Cheese Market Size, Share, Trends and Forecast by Source, Type, Product, Format, Distribution Channel, and Region, 2026-2034

Cheese Market Size and Share:

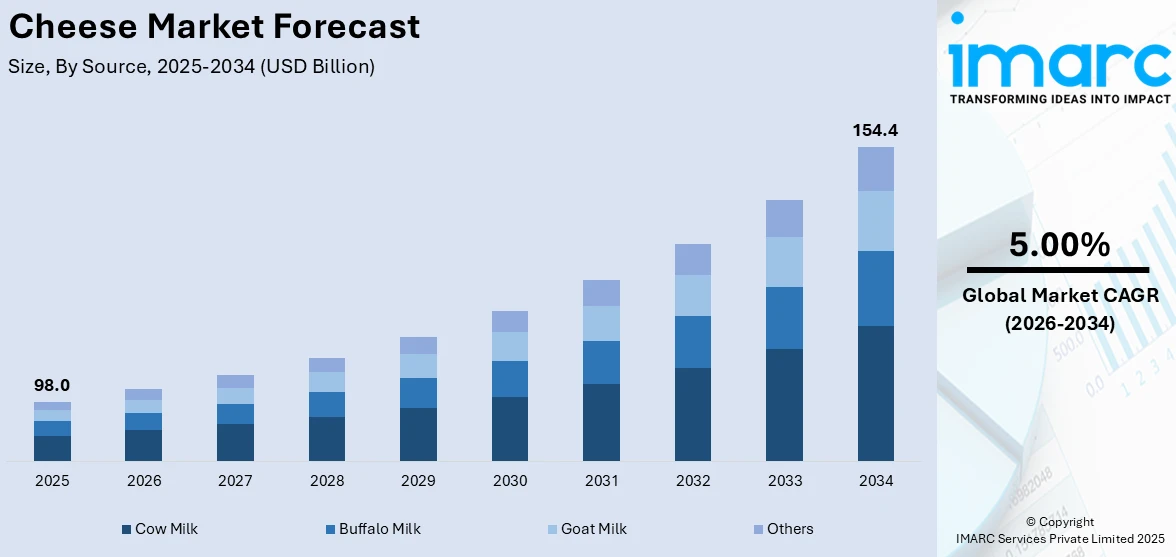

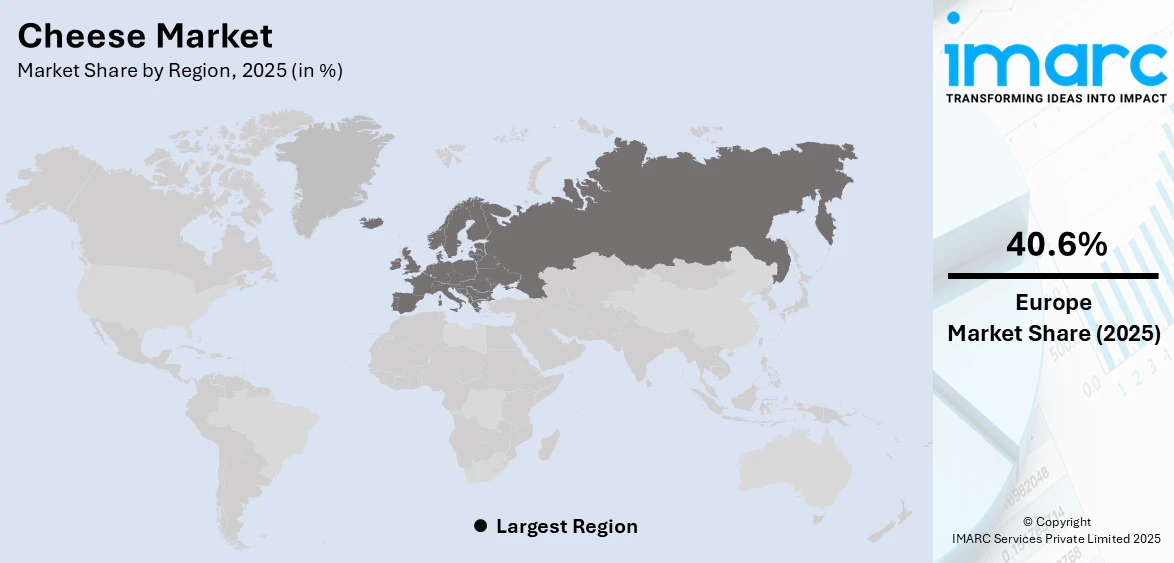

The global cheese market size was valued at USD 98.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 154.4 Billion by 2034, exhibiting a CAGR of 5.00% from 2026-2034. Europe currently dominates the market, holding a market share of over 40.6% in 2025. The cheese market is driven by rising consumer demand for diverse dairy-based products, the growing popularity of ready-to-eat (RTE) and convenience foods and increasing applications in the foodservice sector. Health-conscious consumers seeking protein-rich diets and innovative product offerings, such as organic and plant-based cheeses, further bolstering the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 98.0 Billion |

| Market Forecast in 2034 | USD 154.4 Billion |

| Market Growth Rate (2026-2034) | 5.00% |

Some other major drivers in the market for cheese are the trends of increased consumer preference to convenience and RTE food items. With busy lifestyles and modern living, demand to have quick meal solutions also increased, positioning cheese among the most versatile ingredients and in snacks, meals, or processed foods. Its extended shelf life, ease of incorporation into recipes, and compatibility with various cuisines make it a staple for both households and foodservice providers. Additionally, the rising popularity of cheese-based products like pizzas, burgers, and sandwiches in fast food and casual dining further accelerates market growth, catering to evolving consumer habits and taste preferences.

To get more information on this market Request Sample

The U.S. cheese market is a dominant force globally with a market share of 01.41%, driven by high consumption rates and a diverse product range. Consumer preferences for natural and specialty cheeses, coupled with rising demand in the foodservice sector, fuel market expansion. Popularity of cheese-laden fast foods like pizzas and burgers further contributes to growth. The trend towards artisanal and organic cheese products is also gaining momentum, reflecting consumer interest in premium and health-conscious