Chestnut Market Size, Share, and Trends by Species Type, Distribution, Region, and Forecast 2025-2033

Chestnut Market Size & Share:

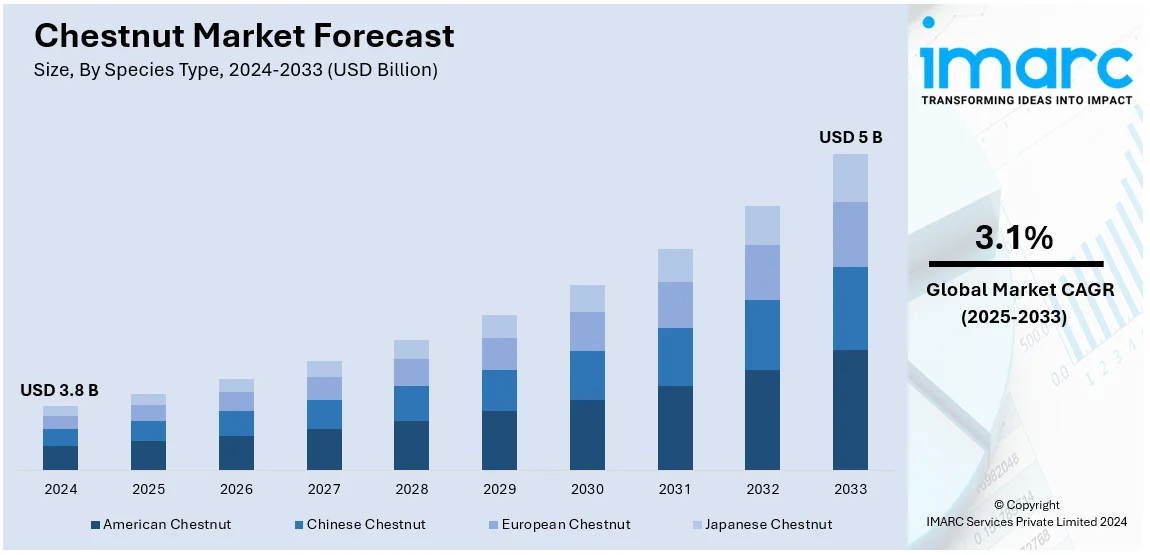

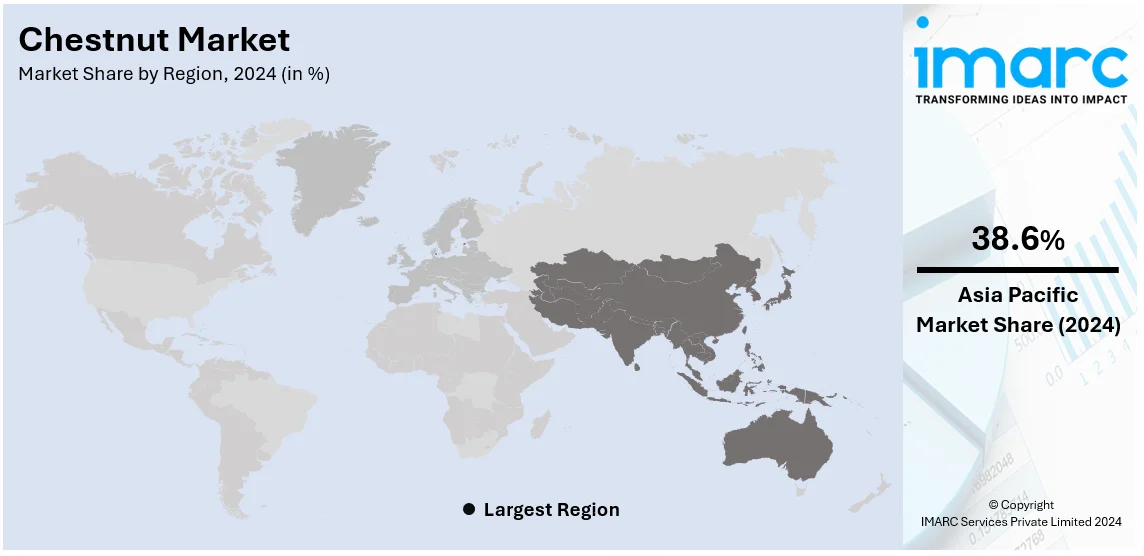

The global chestnut market size was valued at USD 3.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.0 Billion by 2033, exhibiting a CAGR of 3.1% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of around 39% in 2024. The chestnut market is driven by its culinary versatility, expanding global trade, and a shift towards sustainable and organic farming practices, catering to health-conscious consumers and environmentally aware markets, promoting global chestnut demand and production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Market Growth Rate (2025-2033) | 3.1% |

