Cold Pressed Oil Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, and Region, 2026-2034

Cold Pressed Oil Market Size & Trends:

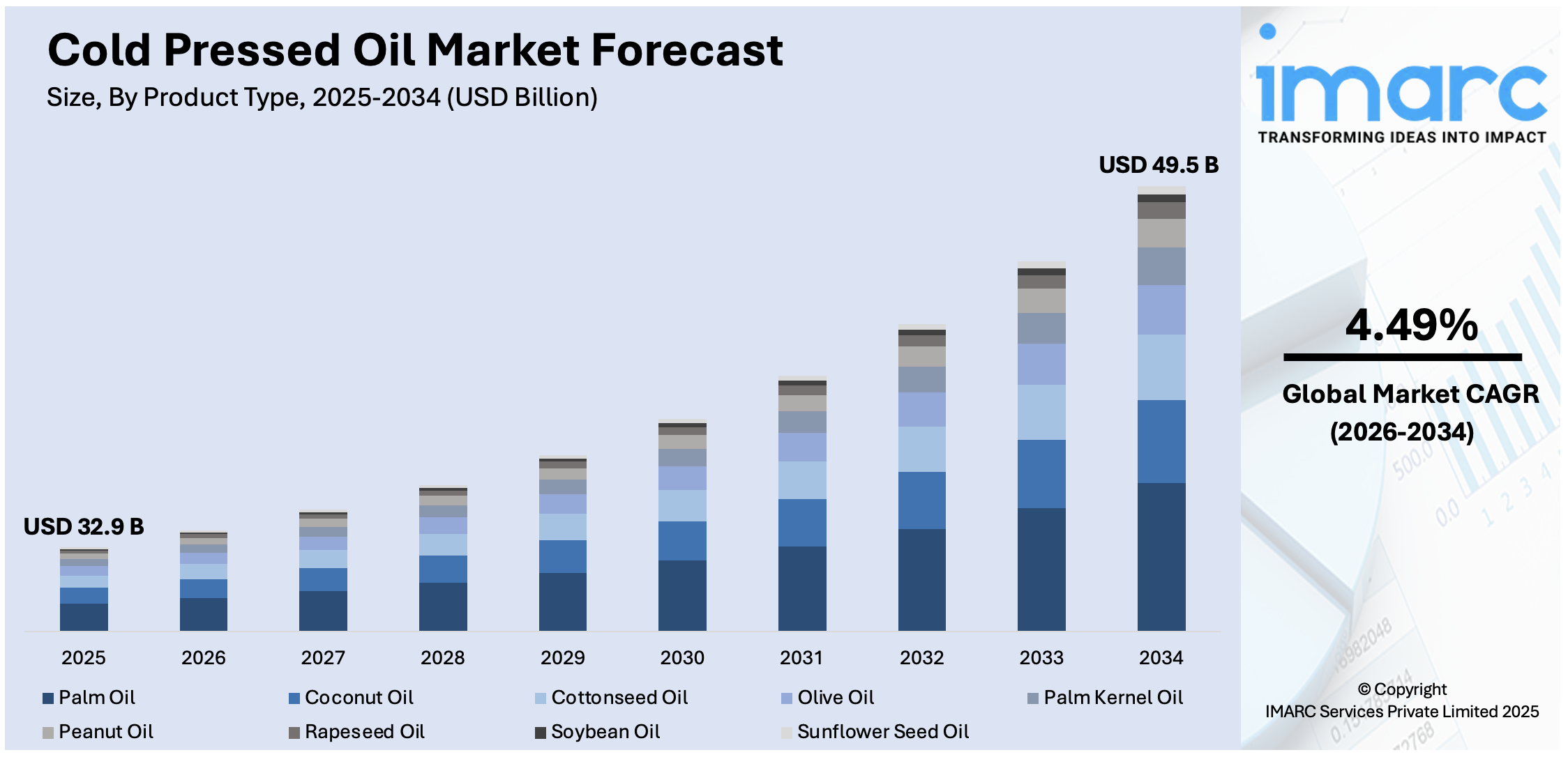

The global cold pressed oil market size reached USD 32.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 49.5 Billion by 2034, exhibiting a growth rate CAGR of 4.49% during 2026-2034. In 2025, the United States accounted for 81.60% of the total North America cold pressed oil market. Some of the major cold pressed market growth drivers in the US include growing health consciousness and the need for minimally processed nutrient-rich oils.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 32.9 Billion |

