Organic Dairy Market in China Report by Product Type (Organic Fluid Milk, Organic Infant Formula, Organic Yogurt, Organic Cheese, Organic Butter, Organic Cream, and Others), Packaging Type (Tetra Packs and Pouches, Bottles, Cans, and Others), Distribution Channel (Supermarkets and Hypermarkets, Organic Specialty Stores, Convenience and Grocery Stores, Discount Stores, Online/E-Retailing, Direct Sales, and Others), and Province 2025-2033

Market Overview:

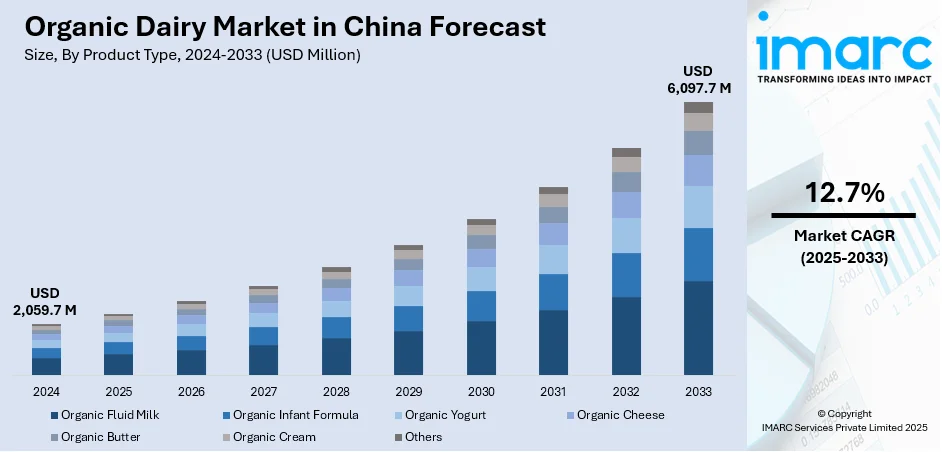

The organic dairy market in China size reached USD 2,059.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,097.7 Million by 2033, exhibiting a growth rate (CAGR) of 12.7% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,059.7 Million |

|

Market Forecast in 2033

|

USD 6,097.7 Million |

| Market Growth Rate 2025-2033 | 12.7% |

Organic dairy products are derived from livestock raised through organic feed and without the use of synthetic fertilizers and pesticides. As a result, organic dairy products are considered healthier and have higher levels of vitamins, omega-3 fatty acids, antioxidants and conjugated linoleic acid (CLA). Unlike conventional dairy farming methods, organic dairy farming helps in sustaining higher production without the environmental risks. Currently, China represents one of the fastest growing markets for organic dairy products in Asia.

One of the major factors bolstering the growth of the organic dairy market in China is the rising awareness about the extensive use of fertilizers, pesticides and bovine growth hormone (BGH) due to which a majority of the consumers have shifted towards healthier and organic dairy products. Some of the other forces that have been proactive in maintaining the market growth include rapid urbanization, escalating disposable incomes and large-scale food adulteration in China.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the organic dairy market in China, along with forecasts at the country and province level from 2025-2033. Our report has categorized the market based on product type, packaging type and distribution channel.

Breakup by Product Type:

- Organic Fluid Milk

- Organic Infant Formula

- Organic Yogurt

- Organic Cheese

- Organic Butter

- Organic Cream

- Others

On the basis of product type, organic fluid milk accounts for the majority of the market share. Other segments include organic infant formula, organic yogurt, organic cheese, organic butter, organic cream, etc.

Breakup by Packaging Type:

- Tetra Packs and Pouches

- Bottles

- Cans

- Others

Based on packaging type, the organic dairy market in China is divided into tetra-packs & pouches, bottles, cans and others. Amongst these, tetra-packs & pouches exhibit a clear dominance in the market.

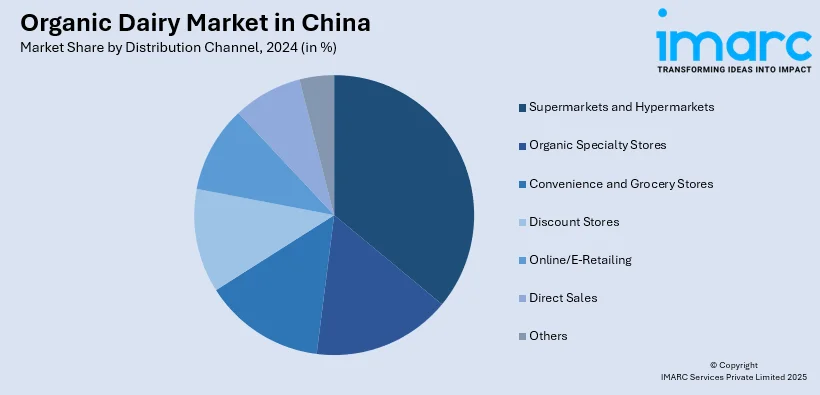

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Organic Specialty Stores

- Convenience and Grocery Stores

- Discount Stores

- Online/E-Retailing

- Direct Sales

- Others

On the basis of distribution channel, supermarkets and hypermarkets enjoy the leading position in the market. Other major segments include organic speciality stores, convenience and grocery stores, discount stores, online/e-retailing, direct sales and others.

Breakup by Province:

- Guangdong Province

- Jiangsu Province

- Shandong Province

- Zhejiang Province

- Henan Province

Based on the province, the market has been segmented as Guangdong Province, Jiangsu Province, Shandong Province, Zhejiang Province, and Henan Province. Currently, Guangdong Province represents the biggest market.

Competitive Landscape:

The competitive landscape of the market has also been examined with some of the key players being China Shengmu Organic Milk Limited, Inner Mongolia Yili Industrial Group and China Mengniu Dairy Company Limited.

This report provides a deep insight into the organic dairy market in China covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the China organic dairy industry in any manner.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Million USD |

| Segment Coverage | Product Type, Packaging Type, Distribution Channel, Province |

| Province Covered | Guangdong Province, Jiangsu Province, Shandong Province, Zhejiang Province, Henan Province |

| Companies Covered | China Shengmu Organic Milk Limited, Inner Mongolia Yili Industrial Group and China Mengniu Dairy Company Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The organic dairy market in China was valued at USD 2,059.7 Million in 2024.

We expect the organic dairy market in China to exhibit a CAGR of 12.7% during 2025-2033.

The rising awareness towards the numerous health benefits of consuming organic dairy, such as strengthening immune system, boosting overall metabolism, and reducing the chances of diseases is primarily driving organic dairy market in China.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of organic dairy products across the nation.

Based on the product type, the organic dairy market in China can be segmented into organic fluid milk, organic infant formula, organic yogurt, organic cheese, organic butter, organic cream, and others. Currently, organic fluid milk holds the majority of the total market share.

Based on the packaging type, the organic dairy market in China has been divided into tetra packs and pouches, bottles, cans, and others. Among these, tetra packs and pouches exhibit a clear dominance in the market.

Based on the distribution channel, the organic dairy market in China can be categorized into supermarkets and hypermarkets, organic specialty stores, convenience and grocery stores, discount stores, online/e-retailing, direct sales, and others. Currently, supermarkets and hypermarkets account for the largest market share.

On a regional level, the market has been classified into Guangdong Province, Jiangsu Province, Shandong Province, Zhejiang Province, and Henan Province, where Guangdong Province currently dominates the organic dairy market in China.

Some of the major players in the organic dairy market in China include China Shengmu Organic Milk Limited, Inner Mongolia Yili Industrial Group, and China Mengniu Dairy Company Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)