Food Enzymes Market Report by Type (Carbohydrase, Protease, Lipase, and Others), Source (Microorganisms, Plants, Animals), Formulation (Powder, Liquid, and Others), Application (Beverages, Processed Foods, Dairy Products, Bakery Products, Confectionery Products, and Others), and Region 2025-2033

Market Overview:

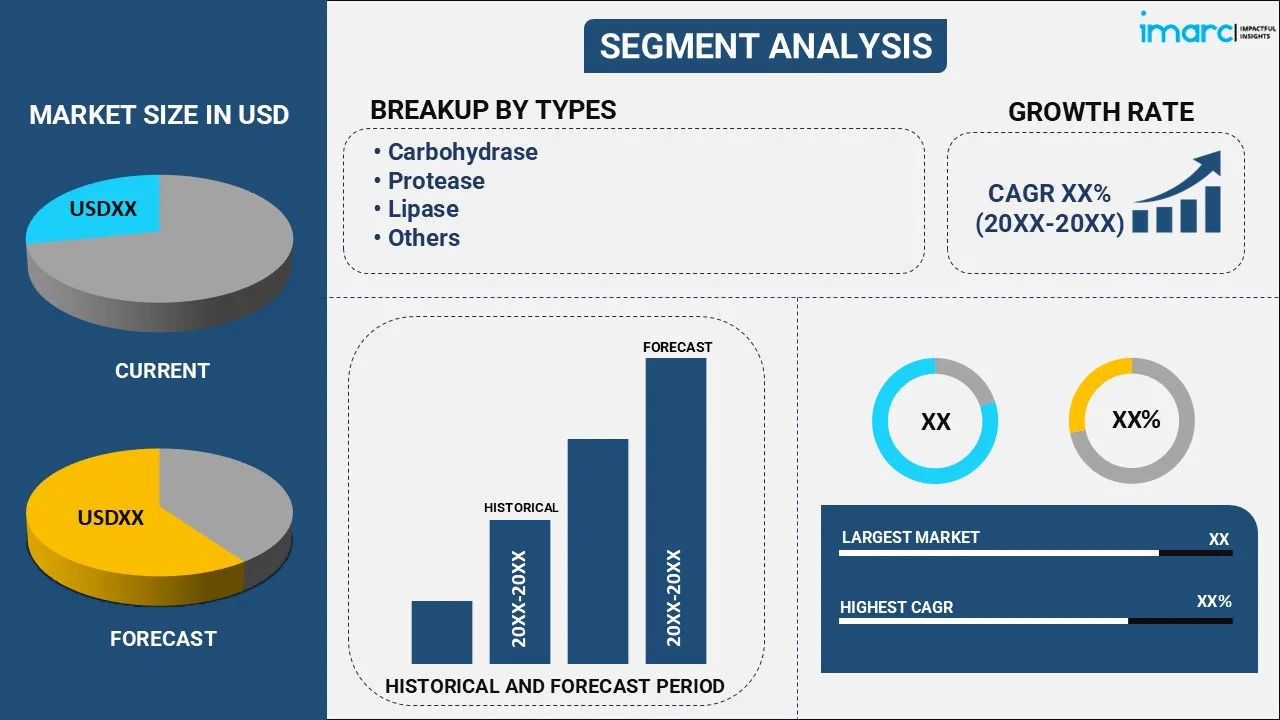

The global food enzymes market size reached USD 3.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.81% during 2025-2033. The expanding food processing sector and rising consumer consciousness, advancements in biotechnology, the rise in consumption of both alcoholic and non-alcoholic beverages, development of newer, more efficient, and more specific enzymes are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.9 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Market Growth Rate (2025-2033) | 5.81% |

Food enzymes are specialized proteins that act as catalysts in various biochemical processes related to food. They are naturally present in raw food and can also be artificially added during food processing to achieve specific outcomes such as improving taste, texture, and shelf-life. These enzymes speed up chemical reactions that break down larger molecules into smaller, more easily absorbed components. Amylase helps break down carbohydrates, while protease works on proteins, and lipase focuses on fats. They are commonly used in the making of bread, cheese, and beverages, such as beer and wine. They play a crucial role in modern food technology, enhancing both the quality and nutritional value of food products.

