Electric Vehicle Battery Recycling Market Size, Share, and Trends by Type, Vehicle Type, Application, Region, and Forecast 2025-2033

Electric Vehicle Battery Recycling Market Size and Share:

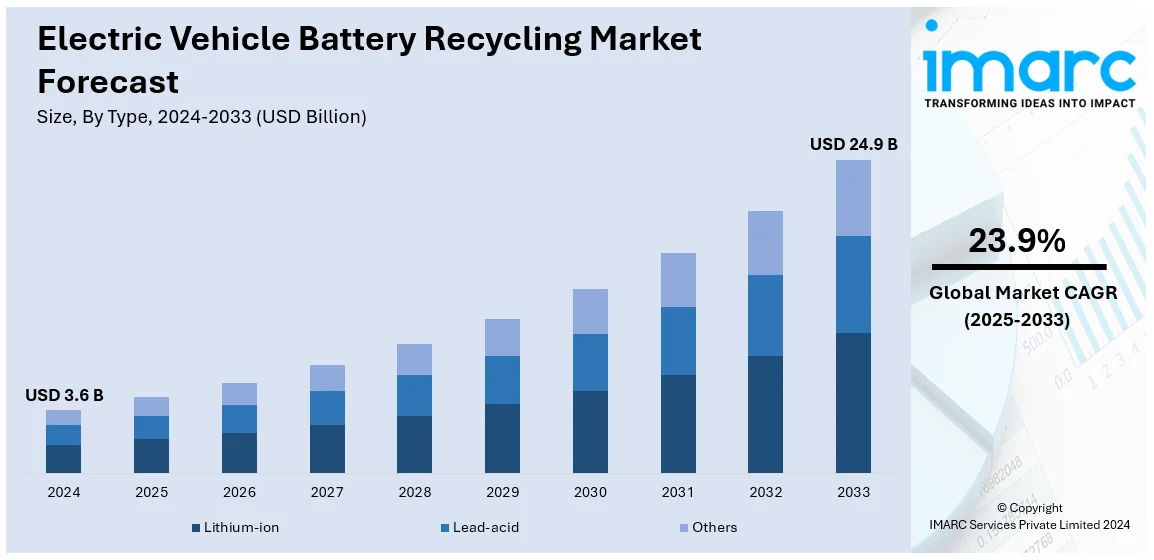

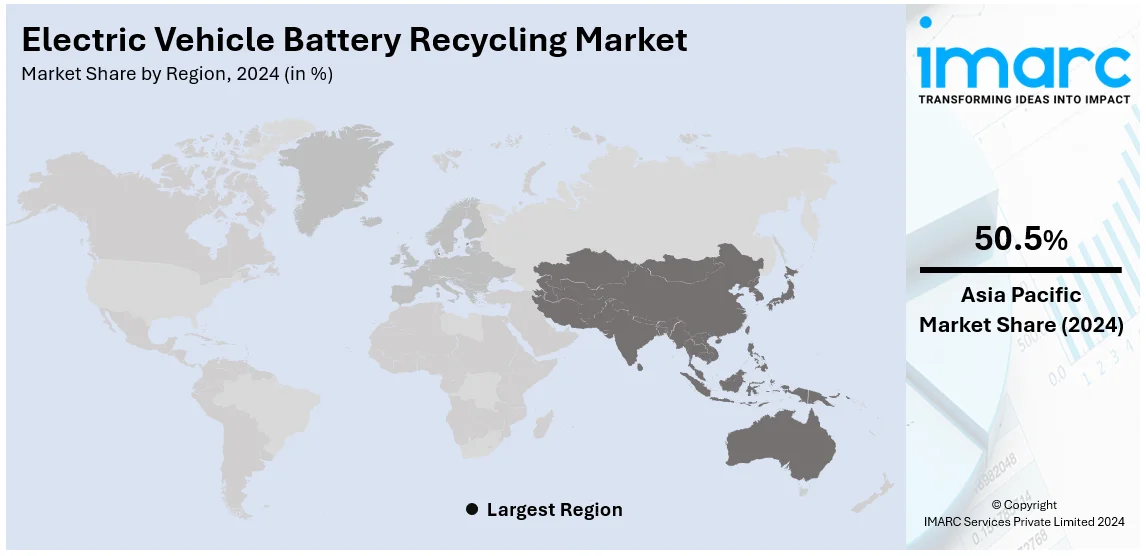

The global electric vehicle battery recycling market size was valued at USD 3.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.9 Billion by 2033, exhibiting a CAGR of 23.9% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 50% in 2024. The increasing adoption of electric vehicles (EVs), growing consumer awareness towards sustainability, extensive research and development (R&D) activities, and the imposition of stringent government regulations are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.6 Billion |

