Brazil E-commerce Market Report by Type (B2C E-Commerce, B2B E-Commerce), and Region 2026-2034

Brazil E-commerce Market Size:

Brazil e-commerce market size reached USD 513.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 1,501.8 Billion by 2034, exhibiting a growth rate (CAGR) of 12.67% during 2026-2034. The market’s growth is driven by increasing Internet penetration, a rising middle-class population, rapid advancements in digital payment systems, growing consumer preference for online shopping, and the widespread adoption of mobile commerce.

- In 2024, Pix payments represented nearly 30% of e-commerce transactions, revolutionizing the digital payment landscape with instant, no-fee transfers, and driving user adoption across demographics.

- Rising smartphone penetration is fueling a shift toward mobile-first shopping experiences.

- Government initiatives supporting digital infrastructure are enhancing connectivity and enabling broader e-commerce access.

- The expansion of online marketplaces and improvements in last-mile delivery logistics are streamlining fulfilment and boosting customer satisfaction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 513.3 Billion |

|

Market Forecast in 2034

|

USD 1,501.8 Billion |

| Market Growth Rate 2026-2034 | 12.67% |

Brazil E-commerce Market Analysis:

- Major Market Drivers: The increasing Internet and smartphone usage, expanding access to digital payment systems, and growing middle class with rising disposable incomes represent the major drivers of the market. The COVID-19 pandemic significantly accelerated online shopping adoption, pushing many traditional retailers to establish an online presence.

- Key Market Trends: The rise in mobile commerce as consumers increasingly shop via smartphones and mobile apps represents a key trend in the market growth. Social commerce, leveraging platforms like WhatsApp and Instagram, is gaining traction among retailers. There's a rising emphasis on personalized shopping experiences and seamless Omni channel strategies, integrating online and offline touch points.

- Competitive Landscape: Some of the major market players in the Brazil e-commerce industry include Amazon.com Inc., Apple Inc., KaBuM (Magazine Luiza S.A.), MadeiraMadeira Comércio Eletrônico S/A, Magazine Luíza S.A., Shopee Pte. Ltd. (Sea Limited), among many others.

- Challenges and Opportunities: The market faces various challenges including high taxation, complex logistics due to vast geography and cybersecurity concerns, along with economic volatility and regulatory hurdles that can impede market growth. However, the market also faces several opportunities such as increasing Internet and smartphone adoption, a growing middle-class population, and significant advancements in digital payment solutions, along with the rise of social commerce and innovative logistics solutions.

Brazil E-commerce Market Trends:

Increasing Internet and Smartphone Usage

The rising accessibility of online shopping with more Brazilians gaining access to the internet and smartphones is fueling the growth of the market. According to datareportal, there were 187.9 million Internet users in Brazil at the start of 2024, when Internet penetration stood at 86.6%. Brazil was home to 144.0 million social media users in January 2024, equating to 66.3% of the total population. A total of 210.3 million cellular mobile connections were active in Brazil in the year 2024, with this figure equivalent to 96.6% of the total population. Ookla’s data reveals that the median mobile Internet connection speed in Brazil increased by 13.73 Mbps (+41.2%) in the 12 months to the start of 2024. Meanwhile, Ookla’s data shows that fixed Internet connection speeds in Brazil increased by 40.73 Mbps (+40.8%) during the same. This is further boosting the Brazil e-commerce market size significantly.

Significant Advancements in Digital Payment Systems

The rising improvement and secure digital payment options such as digital wallets and online banking are making transactions easier and safer, which is encouraging more consumers to shop online, thus contributing to the growth of the market. According to the World Economic Forum, Brazil commerce is leading a Latin American boom in financial inclusion, with FinTech companies and Central Bank-led initiatives providing access to bank accounts for the first time to millions of people. For instance, in May 2022, the World Economic Forum partnered with the Inter-American Development Bank to launch an initiative aimed at further expanding financial inclusions and unlocking digital trade opportunities in Latin America and the Caribbean. The expansion of digital payments in e-commerce Brazil has created an innovative financial ecosystem that works for ordinary people. This progress is the result of a combination of an overhaul in the payments regulatory framework, intensive use of technology, entrepreneurship, and a focus on creating products that address the needs of Brazilian customers. This is expected to fuel the Brazil e-commerce market forecast over the coming years.

Rising Online Shopping

The widespread adoption of online shopping accelerated by the COVID-19 pandemic as consumers turned to e-commerce for convenience and safety, pushing traditional retailers to enhance their online presence. For instance, in July 2023, Swedish clothing company Hennes & Mauritz (H&M) revealed plans to enter the Brazilian market in 2025. The company will launch its store and online in the country. H&M will initially enter major cities in southeast Brazil and plans to expand its presence across the country over time. H&M group CEO Helena Helmersson says that they are thrilled to announce that they are opening their first store offline and online in Brazil in 2025. They have had good development in Latin America and see great potential in Brazil. This is a very exciting step and they look forward to bringing H&M's concept of fashion, quality, and sustainability at the best price to many customers in Brazil, contributing to the Brazil ecommerce market size.

