Empty Capsules Market Size, Share, Trends and Forecast by Type, Raw Material, Functionality, Therapeutic Application, End User, and Region, 2025-2033

Empty Capsules Market Size and Share:

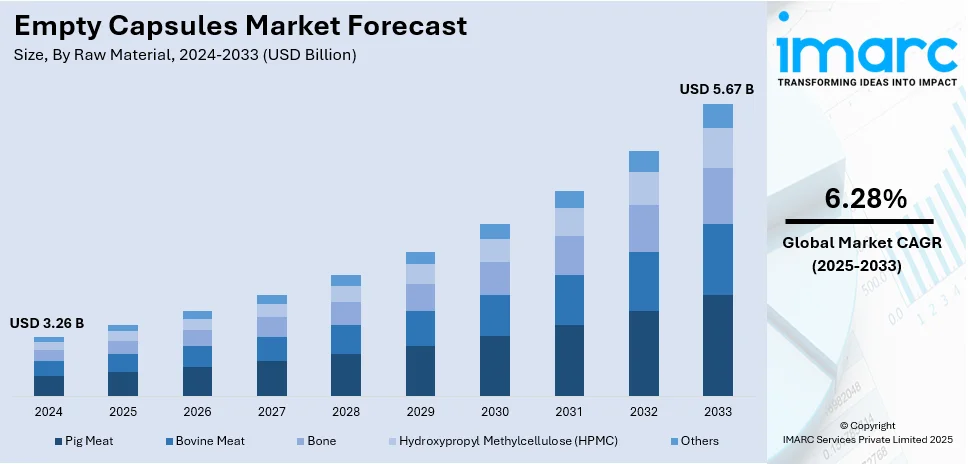

The global empty capsules market size was valued at USD 3.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.67 Billion by 2033, exhibiting a CAGR of 6.28% from 2025-2033. North America currently dominates the market, holding a market share of over 34.5% in 2024. The emerging popularity of capsule-in-capsule technology to ensure the gastrointestinal safety of patients, coupled with numerous advancements in the healthcare industry is primarily fueling the market in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.26 Billion |

|

Market Forecast in 2033

|

USD 5.67 Billion |

| Market Growth Rate (2025-2033) | 6.28% |

Growing demand for encapsulated dietary supplements and pharmaceutical products is the driving factor for the global empty capsules market. Health awareness combined with the widespread usage of nutraceuticals has largely increased the demand for gelatin and non-gelatin capsules. The introduction of vegetarian capsules as part of technological advancements in capsule production has catered to health-conscious and vegan consumers. The rising incidence of chronic diseases has also given a boost to the use of capsule-based drug delivery systems, which provide better bioavailability and patient compliance. Growth in the pharmaceutical industry in emerging markets and the upward trend of self-medication are also contributing factors.

To get more information on this market, Request Sample

The United States is proving to be a major disruptor in the market. It currently holds 85.90% of the overall market share, mainly fueled by rising demand for dietary supplements, growing pharmaceutical applications, and developments in capsule technology. The pharmaceutical industry remains the largest consumer of empty capsules, utilizing them primarily for drug delivery systems, with immediate and sustained-release formulations accounting for the majority. The nutraceuticals industry, too, is another major end-user, and this only reflects the increase in preference for natural health products from consumers. Other technological changes, such as plant-based, non-gelatin capsules are also gaining popularity, especially being vegetarian and vegan-friendly. Furthermore, strategic investments also include any such expansion, such as Lonza expanding to produce 30 billion capsules a year.

Empty Capsules Market Trends:

Occurrence of Chronic Diseases

The expanding geriatric population who are susceptible to developing associated chronic conditions is escalating the demand for the production of therapeutically effective medicines in the form of capsules, as they are easy to swallow and have faster dissolution times compared to other oral dosage forms. According to the World Health Organization (WHO), the number of individuals aged 80 years or older is anticipated to triple between 2020 and 2050, reaching roughly about 426 Million. Besides this, as stated by the Population Reference Bureau's Population Bulletin-Aging in the United States, the Americans aged 65 years and older are expected to nearly double from 52 Million in 2018 to 95 Million by 2060. Additionally, cardiovascular diseases (CVDs) are highly prevalent globally. As per the data published by the WHO in 2019, an estimated 17.9 Million people die each year due to the elevating incidences of cardiovascular diseases, and the number is projected to grow approximately to more than 23.6 Million by 2030. Moreover, according to the British Heart Foundation Centre, around 7.6 Million individuals were living with heart and circulatory diseases in 2021 across the United Kingdom. As a result, the rising incidences of these cases are bolstering the adoption of cardiovascular therapy drugs for effective treatment, which is providing a positive empty capsules market outlook.

