Europe Vegan Food Market Size, Share, Trends and Forecast by Product, Source, Distribution Channel, and Country, 2026-2034

Europe Vegan Food Market Size and Share:

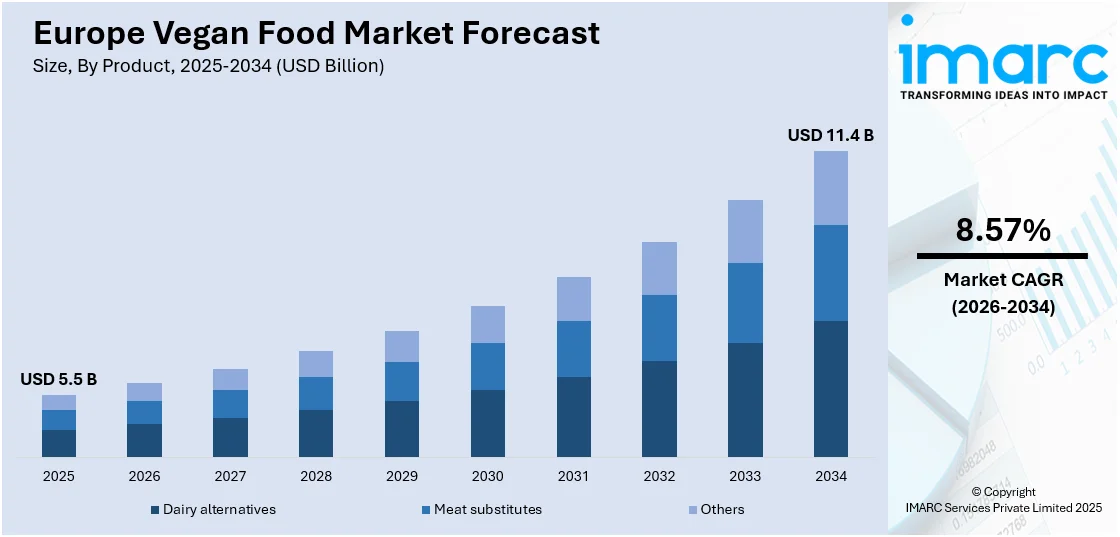

The Europe vegan food market size was valued at USD 5.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 11.4 Billion by 2034, exhibiting a CAGR of 8.57% from 2026-2034. The market is driven by the growing awareness among masses about the health benefits associated with vegan food. The increasing availability of vegan food through various channels, such as specialty stores, convenience stores, and supermarkets, is fueling the demand for plant-based food products in Europe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.5 Billion |

| Market Forecast in 2034 | USD 11.4 Billion |

| Market Growth Rate (2026-2034) | 8.57% |

There is currently a rise in the awareness among the people about obesity, diabetes and heart diseases, which is prompting people to change their diet patterns. Vegan food is usually said to be healthier because it contains less amount of saturated fats, cholesterol, and processed ingredients obtained from animals. Studies shows that diet affects health, and presently plant-based food is marketed as a rich source of fiber, vitamins, and antioxidants, which is useful in chronic conditions as well as for boosting immunity. Vegan food and beverage (F&B) products are associated with their potential in managing weight. The growing prevalence of obesity is encouraging many people to adopt vegan diets, as they help to reduce calorie intake without compromising on nutritious and healthy food. Fitness influencers on social media platforms are also promoting plant-based diet, as vegan proteins like lentils, quinoa, and tofu are effective in athletic recovery and performance. As per the IMARC Group’s report, the Germany diabetes market is expected to reach US$ 14.8 Billion by 2032.