|

Market Forecast in 2034

|

USD 49.5 Billion |

| Market Growth Rate 2026-2034 | 4.49% |

The global cold pressed oil market share is expanding significantly due to the rising consumer preference for natural and chemical-free products due to increasing health consciousness. The increase in demand for premium edible oils with higher nutritional value, such as olive, coconut, and sesame oil, is acting as a significant growth-inducing factor for the market. Along with this, the growing awareness regarding the benefits of cold-pressed oils, including their rich antioxidant and nutrient content among the masses is fostering market growth. Expanding applications in cosmetics and personal care, leveraging the oil's natural and organic properties, is further accelerating demand. Additionally, the rise of vegan and plant-based dietary trends, coupled with increasing disposable incomes in emerging economies, is supporting market expansion.

To get more information on this market Request Sample

The United States stands out as a key regional market, primarily driven by a growing inclination toward clean-label and organic products. In addition, the rising consumer awareness regarding the adverse effects of processed oils is accelerating a shift toward minimally processed alternatives. The rise of dietary trends such as paleo, keto, and plant-based eating is increasing demand for cold-pressed oils rich in essential fatty acids and nutrients. Moreover, innovations in packaging and marketing strategies targeting health-conscious millennials and Gen Z populations are enhancing product visibility and therefore influencing the market positively. Concurrently, the growing prevalence of lifestyle-related health issues, such as obesity and heart disease, is also encouraging a preference for healthier cooking oils. The U.S. Center for Disease Control and Prevention (CDC) on September 12, 2024, reported that in 23 states, at least 35% of adults meet the definition of obesity, an alarming increase from 2013, when not a single state had exceeded an obesity rate of 35%. 20% of adults in every state are obese with higher rates observed in the South and Midwest. Arkansas, Mississippi, and West Virginia had obesity rates greater than 40%. Obesity was lowest in Colorado, along with the District of Columbia; obesity rates were between 20% and 25%. Furthermore, retail expansion through e-commerce platforms is further fueling accessibility and market penetration for cold-pressed oil products in the U.S.

Cold Pressed Oil Market Trends:

Health and Wellness Trends

At present, the prevailing health and wellness trends is encouraging individuals to utilize cold pressed oils in their recipes. According to an industrial report, the global wellness market is on a trajectory to reach USD 1.8 Trillion by 2024, driven by a heightened focus on health and well-being. India is also rapidly emerging as a significant player in this space. India’s wellness market is expected to grow at 5% annually from 2024 to 2032 due to the augmenting health consciousness as well as evolving consumer preferences prevalent across the country. Consumers are becoming increasingly conscious of their dietary choices, seeking products that align with their pursuit of healthier lifestyles. Cold-pressed oils are emerging as a favoured option due to their perceived health benefits. Cold-pressed oils are produced through a method that involves minimal heat and processing, which helps preserve the natural flavours, colours, and nutritional content of the oil. This process retains essential nutrients like vitamins, antioxidants, and healthy fats, making these oils a wholesome choice for health-conscious individuals. Additionally, cold-pressed oils are known for being free from harmful chemicals, additives, and solvents that are often used in traditional oil extraction processes. This purity and naturalness appeal to consumers who are concerned about the potential negative effects of synthetic additives. As a result, consumers are increasingly incorporating cold-pressed oils into their diets, whether for cooking, salad dressings, or as dietary supplements.

Rising Consumer Awareness

The rising awareness among consumers about the advantages of cold pressed oils is propelling the growth of the market. Numerous consumers were unaware of the differences between cold-pressed oils and conventionally processed oils. However, this knowledge gap is rapidly closing as information becomes more accessible. According to ingredient supplier Cargil’s most recent 2021 FATitudes survey, 54% of consumers closely monitor fats and oils while making food purchases, along with 64% of these individuals looking to avoid certain fats and oils and 28% seeking specific fats and oils. Cold-pressed oils are peculiar in their production process. While they are extracted from the seeds, nuts, or fruits, no high heat chemicals or solvents are employed. This gentle process avoids the degradation of natural flavors as well as nutritional properties contained in oil, such as higher levels of antioxidants and essential fatty acids. The role of the internet and social networking sites is crucial in spreading awareness across the globe. Consumers can easily access articles, videos, and social media content that highlight the benefits of cold-pressed oils. This information empowers individuals to make informed choices about their dietary habits, driving them to seek out these healthier alternatives. Additionally, health professionals and nutritionists often recommend cold-pressed oils due to their nutritional profile. This endorsement further solidifies consumer confidence in the product category, contributing to its growing popularity. As consumers are becoming increasingly informed about the advantages of cold-pressed oils, they are more likely to integrate these oils into their daily cooking and dietary routines.