The growing popularity of plant-based diets and protein-rich ingredients is a key driver of market growth. Additionally, the increasing preference for chestnuts, due to their lower fat content compared to other nuts, is fueling the market’s expansion as they are seen as a healthier snack option. Besides this, the growing demand for natural and wholesome food choices across the globe is positively influencing the market. Rising consumer awareness about maintaining a healthy lifestyle is offering lucrative growth opportunities to industry investors. Additionally, the increasing demand for nuts that satisfy hunger and promote satiety paired with increasing popularity among individuals with gluten allergies is contributing to the growth of the market.

The United States chestnut market is driven by the escalating awareness of the numerous health benefits associated with chestnuts, aligning with the increasing preference for organic and natural foods. Additionally, the widespread combination of chestnuts in various cuisines amplifies their positive impact on the market, fostering increased consumption. Notably, the surge in demand in emerging markets fuels heightened chestnut production and exports. An increased focus on sustainability and environmental protection has spurred increased chestnut cultivation, as these trees play a pivotal role in preventing soil erosion and promoting biodiversity. Factors including ongoing product innovations, and extensive research and development (R&D) activities are expected to contribute to the momentum of the United States chestnut market growth over the forecasted period. In a notable development to revive the country’s chestnut variety, in September 2024, The American Chestnut Foundation (TACF) announced the launch of its new brand, which highlights a significant milestone in its 40+ years of journey dedicated toward restoring the American chestnut. This development was planned to help enhance the Foundation’s presence and interactions.

Chestnut Market Trends:

Increasing Demand in Culinary Applications

Chestnuts' ability to be used in various types of food is a key reason for their popularity. As a main part of many traditional foods, and as a popular seasonal treat, chestnuts are used in numerous ways, from roasted snacks to the vital ingredients of luxury dishes, to desserts. Their delicate, sweet taste and soft texture make them preferred for both vegan and non-vegan recipes, hence increasing their demand in different eating cultures. Furthermore, chestnuts are a source of fiber, vitamins, and minerals, with the added advantage of being gluten-free, making them suitable for a variety of health-conscious individuals. They contain about 15 grams of fiber per 100 grams, supporting digestive health. With the trend of healthy eating becoming increasingly popular, chestnut's nutritional profile becomes a powerful marketing card, which contributes to the growth in their demand all over the world.

Expansion of Export Markets

The chestnut market has experienced outstanding growth through export diversification. Various countries, the largest being China, Italy, and South Korea have been gaining popularity in the international market due to innovations in storage and transportation technologies that keep the quality of the chestnuts intact for a long time. China accounts for approximately 80% of the world's annual chestnut production. These chestnut market developments on the other hand have largely contributed to stabilizing the market, ultimately leading to more confidence among the traders abroad when dealing with chestnuts. Moreover, trade agreements and the elimination of tariffs allow suppliers and key players to gain access to foreign markets, especially in North America and Europe. This expansion not only increases the volume of chestnuts traded but also contributes towards stabilizing the global supply and prices thus benefiting producers and exporters.

The Sustainable and Organic Farming Methods

As per the chestnut market report, the trend for eco-friendly and organic farming techniques is a key driving factor in the chestnut industry. In line with the rising environmental and health consciousness of consumers, there is a trend observed in the increasing preference for farm-sourced chestnuts that employ biological methods rather than chemical ones. Organic chestnuts are typically considered safer and of better quality, thus developing a premium consumer segment whose members are ready to pay higher prices to purchase products that correspond with their environmental and health values. This trend is reinforced by both national and international not-for-profit organizations helping to develop sustainable agriculture, which includes subsidies and awards for organic farming. Such policies not only increase the demand for organic chestnuts but also motivate commercial farmers to incorporate sustainable methods, leading to the overall expansion of the market. For instance, Global chestnut production totals approximately 2.353 Tg, with China leading at 1.965 Tg, followed by Bolivia (84.01 Gg), Turkey (63.58 Gg), the Republic of Korea (53.384 Gg), and Italy (53.28 Gg) according to FAOSTAT (2020).

