Bath Soap Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, and Region, 2025-2033

Bath Soap Market Size and Share:

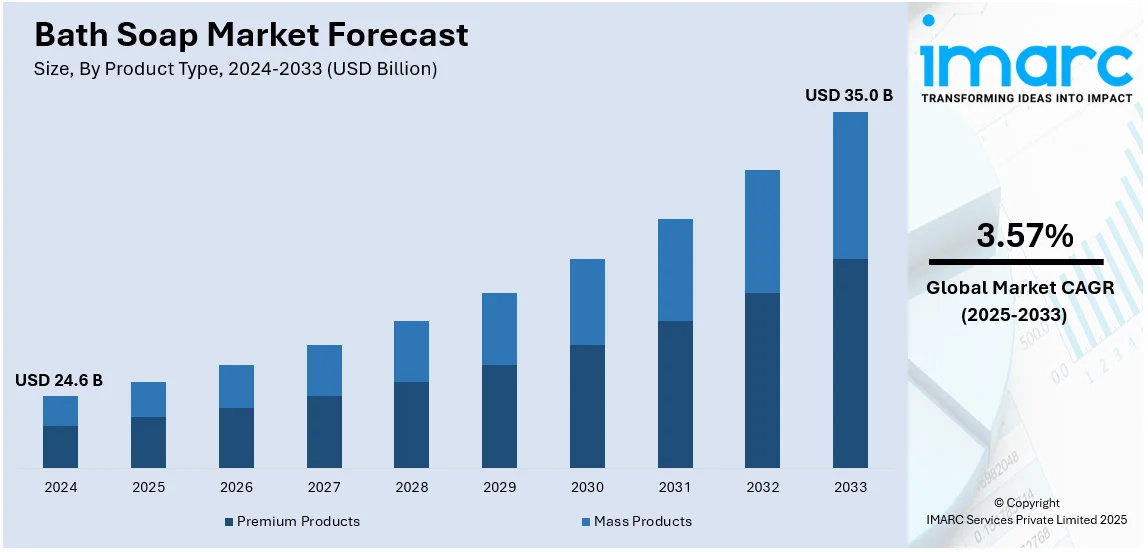

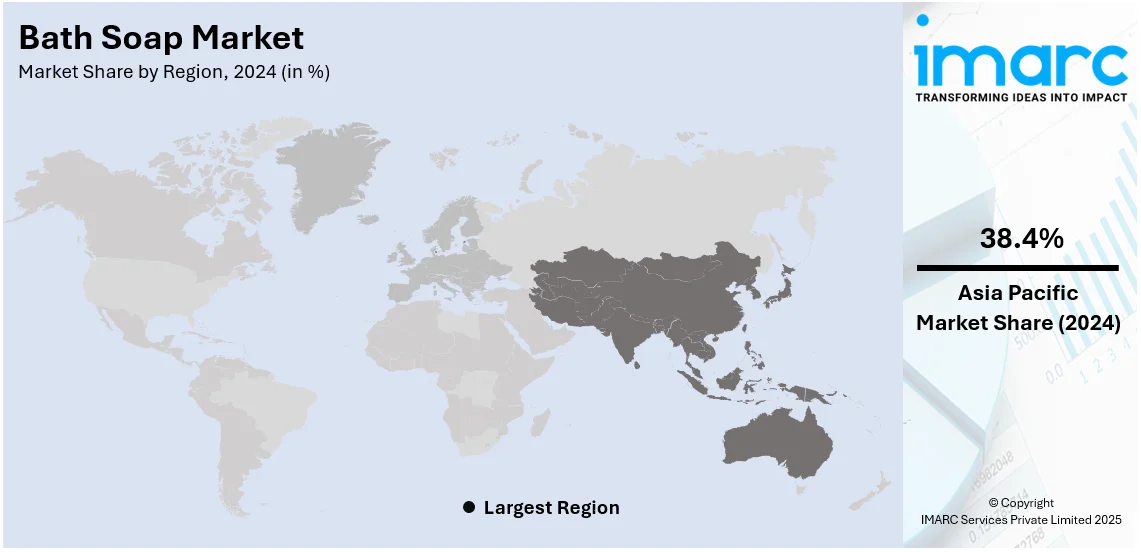

The global bath soap market size was valued at USD 24.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.0 Billion by 2033, exhibiting a CAGR of 3.57% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 38.4% in 2024. The market is experiencing steady growth driven by increasing awareness of personal hygiene and cleanliness, rising popularity of premium and specialty bath soaps, and rapid expansion of e-commerce platforms that allows consumers to access a wider range of bath soap brands and variants.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 24.6 Billion |