Pix Popularity Driving E-commerce Acceleration

The widespread adoption of Pix has become a defining trend in Brazil's e-commerce landscape. Introduced by the Central Bank of Brazil, Pix offers real-time, no-fee transactions, making it a highly attractive option for both consumers and merchants. As of 2024, nearly 75% of the Brazilian population actively uses Pix, significantly enhancing checkout convenience and reducing cart abandonment. This instant payment system supports financial inclusion, drawing more users—especially from underbanked regions—into the digital economy. Its seamless integration with mobile apps and online platforms has made it a preferred method for e-commerce purchases, further driving sales. As merchants increasingly adopt Pix, it is set to remain a key pillar in Brazil’s e-commerce market growth and digital transformation.

Live Shopping

Live shopping is rapidly emerging as a key trend in Brazil's e-commerce market, blending entertainment with real-time purchasing experiences. Popularized through social media platforms like Instagram, TikTok, and YouTube, this format allows brands and influencers to showcase products via live video streams while interacting directly with viewers. Consumers can ask questions, see product demonstrations, and make purchases instantly during the broadcast. This engaging and trust-building model is especially effective for fashion, beauty, and electronics segments. As mobile e-commerce and social media usage grow, more retailers are investing in live commerce to boost conversion rates and reduce return rates. Live shopping is set to play a pivotal role in Brazil e-commerce market trends, enhancing personalization and driving impulsive buying behavior.

Brazil E-commerce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type.

Breakup by Type:

To get more information on this market, Request Sample

- B2C E-Commerce

- Beauty and Personal Care

- Consumer Electronics

- Fashion and Apparel

- Food and Beverage

- Furniture and Home

- Others

- B2B E-Commerce

The report has provided a detailed breakup and analysis of the market based on the type. This includes B2C e-commerce (beauty and personal care, consumer electronics, fashion and apparel, food and beverage, furniture and home, and others) and B2B e-commerce.

The demand for B2C e-commerce in Brazil is driven by increasing internet penetration, widespread smartphone usage, and growing consumer confidence in online shopping. The COVID-19 pandemic accelerated the shift to online retail, with consumers valuing the convenience and safety of e-commerce. Additionally, improved digital payment systems and faster delivery options enhance the online shopping experience. The expanding middle class with rising disposable incomes further fuels B2C e-commerce growth, seeking diverse products and competitive pricing.

B2B e-commerce demand in Brazil is driven by the digitization of business processes, improved supply chain efficiency, and the need for cost-effective procurement solutions. Companies are increasingly adopting online platforms to streamline operations, reduce overhead costs, and access a broader range of suppliers and products. Enhanced digital payment systems and advancements in logistics support B2B transactions. Additionally, the push for digital transformation and competitive pressures compel businesses to embrace e-commerce for greater market reach and operational efficiency.

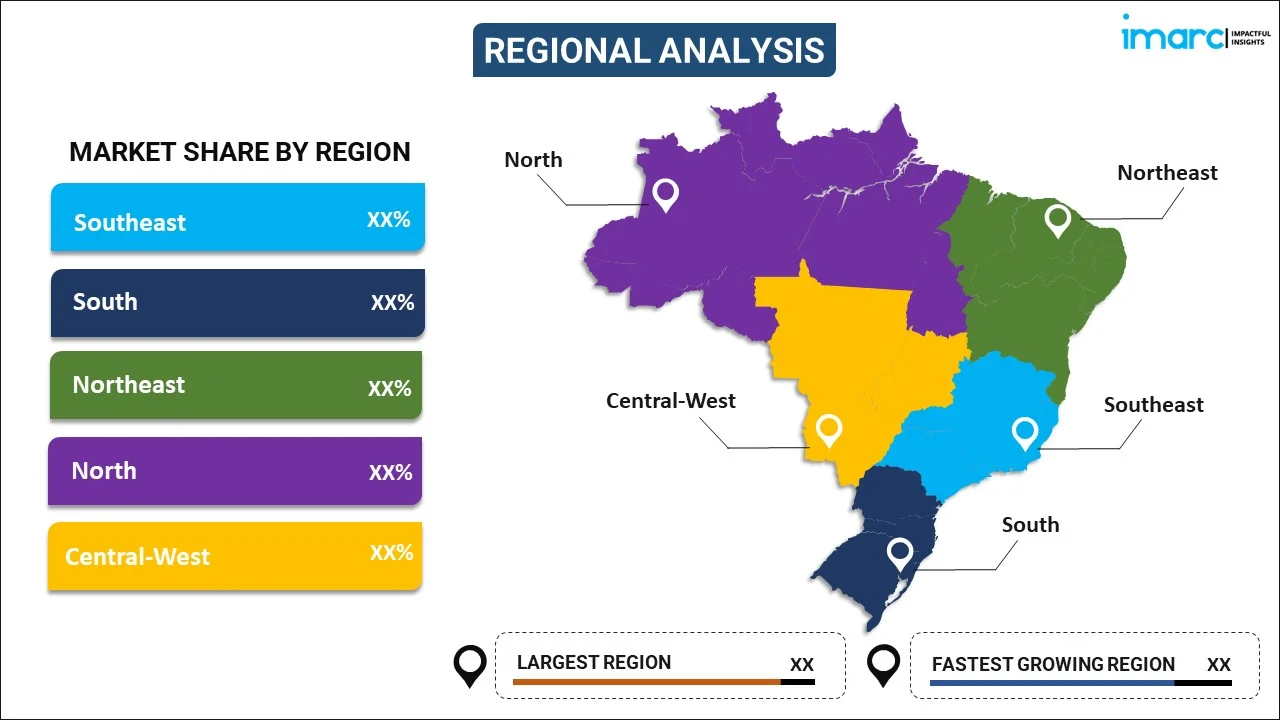

Breakup by Region:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major markets in the region, which include Southeast, South, Northeast, North, and Central-West.