|

Market Forecast in 2033

|

USD 24.9 Billion |

| Market Growth Rate (2025-2033) | 23.9% |

The global market is primarily driven by the burgeoning sales of hybrid and electric vehicles (EVs) across the world. In line with this, governments of various countries are significantly investing in the manufacturing of EVs and undertaking several initiatives such as offering incentives to facilitate their adoption. Furthermore, stringent government regulations for battery disposal, owing to the rising concerns over battery waste disposal and enhanced focus on sustainable development, are providing a thrust to the market growth. The deployment of robotics technology to improve the recovery rates of metals is acting as another major growth-inducing factor. Moreover, the limited availability of raw materials to manufacture lithium-ion batteries is further facilitating the recycling of discarded batteries. Some of the other factors influencing the market growth include rapid industrialization, technological advancements in EV battery recycling, launch of aesthetically appealing battery designs, and extensive research and development (R&D) undertaken by industry players to encourage innovation in EV battery recycling.

To get more information on this market, Request Sample

The United States is one of the most lucrative countries in the market. Significant companies in the United States, such as General Motors and Ford, are strategizing to expand the manufacturing capabilities of EVs, which, in turn, will continue to boost the market demand for lithium-ion batteries in the country. This is expected to positively impact the electric vehicle battery recycling market ecosystem. In October 2024, the U.S. Department of Energy (DOE) announced an investment of US$ 44.8 million from the Bipartisan Infrastructure Law (BIL) to fund eight projects that will help reduce the costs of recycling batteries and battery components for electric drive vehicles, with the long-term aim of reducing vehicle costs.

Electric Vehicle Battery Recycling Market Trends:

The Increasing Adoption of Electric Vehicles (EVs)

The escalating demand for electric vehicles on account of the rising concerns regarding the environment, along with the implementation of favorable government initiatives, is catalyzing the sales of electric vehicles, which in turn is positively impacting the electric vehicle battery recycling market outlook. Moreover, logistics and e-commerce are also investing to increase their electric vehicle fleets. In addition to this, e-commerce giants are extensively investing in EV fleets to make logistics sustainable and environment friendly. For instance, in October 2022, Amazon.com Inc. announced its ambitious plan to invest over US$ 974.8 Million in electric vans, trucks, and low-emission package hubs throughout Europe within the next five years. This strategic investment aimed to accelerate Amazon's commitment to achieving net-zero carbon emissions and promote eco-friendly delivery solutions across the continent. Innovations like these are bolstering the sales of EVs, which is eventually augmenting the need for EV battery recycling.

The Growing Consumer Awareness Towards Sustainability

EV batteries contain valuable resources such as lithium, cobalt, nickel, and other metals. With the rising demand for EVs, the availability of these resources is becoming critical. Moreover, the rising concerns among consumers regarding sustainability are also driving the market for efficient EV battery recycling processes. This is leading to the increasing shift in consumer preferences from IC engine-based vehicles to EV vehicles. Various government authorities of numerous nations are also taking the initiative to limit the use of IC engine-based vehicles. For instance, in 2024, the Government of India launched a new initiative – the Electric Mobility Promotion Scheme 2024 to boost EV adoption. This scheme, with an allocated budget of INR 500 crores is planned to focus on increasing the adoption rate for electric two and three-wheelers in India. Such initiatives are anticipated to propel the electric vehicle battery recycling market growth in the coming years.