|

Market Forecast in 2033

|

USD 35.0 Billion |

| Market Growth Rate 2025-2033 | 3.57% |

The bath soap market is growing due to rising consumer awareness of hygiene and skincare, driven by health concerns, and increased disposable incomes. Urbanization and modern retail channels augment access to premium and natural soap options. The growing demand for organic, chemical-free products is fostering innovation in ingredient sourcing and production. Specialty soaps for specific skin needs, like anti-bacterial or moisturizing properties, are gaining popularity. Notably, on April 30, 2024, Naples Soap Company announced Grow Beautii, a sensitive skin care line featuring natural ingredients like goat’s milk, set to launch in Q4 2024, targeting the USD 41 Billion sensitive skin care market. Advances in packaging, branding, and marketing further enhance global bath soap market growth.

The United States is a key regional market and is growing due to increased health and hygiene awareness and rising interest in personalized skincare. The growing demand for premium soaps with natural and organic ingredients is reflecting a shift toward sustainability. Innovations like vegan, paraben-free, and dermatologist-tested formulations cater to diverse preferences, while artisanal and handcrafted soaps expand niche markets. Digital marketing and e-commerce enhance visibility and accessibility for consumers. Collaborations between soap manufacturers and wellness brands drive innovation, as seen with P&G's Native partnering with Jarritos and Dunkin’ for exclusive scented products at Target and Walmart on December 9, 2024. Trending vanilla and gourmand fragrances, along with Dove’s Crumbl-inspired collection, highlight opportunities for brands to innovate with unique scent combinations.

Bath Soap Market Trends:

Increasing Hygiene Awareness

The increasing awareness of personal hygiene, notably highlighted by the global coronavirus (COVID-19) pandemic, serves as a major driver in the bath soap market. With a heightened focus on health and cleanliness, consumers worldwide have become more conscious of the importance of proper hygiene practices. Bath soaps are a fundamental component of personal hygiene routines, as they effectively remove dirt, bacteria, and contaminants from the skin. The pandemic has reinforced the significance of thorough handwashing and overall body cleansing, leading to an upsrise in the demand for bath soaps. As a result, demand for soap increased by 50% in 2020, with some markets like the U.S. seeing soap sales increase by 27% compared to 2023, as per industrial reports. Consumers are actively seeking soap products that offer effective germ protection and cleanliness, further augmenting market growth. Manufacturers are responding to this demand by introducing antibacterial and antiviral soap formulations to meet the specific hygiene needs of consumers. The growing awareness of personal hygiene as a preventative measure against diseases and infections ensures that bath soap remains a vital product in daily life, sustaining its role as a key driver in the market.

Diverse Product Offerings

The bath soap market growth is significantly influenced by the diverse array of product offerings available to consumers. This diversity encompasses a wide range of bath soap variants, including premium, organic, natural, and specialty formulations. Consumers today have increasingly diverse preferences when it comes to their skincare and personal hygiene routines. As a result, they are actively seeking bath soaps that cater to their specific skin types, concerns, and lifestyle choices. Premium bath soaps offer added benefits and unique fragrances, appealing to those seeking a more luxurious bathing experience. According to an industrial report, in 2023, premium and organic soap sales accounted for approximately 40% of the U.S. Organic and natural variants have gained immense popularity among consumers who prioritize chemical-free and environmentally friendly options. Specialty soaps address specific skin conditions or offer unique features, such as exfoliating properties or moisturizing capabilities. As consumer preferences continue to diversify, the market's growth is supported by its ability to provide products that cater to individualized skincare needs and personal preferences.

Rapid Growth in Emerging Markets

The growth in emerging markets, notably in regions like Asia Pacific, plays a pivotal role in propelling the bath soap industry forward. Several interconnected factors contribute to this expansion. Rapid urbanization in these regions is gaining 3% annually, wherein more than 55% of Asia Pacific's population is now urbanized as per world bank data. This rise in urbanization increases demand for personal care products in the form of bath soaps. Increasing disposable incomes render the purchasing power stronger since Asia Pacific's middle-class population is to reach more than 3.5 billion by 2030 according to Brookings Institution. As more people migrate to urban areas, there is a growing awareness of the need for proper hygiene and grooming. Apart from this, the rising disposable incomes in emerging markets enable consumers to allocate more of their budget to personal care and grooming products, such as premium and specialty bath soaps. This increased purchasing power stimulates market growth as consumers seek higher quality and more diverse product offerings. Furthermore, the heightened awareness of personal care and hygiene practices, influenced by global health concerns and changing lifestyles, leads to an increased demand for bath soaps. Consumers in emerging markets are adopting self-care routines that include regular and thorough body cleansing, contributing to market growth.