Novel Product Launches

The introduction of advanced encapsulation solutions in the pharmaceutical industry is fueling the market. The global pharmaceutical drug delivery market size was valued at USD 1,465.2 Billion in 2024. Key players are developing better-filled empty capsule versions, which may be vegetarian alternatives for the hard gelatin capsules to comply with certain dietary or cultural requirements. For instance, Capsugel is a leader in the empty capsules production with over 20 years of experience and more history in hard gelatin capsule production, among other technologies. Capsugel offers different kinds of hydroxypropyl methyl cellulose capsules for the use of pharmaceuticals by either inhalation or orally. Another example is the ACGcaps NTone developed by ACG in March 2022, which features natural coloring from edible sources and targets health-conscious consumers. Also, Suheung Capsule, which is one of the significant contract manufacturers for HPMC and hard gelatin capsule shell services, provides extremely stable hard gelatin capsule shell materials for pharmaceutical customers. Apart from this, an increase in the number of regulatory approvals both by the European Medicines Agency and the U.S. Apart from this, the increasing number of regulatory approvals from the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) are simplifying the process of new formulations, which, in turn, is one of the empty capsules market recent opportunities. For example, in April 2020, Qualicaps, one of the manufacturers of hard capsules and pharmaceutical-related equipment, expanded its presence in the Middle East and Africa after signing agency and distribution partnership agreements with a number of leading companies operating in the region. Similarly, in August 2020, Dr. Reddy Laboratories received USFDA approval for the development of generic Penicillamine capsules that can be used for the treatment of cystinuria and Wilson's disease.

Adoption of Dietary Supplements

The inflating popularity of cosmeceuticals and nutraceuticals that are preferred in capsule forms, such as CosmoPod capsules and cod liver oil capsules, respectively, is acting as a significant growth-inducing factor. According to the report published by IMARC, the global nutraceuticals market size reached USD 468.5 Billion in 2023. Looking forward, IMARC Group anticipated the market to reach USD 856.3 Billion by 2032, exhibiting a growth rate (CAGR) of 6.7% during 2024-2032. Consequently, the introduction of supplements in the form of capsules that allow lucrative opportunities for new formulations is propelling the empty capsules market demand. For instance, in December 2023, ACG, one of the Mumbai-based capsule manufacturing providers, developed a novel design for nutraceuticals by using side by sides technology that separates capsules into two compartments, thereby enabling ingredients of two different forms, such as liquid and powder, to be made into one capsule. Apart from this, the data from the Dietary Supplements Label Database (DSLD) revealed that roughly 50,000 dietary supplement capsules, softgel, tablet, powder, liquid, gummy, and packet products are available. Most of these products are multiple dosage forms of single vitamins, multi-vitamins, amino acids, herbals, multi-minerals, etc. In addition, DSLD data mentioned that more than 17,000 products are available as capsules under several categories and account for a 34 % share among all dosage forms. This, in turn, is driving the global market.

Empty Capsules Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global empty capsules market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, raw material, functionality, therapeutic application, and end user.

