Europe Automotive Glass Market Size, Share, Trends, and Forecast by Glass Type, Material Type, Vehicle Type, Application, End User, Technology, and Country, 2025-2033

Europe Automotive Glass Market Size and Share:

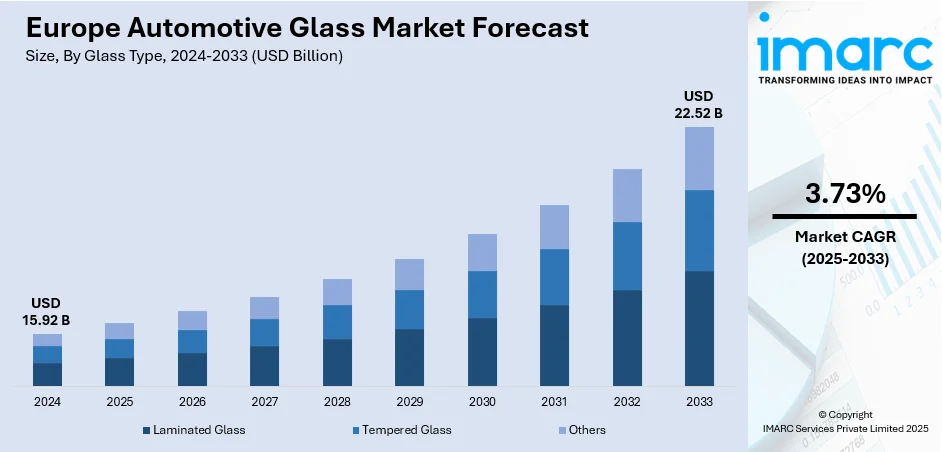

The Europe automotive glass market size was valued at USD 15.92 Billion in 2024. Looking forward, the market is expected to reach USD 22.52 Billion by 2033, exhibiting a CAGR of 3.73% during 2025-2033. Germany currently dominates the market, holding a significant market share in 2024. The market is advancing with rising demand for lightweight, durable, and technologically integrated glass solutions in vehicles. Growing adoption of smart glass, enhanced safety standards, and increasing focus on energy efficiency are also shaping innovation. Expanding electric and connected car production further supports growth, strengthening Europe automotive glass market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.92 Billion |

|

Market Forecast in 2033

|

USD 22.52 Billion |

| Market Growth Rate 2025-2033 | 3.73% |

The market is witnessing significant growth, driven by multiple factors that align with evolving consumer preferences, regulatory requirements, and technological advancements. One of the primary drivers is the rising production and sales of automobiles across the region, particularly passenger cars, which constitute the largest share of glass consumption. With growing demand for electric, hybrid, and luxury vehicles, the need for advanced automotive glass solutions has surged, as these models often integrate panoramic sunroofs, laminated safety glass, and smart glass technologies. For instance, in September 2023, Automotive Glass Experts (AGE), a network of premium service providers in the automotive glass sector, announced a strategic alliance with ABC Autoglas Europe GmbH, a prominent distributor headquartered in Kirkel, Germany. This collaboration marks a significant step in broadening the market presence of both organizations while reinforcing their dedication to supplying high-quality products and outstanding services to customers across the automotive glass industry.

To get more information on this market, Request Sample

The Europe automotive glass market growth is also driven by the rising adoption of electric and autonomous vehicles, which require specialized glass equipped with sensors, cameras, and heads-up displays to support advanced driver assistance systems (ADAS). This has accelerated innovation in smart and coated glass technologies. Consumer demand for comfort, security, and design aesthetics also drives market expansion. Features such as glare reduction, UV protection, colored coatings, and burglar-resistant glass are gaining popularity across segments. Additionally, the rapid growth of premium and luxury car sales in Europe has boosted demand for high-quality, technologically integrated glass. For instance, in July 2025, Gauzy Ltd., a worldwide pioneer in vision and light control technologies, introduced a comprehensive solution aimed at boosting production efficiency and advancing the use of smart glass in the automotive industry. The company launched the first-ever prefabricated smart glass stack, a fully industrialized product designed to enable seamless, large-scale integration across various vehicle platforms. In addition to streamlining adoption, the innovation is expected to provide substantial benefits for investors by enhancing scalability and long-term value creation.