options. Moreover, innovations in packaging and product formulations enhance convenience and shelf life, aligning with modern lifestyles. The U.S. remains one of the leading exporters of cheese, with the USDA noting that U.S. cheese exports reached over 1 million metric tons in 2023, contributing significantly to the global market share, bolstering by its robust dairy industry infrastructure.

Cheese Market Trends:

Technological Advancements in Cheese Production

The inflating popularity of specialized proteins in cheese-making processes is one of the key factors propelling the market growth across the globe. For example, micellar casein, owing to its unique functional and structural characteristics, contributes to higher water retention, protein content, heat stability, and nutritional benefits in cheese. Furthermore, key players are also using precision fermentation techniques, thereby acting as another significant growth-inducing factor. For instance, in March 2023, Daiya Foods, a leading plant-based food brand known for its plant-based cheese products, announced an investment in fermentation technology to introduce a plant-based cheese that closely mimics traditional dairy-based cheese. By combining traditional cheese-making methods with modern technology, the company aimed to enhance experience in the plant-based cheese category. Concurrently, in August 2023, Agrocorp International developed HerbY-Cheese, which is a nut-free and plant-based cheese range under the brand HerbYvore in Singapore. The company partnered with the Singapore Institute of Technology (SIT) to launch sustainable plant protein extraction methods. In addition to this, the collaboration enabled the successful commercialization and development of HerbY-Cheese, which includes dairy-free alternatives to mozzarella, cheddar, and parmesan. Besides this, HerbY-Cheese is commonly available in selected local establishments and for purchase online, catering to consumers looking for nutritious and sustainable dairy alternatives. In line with this, in March 2023, PlantWise, a plant-based dairy alternative company, introduced vegan cheese shreds, spreads, and cheesy nuggets that taste like dairy cheeses. PlantWise's unique natural fermentation process creates an authentic cheese flavor similar to dairy cheese.