Extensive Research and Development (R&D) Activities

Various industry players are extensively investing in the battery recycling processes to enhance the overall procedure and decrease the recycling cost and time. Moreover, the recent development of direct cathode recycling methods, which focuses on recycling the cathode materials directly from used EV batteries, thus saving costs, simplifying the recycling process, and eliminating the need for extensive battery disassembly, is contributing to the market growth. Additionally, various leading market players are investing in expanding the recycling plants to cater to the bolstering demand for battery recycling. For instance, lithium-ion (Li-ion) battery recycling start-up BatX Energies has raised US$ 5 Million in its Pre-Series A funding round from Zephyr Peacock, with participation from LetsVenture and existing investors including JITO Angel Network, family offices of Mankind Pharma, Excel Industries and BluSmart. With the fresh funds, BatX Energies planned to scale up recycling operations across the country.

Electric Vehicle Battery Recycling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric vehicle battery recycling market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, process, vehicle type, application, and region.

Analysis by Type:

- Lithium-ion

- Lead-acid

- Others

Lithium-ion leads the market with around 45% market share in 2024. Lithium-ion batteries are dominating the market as they are widely used in EVs owing to their high energy density, long cycle life, and excellent power-to-weight ratio. Furthermore, the increasing volume of end-of-life lithium-ion batteries is creating a strong demand for recycling services specifically tailored to this battery chemistry. Additionally, lithium-ion batteries contain valuable resources, including lithium, cobalt, nickel, and other metals that are in high demand for the production of new batteries, consumer electronics, and renewable energy storage. Moreover, the recent advancements in sorting, disassembly, and material recovery techniques have made it increasingly efficient and economically viable to recycle lithium-ion batteries, which is further catalyzing the electric vehicle battery recycling market demand.

Analysis by Process:

- Hydrometallurgical

- Pyro-metallurgical

- Others

Hydrometallurgical leads the market with over 60% of market share in 2024. Hydrometallurgical processes offer efficient extraction of valuable metals from EV batteries. These processes involve the use of aqueous solutions, such as acids or leaching agents, to dissolve the metals present in the batteries. Furthermore, it is a highly versatile process that can be applied to multiple battery chemistries, including lithium-ion (Li-ion) batteries, thus contributing to the market growth. Additionally, the hydrometallurgical process is effective in recovering valuable metals, such as cobalt, lithium, nickel, and manganese, from EV batteries that are essential for the production of new batteries and have significant economic value.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars segment leads the market with around XX% market share in 2024. Electric passenger vehicles, including sedans, SUVs, and hatchbacks, have been at the forefront of the EV revolution. The appeal of zero-emission driving, combined with advancements in battery technology, has fueled the adoption of these vehicles nationwide. A growing range of models from various manufacturers, varying in size, performance, and features, caters to diverse consumer preferences. The annual sales volume of electric passenger cars is projected to cross the 5 million mark by the end of 2025, and it is expected to account for 15% of the overall vehicle sales by the end of 2025. This trend is projected to widen the scope of the electric vehicle battery recycling market.

Analysis by Application:

- Electric Cars

- Electric Buses

- Energy Storage Systems

- Others

Electric cars represent a significant segment of the market, driven by the increasing demand for cleaner transportation and supportive government policies. Advancements in battery technology and cost reductions are enhancing their appeal, making them more competitive with internal combustion engine vehicles. The shift toward EV adoption is further fueled by the expansion of charging infrastructure and consumer awareness of environmental benefits.

Energy storage systems (ESS) are critical for stabilizing renewable energy generation, enabling grid reliability, and reducing energy costs. The growing penetration of solar and wind energy is driving demand for ESS, particularly in residential, commercial, and industrial sectors. Innovations in battery technology, especially lithium-ion, are reducing costs and improving performance, which is driving the market demand.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 50%. The Asia Pacific region holds the majority of the market share as it has witnessed significant growth in the adoption of electric vehicles. Furthermore, it is a major hub for battery production, with several leading battery manufacturers located in the region. Additionally, electric vehicle battery recycling market overview indicates that the government authorities in various APAC countries are taking initiatives to control pollution and promote the adoption of EVs. For instance, India, with its FAME and FAME II policies, has been providing incentives to customers and attractive options for investors as well as manufacturers to set up EV plants to propel the nation toward the faster adoption of green vehicles. Additionally, automobile manufacturers in India are also taking initiatives and investing in R&D practices to provide affordable electric cars in India. For instance, in January 2023, Tata AutoComp Systems Limited (Tata AutoComp) displayed a wide range of parts that it has already localized and is offering to the EV segment. Tata AutoComp has also been working on lightweight products and solutions to help electric vehicles extend their range. Such factors are likely to propel the electric vehicle battery recycling market revenue in the coming years.