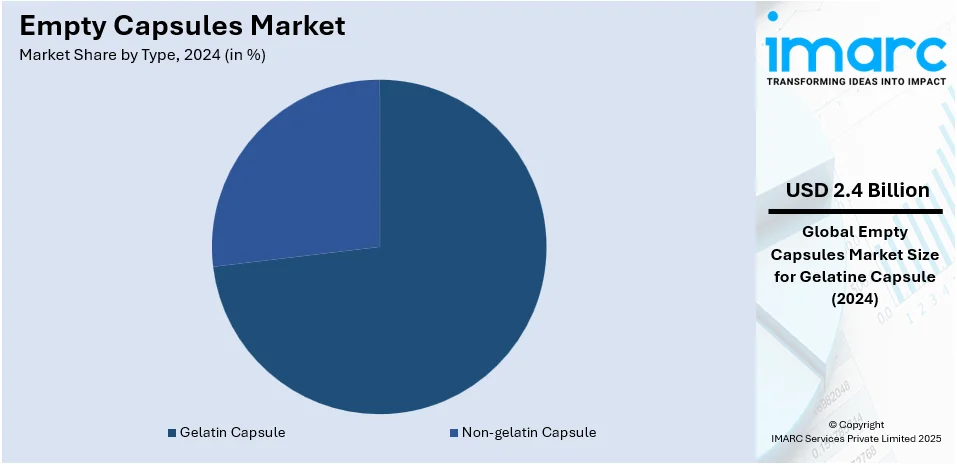

Analysis by Type:

- Gelatin Capsule

- Non-gelatin Capsule

Gelatin capsule stands as the largest component in 2024, holding around 73.4% of the market. Gelatin capsules, also called gel caps, represent a popular form of oral dosage used in the nutraceutical and pharmaceutical industries due to their ease of use, versatility, and ability to mask unpleasant tastes and odors of enclosed substances. Moreover, they are commonly available in both hard and soft forms. Hard gelatin capsules are widely used for dry, powdered ingredients and pellets, while soft gelatin capsules are ideal for oils and liquid-based formulations. The introduction of gelatin capsules with optimal properties, such as improved stability and modified release profiles, is augmenting the segment's growth. For instance, companies, such as Suheung, offer EMBO CAPS capsules that are manufactured to optimize stability. These capsules are also produced by adopting high-grade raw materials, including gelatine, which is sourced from Geltech, a subsidiary of Suheung. In addition, stringent specification compliance and computerized raw material cross-blending ensure only powders that meet the exact requirements can reach the capsulation machines. Apart from this, in February 2023, Vivion, Inc. introduced a wide range of empty gelatin capsules.

Analysis by Raw Material:

- Pig Meat

- Bovine Meat

- Bone

- Hydroxypropyl Methylcellulose (HPMC)

- Others

Pig meat leads the market with around 30.5% of market share in 2024. Pig meat, specifically pork-derived gelatin, exhibits a clear dominance in the market share, owing to its widespread availability and excellent gelling properties, which are crucial for capsule manufacturing. Pork gelatin is favored for its consistent quality and ability to form strong and flexible capsules that dissolve readily in the stomach. For example, Capsugel adopts pork-derived gelatin in their widely used capsules, thereby ensuring reliable performance. Additionally, in November 2021, the International Gelatin Manufacturers Association reported that approximately 85% of the gelatin used in pharmaceutical applications, including capsules, is derived from pork. This dominance is also driven by the well-established supply chains and lower production costs associated with pork gelatin compared to other sources, such as bovine or fish gelatin. Despite the growing interest in alternative sources due to dietary restrictions and ethical concerns, pork gelatin remains the preferred choice in the industry.

Analysis by Functionality:

- Immediate-release Capsules

- Sustained-release Capsules

- Delayed-release Capsules

In 2024, immediate-release capsules account for the majority of the market at around 50.2%. The inflating need for delivering medications that require rapid onset of action is propelling the growth in this segment. Immediate-release capsules dissolve quickly in the stomach, releasing their contents promptly for fast therapeutic effects, which makes them ideal for a broad range of pharmaceutical and nutraceutical products. For example, in August 2022, ACG launched its line of immediate-release capsules, ACGcaps IR, which are specifically designed to optimize the release profile of active ingredients, enhancing their efficacy and patient compliance. Similarly, in January 2023, Capsugel introduced their Vcaps Plus capsules with immediate-release properties, tailored for high-speed filling processes and ensuring quick dissolution and bioavailability. These innovations cater to the escalating demand for effective and fast-acting medications, which is elevating the empty capsules market's recent price.

Analysis by Therapeutic Application:

- Antibiotic and Antibacterial Drugs

- Vitamins and Dietary Supplements

- Antacid and Antiflatulent Preparations

- Cardiovascular Therapy Drugs

- Others

The increased use of capsules in antibiotics such as amoxicillin improves patient compliance because of their ease of swallowing and controlled dosage forms. Furthermore, capsule formulations improve the stability of the drug, protect it from environmental factors, and ensure a more consistent release of the active ingredient, thus improving therapeutic efficacy.

