Market Analysis:

- Market Growth and Size: The market is witnessing steady growth, driven by the increasing birth rates and changing consumer preferences.

- Technological Advancements: Technological innovations have played a crucial role in the baby food packaging industry. Advanced materials and designs have enhanced the safety and convenience of packaging.

- Industry Applications: Baby food packaging is primarily used for packaging infant formula, baby cereals, purees, and snacks. The industry also caters to toddler food packaging as children transition to solid foods.

- Geographical Trends: North America and Europe dominate the market due to higher disposable incomes and health-conscious parenting trends.

- Competitive Landscape: Key players in the baby food packaging market include well-established companies with a strong presence in the food packaging industry. Competition is fierce, with companies vying to provide innovative and sustainable packaging solutions.

- Challenges and Opportunities: Challenges include stringent regulations related to food safety and labeling, which can impact packaging design and materials. Opportunities lie in eco-friendly packaging options, as sustainability becomes a key focus for both consumers and manufacturers.

- Future Outlook: The global baby food packaging market is expected to continue its growth trajectory, fueled by an increasing global population and evolving dietary preferences. Sustainable packaging solutions, such as recyclable and biodegradable materials, are likely to gain prominence in the coming years, aligning with environmental concerns.

Baby Food Packaging Market Trends:

Growing birth rates

The increase in global birth rates is a significant driver of the baby food packaging market. As populations expand in various regions, the demand for baby food products rises. This demographic shift fuels the need for safe and convenient packaging solutions for infant formula, purees, and snacks. Market research indicates that regions such as, Asia-Pacific and Africa, with their high birth rates, contribute significantly to the growth of the market. Additionally, urbanization and changing lifestyles often lead to more working parents who opt for packaged baby food products, further boosting demand. Packaging companies respond by developing user-friendly, portion-controlled, and shelf-stable packaging to cater to the needs of busy parents.

Health-Conscious Parenting Trends

With the growing awareness about the importance of nutrition during infancy, parents are increasingly seeking healthier and more transparent baby food options. This trend drives innovation in baby food packaging, as companies strive to create packaging that preserves the freshness and nutritional value of the products. Parents look for packaging that clearly conveys ingredient information, allergen warnings, and nutritional content, promoting trust and confidence in the products. Additionally, the demand for organic and natural baby food products is on the rise. Sustainable and eco-friendly packaging solutions align with these preferences, further propelling market growth.

Technological Advancements in Packaging

Technological innovations play a pivotal role in the baby food packaging market. Advanced packaging materials, such as BPA-free plastics and recyclable options, ensure product safety and sustainability. Smart packaging with features such as, temperature indicators and portion control aids parents in maintaining optimal storage and serving conditions for baby food. Furthermore, packaging companies are investing in research and development to create designs that enhance the convenience of use, such as single-serve pouches and resealable packages. These innovations cater to parental preferences and also contribute to the expansion of the market.

Increasing Disposable Incomes

The rise in disposable incomes in many parts of the world has led to an increase in consumer spending on premium baby food products. Parents are willing to invest in higher-quality and more expensive baby food options, driving the demand for premium packaging solutions. Premium packaging often includes aesthetically pleasing designs, premium materials, and unique shapes that distinguish products on the shelves. This trend allows packaging companies to offer a wider range of options to cater to varying consumer preferences.

Regulatory Compliance and Safety Concerns

Stringent regulations and safety concerns regarding baby food packaging promote market growth. Governments and regulatory bodies impose strict standards to ensure the safety and hygiene of baby food products, including packaging materials. Packaging companies must adhere to these regulations, which can lead to ongoing improvements in packaging technology and materials. Compliance with safety standards protects infants and enhances consumer trust in baby food products and their packaging.

Baby Food Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on product, material, and package type.

Breakup by Product:

- Liquid Milk Formula

- Dried Baby Food

- Powder Milk Formula

- Prepared Baby Food

Prepared baby food accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes liquid milk formula, dried baby food, powder milk formula, and prepared baby food. According to the report, prepared baby food represented the largest segment.