Europe Automotive Glass Market Trends:

Rising Automobile Sales and Lightweight Vehicle Demand

The increasing sales of automobiles across Europe serve as a major driver for the automotive glass market. According to the 2025 International Council on Clean Transportation, new car registrations in the European Union rose for the first time since 2019, reaching 10.6 million vehicles across 27 Member States in 2023, a 14% increase compared to 2022. In parallel, the European Commission has introduced stringent regulations to curb carbon emissions. As per the European Environment Agency (EEA), average CO₂ emissions from newly registered passenger cars dropped by 1.6% in 2023 compared to 2022, reaching 106.4 gCO₂/km. This regulatory shift is fueling demand for lightweight, fuel-efficient vehicles, thereby increasing the adoption of advanced automotive glass solutions.

Growing Popularity of Electric, Hybrid, and Autonomous Vehicles

The rising adoption of electric, hybrid, and autonomous vehicles is another critical factor influencing Europe’s automotive glass market. Modern electric automobile glass is being designed with embedded sensors and cameras to support vehicle intelligence and advanced safety systems. According to ACEA, by June 2025, battery-electric cars accounted for 15.6% of the EU market share, up from 12.5% in the first half of 2024. Hybrid-electric vehicles remained dominant, capturing 34.8% of total new car registrations across the European Union. This transition toward greener mobility and technologically advanced vehicles is escalating demand for specialized glass products with enhanced safety, connectivity, and performance features, further propelling the Europe automotive glass market trends.

Technological Advancements and Market Disruptions

Leading automotive glass manufacturers in Europe are increasingly introducing innovative features to enhance safety, comfort, and security. Innovations include colored coatings, glare protection, acoustic insulation, anti-burglary glass, and glazing that prevents passenger ejection during collisions. These advancements improve the overall driving experience and align with stricter safety standards. However, the industry has faced challenges due to the sudden outbreak of coronavirus disease (COVID-19), which disrupted production and supply chains following lockdown restrictions across various regions. Despite this temporary setback, the market is expected to regain momentum as restrictions ease, supported by continued investment in advanced automotive glass technologies and growing consumer preference for safer, more comfortable, and technologically integrated vehicles.

Europe Automotive Glass Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe automotive glass market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on glass type, material type, vehicle type, application, end user, and technology.

Analysis by Glass Type:

- Laminated Glass

- Tempered Glass

- Others

Laminated glass holds the largest share in the market primarily due to its superior safety and durability features. Unlike tempered glass, laminated glass consists of multiple layers bonded with a plastic interlayer, which prevents shattering on impact and reduces the risk of passenger ejection during accidents. This aligns with stringent European safety regulations and growing consumer demand for enhanced vehicle protection. Moreover, laminated glass provides additional benefits such as improved acoustic insulation, UV protection, and resistance to burglary attempts, making it highly desirable for modern vehicles. With the rising popularity of electric, hybrid, and luxury cars that emphasize comfort and advanced features, laminated glass has become the preferred choice, thereby dominating the regional market share.

Analysis by Material Type:

- IR PVB

- Metal Coated Glass

- Tinted Glass

- Others

IR PVB (Infrared Polyvinyl Butyral) glass is expected to dominate due to its ability to block infrared radiation, thereby reducing heat buildup inside vehicles. This enhances passenger comfort, lowers air-conditioning usage, and improves overall fuel efficiency, key priorities under Europe’s stringent emission regulations. Additionally, IR PVB glass provides excellent UV protection and acoustic insulation, making it particularly appealing for electric and luxury vehicles where comfort and energy efficiency are crucial. With rising demand for sustainable and high-performance automotive glass, IR PVB is gaining traction across passenger cars, significantly boosting its market share in Europe.

Metal-coated glass is gaining prominence in the European automotive market for its advanced thermal management properties. By reflecting solar radiation and controlling heat transfer, it helps maintain optimal cabin temperatures and reduces reliance on climate control systems, aligning with Europe’s push for fuel efficiency and carbon reduction. It also enhances connectivity by integrating with antenna systems and advanced driver assistance technologies. These benefits make it highly suitable for electric, hybrid, and connected vehicles. As manufacturers increasingly prioritize energy efficiency, safety, and comfort, metal-coated glass is positioned to capture a large market share across the European automotive sector.

Tinted glass is expected to hold a significant share in Europe’s automotive glass market due to its dual benefits of aesthetics and functionality. It enhances vehicle design appeal while providing privacy and protection against glare and harmful UV rays. By reducing interior heat buildup, tinted glass improves passenger comfort and supports energy efficiency goals, particularly in electric vehicles, where battery performance is sensitive to climate control usage. Additionally, tinted glass aligns with consumer preferences for enhanced security and premium styling in modern cars. Its widespread adoption across passenger and commercial vehicles solidifies its position as a leading segment in Europe’s automotive glass market.