Additionally, vitamins and dietary supplements also comprise a large portion of the market, driven by the rising consumer focus on health and wellness. Capsules offer a convenient way to consume essential nutrients, such as omega-3 fatty acids and vitamin D, which are often found in capsule form.

Antacid and antiflatulent preparations benefit from the ability of capsules to deliver fast-acting relief from digestive issues. Furthermore, the encapsulated form helps mask unpleasant tastes or odors of active ingredients, enhancing patient compliance and overall user experience.

The primary role of capsules in cardiovascular therapy is to ensure proper drug delivery of statins and antihypertensives, which play a significant role in controlling chronic heart conditions. More importantly, the sustained or delayed release ability of drugs enhances the therapeutic effect due to stable plasma drug concentrations, less frequent dosing, and improved patient compliance.

Besides this, other therapeutic areas, including pain management and hormonal therapies, utilize capsules for their versatility and efficacy in drug delivery, which is expected to bolster the empty capsules market revenue in the coming years.

Analysis by End User:

- Pharmaceutical Industry

- Nutraceutical Industry

- Cosmetics Industry

- Others

Pharmaceutical leads the market with around 37.6% of the market share in 2024. As per the empty capsules market statistics, the escalating demand for patient-friendly delivery methods is stimulating the market. Empty capsules provide a reliable form for encapsulating various types of medications, from powders and granules to liquids and semisolids. For instance, in September 2023, Lonza reported a significant increase in demand for its Capsugel hard gelatin capsules, driven by their use in novel drug formulations and clinical trials. These capsules are favored for their consistent performance and compatibility with a wide range of active pharmaceutical ingredients (APIs). Similarly, Qualicaps developed its new line of Quali-G hard gelatin capsules, which is designed specifically for high-potency drugs, which require precise dosing and enhanced stability. Key players in the pharmaceutical industry also leverage empty capsules for controlled-release formulations, enhancing therapeutic efficacy and patient compliance.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the highest market share of more than 34.5%. The rising cases of chronic diseases, coupled with the growth of the geriatric population in the United States, is driving the regional market. As indicated by the Population Reference Bureau's Population Bulletin-Aging in the United States, the population aged 65 years and older is projected to almost double from 52 Million in 2018 to 95 Million by 2060. In addition to this, the increasing need for capsule-based nutraceutical formulations is also one of the other important growth promoters. According to the CRN Consumer Survey, 77% of the Americans indicated using dietary supplements in 2019. Additionally, a survey found out that vitamins and minerals stood as the leading supplement group consumed by people all around the United States during the same period, constituting 76% of the overall dietary supplement usage. Other than this, the highly developed healthcare systems in Canada are also attracting investments towards R&D activities, and hence are likely to boost the North America market for empty capsules through the forecast period.

Key Regional Takeaways:

United States Empty Capsules Market Analysis

The US empty capsule market is rising on account of increasing demand from people for nutraceuticals and dietary supplements, which are now normal in American health habits. A survey from 2023 shows that 74% of U.S. adults consume dietary supplements, with 55% being “regular users,” this data projects how important dietary supplements have become in daily health care of the people. This trend is also pushing up the need for empty capsules, which are needed to hold various active ingredients. Along with the boost in supplement use, the market is also helped by the trend toward personalized medicine, as people want drugs made just for them. Advances in technology for making capsules help produce them better and cheaper, further helping market growth. The rise in demand for plant-based capsules, like vegan and vegetarian options, is also happening as consumers want more eco-friendly and ethical choices. Additionally, an increasing number of uses in pharmaceuticals, especially in clinical trials and drugs made for specific patients, raises the demand for empty capsules. This mix of factors is likely to keep the US empty capsule market growing, driven by rising interest in health and wellness.