Prepared baby food encompasses a wide range of products, including purees and meals. Packaging for prepared baby food is designed to provide convenience to parents while ensuring the freshness and safety of the product. Common packaging formats include glass jars, plastic containers, and pouches with resealable spouts. Packaging for prepared baby food often features tamper-evident seals and easy-open lids or caps. Parents appreciate packaging that allows for easy feeding and minimizes waste. Labels on these products include information about ingredients, nutritional content, and age-appropriate recommendations, offering transparency to health-conscious consumers. Sustainable packaging options are becoming more prevalent in this segment, aligning with environmental concerns.

Liquid milk formula is a popular choice among parents for its convenience and nutritional value. This segment includes products such as, ready-to-feed infant formula, which requires minimal preparation. Packaging for liquid milk formula is crucial to maintain product freshness and hygiene. Typically, these products come in aseptic packaging, such as Tetra Pak or plastic bottles, with secure caps to prevent contamination. The packaging design often features easy-pour spouts and measurement markings for precise serving. Manufacturers focus on ensuring leak-proof and tamper-evident closures to guarantee product safety. Additionally, labeling plays a vital role in providing essential information about ingredients, nutrition, and usage instructions, addressing parents' concerns about the health of their baby. As health-conscious parenting trends continue to grow, the demand for appealing, informative, and user-friendly packaging for liquid milk formula is expected to rise.

Dried baby food includes products such as, baby cereals and snacks. Packaging for dried baby food aims to maintain product freshness and extend shelf life. Common packaging formats for dried baby food include resealable pouches, stand-up pouches, and plastic or glass jars. These packages are designed to keep moisture out and preserve the quality of the contents. Many parents appreciate the convenience of resealable pouches, which allow for portion control and easy storage. Packaging materials are carefully chosen to ensure that the products stay fresh and free from contamination. Labels provide essential information about ingredients, allergen warnings, and preparation instructions. Sustainable packaging options, such as recyclable pouches and jars, are gaining popularity as eco-conscious consumers seek more environmentally friendly choices.

Powder milk formula is a staple in the baby food industry. Packaging for powdered formula focuses on maintaining product integrity and preventing moisture from affecting the powder. Typically, powdered milk formula comes in metal cans or composite canisters with airtight seals to ensure freshness. The packaging design emphasizes ease of scooping and accurate measurement. Manufacturers often include a scoop holder and usage instructions to assist parents in preparing the formula correctly. Labels on the packaging provide crucial information about nutritional content, preparation guidelines, and storage recommendations. As parents seek reliable and safe options for their infants, packaging plays a critical role in assuring them of the quality and safety of the baby.

Breakup by Material:

- Plastic

- Paperboard

- Metal

- Glass

- Others

Plastic holds the largest share in the industry

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes plastic, paperboard, metal, glass, and others. According to the report, plastic accounted for the largest market share.

Plastic is the dominant material in the baby food packaging market due to its versatility, durability, and cost-effectiveness. It is commonly used for various packaging formats, including bottles, jars, pouches, and containers. Plastic offers excellent protection against moisture and contaminants, ensuring the safety and freshness of baby food products. Plastic packaging is lightweight and shatter-resistant, making it convenient for parents on the go. Many plastic baby food containers are also designed for portion control, allowing precise serving sizes. However, concerns have arisen about the environmental impact of plastic waste, leading to increased demand for eco-friendly and recyclable plastic options.

Paperboard packaging is another significant segment in the baby food industry. It is often used for cartons and boxes, especially for dry baby cereals and snacks. Paperboard is known for its sustainability and recyclability, which align with the growing trend of eco-conscious parenting. Manufacturers can print informative and attractive designs on paperboard packaging, including nutritional information and engaging graphics. This helps build trust with parents who seek transparency in baby food products. Paperboard is also preferred for its eco-friendly attributes, as it can be sourced from sustainable forests and is biodegradable.

Metal packaging, primarily in the form of cans, has been a traditional choice for baby food. It provides an excellent barrier against light, air, and moisture, ensuring the long shelf life of products such as, baby formula and purees. Metal cans are known for their durability and tamper-evident features, assuring parents of the safety and integrity of the contents. However, metal packaging tends to be heavier and less convenient for on-the-go use compared to plastic or pouches. Additionally, the environmental impact of metal production and disposal has led to increased interest in sustainable alternatives.