Bath Soap Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bath soap market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, form, and distribution channel.

Analysis by Product Type:

- Premium Products

- Mass Products

Mass products lead the market in 2024. Mass-produced bath soaps target the broader consumer base with affordability and accessibility. These products offer basic cleansing and hygiene benefits, making them a staple in households worldwide. Mass-produced soaps often focus on economies of scale, competitive pricing, and widespread distribution, ensuring their availability to a wide range of consumers, including those who prioritize cost-effective and functional options for daily use. These soaps are typically formulated for universal skin types, appealing to a diverse demographic. Manufacturers often incorporate mild fragrances and standard packaging to maintain affordability. Additionally, mass-produced bath soaps are increasingly adopting sustainable practices, such as recyclable packaging and plant-based ingredients, to align with growing consumer awareness of environmental and ethical considerations.

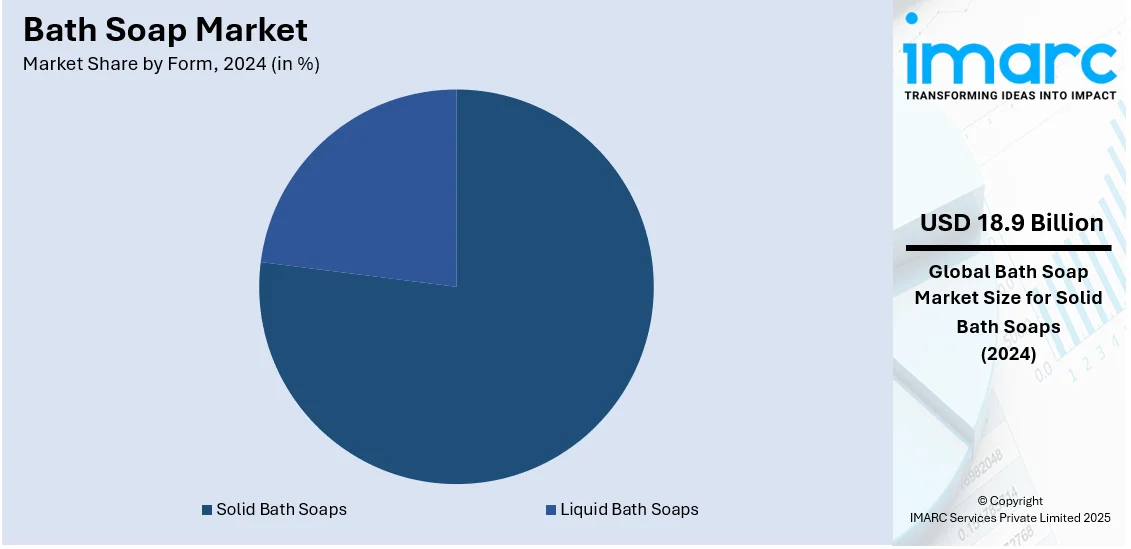

Analysis by Form:

- Solid Bath Soaps

- Liquid Bath Soaps

Solid bath soaps lead the market with around 76.7% of market share in 2024. Solid bath soaps represent the largest market segment due to their enduring popularity and various advantages. These bars are a traditional and familiar choice for consumers, offering a tactile and sensory experience during use. Solid soaps are often preferred for their longevity, as they tend to last longer than their liquid counterparts. They also require less packaging, contributing to environmental sustainability. Solid bath soaps are available in a wide range of formulations, including specialty and organic options, catering to diverse consumer preferences. Their convenience, affordability, and versatility render them a staple in many households.

Analysis by Distribution Channel:

- Supermarkets and hypermarkets

- Convenience stores

- Pharmacies

- Specialty Stores

- Online

- Others

Supermarkets and hypermarkets offer a diverse range of brands and soap types, providing consumers with ample choices in one location. Shoppers can easily compare different products and select those that align with their preferences. The convenience of one-stop shopping and the ability to physically examine products render supermarkets and hypermarkets popular outlets for bath soaps. Additionally, these large retailers often run promotions and discounts, enticing consumers to enable bulk purchases, further driving sales in the bath soap market.

Convenience stores also play a vital role in the market by catering to customers who prioritize quick and hassle-free shopping. These stores are strategically located for accessibility and typically stock popular and essential bath soap brands. Consumers often turn to convenience stores for immediate soap needs, whether it's for travel, emergencies, or daily use. The convenience factor and extended operating hours make convenience stores an indispensable distribution channel for bath soaps.