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Others

Passenger cars hold the largest share in the market due to their high production volume, strong consumer demand, and increasing preference for technologically advanced vehicles. Europe has one of the largest passenger car fleets globally, with steady growth in new registrations driven by electric, hybrid, and luxury models. Passenger cars require multiple glass applications, including windshields, side windows, rear glass, and increasingly panoramic sunroofs, boosting overall consumption. According to the Europe automotive glass market forecast, rising safety regulations, emphasis on lightweight materials, and demand for acoustic comfort further drive the use of advanced glass solutions. With consumers prioritizing comfort, design, and sustainability, passenger cars remain the primary end-user segment, ensuring their dominant share in the European automotive glass market.

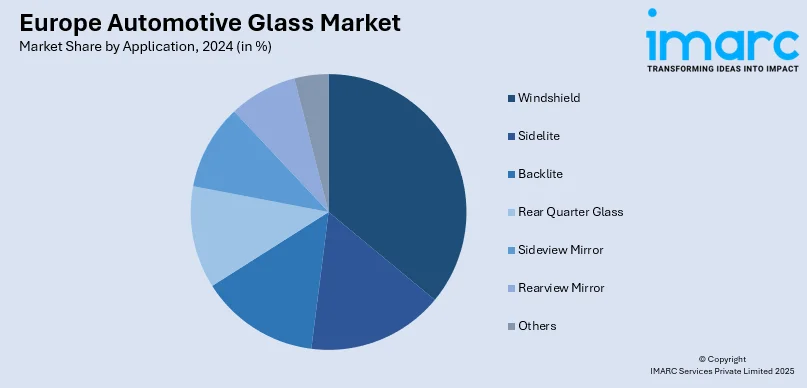

Analysis by Application:

- Windshield

- Sidelite

- Backlite

- Rear Quarter Glass

- Sideview Mirror

- Rearview Mirror

- Others

Windshield holds the largest share in the Europe automotive glass market as they are an essential safety and structural component in every vehicle. Unlike other glass segments, windshields are mandatory across all passenger and commercial vehicles, ensuring consistent and high-volume demand. European safety regulations require laminated windshields, which provide superior protection against shattering, glare reduction, and passenger ejection in accidents. Additionally, windshields are increasingly integrated with advanced driver assistance systems (ADAS), sensors, cameras, and heads-up displays, enhancing their technological importance. The shift toward electric and connected cars further boosts demand for high-performance windshields that improve efficiency, visibility, and comfort. Their universal application and advanced functionalities make windshields the leading segment in Europe’s automotive glass market.

Analysis by End User:

- OEMs

- Aftermarket Suppliers

OEMs (Original Equipment Manufacturers) hold the largest share in the market because of the strong presence of leading automobile manufacturers and the region’s high vehicle production volume. Automakers prefer sourcing glass directly from OEM suppliers to ensure compliance with stringent European safety, quality, and environmental standards. OEM glass is integrated during vehicle assembly, covering essential components like windshields, side windows, rear glass, and sunroofs, driving consistent demand. Additionally, with the rising adoption of electric, hybrid, and luxury cars, OEMs increasingly rely on advanced glass solutions such as IR PVB, laminated, and metal-coated glass. The focus on durability, performance, and seamless integration ensures OEM dominance over aftermarket segments in Europe automotive glass market outlook.

Analysis by Technology:

- Active Smart Glass

- Suspended Particle Glass

- Electrochromic Glass

- Liquid Crystal Glass

- Passive Glass

- Thermochromic

- Photochromic

Active smart glass holds a strong share in the market due to its ability to enhance comfort, safety, and energy efficiency. Using technologies like electrochromic or suspended particle devices (SPD), active smart glass allows drivers and passengers to control transparency, glare, and heat levels instantly. This feature reduces the need for mechanical sunshades or heavy air-conditioning, aligning with Europe’s stringent emission reduction and sustainability goals. Luxury and electric vehicle manufacturers are increasingly adopting active smart glass for panoramic roofs, side windows, and windshields to improve driving experience and aesthetics. Its advanced functionality, premium appeal, and compatibility with connected car technologies make active smart glass a leading choice across the European automotive industry.