Key Regional Takeaways:

North America Electric Vehicle Battery Recycling Market Analysis

Key trends in North America’s EV battery recycling market include the surge in electric vehicle adoption, supportive government regulations and incentives, advancements in recycling technologies, and increased investments in recycling infrastructure. Technological advancements in recycling methods, such as hydrometallurgical and pyrometallurgical processes, are improving the efficiency and recovery rates of critical materials like lithium, cobalt, and nickel. Additionally, strategic partnerships between automakers and recyclers, along with a focus on sustainability and circular economy practices, are driving market growth.

United States Electric Vehicle Battery Recycling Market Analysis

The United States accounted for 68.6% of the electric vehicle battery recycling market in North America. The market for recycling EV batteries in the US is being pushed by a number of factors, including growing EV usage, regulatory requirements, and the growing need for environmentally friendly waste management techniques. The EV battery recycling business has grown significantly as the U.S. government works for decarbonization through programs like the Inflation Reduction Act (2022), which offers large incentives for EV adoption and battery material recovery. In the US, more people are realizing the importance of recycling and reusing Li-ion batteries. The U.S. Department of Energy, for example, recently announced the launch of its ReCell initiative. The "Battery and Critical Mineral Recycling Act of 2020" was also referred to the Committee on Energy and Natural Resources by the US Senate in an effort to improve the current recycling situation.

Critical raw elements like nickel, cobalt, and lithium are expensive and scarce, which is driving the creation of recycling initiatives to recover these resources and lessen reliance on mining. With the help of both public and private investments, industry leaders including Redwood Materials and Li-Cycle are increasing their recycling capacities in the United States. Policies at the state level, especially in California, also require that EV batteries be disposed of and recycled properly, which propels market expansion. Other factors driving the U.S. industry include the growing emphasis on creating a circular economy and reducing environmental risks related to wasted batteries.

Europe Electric Vehicle Battery Recycling Market Analysis

The market for recycling EV batteries in Europe is fueled by strict laws, growing EV adoption, and robust government backing for environmentally friendly policies. The Green Deal and Battery Regulation of the European Union have established a strong regulatory framework to assist the market by requiring the appropriate recycling of batteries and setting goals for material recovery rates. End-of-life battery management is becoming more and more necessary since electric vehicles accounted for 22.7% of new car registrations and 7.7% of new van registrations in Europe. With large investments in recycling infrastructure, nations like France, Germany, and Norway dominate the industry. As lithium and cobalt are scarce in Europe, recycling is strategically necessary to lessen dependency on imports. Furthermore, manufacturers like Northvolt and Volkswagen have been prompted to invest in closed-loop battery recycling systems by the movement toward a circular economy. These elements, along with growing consumer consciousness regarding sustainability, are propelling this market's expansion throughout the area.

Latin America Electric Vehicle Battery Recycling Market Analysis

The market for recycling EV batteries is expanding in Latin America as a result of the region's abundant lithium sources, rising environmental consciousness, and increased EV use. Key markets include nations like Brazil and Chile, where recycling and sustainability are encouraged by government programs. As a significant producer of lithium, Chile is concentrating on developing value-added sectors to support its mining industry, such as battery recycling. Additionally, expenditures in recycling infrastructure are increasing as countries in Latin America work to meet their climate goals.

Middle East and Africa Electric Vehicle Battery Recycling Market Analysis

Growing EV adoption, government-led environmental initiatives, and the demand for vital raw material recovery are the main factors propelling the EV battery recycling market in the Middle East and Africa. Key participants are South Africa and the United Arab Emirates, whose Green Mobility programs place a strong emphasis on environmentally friendly battery disposal methods. The lack of resources and the high expense of importing raw materials are also driving the growth of recycling initiatives. Battery recycling procedures are becoming more popular in the region as a result of the growing emphasis on green technologies and renewable energy.