Glass has a niche presence in the baby food packaging market, typically used for premium and organic baby food products. Glass jars and containers are preferred by some parents for their perceived purity, as glass does not leach any chemicals into the food. Glass offers excellent product visibility, allowing parents to see the contents clearly. It is also inert, preserving the taste and quality of baby food without any risk of contamination. However, glass packaging is heavier and more fragile than plastic or paperboard, making it less convenient for portable use. Moreover, recycling and disposal of glass require specific infrastructure.

Breakup by Package Type:

- Bottles

- Metal Cans

- Cartons

- Jars

- Pouches

- Others

Pouches represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the package type. This includes bottles, metal cans, cartons, jars, pouches, and others. According to the report, pouches represented the largest segment.

Baby food pouches have seen a surge in popularity in recent years. These flexible, lightweight containers are typically made from laminated plastic materials. Pouches are known for their convenience, portability, and ease of use. They often come with resealable spouts or caps, allowing for mess-free dispensing and controlled portion sizes. The squeezable design of pouches enables parents to feed their infants directly from the pouch or use a spoon, making them a versatile choice. Many baby food pouches feature colorful graphics and engaging designs that appeal to children, making mealtime more enjoyable. The single-serving nature of pouches reduces food waste and allows for a longer shelf life, as the contents are less exposed to air and contaminants. Pouches are also lightweight and space-efficient, making them suitable for travel. However, recycling options for baby food pouches can vary, depending on local facilities, which is an important consideration for environmentally conscious consumers.

Bottles have been a traditional and reliable packaging choice for baby food. They offer excellent protection against contamination and are easy to sterilize. Glass bottles, in particular, are known for their durability and non-reactive nature, making them suitable for storing liquids and purees. Plastic baby food bottles are also popular due to their lightweight and shatterproof characteristics. Manufacturers often include measurement markings for precise portion control. Additionally, some baby bottles come with specialized nipples that mimic breastfeeding to ease the transition for infants. The convenience and familiarity of baby food bottles continue to make them a prominent choice among parents who prefer feeding from containers that resemble traditional milk bottles.

Metal cans provide an excellent barrier against oxygen and light, preserving the freshness and nutritional content of baby food products. These cans are commonly used for packaging powdered infant formula and cereals. They offer a long shelf life and are tamper-resistant. The compact and stackable nature of metal cans makes them easy to store and transport. Some metal cans feature easy-open lids or peel-off seals for added convenience. Manufacturers often print informative labels with nutritional information and preparation instructions on the can, enhancing consumer understanding. While there is a shift toward more eco-friendly packaging options, metal cans continue to be a trusted choice in the baby food packaging market for their preservation qualities.

Cartons have gained popularity in the baby food packaging market, particularly for liquid products such as, ready-to-drink formula and fruit juices. These cartons are typically made from paperboard with a layer of foil or plastic lining to ensure product freshness and prevent leakage. They are lightweight and easy to handle, making them convenient for parents on the go. Cartons often feature resealable caps or spouts for controlled pouring. The Tetra Pak design, with its triangular shape and resealable screw caps, is a notable instance. The visual appeal of carton packaging, along with the ability to print engaging graphics and information, helps brands differentiate their products on the shelves. Moreover, cartons are recyclable and have a relatively low environmental footprint, aligning with sustainability trends in the industry.

Glass and plastic jars are commonly used for packaging baby food in semi-solid or pureed forms. They are known for their airtight seals, which preserve the freshness and quality of the contents. Glass jars are transparent, allowing parents to see the product inside and ensuring visual quality control. They are also microwave-safe, which adds to their convenience. Plastic jars, on the other hand, are lightweight and less likely to break, making them suitable for travel. Many baby food jars come in single-serving portions, facilitating portion control and reducing waste. Labels on baby food jars typically provide information on ingredients, nutritional content, and serving instructions. The reusable nature of glass jars and the recyclability of plastic jars contribute to their eco-friendliness, which is a significant consideration for environmentally conscious parents.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest baby food packaging market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America holds a significant share in the global baby food packaging market. The market of the region is characterized by a well-established baby food industry and a high level of consumer awareness regarding product safety and quality. The United States and Canada are major contributors to this market segment. The demand for innovative and convenient packaging solutions is on the rise in North America, driven by busy lifestyles and a preference for on-the-go baby food options. Sustainable and eco-friendly packaging materials are gaining traction as environmentally conscious consumers seek products that align with their values.