Rising Product Offerings

The introduction of product variants that can be used in preparing many dishes, such as burgers, pizzas, pasta, etc., is elevating the production of cheese across the global market. Leading manufacturers are also developing flavored, artisanal, and plant-based options, which, in turn, represent primary drivers propelling the market growth. For example, in October 2022, Armored Fresh, a subsidiary of Korean company Yangyoo, introduced plant-based cheese in USA. Additionally, the cheese provides a similar protein content to animal-based cheese and is made from plant-based lactic acid and almond milk. The company raised significant funding and aimed to enter the U.S. market via national grocery retailers.

Increasing Focus on Strategic Approaches

Positive impact on the price of the cheese market through strategic collaborations and partnerships by leading companies to enhance their brand awareness among consumers. In December 2022, for instance, Britannia Industries formed a partnership; Bel acquired a 49% stake in Britannia's subsidiary, Britannia Dairy, to leverage on the cheese market growth trend in India. The alliance was also set to trade and manufacture co-branded products under "The Laughing Cow" and "Britannia" trademarks. It entered the cheese product market with mozzarella and processed cheese launches in February 2021. The company claimed that the variants were made of pure cow milk. The newly launched cheese products introduced by Heritage Foods contain a naturally occurring cheesy flavor suitable for consumption by individuals of all age groups.

Cheese Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cheese market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on source, type, product, format, and distribution channel.

Analysis by Source:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Others

Cow milk stands as the largest component in 2025, holding around 91.4% of the market due to its availability, versatility, and well-established dairy farming infrastructure worldwide. It is high in protein, fat, and calcium, and hence suitable for producing an enormous number of cheeses that have varied textures and flavors. The most common cheese varieties like cheddar, mozzarella, and gouda are primarily prepared using cow milk, which further emphasizes its prevalence. In addition to that, the cow milk-based cheeses are more accessible, easier to find, and better received by many cultures. Goat, plant-based milks are gaining more preference, yet cow milk remains the preferred source due to its long tradition of domination in dairy and popularity in the market among consumers.

Analysis by Type:

- Natural

- Processed

Natural leads the market with around 72.9% of market share in 2025 driven by consumer preferences for authentic, minimally processed products. Natural cheeses like cheddar, mozzarella, and gouda have a very appealing taste, texture, and nutritional profile from the milk content. They are thus highly sought after. In addition, rising health consciousness among consumers benefits the natural cheeses because they seem more wholesome compared to their processed counterparts. Finally, a growing interest in artisanal and organic cheeses propels demand for natural cheese products. With a wide range of applications in cooking, snacking, and foodservice, natural cheese remains the preferred choice for both households and restaurants, thereby further cementing its leadership in the global cheese market.

Analysis by Product:

- Mozzarella

- Cheddar

- Feta

- Parmesan

- Roquefort

- Others

In 2025, cheddar accounts for the majority of the market at around 32.4% due to cheddar's widespread popularity and versatility in various culinary applications, from sandwiches and burgers to salads and snacks. Its high flavor intensity, firmness, and ability to melt properly make it one of the household items of both homes and food-service industries. This is made easier by the product's attractiveness to different consumers across varying age brackets; it's also quite inexpensive. And with growing popularity in its mildest and sharpest forms alongside increased innovations that include its reduced fat as well as organic options, cheddar remains at the top globally. Its consistent availability and adaptability in global cuisines ensure its continued market dominance.

Analysis by Format:

- Slices

- Diced/Cubes

- Shredded

- Blocks

- Spreads

- Liquid

- Others

Slices represented the leading market segment, holding 31.8% of the total share due to its popularity of cheese slices is primarily driven by their convenience and versatility, making them a staple in sandwiches, burgers, and other RTE meals. Their easy-to-use packaging and portion control make them particularly appealing to busy consumers seeking quick meal solutions. Moreover, cheese slices cater to the growing demand for processed and pre-packaged foods, aligning with modern, fast-paced lifestyles. Manufacturers have responded to this demand by offering various flavors, including cheddar, mozzarella, and specialty cheeses, as well as options like reduced-fat and lactose-free varieties. The consistent growth of fast food and quick-service restaurants also contributes to the segment's dominance, further solidifying cheese slices as a key product in the global cheese market.