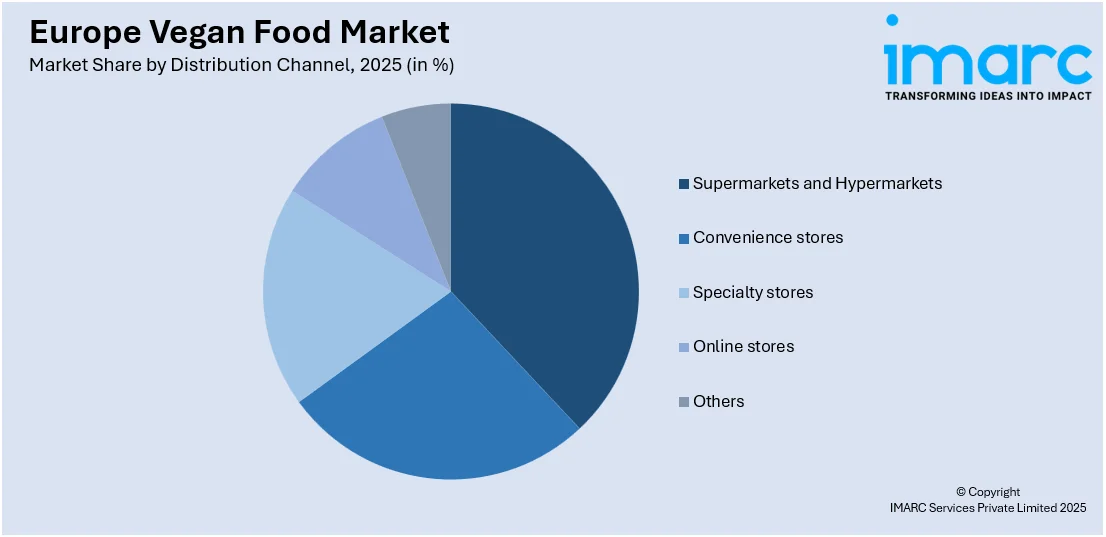

To get more information on this market Request Sample

Increased number of people can now access vegan food items due to the expansion of supermarkets, hypermarkets, and online platforms, which offer dedicated sections and aisles for plant-based food. This is making vegan food more mainstream and engrained into everyday shopping habits. Retail giants are responding to the increased demand for plant-based food by supplying all varieties of vegan products, ranging from the dairy substitute to the meat alternative, ensuring wide availability of vegan food options. E-commerce sites are making it possible for consumers to shop for vegan products from home, even from places that do not have a physical store. Online shopping also offers plenty in terms of variety and the convenience of home delivery, thus making it a preferred alternative among most consumers. The IMARC Group’s report shows that the Europe online grocery store market is expected to reach USD 422.1 Billion by 2032.

Europe Vegan Food Market Trends:

Growing adoption of flexitarian diet

A flexitarian diet encourages to limit the meat consumption and substituting meat with different plant-based products for a few days in a week. The growing adoption of this diet is influencing the demand for pant-based products for various reasons, including health, sustainability, and ethical reasons. The escalating awareness among people about the health benefits associated with plant-based diet adoption is supporting the market growth. It is also believed that vegan dishes can improve cardiovascular health, control weight gain, and decrease the risk of chronic diseases. As a rising number of alternatives are available for ready-to-eat (RTE) plant-based meat, flexitarians are switching to mock meat options over the traditional alternatives. According to the IMARC Group’s report, Europe plant-based meat market size is projected to exhibit a growth rate (CAGR) of 17.82% during 2024-2032.

Environmental concerns

The food and beverage production and processing industry is noted to be a great cause of deforestation, water pollution, greenhouse gas emissions, and the loss of biodiversity. As the problems of global warming and environmental degradation continue to worsen, many Europeans are shifting to plant-based food to decrease their carbon footprint and save valuable resources. Moreover, vegan food production requires less natural resources like water and energy than the animal-based products, thus making it more sustainable. Vegan diets are seen as a means through which environmental problems can be solved as they are less harmful to the environment through food production. The awareness among the public about the effects of environmental activism is encouraging them to make friendly environment choices. The data published on the website of IMARC Group shows that the Europe organic food and beverages market is anticipated to reach US$ 320.6 Billion by 2032.

Rising food intolerance

Lactose intolerance is one of the most common conditions affecting the human population. This is driving the demand for vegan, dairy-free alternatives like plant-based milk, cheese, and yogurt products. With the growing knowledge about lactose intolerance in people, they are adopting plant substitute to fulfill their dietary requirements without the digestive discomfort linked with dairy products. Likewise, gluten sensitivities and celiac diseases are growing among the masses, which is driving the demand for vegan food as there are numerous gluten free options available in the vegan food range. F&B manufacturers are constantly innovating to meet the latest food trend, offering products that cater to wide range of consumers with different dietary preferences, which is bolstering the growth of the market across Europe. IMARC Group’s report stated that the United Kingdom dairy alternatives market is exhibited to reach US$ 3.3 Billion by 2032.

Europe Vegan Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe vegan food market, along with forecast at the country and regional levels from 2026-2034. The market has been categorized based on product, source, and distribution channel.

Analysis by Product:

- Dairy alternatives

- Cheese

- Desserts

- Snacks

- Others

- Meat substitutes

- Tofu

- Texturized vegetable protein (TVP)

- Seiten

- Quorn

- Others

- Others

With increased awareness among consumers about the environmental impact of dairy production and the rising prevalence of lactose intolerance, this segment is expanding. Products like soy yogurt, almond milk, and other varieties of vegan cheese are catering to consumers who are health-conscious and opting for ethically sourced food products.

Technological advancements in the processing of plant-based food along with the growing adoption of flexitarian diet among individuals are fueling the demand for meat substitutes. The products include soy-based patties and pea protein sausages, which attract the health-conscious and sustainability-minded customers looking for better protein alternatives.

Analysis by Source:

- Almond

- Soy

- Oats

- Wheat

- Others

Almond-based products are gaining popularity because they are mild-tasting and versatile and come with added health benefits like Vitamin E and healthy fats. People looking for dairy alternatives are progressively adopting almond milk as an alternative.