Asia Pacific is one of the fastest-growing regions in the baby food packaging market. The dynamic population of the region, including a rising middle-class segment, fuels demand for baby food products. Countries such as, China and India are key players in this segment due to their large populations and increasing disposable incomes. In Asia Pacific, convenience and affordability are critical factors driving packaging choices. Single-serve pouches, lightweight and durable materials, and packaging designs that cater to the cultural preferences of the region are prominent. Additionally, as awareness about food safety and hygiene grows, the demand for packaging that ensures product integrity and freshness remains high.

Europe is a mature market for baby food packaging, characterized by stringent regulations and a well-established infrastructure. The region prioritizes product safety and quality, resulting in a demand for high-barrier packaging materials and clear labeling. Sustainability is a significant trend in Europe, with consumers and manufacturers alike focusing on eco-friendly packaging solutions. Materials such as glass, aluminum, and recyclable plastics are preferred options. Innovative packaging designs that enhance the convenience of use, such as resealable closures and portion-controlled packs, continue to gain popularity.

The Latin American baby food packaging market is experiencing steady growth, driven by changing consumer lifestyles and an increasing awareness about the importance of nutrition during infancy. Countries such as, Brazil and Mexico are significant contributors to this market segment. Affordability and convenience play crucial roles in packaging preferences in Latin America. Pouches and flexible packaging formats are common choices due to their cost-effectiveness and ease of use. As consumers become more health-conscious, packaging that highlights nutritional information and ingredients gains importance.

The Middle East and Africa represent emerging markets in the baby food packaging industry. Growing populations and rising incomes are driving demand for baby food products. The region is characterized by diverse consumer preferences and a need for packaging that caters to local tastes and traditions. In this region, packaging that ensures product safety and shelf stability in hot climates is essential. Manufacturers are exploring cost-effective and sustainable packaging solutions to meet the growing demand for baby food products.

Leading Key Players in the Baby Food Packaging Industry:

The key players in the market are investing heavily in research and development to create innovative packaging solutions. They aim to design packaging that enhances the freshness, safety, and convenience of baby food products. This includes developing eco-friendly materials, smart packaging features, and user-friendly designs. Additionally, sustainability is a top priority for key players. They are actively working on reducing the environmental footprint of their packaging by using recyclable, biodegradable, and eco-friendly materials. Many are also focusing on reducing packaging waste and optimizing packaging sizes to minimize resource consumption. Other than this, to tap into emerging markets with growing populations, major players are expanding their global reach. They are establishing production facilities and distribution networks in regions such as, Asia-Pacific and Latin America to cater to the increasing demand for baby food products.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Amcor PLC

- Ardagh Group S.A.

- Mondi Plc

- RPC Gorup Plc (Berry Global Group Inc.)

- Sonco Products Company

- Tetra Pak (Tetra Laval)

- Winpak Ltd. (Wihuri Oy)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- 2020: Tetra Pak International S.A. has introduced an innovative range of carton packaging solutions specifically tailored for baby food products. This cutting-edge packaging has been meticulously crafted with a dual focus: preserving the essential nutritional content and flavor of the baby food while simultaneously offering user-friendly features and eco-conscious design.

Baby Food Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Liquid Milk Formula, Dried Baby Food, Powder Milk Formula, Prepared Baby Food |

| Materials Covered | Plastic, Paperboard, Metal, Glass, Others |

| Package Types Covered | Bottles, Metal Cans, Cartons, Jars, Pouches, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor PLC, Ardagh Group S.A., Mondi Plc, RPC Gorup Plc (Berry Global Group Inc.), Sonco Products Company, Tetra Pak (Tetra Laval), Winpak Ltd. (Wihuri Oy), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global baby food packaging market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global baby food packaging market?

- What is the impact of each driver, restraint, and opportunity on the global baby food packaging market?

- What are the key regional markets?

- Which countries represent the most attractive baby food packaging market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the baby food packaging market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the baby food packaging market?

- What is the breakup of the market based on the package type?

- Which is the most attractive package type in the baby food packaging market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global baby food packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the baby food packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global baby food packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the baby food packaging industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)