Chestnut Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global chestnut market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on species type, distribution, and region.

Analysis by Species Type:

- American Chestnut

- Chinese Chestnut

- European Chestnut

- Japanese Chestnut

Chinese chestnut leads the market with around 39% market share in 2024. This species, known to have originated in China and East Asia, has received enormous cultivation credit, due to its adaptability to different climates and soil types which is a reason for its widespread planting throughout the continents. The Chinese chestnut stands out for its sweet, nutty taste and large size that meet both fresh eating and industrial applications like flour and pastes. Additionally, this species is resistant to chestnut blight, a fungal disease that has swept across other species and given it an outstanding advantage in the global agriculture industry. The Chinese nut represents one of the best international trading commodities with several favorable growing conditions in the market enhanced further by both the incorporation of Asian traditional cuisine and the increasing popularity of the produce in the Western markets.

Analysis by Distribution:

- Food and Beverage Industry

- Food Service

- Retail

- Others

The food and beverage sector is experiencing a surge in demand for chestnuts, largely due to their nutritional value and adaptability in different products. Chestnuts are being used in a variety of food items such as snacks, plant-based meals, baked goods, and even beverages. With the growing trend toward organic, gluten-free, and health-conscious eating, chestnuts are a sought-after ingredient. Their high fiber content, vitamins, and antioxidants appeal to consumers looking for healthier alternatives, making them a popular choice for manufacturers creating innovative food products.

In the food service industry, chestnuts are increasingly featured in restaurants, especially in seasonal dishes. With its combination into savory meals like soups and pastas or used in desserts such as cakes and purees, chestnuts offer a unique flavor profile. This versatility is attractive to restaurants that are seeking to provide fresh, exciting, and sustainable menu options. Additionally, the trend toward plant-based and health-conscious dining has further boosted chestnut use in food service.

The retail distribution of chestnuts is growing steadily, as more consumers discover the benefits of incorporating them into their diets. Chestnuts are now available in various forms such as fresh, roasted, frozen, and packaged products, making them easier for consumers to access and use in home cooking. Grocery stores, supermarkets, and specialty retailers are capitalizing on the trend by offering a variety of chestnut products, which appeal to shoppers interested in healthy, convenient options. Packaging innovations have also made it simpler for customers to consume chestnuts as ready-to-eat snacks or as ingredients in their recipes.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of around 39%. The Asia Pacific region is the leading producer of chestnut due to the huge number of consumers, particularly in Asian countries such as China South Korea, and Japan. China as the largest producer and consumer remains a major player, which adopts chestnuts in cooking different traditional dishes and snacks. The region has a favorable climate for chestnut growth and a long history of chestnut consumption. This gives rise to a resilient domestic market that is also a major exporter. Innovation in cultivation methods and postharvest technologies support market expansion. In addition, the burgeoning middle class in these regions is increasingly embracing healthy lifestyles, propelling the need for nutritious foods like chestnuts.

Key Regional Takeaways:

North America Chestnut Market Analysis

The North America chestnut market is primarily driven by a rising demand for gluten-free products, as chestnuts are naturally gluten-free and appealing to those with dietary restrictions, including celiac disease. Furthermore, efforts to cultivate blight-resistant American chestnut varieties are gaining momentum, helping to revive this historically significant species and expand its market presence. Chestnuts are also increasingly recognized for their nutritional benefits and versatility in various cuisines, from traditional dishes to modern vegan recipes, which, in turn, is driving the market growth.

United States Chestnut Market Analysis

In 2024, the US dominated the North America market with a market share of 80%. The market for chestnuts in the US is being pushed by rising plant-based food demand, expanding consumer awareness of health and wellbeing, and renewed interest in heritage and specialty crops. Known for their high nutritional content—they are low in fat and calories and high in vitamins, minerals, and antioxidants—chestnuts are highly preferred by health-conscious consumers. As a healthy, gluten-free baking substitute, chestnut flour is in high demand, which is further supported by the trend toward gluten-free diets.