Sustainable and Eco-Friendly Practices

Sustainability and eco-friendliness are critical factors expanding the cold-pressed oil market share. Besides this, consumers are seeking products that align with sustainable and ethical practices. Cold-pressed oils are garnering attention for their environment-friendly production methods. Unlike traditional oil extraction processes, cold pressing minimizes energy consumption and reduces the emission of greenhouse gases. The absence of heat-intensive refining and chemical treatments significantly lowers the carbon footprint associated with cold-pressed oil production. This eco-friendly approach appeals to environmentally conscious consumers who prioritize products that have a reduced negative impact on the planet. Many companies producing cold-pressed oils are also investing in sustainable sourcing of raw materials. They work closely with farmers who adopt organic farming practices, which not only contribute to the quality of the oil but also promote sustainable agriculture. Moreover, the packaging of cold-pressed oils often reflects eco-conscious choices, with many brands opting for recyclable or biodegradable materials. This holistic approach to sustainability resonates with consumers who are increasingly inclined to support brands that prioritize eco-friendliness.

Cold Pressed Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cold pressed oil market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, distribution channel, and application.

Analysis by Product Type:

- Palm Oil

- Coconut Oil

- Cottonseed Oil

- Olive Oil

- Palm Kernel Oil

- Peanut Oil

- Rapeseed Oil

- Soybean Oil

- Sunflower Seed Oil

Palm oil leads the market with around 38.2% of market share in 2025. Palm oil stands out as the largest segment in the market. Its dominance can be attributed to its versatility, affordability, and wide range of applications. In addition to this, it is used extensively in both food and non-food industries and is a staple in various cuisines and processed foods. Additionally, it serves as a key ingredient in personal care products and biodiesel production.