Soy stands out as the most dominant source owing to its high protein content and its age-old application in meat substitutes and dairy-type alternatives. It is also very affordable and functional in mimicking the texture of animal-based products.

Oat-based products are gaining popularity due to their creamy texture and sustainability. Oats-milk is a popular replacement to the traditional milk, appealing to environmentally aware and allergen-sensitive consumers.

Seitan is made from wheat, which is the main source in meat substitutes because of its texture similar to meat. Its affordability and ease of accessibility are responsible for the incorporation of wheat in formulations of vegan food.

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience stores

- Specialty stores

- Online stores

- Others

Supermarkets and hypermarkets are mostly preferred owing to their large reach, vast assortment of vegan products, and promotional activities. This makes them a one-stop shopping centers catering to all the food related requirements, which appeals to the masses.

On-the-go (OTG) convenience stores sell essential vegan products at smaller and more accessible outlets. Their availability in the urban areas makes them an ideal choice for frequent purchases.

Specialty stores offer exclusive, high-end, and organic vegan food items that health-conscious and ethical shoppers seek in the form of a premium and niche alternative.

A growth in the presence of online stores is driven by the home delivery service, wider product availability, and constant discounts offered. They attract the tech-savvy consumers and also those living in remote areas with limited or no physical access to stores.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Owing to its strong focus on sustainability and health trends, Germany leads the vegan food market in the Europe. The local businesses are constantly innovating in the processing technology due to the rising adoption of a flexitarian diet and plant-based product launches.

With the growing interest in veganism, especially in the capital city Paris, which has a history of meat centric cuisine is driving the demand for plant-based food in France. Most of the retailers within France have started offering vegan food in their stores. Additionally, more restaurants are incorporating plant-based dishes into their menus to cater to the demand for vegan and vegetarian alternatives.

Driven by health, environmental, and ethical considerations, the United Kingdom is witnessing a rise in the adoption of vegan diet. Plant-based food products are easily available in supermarket and specialty stores owing to UK’s vibrant plant-based food culture. The constant governmental advocacy of sustainable and ethical consumption alongside the hype of programs like Veganuary are putting more momentum to the growth of the vegan food market.

More Italians are adopting plant-based diets due to the health and environmental reasons. Increased interest in vegan pizza and pasta and other traditional food reformulated with plant-based ingredients are contributing to this shift. The country is also influenced by international trend of veganism with an increasing availability of plant-based food across restaurants and retail stores, making plant-based eating more mainstream.

The growing consciousness around health, sustainability issues, and increased acceptance of plant-based diets among younger generations is driving the demand for vegan food products in Spain. Spanish consumers are looking for vegan alternatives to classic cuisine, such as tapas, and shops and restaurants are extending their vegan choices to suit this demand. In addition, social media celebrities and vegan advocacy efforts are helping to popularize plant-based diet in Spain.

Competitive Landscape:

To improve their market position, major participants in the market are aggressively broadening their frontiers and innovating new products. Big businesses are spending money on research and development (R&D) to improve the taste, texture, and nutrient levels in plant-based food products to cater to varied preference. To improve awareness about the benefits of vegan food and reach a wider audience, many key players are concentrating on incorporating marketing strategies, such as celebrity endorsements and the use of social media influencers. Besides this, through spreading awareness among people about environmental and animal welfare, these businesses are promoting sustainable and ethical eating choices. Key players are associating with retailers to ensure the availability of plant-based products in specialty stores, supermarkets, and other online and retail channels. For promoting their visibility and accessibility, many businesses are also collaborating with restaurants and cafes.

The report provides a comprehensive analysis of the competitive landscape in the Europe vegan food market with detailed profiles of all major companies.

Latest News and Developments:

- February 2024: Vegan Food Group acquired Germany's TOFUTOWN to be one of the largest expanding its vegan product reach in Europe. The deal pushed VFG's revenues above €100 million and strengthened its presence in the plant-based food market across the region.

Europe Vegan Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | • Dairy Alternatives: Cheese, Desserts, Snacks, Others • Meat Substitutes: Tofu, Texturized Vegetable Protein (TVP), Seiten, Quorn, Others • Others |

| Sources Covered | Almond, Soy, Oats, Wheat, Others |

| Distribution Channels Covered | Supermakrets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Countries Covered | Germany, France, the United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe vegan food market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe vegan food market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe vegan food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe vegan food market was valued at USD 5.5 Billion in 2025.

The market is driven by rising health awareness, demand for low-calorie and plant-based diets, growing adoption of flexitarian lifestyles, increased accessibility via supermarkets and online platforms, environmental concerns, and a rise in food intolerances such as lactose and gluten sensitivity, leading to demand for vegan dairy and gluten-free alternatives.

The Europe vegan food market is projected to exhibit a CAGR of 8.57% during 2026-2034, reaching a value of USD 11.4 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)