Europe Empty Capsules Market Analysis

Europe has a thriving market for empty capsules, primarily due to the growing demand for pharmaceuticals, nutraceuticals, and dietary supplements. There has been a particularly strong move towards plant-based products with the ProVeg International survey showcasing that 46% of European consumers have reduced meat intake. This increasing trend of veganism and vegetarianism is propelling the consumption of plant-based and vegan capsules, as consumers are looking for ethical, sustainable, and clean-label options. Along with the increased health awareness in the region, the growing demand for natural and alternative medicine also fuels the reliance on empty capsules as a dependable drug delivery method. The region also has a well-established pharmaceutical industry and the strict regulatory environment that also contribute significantly to the market's growth by guaranteeing top-notch production. The leading pharmaceutical companies headquartered in Germany, Switzerland, and the United Kingdom are still striving for more efficient drug delivery systems, which results in the growing demand for capsules. Besides, the increasing number of people suffering from chronic diseases such as cardiovascular diseases, diabetes, and cancer is also propelling the demand for prescription-based capsules even more pronounced. The rise in self-medication and the use of over-the-counter products is also boosting the market. Europe's focus on innovation, as well as its demand for high-quality capsules, makes it a major player in the global empty capsule market.

Asia Pacific Empty Capsules Market Analysis

Empty capsules market is a prominent sector in the APAC region because of massive consumption of both traditional and modern medicine in the region. In the National Library of Medicine, it is reported, that more than 70% of the population in India's 1.1 Billion still prefer not to use allopathic medical set-ups, which are non-therapeutic or herbal medicine. The capsule delivery technology is not only affected by internal factors but also by the additional popularity of the supplements. Besides this, there is a heightened demand for pure vegan and plant-based capsules due to the consumer choice of ethical and sustainable products. Furthermore, the expansion of the pharmaceutical industry in these emerging markets also becomes important in the overall market growth. Innovations in capsule production, by means of plant-based alternatives, are facilitating the development of cleaner products which are extremely popular. Besides, among the elderly in this region, there is a higher prevalence of chronic diseases, and thus the consumption of capsules is still possible. And all this adds positivity to the market growth of this region.

Latin America Empty Capsules Market Analysis

The Latin American empty capsule market is growing on account of rising awareness regarding health people are becoming more aware of health care. According to research from BMC Public Health, about 70% of Brazilians will have one or more chronic diseases by the age of 60 and this has made the production of the pharmaceutical capsules an effective way to manage these conditions. Nevertheless, the rising demand for nutraceuticals and dietary supplements is additionally a factor of market growth. Aside from that, a major change is the consumers' bias towards plant-based and vegan products as they pay more attention to a healthy lifestyle. Also, the construction of healthcare infrastructure in Brazil and Mexico leads to the growth of the market.

Middle East and Africa Empty Capsules Market Analysis

The Middle East and Africa (MEA) region has been witnessing an explosion in the demand for empty capsules as the healthcare sector leaps forward and health becomes of more interest. In a study by the National Library of Medicine, it is found that an approximate 4.7% of populations in the Middle East and Northern Africa are elderly, thus leading to more pharmaceutical products such as capsules. Aside from that, there has been a developing interest in nutraceuticals, dietary supplements, and plant-based capsules among consumers. The increasing occurrence of chronic diseases in the region coupled with the self-medication trend is also pushing the market up.

Competitive Landscape:

The global empty capsules market is highly competitive, characterized by the dominance of key players. These companies hold significant market shares due to their extensive product portfolios, robust manufacturing capabilities, and widespread distribution networks. The market is consolidated, with large players investing in R&D and expanding production capacities to meet growing demand. Smaller and emerging companies are entering the market, especially in regions like Asia-Pacific, to capitalize on rising consumer awareness and demand for plant-based or vegetarian capsules. Strategic initiatives such as mergers, acquisitions, and product launches are prevalent, fostering innovation and strengthening market positions. Additionally, regulatory compliance and customization of capsules for specific applications give established players a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the empty capsules market with detailed profiles of all major companies, including:

- ACG

- Bright Pharma Caps Inc.

- Farmacápsulas

- HealthCaps India

- Hunan ErKang Pharmaceutical Co., Ltd

- Lonza

- Medicaps Limited

- Nectar Lifesciences Ltd.

- Qualicaps

- Roxlor

- Sirio Pharma Co., Ltd.

- Suheung Co. Ltd

- Sunil Healthcare Limited

Latest News and Developments:

- September 2024: Evonik has developed EUDRACAP® pre-locked capsules for pharmaceutical companies, designed for filling powders, pellets, and granules. Coated with EUDRAGIT®, these capsules offer precise pH targeting and up to four hours of acid resistance. They protect sensitive active ingredients from heat, moisture, and gastric acids, optimizing absorption and preventing premature dissolution. EUDRACAP® capsules are compatible with standard filling systems and support regulatory excellence.