Pharmacies serve as reliable distribution channels for bath soaps, especially those with a focus on skincare and dermatological considerations. Consumers seeking soap options that align with specific skin conditions or sensitive skin often turn to pharmacies for expert guidance. Pharmacies carry soap brands with dermatologist-approved formulations, providing confidence to health-conscious consumers who prioritize the well-being of their skin. This distribution channel bridges the gap between personal care and healthcare, propelling the bath soap market through trust and specialized offerings.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 38.4%. Asia Pacific held the biggest market share due to its large population, urbanization, and increasing consumer disposable incomes. Growing awareness of personal hygiene and self-care, especially in countries like India and China, also fuels the demand for bath soaps. Additionally, the region's diverse consumer preferences lead to a wide variety of soap options, from traditional to premium and natural. The increasing penetration of modern retail formats and e-commerce platforms further enhances accessibility, thus contributing to market growth.

Key Regional Takeaways:

United States Bath Soap Market Analysis

In 2024, the United States represented 88.10% of the North America bath soap market. The U.S. bath soap market is really booming with a growing number of people preferring premium and sustainability-based personal care products. According to an industrial report, the U.S. soap market was valued at approximately USD 5.5 Billion in 2023, with 95% of the population reported to use soap regularly. Organic and natural soaps are more in demand, where 35% of its sales come from consumers emphasizing eco-friendly and chemical-free stuff. Major players in the soap market include Procter & Gamble and Unilever, which offer a wide array of products to cater for various demographic needs. In the words of NPD Group, e-commerce channels accounted for 25% of total soap revenue; thus, online platforms increasingly determine product accessibility. Furthermore, government hygiene promotion initiatives, especially during the COVID-19 pandemic, reinforced soap's role in daily activities. Customized products like therapeutic and fragrance-enhanced soaps are also finding increasing popularity. This diversification, innovation, and consumer demand ensure continued market growth and changing consumer engagement.

Europe Bath Soap Market Analysis

The European bath soap market is steadily growing with increased consciousness about personal hygiene and sustainability. Eurostat statistics revealed that organic soap sales captured 35% of the overall market revenue in 2023, which is a powerful shift toward eco-friendly and biodegradable products. Germany, France, and the UK are at the top of sales, accounting for more than a market valuation of USD 3 Billion. Innovation on the part of manufacturers is inspired by the strict EU legislation about biodegradable ingredients and sustainability standards. Local players such as L'Occitane and Weleda lure environmentally conscious customers by playing on the need for natural formulations and green packaging. It is premiumisation, wherein luxury soaps are increasing by 12% annually, according to Mintel, as consumers enjoy increasing disposable incomes and desire new, higher-quality items. Sustaining the best source of living and following mandatory regulations would continue to keep up the competition in the European bath soap market through the expectations of consumers.

Asia Pacific Bath Soap Market Analysis

The Asia Pacific bath soap market is increasing at a great pace due to factors such as urbanization, increasing disposable incomes, and increased hygiene consciousness. In volume consumption terms, countries such as India and China are at the forefront, with vast populations and expanding middle-class demographics. For instance, according to an article, in 2019, soap consumption in China stood at over 20 million tons, whereas India consumed nearly 7.6 million tons, accounting for 8.2% of global consumption. Per capita soap consumption in India is 460 grams per annum, a significant growth area as the disposable incomes grows and hygiene becomes more of a concern. Natural and herbal soap products are becoming popular, and local brands such as Patanjali in India and Shanghai Jahwa in China are taking advantage of the trend of aligning with consumer preferences for traditional and eco-friendly options. International brands are also capturing market share by partnering with local distributors and launching premium products to urban markets. Innovations such as antibacterial and moisturizing soaps respond to changing consumer needs. In addition, e-commerce increased access to goods, especially in rural areas, therefore increasing market penetration.

Latin America Bath Soap Market Analysis

The Latin American bath soap market is growing due to rising hygiene consciousness and the affordability of soap products. An industrial report suggests that Brazil holds the largest regional market share at USD 1.2 Billion in 2023, with 92% of households reporting regular usage of soap. Natural and herbal soaps are also highly sought after in countries such as Mexico and Colombia, where the desire for organic personal care is increasingly being expressed. Local brands such as Natura in Brazil and Grupo Bimbo in Mexico effectively compete with global players by offering culturally relevant and cost-effective products. Government-led hygiene campaigns have significantly augmented soap consumption, especially in rural areas where awareness was previously limited. The rise of e-commerce platforms has further facilitated access to premium and mass-market soap products. The factors, such as affordability and increasing awareness, are combining to provide steady growth for the Latin American bath soap market.