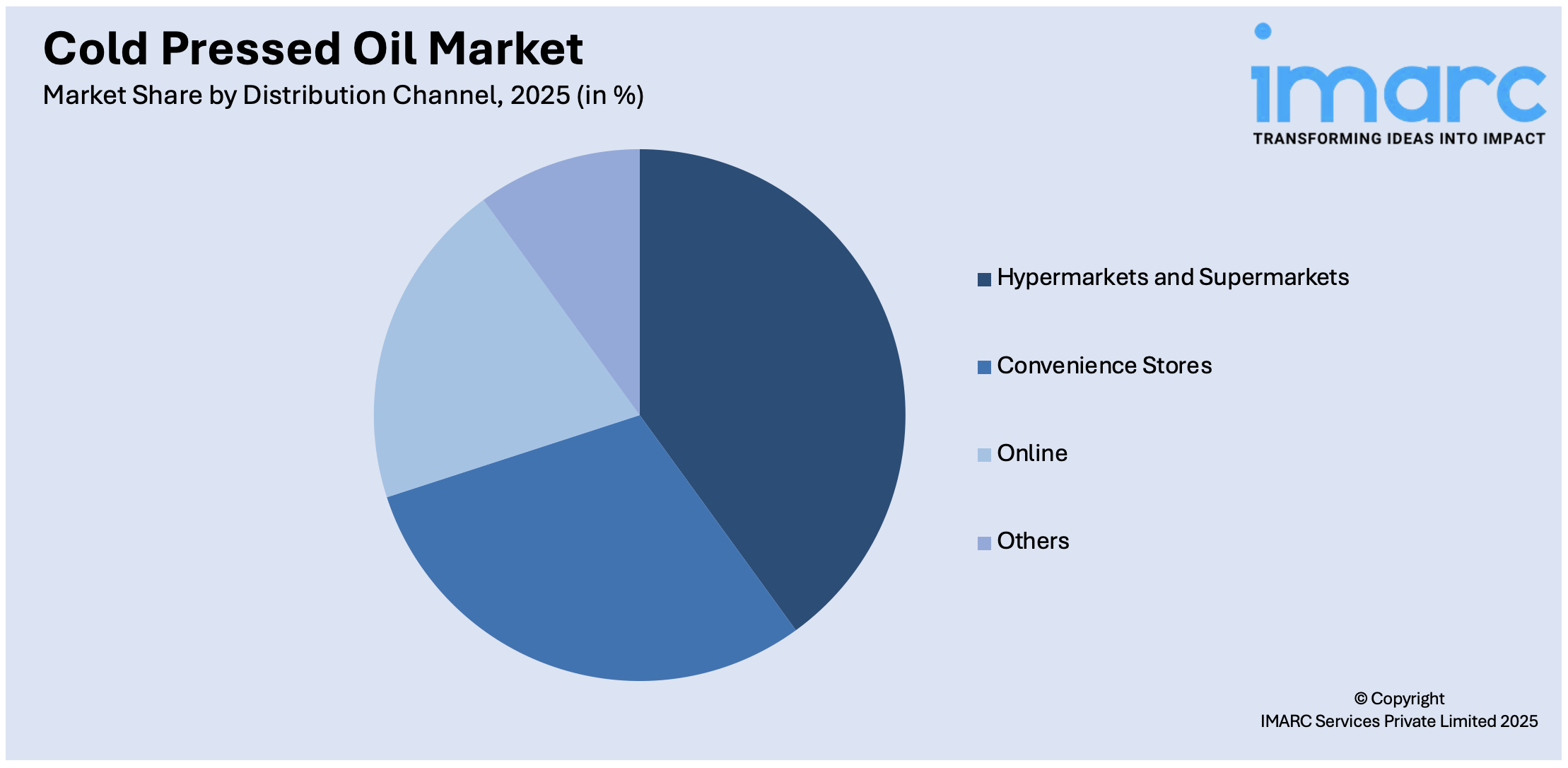

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Hypermarkets and Supermarkets

- Convenience Stores

- Online

- Others

Hypermarkets and supermarkets lead the market with around 45.7% of market share in 2025. Hypermarkets and supermarkets stock numerous brands and variants of edible oil under one roof, thereby offering convenience and variety to consumers. Shoppers opt to buy edible oils in this store due to several factors such as convenience, competitive pricing, and comparison of brands and sizes available. Moreover, in hypermarkets and supermarkets, the amount of shelf space and display space for edible oils influences consumers' choices. Convenience in one-stop shopping and the level of confidence consumers have in these retail chains make them extremely popular.

Analysis by Application:

- Food Industry

- Agriculture

- Cosmetics and Personal Care Industry

Food industry lead the market with around 58.5% of market share in 2025. Food represents the largest segment of the market for edible oils. These products are fundamental constituents of most foodstuffs and culinary dishes. They are fried, sautéed, baked, or used as the main material in different types of cuisines. Edible oils serve as essential cooking mediums while contributing greatly to flavor and texture within the food industry. A diversity of edible oils exist-from palm and vegetable for frying to olive and coconut for specialty items- in meeting different culinary requirements. Within the food and beverage F&B industry, the constant demand for edible oils lies in the consumption of processed as well as restaurant foods in all parts of the world.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 44.1%. Rising importance to health and wellness as consumers seek healthier dietary alternatives fuel the Asia Pacific cold-pressed oil market. In addition to that, cold-pressed oils are gaining popularity due to perceived health benefits and their natural production process. There is a growing concern on the part of consumers towards sustainability and transparency in the production of food. Consumers increasingly demand cold-pressed oils produced and sourced sustainably and in an environmentally friendly manner, thus fueling demand for eco-friendly products.

Key Regional Takeaways:

United States Cold Pressed Oil Market Analysis

In 2025, the United States accounted for 81.60% of the total North America cold pressed oil market. Growing health consciousness and the need for minimally processed nutrient-rich oils are driving the U.S. market. Cold-pressed oils, such flaxseed, coconut, and olive oils, are becoming more and more popular among consumers due to their alleged health advantages, which include high levels of omega fatty acids and antioxidants. The increased demand for clean-label and organic food products is consistent with the trend.