Additionally, as chestnuts are a main ingredient in many traditional recipes, the rise of ethnic cuisines in the United States, especially Mediterranean and Asian cuisines, has increased the use of chestnuts. States like Michigan, Ohio, and California are leading the way in domestic production, which is progressively growing as growers react to increased demand and larger profit margins than other tree nuts. Chestnut production in the United States is further supported by agroforestry programs and sustainable agricultural methods, which address consumer demands for locally produced, eco-friendly goods.

In the United States, cultivating chestnuts offers farmers an opportunity to cater to an under-served and expanding demand. The United States imported about 6.7 million pounds chestnuts in 2022. Further, over 7.5 million pounds of chestnuts are consumed by Americans each year. Most of these chestnuts are imported from nations like China, Korea, and Italy. Based on retail-to-wholesale market ratios, investment data indicates that the Internal Rate of Return (IRR) for starting a chestnut production operation is between 15% and 25%. Due to their use in festive meals, chestnuts continue to be a major driver of seasonal demand around holidays like Thanksgiving and Christmas.

Europe Chestnut Market Analysis

Cultural and culinary traditions are major drivers of the European chestnut market, particularly in nations like Italy, France, and Spain where chestnuts are a common element in a variety of regional dishes. Europe is a major producer and consumer of chestnuts, with major production focused on nations like Greece, Portugal, and Italy. In 2020, Italy was the largest importing country with an import of about 24,000 Tons, representing around 26% of total EU imports. France (7,700 Tons) occupied 8.3% share of total EU imports, which put it in second place, followed by Switzerland (5.9%).

Owing to their natural sweetness, high fiber content, and low fat level, chestnuts are becoming increasingly popular in Europe as a health food. Products made from chestnuts, including purées, flours, and snacks, satisfy consumers' increasing need for plant-based and gluten-free diets. Incentives for chestnut farming have resulted from the European Union's emphasis on rural development and sustainable agriculture, which has increased production even more. The fall and winter seasons experience the most seasonal demand, especially during Christmas markets where roasted chestnuts are a common street snack.

Asia Pacific Chestnut Market Analysis

Due to the region's long-standing culinary traditions and strong production levels—especially in China, which produces more than 80% of the world's chestnuts—the Asia-Pacific chestnut market is flourishing. China is also the world’s leading consumer of chestnuts, consuming nearly 1.65 Million Tons in 2015, nearly 80% of global consumption. Asian cuisines heavily incorporate chestnuts into their dishes, which range from savory meals to snacks and desserts.

In nations like South Korea and Japan, the demand for items made from chestnuts is being driven by rising disposable incomes and health-conscious consumer habits. Similarly, growing awareness about the health benefits of chestnuts coupled with rising cases of lifestyle disease is augmenting the market in India. There are multiple emerging businesses from Kinnaur, Himachal Pradesh that offer dried chestnuts through online distribution channel as well. Chestnuts are becoming popular throughout Southeast Asia as a unique and wholesome cuisine. The market is growing because of the expansion of export prospects for value-added products and processed chestnuts.

Latin America Chestnut Market Analysis

The market for chestnuts in Latin America is comparatively small, but it is expanding due to growing awareness of the food's nutritional value and adaptability. Chestnuts are being launched in the gourmet and health food sectors in Brazil and Chile. Opportunities for chestnut production are being created by regional interest in agroforestry and sustainable agricultural methods, which is in line with the demand for eco-friendly products worldwide.

Middle East and Africa Chestnut Market Analysis

The Middle East and Africa chestnut market is at a nascent stage, with growing awareness of chestnuts as a nutrient-abundant food and its use in high-end and imported food categories, it is expected to gain momentum in the coming years. The Middle East's high consumption of dried fruits and nuts is linked to demand, with chestnuts becoming more popular during holiday seasons. Initiatives for chestnut cultivation are being initiated in Africa, and they have immense scope to grow in the upcoming years.