The Southeast's e-commerce demand is driven by high urbanization, advanced internet infrastructure, and higher disposable incomes. Major cities like São Paulo and Rio de Janeiro act as economic hubs with tech-savvy populations. Improved logistics and a strong retail presence enhance the region's e-commerce growth, supported by a diverse and affluent consumer base.

In the South, demand is fueled by high literacy rates, widespread internet access, and a robust industrial base. Cities like Curitiba and Porto Alegre lead in digital adoption. The region's affluent population prefers online shopping for its convenience and variety, supported by well-developed logistics and technology infrastructure.

Northeast Brazil sees growing e-commerce demand due to increasing internet penetration, rising smartphone usage, and an expanding middle class. Improved digital literacy and better logistics networks make online shopping more accessible. E-commerce platforms offer convenience and variety, catering to both urban and rural consumers in this developing region.

The North's e-commerce growth is driven by rising internet and mobile connectivity, even in remote areas. Government initiatives to improve digital infrastructure and economic development boost online shopping. E-commerce provides essential convenience and accessibility in a region with limited physical retail options, meeting the needs of a dispersed population.

In Central-West Brazil, e-commerce demand is driven by growing internet and smartphone penetration, along with the region's significant agribusiness sector. Cities like Brasília and Goiânia lead in digital adoption. Improved logistics and transportation networks support e-commerce services, catering to both urban and rural consumers seeking convenience and diverse product options.

Top Brazilian E-Commerce Companies in 2025:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided. Some of the major market players in the Region e-commerce industry include Amazon.com Inc., Apple Inc., KaBuM! (Magazine Luiza S.A.), MadeiraMadeira Comércio Eletrônico S/A, Magazine Luíza S.A., Shopee Pte. Ltd. (Sea Limited), among many others.

- The competitive landscape of the market is highly competitive, dominated by key players such as MercadoLibre, Amazon, and Magazine Luiza. Local giants including B2W Digital (Americanas) and Via Varejo also hold significant Brazil e-commerce market share. These companies compete on diverse fronts, like pricing, product variety, delivery speed, and customer service. For instance, in March 2024, Latin American e-commerce giant MercadoLibre planned to invest a record 23 billion reais ($4.6 billion) in 2024 in Brazil, its main market, a 21.1% increase from 2023.

Brazil E-commerce Market News:

- In June 2024, the award-winning marketplace marketing agency, Podean, launched in Brazil. This comes after having gained impressive traction in Mexico over the past two years, where the agency was appointed by prestigious clients including Hasbro, Danone, Under Armour, AB InBev, and Hugo Boss.

- In June 2024, Pinduodo’s cross-border e-commerce platform, Temu officially launched in Brazil. Consumers can purchase a wide range of products on its website at competitive prices, including beauty products, clothing, jewelry, pet supplies, office supplies, electronics, and household appliances.

- In March 2024, MercadoLibre invested 23 billion reais ($4.6B) in Brazil, a 21% increase from 2023, to strengthen its lead in e-commerce. The funds will focus on logistics, technology hiring, fintech (Mercado Pago), and advertising (Mercado Ads). A new distribution center in Pernambuco is planned, with two more under consideration. Brazil remains its top market, accounting for over half of its revenue.

Brazil E-commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Companies Covered | Amazon.com Inc., Apple Inc., KaBuM! (Magazine Luiza S.A.), MadeiraMadeira Comércio Eletrônico S/A, Magazine Luíza S.A., Shopee Pte. Ltd. (Sea Limited), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil e-commerce market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil e-commerce market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil e-commerce industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Brazil’s e-commerce market is experiencing robust growth, supported by rising internet penetration, AI-driven personalization, mobile commerce adoption, and instant payment systems like Pix, which now accounts for nearly 30% of all e-commerce transactions. Strong government support for digital infrastructure and growing trust in online marketplaces continue to fuel expansion and consumer engagement across sectors.

The market is anticipated to grow at a CAGR of 12.67% from 2026-2034.

Key factors driving the e-commerce market in Brazil include rising internet and smartphone penetration, widespread adoption of Pix instant payments, and increasing consumer preference for online shopping. Government support for digital infrastructure, the expansion of mobile commerce, and improvements in last-mile delivery logistics also contribute to growth. Additionally, innovations such as AI-driven personalization and the rise of live shopping formats are enhancing user experience and boosting online sales across diverse demographics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)