The increasing interest in plant-based diets is another driver, as cold-pressed oils fulfill the requirements of vegetarians and vegans seeking healthier fats. Growing sectors such as skincare and cosmetics also contribute a lot as cold-pressed oils have inherent anti-aging and moisturizing properties. Accessibility is being increased by growing e-commerce and direct-to-consumer marketing tactics, particularly among millennials. Concerns about sustainability also spur market expansion since eco-aware buyers favour goods with less environmental impact. Additionally, consumer preferences are shifting towards cold-pressed alternatives because of legislative changes that discourage trans-fat-rich oils and encourage healthier living. Strong market momentum is anticipated to be maintained by this advantageous regulatory environment in conjunction with creative product introductions. Meanwhile, the online stores are expected to witness the fastest growth rate during the forecast period. According to Digital Commerce 360 analysis of U.S. Department of Commerce data, U.S. e-commerce represented 22.0% of the total retail sales in 2023. That compares with 21.2% penetration in 2022.

Europe Cold Pressed Oil Market Analysis

The market for cold-pressed oil in Europe is driven by a strong demand for organic and natural goods. Owing to their excellent nutritional profile and minimal processing, cold-pressed oils are becoming more and more popular among health-conscious consumers. A mainstay of the Mediterranean diet, extra virgin olive oil is in high demand in nations like Italy, Spain, and Greece, which control the market. The strict labelling and food safety laws of the European Union encourage openness and boost customer confidence in cold-pressed goods. Another important factor is sustainability, since shoppers who care about the environment choose oils made using eco-friendly methods. Cold-pressed oils for use in cosmetics have grown significantly in Germany and France, with double-digit yearly growth rates observed in skincare and haircare applications. Additionally, innovation in oils made from seeds, nuts, and fruits is fuelled by the growing vegan population and the need for plant-based products, especially in Northern Europe. Strong consumer purchasing power and sophisticated distribution networks encourage this tendency. According to an industrial report, the ecommerce penetration rates are forecast to growth in all regions of Europe through 2029. The ranking by penetration rate in the ecommerce market is forecast to be led by the United Kingdom (97.25%), followed by Germany (70%), France (62%) At the same time, the ranking is trailed by Italy (45.65%) with recording a difference of 51.6 percentage points to the United Kingdom.

Asia Pacific Cold Pressed Oil Market Analysis

Growing disposable incomes and growing knowledge of the health advantages of cold-pressed oils are driving the Asia-Pacific market for these oils. China and India contribute significantly, and cold-pressed coconut, mustard, and sesame oils are becoming more and more well-liked for their culinary and therapeutic applications. Demand is further increased by the traditional applications of these oils in Chinese and Ayurvedic medicine. With rising number of lifestyle disease in the region, the demand for cold pressed oil is on the rise. Asia has one of the largest populations of diabetes patients with India alone having more than a 100 million diabetes patients, as per an industry report.

Cold-pressed oils are also promoted in skincare and haircare products by the growing cosmetics industries in countries like South Korea and Japan. With increasing e-commerce platforms and health-oriented marketing campaigns, these products are now more accessible to consumers in both cities and villages. Furthermore, the trend of natural ingredients and plant-based diets is consistent with the demand for fewer processed foods and integrated health care solutions in the local culture.

Latin America Cold Pressed Oil Market Analysis

Cold-pressed oils are increasingly in demand in Latin America due to increasing health awareness and the abundance of raw materials in the region, such as avocados and coconuts. The top players in this market are Brazil and Mexico, followed by avocado oil, which has numerous applications in both food and cosmetics. Demand for premium oils is being driven by the growing middle class and rising disposable budgets, while local culinary traditions place an emphasis on using natural and unprocessed products. Further driving the market's expansion are wellness trends and the rising demand for organic products. Market penetration is further increased by strategic partnerships between foreign brands and regional producers. Moreover, growth in e-commerce sector is also projected to provide momentum to the market. For instance, as per an industrial report, the LatAm market currently boasts over 300 million digital buyers, which is poised to increase by over 20% by 2027. The business-to-consumer (B2C) e-commerce market in the region will surpass USD 7.5 Trillion by 2030, offer a lucrative opportunity for merchants to attract new consumers by making their products and services accessible in new markets.

Middle East and Africa Cold Pressed Oil Market Analysis

Interest in organic products and health benefits are factors driving the Middle East and Africa cold-pressed oil market. In Middle Eastern cooking, olive oil is a staple and represents the majority of the cold-pressed oil market due to its popularity as superior-tasting and better-quality varieties gain in acceptance. Cold-pressed oils of argan and baobab are sought after everywhere in Africa, particularly as cosmetics in the field of skincare. The urbanizing population and an increasing disposable income are driving demand for luxurious goods. As reported from the industrial report, it is estimated that nearly two-thirds of the individuals in the Middle East reside in the cities, well above the global total of just over half. According to an industrial report, the Gulf region’s urban population is expected to increase by 30 percent between 2020 and 2030 alone, and by 2050, 90 percent of the population across the nations of the Gulf Cooperation Council (GCC) is estimated to live in cities, which is projected to further increase, thereby making the GCC amongst the most urbanized regions in the world. Government programs encouraging sustainable agriculture also help the region's market expand.