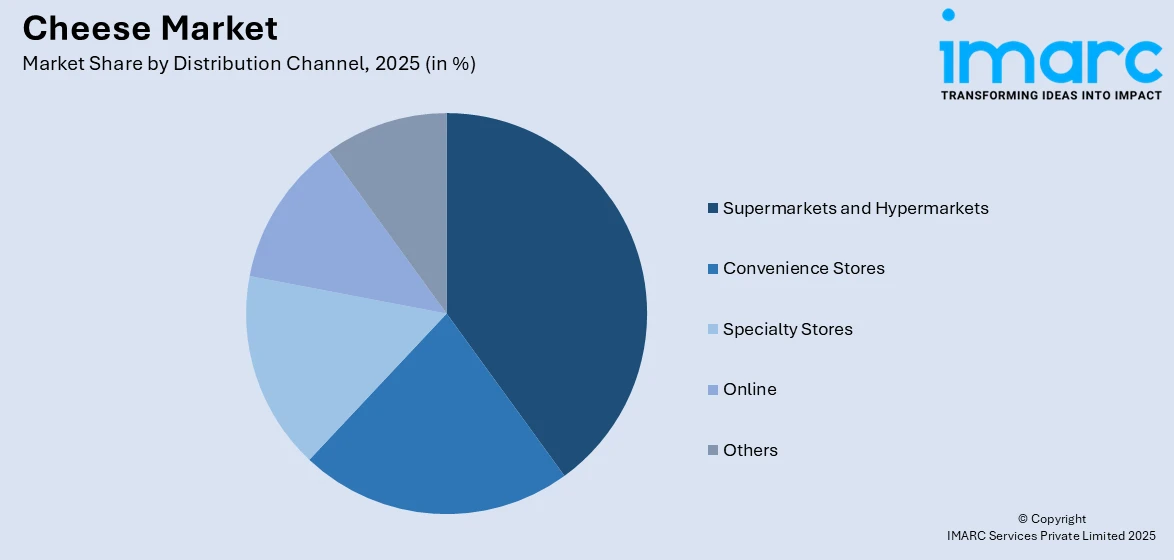

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Supermarket and hypermarkets lead the market with around 35.8% of market share in 2025 due to their wide reach, convenience, and extensive product offerings, allowing consumers to access a broad variety of cheeses, including premium, organic, and international options. Supermarkets and hypermarkets also have strategic partnerships with large cheese producers where they enjoy price competitiveness and offers, thus pulling in an enormous customer base. Other factors that explain its market supremacy are the development of supermarket grocery shopping in large retail stores in urban areas. As supermarkets and hypermarkets have large store networks and expand their online platforms, the role of supermarkets and hypermarkets remains paramount in cheese distribution and consumption to fulfill consumer demands for variety, quality, and convenience.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2025, Europe accounted for the largest market share of over 40.6% driven by the region’s long-standing tradition of cheese consumption, with countries like France, Italy, Germany, and the UK being major producers and consumers. The European market is characterized by a wide range of cheese varieties, from popular cheeses like Brie and Gouda to regional artisanal products, which cater to diverse consumer preferences. Increasing demand for premium, organic, and specialty cheeses further boosts market growth, alongside rising popularity in plant-based and lactose-free alternatives. Additionally, the strong foodservice sector, which includes fine dining and casual eateries, contributes significantly to the demand for cheese. Furthermore, Europe’s well-established dairy production infrastructure and export capabilities strengthen its position as a market leader.