Competitive Landscape:

The competitive landscape of the global electric vehicle battery recycling market is characterized by intense rivalry and dynamic players vying for significant market share. Established recycling giants, EV companies, emerging startups, and technology companies are all entering the market, each striving to position themselves as leaders in the market space. Partnerships and collaborations are becoming increasingly prevalent as players seek to leverage their strengths and accelerate market penetration. Government policies and regulatory frameworks also impact the competitive landscape, as supportive measures and incentives can influence consumer preferences and industry growth. Moreover, advancements in battery technology are further driving competition, as companies seek to offer cutting-edge solutions to meet evolving consumer demands.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Ascend Elements, Inc.

- Cox Automotive

- Ecobatt

- Exxon Mobil Corporation

- Fortum

- Li-Cycle Corp.

- LOHUM

- Redwood Materials Inc.

- SK Tes

- SNAM Groupe

- Syensqo

- Umicore

- Veolia Group

Recent Developments:

- November 2024: Mercedes-Benz inaugurated Europe’s first battery recycling plant for electric vehicles featuring an innovative mechanical-hydrometallurgical process, marking a significant milestone in sustainable automotive production.

- April 2024: The European Union and India collaborated to launch an Expression of Interest (EoI) aimed at startups specializing in Battery Recycling Technologies for electric vehicles.

- March 2024: Renault announced plans to pioneer a groundbreaking initiative to develop a closed-loop recycling process for EV batteries in Europe, aiming to significantly diminish Europe’s reliance on imported battery materials, particularly from China.

- January 2024: BASF, a global battery materials producer and battery recycler, and Stena Recycling entered into a black mass purchase agreement. This agreement is part of a broader collaboration envisaged by BASF and Stena Recycling with the goal of setting up a battery recycling value chain for the European electric vehicle battery market.

- December 2023: Lithium-ion battery recycling start-up BatX Energies raised US$ 5 Million in its Pre-Series A funding round from Zephyr Peacock, with participation from LetsVenture and existing investors including JITO Angel Network, family offices of Mankind Pharma, Excel Industries and BluSmart. With the fresh funds, BatX Energies planned to scale up recycling operations across the country.

Electric Vehicle Battery Recycling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lithium-ion, Lead-acid, Others |

| Processes Covered | Hydrometallurgical, Pyro-metallurgical, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Applications Covered | Electric Cars, Electric Buses, Energy Storage Systems, Others |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ascend Elements, Inc., Cox Automotive, Ecobatt, Exxon Mobil Corporation, Fortum, Li-Cycle Corp., LOHUM, Redwood Materials Inc., SK Tes, SNAM Groupe, Syensqo, Umicore, Veolia Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric vehicle battery recycling market from 2019-2033.

- The electric vehicle battery recycling market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric vehicle battery recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Electric vehicle battery recycling refers to the process of recovering valuable materials and components from used or end-of-life batteries of electric vehicles (EVs). The goal is to reduce waste, minimize environmental impact, and create a sustainable supply chain for critical battery materials such as lithium, cobalt, nickel, and manganese.

The electric vehicle battery recycling market was valued at USD 3.6 Billion in 2024.

IMARC estimates the global electric vehicle battery recycling market to exhibit a CAGR of 23.9% during 2025-2033.

The increasing adoption of electric vehicles, growing consumer awareness towards sustainability, extensive research and development (R&D) activities, and the imposition of stringent government regulations are some of the major factors propelling the market growth.

According to the report, lithium-ion represented the largest segment by type, driven by the increasing adoption in EVs owing to their high energy density, long cycle life, and excellent power-to-weight ratio.

Hydrometallurgical leads the market by process owing to its exceptional ability to offer efficient extraction of valuable metals from EV batteries.

Passenger cars segment is the leading segment by industry vertical, driven by increasing production and sales of these vehicles. The appeal of zero-emission driving, combined with advancements in battery technology, has fueled the adoption of these vehicles nationwide.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global electric vehicle battery recycling market include Ascend Elements, Inc., Cox Automotive, Ecobatt, Exxon Mobil Corporation, Fortum, Li-Cycle Corp., LOHUM, Redwood Materials Inc., SK Tes, SNAM Groupe, Syensqo, Umicore, and Veolia Group among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)