Passive glass continues to dominate in the market due to its cost-effectiveness, widespread availability, and proven durability. Unlike active smart glass, passive glass relies on fixed properties such as tinting or coatings to block UV rays, reduce glare, and minimize heat absorption, ensuring consistent comfort without added complexity. It is extensively used across mass-market passenger cars and commercial vehicles, where affordability and reliability are key purchasing factors. With strong demand for laminated, tempered, tinted, and coated varieties, passive glass offers versatile solutions that meet European safety regulations while supporting energy efficiency. Its balance of performance, lower cost, and ease of manufacturing ensures that passive glass maintains the largest overall share in Europe’s automotive glass market.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The Europe automotive glass market demand in Germany is driven by the country’s strong automobile manufacturing base, technological innovation, and rising demand for premium vehicles. Germany is home to leading OEMs such as BMW, Mercedes-Benz, and Volkswagen, which continuously integrate advanced glass solutions like laminated, tinted, and smart glass into their models. Stringent EU safety and emission regulations push manufacturers toward lightweight, durable, and energy-efficient glass to improve vehicle performance and sustainability. Growing adoption of electric and hybrid vehicles further accelerates demand for specialized glass equipped with sensors and ADAS compatibility. Additionally, rising consumer preference for comfort features such as panoramic sunroofs, acoustic insulation, and glare protection strengthens the market, making Germany a key contributor to Europe’s automotive glass growth.

Competitive Landscape:

The competitive landscape of the Europe automotive glass market is characterized by the presence of global and regional players focusing on innovation, partnerships, and sustainability. Key companies such as Saint-Gobain Sekurit, AGC Inc., Nippon Sheet Glass, Fuyao Glass, and Guardian Industries dominate with strong OEM collaborations and advanced product portfolios. These players emphasize lightweight, laminated, and smart glass technologies to meet safety and emission standards while enhancing comfort and connectivity. Growing investments in electrochromic and IR PVB glass highlight a shift toward energy-efficient solutions, particularly for electric and luxury vehicles. Intense competition drives continuous R&D, while regional manufacturers strengthen their foothold through cost-effective offerings, ensuring a dynamic market structure across Europe’s automotive glass industry.

The report provides a comprehensive analysis of the competitive landscape in the Europe automotive glass market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: ExpressGlass expanded its footprint in Portugal by acquiring Newcar, adding 32 workshops to its network and increasing its total to 120. The move strengthens ExpressGlass’s local presence and aligns with Cary Group’s strategy to consolidate the European vehicle glass repair and replacement market through targeted acquisitions.

- May 2025: AGC Automotive Czech celebrated 100 years of glass production in Chudeřice and began constructing a high-tech laminated windshield line. Part of AGC’s European automotive division, the plant will augment annual output by over 1 million units, reinforcing its key role in Europe’s automotive glass industry.

- January 2025: Gauzy launched black Suspended Particle Device (SPD) smart glass with energy-harvesting capabilities. Unveiled at CES 2025, it blocks over 99% of visible light, enhances temperature control, supports retrofits, and integrates transparent solar cells. The product targets automotive, architecture, and aeronautics sectors.

- January 2025: AGC Glass Europe acquired Germany-based Sicherheitsglastechnik Oelsnitz GmbH (SGT), expanding its safety glass operations and European network. The move strengthens AGC’s position in architectural and automotive glass, enhances its value chain, and reinforces global leadership in complex façade projects and high-performance glass solutions.

- January 2025: Cary Group acquired a 51% stake in French vehicle glass repair specialist 123 Pare-Brise, marking its entry into the French market. With 129 workshops and EUR 100 Million in sales, the move strengthens Cary Group’s European presence and supports its strategy to consolidate the VGRR sector.

Europe Automotive Glass Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Glass Types Covered | Laminated Glass, Tempered Glass, Others |

| Material Types Covered | IR PVB, Metal Coated Glass, Tinted Glass, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Trucks, Buses, Others |

| Applications Covered | Windshield, Sidelite, Backlite, Rear Quarter Glass, Sideview Mirror, Rearview Mirror, Others |

| End Users Covered | OEMs, Aftermarket Suppliers |

| Technologies Covered |

|

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe automotive glass market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe automotive glass market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe automotive glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive glass market in Europe was valued at USD 15.92 Billion in 2024.

The Europe automotive glass market is projected to exhibit a CAGR of 3.73% during 2025-2033, reaching a value of USD 22.52 Billion by 2033.

The Europe automotive glass market is driven by rising automobile sales, stringent EU safety and emission regulations, and growing demand for lightweight, durable, and energy-efficient materials. Increasing adoption of electric, hybrid, and autonomous vehicles, along with consumer preference for advanced features like panoramic sunroofs and smart glass, further supports market growth.

Germany currently dominates Europe automotive glass market due to strong automobile production, rising demand for premium and electric vehicles, and strict EU safety and emission standards. Advancements in laminated, smart, and lightweight glass, coupled with consumer preference for comfort and safety features, further accelerate market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)