Key Regional Takeaways:

North America Cheese Market Analysis

The North American cheese market is experiencing significant growth, driven by strong consumer demand for both traditional and innovative cheese products. The U.S. leads the market, with cheese being a staple in fast food, processed meals, and snacks. Popular cheese types like cheddar, mozzarella, and cream cheese dominate, while specialty cheeses, such as organic and artisan varieties, are gaining traction among health-conscious consumers. The rise of plant-based and lactose-free cheese options reflects shifting dietary preferences, catering to vegan, lactose-intolerant, and health-conscious consumers. The expanding foodservice sector, including restaurants, cafes, and fast-food chains, also fuels cheese consumption, with pizza and burgers being prime drivers. Apart from this, increasing consumer interest in premium and locally sourced cheeses is encouraging producers to innovate and offer unique flavors. The market is also benefiting from robust distribution networks and e-commerce platforms, making cheese products more accessible to a wider audience.

United States Cheese Market Analysis

The United States cheese market is currently experiencing significant growth due to several specific drivers. The increasing demand for natural and specialty cheeses is being driven by the rising popularity of gourmet dining and artisanal food trends. Consumers are increasingly seeking cheeses with unique flavors and regional origins, leading to the expansion of niche cheese varieties. The ongoing adoption of plant-based and lactose-free cheese alternatives is catering to the growing population of health-conscious and lactose-intolerant individuals. According to the National Institutes of Health, in the United States, approximately 36% of the population is affected by lactose malabsorption. Cheese manufacturers are also capitalizing on the demand for protein-rich snacks, with high-protein cheese snacks gaining traction among fitness enthusiasts. Furthermore, fast-food chains and restaurants are actively incorporating premium and diverse cheese options into their menus to enhance customer appeal. Meanwhile, the foodservice sector is continuously innovating with cheese-based offerings, supporting the market's expansion.

Europe Cheese Market Analysis

The European cheese market is experiencing growth driven by several specific factors. Consumers are increasingly favoring artisanal and specialty cheeses due to their unique flavors and traditional production methods. Demand for plant-based cheese alternatives is expanding, supported by rising veganism and lactose-intolerance awareness. According to the National Institutes of Health, approximately 25% of the European population is affected by lactose intolerance. The market is also benefiting from innovations in cheese packaging that are extending shelf life and ensuring better convenience for consumers. Producers are actively introducing new varieties, including flavored and spiced options, to cater to evolving taste preferences. The foodservice industry is incorporating premium cheese products into gourmet offerings, particularly in pizzas, burgers, and fine-dining dishes. Export opportunities are growing as European cheese gains popularity in international markets, especially in Asia and the Middle East. According to the European Commission, Japan accounted for 95,000 tonnes, representing 11% of Europe's cheese exports. Similarly, South Korea imported 45,000 tonnes, contributing to 5% of the total, while Saudi Arabia purchased 40,000 tonnes, also making up 5% of European cheese exports.

Asia Pacific Cheese Market Analysis

The cheese market in the Asia-Pacific region is witnessing growth as consumers are increasingly adopting Western dietary habits, leading to higher demand for cheese in urban areas. According to the CIA, 36.4% of the total population of India is urbanized in the year 2023. Manufacturers are expanding their product portfolios by introducing region-specific flavors, catering to diverse taste preferences across the Asia-Pacific countries. The foodservice industry is actively incorporating cheese in fusion cuisines, aligning with the evolving palates of younger demographics. Companies are investing in innovative packaging solutions to enhance the shelf life of cheese products, addressing logistical challenges in the region. Along with this, domestic dairy producers are collaborating with international firms to strengthen production capabilities, ensuring a consistent supply of high-quality cheese to meet rising consumer expectations.

Latin America Cheese Market Analysis

The Latin America cheese market is currently witnessing growth driven by the increasing demand for premium and specialty cheese varieties, particularly in urban areas. According to the CIA, 87.8% of the total population of Brazil is urbanized in the year 2023. Manufacturers are innovating with local flavors and traditional recipes, aligning with regional taste preferences. The rising use of cheese in fast-growing food service sectors, especially in pizzas and burgers, is further boosting sales. However, companies are expanding production capacities and distribution networks to cater to growing consumer demand.