- May 2024: Global plant-based ingredient leader Roquette is launching its new LYCAGEL® Flex hydroxypropyl pea starch premix for nutraceutical and pharmaceutical softgel capsules. Backed by the latest innovation of Roquette's LYCAGEL® pea starch technology, this plasticizer-free excipient gives the formulator the opportunity to create a perfect formulation using an optimal combination of plasticizers that fits the diversified requirements of manufacturing and the final consumer. The product offers new quality, stability, and performance standards in the production of plant-based softgels.

- February 2023: Vivion, a provider of ingredient solutions, has launched a new range of empty gelatin, HPMC, and pullulan capsules. These two-piece capsules are designed for encapsulating powders, herbs, and nutraceutical ingredients, and are suitable for use in medicines, vitamins, supplements, and amino acids. The company aims to support nutraceutical manufacturers by addressing challenges related to ingredient interactions with capsules, helping to develop more cost-effective products.

- December 2023: Rousselot, a health brand of Darling Ingredients, has received U.S. Patent No. US11795489B2 for StabiCaps™, a specialized gelatin for improving the stability of empty softgel capsules. The technology addresses crosslinking, which can slow or hinder the dissolution of capsules, ensuring better release of active ingredients. StabiCaps also received a European patent in May 2022, offering softgel manufacturers improved product quality and shelf stability.

- November 2021: ACG signed an MoU with the Government of Maharashtra to establish Asia’s largest manufacturing plant and R&D center in Aurangabad. The plant is designed to produce 40 Billion capsules annually, and was set to serve both Indian and international pharmaceutical and nutraceutical companies.

Empty Capsules Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gelatin Capsule, Non-gelatin Capsule |

| Raw Materials Covered | Pig Meat, Bovine Meat, Bone, Hydroxypropyl Methylcellulose (HPMC), Others |

| Functionalities Covered | Immediate-release Capsules, Sustained-release Capsules, Delayed-release Capsules |

| Therapeutic Applications Covered | Antibiotic and Antibacterial Drugs, Vitamins and Dietary Supplements, Antacid and Antiflatulent Preparations, Cardiovascular Therapy Drugs, Others |

| End Users Covered | Pharmaceutical Industry, Nutraceutical Industry, Cosmetics Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACG, Bright Pharma Caps Inc., Farmacápsulas, HealthCaps India, Hunan ErKang Pharmaceutical Co., Ltd, Lonza, Medicaps Limited, Nectar Lifesciences Ltd., Qualicaps, Roxlor, Sirio Pharma Co., Ltd., Suheung Co. Ltd, Sunil Healthcare Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the empty capsules market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global empty capsules market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the empty capsules industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Empty capsules are two-piece, hollow containers made from gelatin or non-gelatin materials used for encapsulating powders, liquids, or granules. They are widely utilized in pharmaceuticals, nutraceuticals, and dietary supplements for their ease of use and precise dosage delivery.

The empty capsules market was valued at USD 3.26 Billion in 2024.

IMARC estimates the global empty capsules market to exhibit a CAGR of 6.28% during 2025-2033.

The market is driven by increasing demand for encapsulated dietary supplements, rising health awareness, advancements in capsule technology like vegetarian and plant-based capsules, and the growing prevalence of chronic diseases that necessitate capsule-based drug delivery systems.

In 2024, gelatin capsules were the largest segment by type, driven by their ease of manufacturing, versatility, and widespread application in pharmaceuticals and nutraceuticals.

Pig meat-derived gelatin leads the market by raw material due to its excellent gelling properties and cost-effective production.

Immediate-release capsules represent the largest segment by functionality, offering fast dissolution and rapid therapeutic effects.

In 2024, pharmaceuticals represented the largest segment by end user, driven by the surging demand for patient-friendly delivery methods.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global empty capsules market include ACG, Bright Pharma Caps Inc., Farmacápsulas, HealthCaps India, Hunan ErKang Pharmaceutical Co., Ltd, Lonza, Medicaps Limited, Nectar Lifesciences Ltd., Qualicaps, Roxlor, Sirio Pharma Co., Ltd., Suheung Co. Ltd, Sunil Healthcare Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)