Competitive Landscape:

The key players in the cold-pressed oil market are actively adopting several strategies to sustain their presence in the market and fulfill the changing needs of consumers. They are also expanding their product lines by launching more varieties of cold-pressed oils, including specialty and organic options, to cater to diverse consumer preferences. The leading companies have also been stressing sustainability in sourcing and production processes. To gain certification in sustainable and ethical practices and keep up with the eco-conscious consumer base, top companies seek certification. In addition, marketing and branding are also undertaken to emphasize the health benefits and natural characteristics of products, and this would be in the interest of educating consumers about the advantages of cold-pressed oils. Additionally, leading companies are leveraging e-commerce and online sales channels to reach a wider audience.

The report provides a comprehensive analysis of the competitive landscape in the cold pressed oil market with detailed profiles of all major companies, including:

- Brightland

- California Olive Ranch, Inc

- Cobram Estate

- FreshMill Oils

- Gramiyum NatureFresh Private Limited

- Jivo Wellness

- La Tourangelle

- Naissance

- Spectrum Organic Products LLC

- Statfold Seed Oils Ltd.

Latest News and Developments:

- November 2024: The opening of Bharat Botanics' wood-pressed cold oil manufacturing facility in Gondal, Rajkot, Gujarat, was announced. According to a statement from the company, this 16,000 square foot automated facility is unique and promotes complete transparency and hygiene.

- October 2024: NK Proteins Private Limited's cold-pressed oil brand, Olixir Oils, announced the addition of four new wellness items to its lineup. With the goal of offering natural remedies for healthy skin and hair, these include hair growth oil, complete hair care oil, hair nourishing oil, and face oil. Olixir's dedication to providing premium cold-pressed oils made from natural ingredients is reflected in the new offerings.

- November 2023: Bunge Limited joined forces with Musim Mas Group in Sambas, West Kalimantan, Indonesia to foster sustainable practices amongst smallholder farmers. The collaboration aims to provide training for over 1,000 independent smallholders, equipping them with the skills needed for sustainable palm oil production.

- August 2023: Tata Consumer Products (TCP), the consumer goods corporation that unifies the main food and beverage businesses of the Tata Group under a single roof, announced its foray into the high-end and quickly expanding Cold Pressed Oils market. Under the "Tata Simply Better" brand, Tata Consumer Products is introducing a line of cold-pressed oils that are 100% pure and unrefined.

Cold Pressed Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Palm Oil, Coconut Oil, Cotton Seed Oil, Olive Oil, Palm Kernel Oil, Peanut Oil, Rapeseed Oil, Soybean Oil, Sunflower Seed Oil |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Online, Others |

| Applications Covered | Food Industry, Agriculture, Cosmetics and Personal Care Industry |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Brightland, California Olive Ranch, Inc, Cobram Estate, FreshMill Oils, Gramiyum NatureFresh Private Limited, Jivo Wellness, La Tourangelle, Naissance, Spectrum Organic Products LLC, Statfold Seed Oils Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, cold pressed oil market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cold pressed oil market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the cold pressed oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold pressed oil market was valued at USD 32.9 Billion in 2025.

The cold pressed oil market is projected to exhibit a CAGR of 4.49% during 2026-2034, reaching a value of USD 49.5 Billion by 2034.

The market is majorly driven by increasing consumer preference for chemical-free and natural products, rising demand for premium edible oils with high nutritional value, escalating demand for clean-label products, expanding applications in cosmetics, and the growing popularity of vegan and plant-based diets.

Asia Pacific currently dominates the market, accounting for a share of over 44.1%, driven by the rising health awareness, increasing demand for natural and organic products, along with expanding food processing industries.

Some of the major players in the cold pressed oil market include Brightland, California Olive Ranch, Inc, Cobram Estate, FreshMill Oils, Gramiyum NatureFresh Private Limited, Jivo Wellness, La Tourangelle, Naissance, Spectrum Organic Products LLC, and Statfold Seed Oils Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)