Middle East and Africa Cheese Market Analysis

The Middle East and Africa cheese market is expanding due to increasing consumer demand for specialty cheeses like halloumi and feta, influenced by traditional culinary preferences. Manufacturers are innovating by introducing plant-based cheese options to cater to growing vegan and lactose-intolerant populations. Urbanization is driving higher consumption of packaged and processed cheeses in convenience foods. According to the CIA, 87.8% of the total population of UAE is urbanized in the year 2023. In addition to this, according to the CIA, 85% of the total population of Saudi Arabia is urbanized in the year 2023.

Competitive Landscape:

The competitive landscape of the cheese market is marked by the presence of several key global players, regional producers, and emerging brands. Leading companies, with a diverse range of cheese offerings, including processed, natural, and specialty varieties. These players have a broad distribution network and strong brand recognition. Regional players also hold significant market share by catering to local tastes and preferences, offering artisanal and traditional cheeses that emphasize authenticity and quality. The market is becoming increasingly fragmented as consumer demand shifts towards organic, plant-based, and health-conscious options. Smaller niche producers are capitalizing on this trend by introducing innovative cheese alternatives, such as vegan and lactose-free products, attracting health-conscious consumers. Competitive strategies include mergers and acquisitions, expanding product portfolios, and investing in sustainability initiatives. Price sensitivity and product differentiation are key factors influencing competition, with companies vying for market share through innovation and quality offerings.

The report provides a comprehensive analysis of the competitive landscape in the cheese market with detailed profiles of all major companies, including:

- Arla Foods amba

- Dairy Farmers of America Inc.

- Fonterra Co-operative Group Limited

- FrieslandCampina

- Lactalis (The Kraft Heinz Company)

- Savencia SA

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- In July 2024, Credo Foods, a US-based company that specializes in plant-based foods, launched what it claims to be the first oat milk-based vegan spray cheese in the world. Available in two flavors-Cheddar and Smoky-the product contains no GMOs, artificial preservatives, or seed oils.

- In September 2024, Kovalus company RELCO® entered a strategic partnership with the private dairy player in India, Milky Mist Dairy Food Private Limited. The alliance marks the next level in the history of Indian dairy with the building of the country's biggest Cheddar cheese production plant.

- In October 2024, Pure Dairy, Melbourne-based, entered into a strategic alliance with Great Lakes Cheese, the leading U.S. packager of natural and processed cheese, an important step in Pure Dairy's expansion plans worldwide.

- In October 2024, Britannia Bel Foods, a leading player in the cheese market of India announced the opening of its 'cheese manufacturing facility' in the country. This factory in India is for the home production of Britannia The Laughing Cow products. For this, the company is making utmost efforts to provide premium quality, locally developed products to Indian consumers with its offerings.

- In November 2023, Kraft Heinz Company rolled out a new line of Kraft vegan cheese slices with flavors available in American, provolone, and cheddar. Branding it under the title NotCheese slices, this new innovative product comes as a plant-based alternative to traditional Kraft Singles, in a formulation of water, coconut oil, modified starch, and chickpea protein. These new offerings are now available nationwide.

Cheese Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Metric Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow Milk, Buffalo Milk, Goat Milk, Others |

| Types Covered | Natural, Processed |

| Products Covered | Mozzarella, Cheddar, Feta, Parmesan, Roquefort, Others |

| Formats Covered | Slices, Diced/Cubes, Shredded, Blocks, Spreads, Liquid, Others |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Arla Foods amba, Dairy Farmers of America Inc., Fonterra Co-operative Group Limited, FrieslandCampina, Lactalis (The Kraft Heinz Company), Savencia SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cheese market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cheese market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cheese industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global cheese market was valued at USD 98.0 Billion in 2025.

IMARC Group estimates the market to reach USD 154.4 Billion by 2034, exhibiting a CAGR of 5.00% from 2026-2034.

Key factors driving the global cheese market include rising consumer demand for diverse cheese varieties, increasing adoption of cheese in fast foods and RTE meals, health-conscious trends favoring protein-rich options, and innovations in organic, plant-based, and specialty cheeses.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global cheese market include Arla Foods amba, Dairy Farmers of America Inc., Fonterra Co-operative Group Limited, FrieslandCampina, Lactalis (The Kraft Heinz Company), Savencia SA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)