Middle East and Africa Bath Soap Market Analysis

The Middle East and Africa bath soap market are growing due to increased hygiene awareness and urbanization. International Trade Administration estimates that in 2023, the Middle East personal care market, which includes soaps, was valued at USD 4.6 Billion, while soaps accounted for 20% of the total market. GCC countries have high living standards; therefore, per capita consumption of soap is high, especially premium and luxury soap. African countries like South Africa and Nigeria are witnessing increased soap consumption, which is driven by growing middle-class populations and government initiatives for hygiene. Euromonitor International reports that soaps produced by local manufacturers in Saudi Arabia, such as Jamjoom Group, have been Halal-certified to meet religious and cultural requirements. International brands are now launching new, environmentally friendly products to meet the changing expectations of consumers. Increased focus on hygiene and accessibility through modern retail and e-commerce platforms will ensure growth and diversification of markets across the region.

Competitive Landscape:

Various key players in the market are actively engaging in several strategic initiatives. They are focusing on product innovation, introducing new formulations, and expanding their product portfolios to cater to changing consumer preferences, including natural and organic options. Additionally, marketing efforts play a significant role, with companies emphasizing eco-friendly packaging, sustainability, and product efficacy to attract environmentally conscious consumers. Furthermore, rising investments in research and development (R&D) are enabling the creation of dermatologically approved and specialty soap variants to address specific skin concerns. These industry leaders are also expanding their distribution networks, both through traditional retail channels and online platforms, to enhance accessibility and reach a wider customer base.

The report provides a comprehensive analysis of the competitive landscape in the bath soap market with detailed profiles of all major companies, including:

- Procter and Gamble

- Unilever

- Colgate Palmolive

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- October 2024: Goop has collaborated with evolvetogether on the launch of a biodegradable, dissolvable soap exfoliating bar soap packaged from wood pulp. This soap is luxurious, sustainable, and functional, combining moisturizing elements such as shea butter and licorice root, as well as its signature spicy wood fragrance.

- August 2024: Hindustan Unilever unveiled the innovative HUL Stratos Technology, enabling a 25% reduction in palm oil usage for soap production, claiming to have superior functional benefits to the skin barrier, fragrance delivery, and more.

- October 2023: Unilever cut product prices in India in a few categories, such as soaps and laundry, to pass on the benefits of lower commodity prices, augment volumes and compete with local entrants. This pricing strategy aims to enhance sales volumes and enhance competitiveness, particularly against local market players. By offering more affordable products in these essential categories, Unilever can cater to a broader consumer base and potentially gain a competitive edge in India's highly competitive consumer goods market.

- May 2023: Colgate-Palmolive announced its plans to diversify beyond oral care under Palmolive brand. By utilizing the well-established Palmolive brand, which is already recognized for personal care and household products, the company aims to broaden its portfolio and enter markets beyond traditional oral care. This move reflects a strategic response to shifting consumer preferences and market opportunities, allowing Colgate-Palmolive to tap into additional segments of the consumer goods industry and potentially drive growth and market share in diverse product categories.

- March 2023: Procter and Gamble collaborated with Celebrity Chef Jet Tila to introduce the Dawn Professional Heavy Duty Manual Pot and Pan Detergent. This innovative product is designed to meet the rigorous cleaning demands of commercial kitchens and culinary professionals. With Chef Jet Tila's culinary expertise and Procter and Gamble's commitment to quality, the detergent aims to provide an effective and efficient solution for tackling tough, baked-on residues and grease.

Bath Soap Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Premium Products, Mass Products |

| Forms Covered | Solid Bath Soaps, Liquid Bath Soaps |

| Distribution Channels Covered | Supermarkets and hypermarkets, Convenience stores, Pharmacies, Specialty Stores, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Procter and Gamble, Unilever, Colgate Palmolive, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bath soap market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bath soap market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bath soap industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bath soap market was valued at USD 24.6 Billion in 2024.

The bath soap market is projected to exhibit a CAGR of 3.57% during 2025-2033, reaching a value of USD 35.0 Billion by 2033.

Key factors driving the market include increasing hygiene awareness, rising disposable incomes, growing demand for premium and organic soaps, urbanization, and expansion of e-commerce platforms. The trend towards sustainability, specialty soaps, and innovative formulations also contributes to the market's growth.

Asia Pacific currently dominates the bath soap market, accounting for a share exceeding 38.4%. This dominance is fueled by large populations, urbanization, rising disposable incomes, and growing awareness of personal hygiene.

Some of the major players in the bath soap market include Procter and Gamble, Unilever, Colgate Palmolive, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)