Competitive Landscape:

Significant market players are undertaking strategies for gaining higher chestnut market revenue and upgrading their technologies and products to gain higher demand. High-ranked producers commit to the development of better storage and process technologies for enhanced quality and extended shelf life of chestnuts. In addition, they are supporting the development of sustainable and organic agroecological practices to cater to the needs of their customers for environmentally friendly and healthy products. Marketing strategies are now targeting the nutritional importance of chestnuts, by promoting it in existing and developing markets.

The market research report provides a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major chestnut companies have also been provided. Some of the major market players in the chestnut industry include:

- Chengde Shenli Food Co. Ltd.

- Chestnut Growers Inc.

- Qinhuangdao Yanshan Chestnut Food Co. Ltd.

- Roland Foods LLC

- Royal Nut Company.

- Shandong Maria Food Co. Ltd

- Shandong Zhifeng Foodstuffs Co. Ltd

- V. Besana Spa

Latest News and Developments:

- October 2024: Chestnut Petroleum Distributors Inc. (CPD) based in New Paltz, New York, implemented LottoShield’s lottery management system across all 75 of its Chestnut Market convenience stores. LottoShield, a state-integrated platform, streamlines lottery operations, focusing on inventory reconciliation, theft detection, and other automated features.

- September 2024: The Jamal family reopened the Chestnut Market convenience store along the Hutchinson River Parkway. CPD Energy operates 75 Chestnut Market locations outside New York City. The remodel of the store focuses on enhancing its functionality and customer experience.

- August 2023: Roland Foods acquired IfiGourmet, which merged with its sweets division, AUI Fine Foods; owner and CEO Rick Brownstein remains, citing the merger's potential to enhance resources and relationships for growth.

- June 2023: The Warnell School of Forestry and Natural Resources made a significant advancement in chestnut restoration efforts. Researchers in Central New York gathered more than 11,000 chestnuts, launching a project to identify the OxO gene, which is key to chestnut blight resistance. This breakthrough represents a major step toward reviving depleted chestnut populations, utilizing cutting-edge methods such as somatic embryogenesis for precise genetic replication.

- February 2022: In New York State, more than 200 acres were allocated to chestnut and hazelnut cultivation. A two-year initiative, funded by the Edwards Mother Earth Foundation, aims to scale nut crop production in the Finger Lakes region. Spearheaded by Cornell Cooperative Extension Tompkins County and key collaborators, the project seeks to establish a sustainable and economically viable model, enhancing revenue opportunities for farmers while promoting environmental stewardship across the Northeast.

Chestnut Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Types Covered | American Chestnut, Chinese Chestnut, European Chestnut, Japanese Chestnut |

| Distributions Covered | Food and Beverage Industry, Food Service, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Chengde Shenli Food Co. Ltd., Chestnut Growers Inc., Qinhuangdao Yanshan Chestnut Food Co. Ltd., Roland Foods LLC, Royal Nut Company, Shandong Maria Food Co. Ltd, Shandong Zhifeng Foodstuffs Co. Ltd, V. Besana Spa, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Chestnut market from 2019-2033.

- The Chestnut market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Chestnut industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A chestnut is an edible nut that grows on trees or shrubs that are native to regions in the Northern Hemisphere, including parts of Europe, Asia, and North America. Chestnuts are encased in a spiny outer shell, or burr, and have a sweet, starchy flavor, making them a popular food ingredient. They can be roasted, boiled, or used in recipes for desserts, bread, and savory dishes.

The global chestnut market was valued at USD 3.8 Billion in 2024.

IMARC estimates the global chestnut market to exhibit a CAGR of 3.1% during 2025-2033.

The chestnut market is driven by its culinary versatility, expanding global trade, and a shift towards sustainable and organic farming practices, catering to health-conscious consumers and environmentally aware markets, promoting global chestnut demand and production.

According to the report, Chinese chestnut represented the largest segment by species types, driven by its adaptability to diverse growing conditions, high yield, and widespread consumer acceptance.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global chestnut market include Chengde Shenli Food Co. Ltd., Chestnut Growers Inc., Qinhuangdao Yanshan Chestnut Food Co. Ltd., Roland Foods LLC, Royal Nut Company, Shandong Maria Food Co. Ltd, Shandong Zhifeng Foodstuffs Co. Ltd, V. Besana Spa, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)