The expanding food processing sector and rising consumer consciousness about healthful options are driving the global market. Demand is rising for foods and drinks that are rich in nutrients and of superior quality. Moreover, the uptick in consumption of both alcoholic and non-alcoholic beverages has amplified the application of food enzymes in the drinks sector. These enzymes play critical roles in juice extraction from fruits and vegetables and are also employed for clarification, filtration, and juice yield enhancement in the wine industry. Furthermore, ongoing research and development efforts aimed at minimizing waste and improving food safety and security continue to fuel market growth. In line with this, the development of newer, more efficient, and more specific enzymes helps in better catalyzing food-related processes. Advances in biotechnology have made it easier to produce enzymes that can withstand various processing conditions.

Food Enzymes Market Trends/Drivers:

Consumer Demand for Processed Foods

As lifestyles become busier, the need for ready-to-eat meals and fast foods has grown exponentially. Enzymes, including proteases, amylases, and lipases are instrumental in prolonging shelf life, enhancing flavors, and improving the texture of these foods. Enzymes can make bread softer, prolong the freshness of dairy products, or even enhance the juiciness of processed meats. Such qualities make processed foods more appealing to consumers, thereby creating a higher demand for food enzymes. Additionally, enzymes reduce the production time and resources needed, making the food processing more efficient and cost-effective. This efficiency is particularly crucial in today’s world, where there is a growing demand to produce more food with fewer resources. Thus, food enzymes have become indispensable in meeting consumer expectations for quality, taste, and longevity, while also satisfying manufacturer’s needs for efficiency and cost reduction.

Health and Wellness Trends

Consumers are becoming increasingly aware of the nutritional content of the food they consume. Enzymes can help in this regard by breaking down complex molecules into simpler forms that are easier to absorb, thereby enhancing the nutritional value of food. Lactase is an enzyme that breaks down lactose, making dairy products digestible for people who are lactose intolerant. Similarly, enzymes, such as cellulase can break down fiber in fruits and vegetables, making them easier to digest and thereby increasing their nutritional value. This trend is backed by increasing scientific research that underscores the health benefits of food enzymes. As a result, health-conscious consumers are more willing to purchase foods that contain beneficial enzymes, making it a lucrative sector for food manufacturers to invest in.

Regulatory Support and Consumer Safety

Organizations, including the Food and Drug Administration (FDA) in the United States and the European Food Safety Authority (EFSA) in Europe have stringent guidelines for the use of food enzymes. These organizations ensure that the enzymes used in food processing are safe for human consumption and environmentally sustainable. The regulatory approval provides a layer of assurance to both manufacturers and consumers, which, in turn, augments market confidence. For instance, enzymes used in organic food production often need to meet specific standards to maintain the organic certification of the end product. The existence of such regulatory frameworks can accelerate market growth as they provide a clear path for the development and application of new enzyme technologies, while also assuring consumers about the safety and quality of their food.

Food Enzymes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global food enzymes market report, along with forecasts at the global and regional and country levels for 2025-2033. Our report has categorized the market based on type, source, formulation, and application.

Breakup by Type:

- Carbohydrase

- Amylase

- Cellulase

- Lactase

- Pectinase

- Others

- Protease

- Lipase

- Others

Carbohydrase dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes carbohydrase (amylase, cellulase, lactase, pectinase, and others), protease, lipase, and others. According to the report, carbohydrase represented the largest segment.

Carbohydrases group includes several vital enzymes, such as amylase, cellulase, and lactase, each serving unique functions but all contributing to the modification or degradation of carbohydrate molecules. Amylase is extensively used in the baking industry to break down starches into simpler sugars, thereby enhancing the texture and prolonging the shelf life of bread. Also, lactase is crucial in the dairy industry, as it breaks down lactose into glucose and galactose, making milk and milk-based products digestible for lactose-intolerant individuals. The significance of carbohydrases in the food industry is further emphasized by rising consumer expectations for quality and freshness in processed foods. As consumers become more health-conscious, they seek products that not only taste good but also offer nutritional benefits. Furthermore, the growth of this segment is fueled by technological advancements. Improved methods of enzyme isolation, purification, and mass production have made it cost-effective for manufacturers to include Carbohydrases in food processing.

Breakup by Source:

- Microorganisms

- Plants

- Animals

Microorganisms dominates the market

The report has provided a detailed breakup and analysis of the market based on the source. This includes microorganisms, plants, and animals. According to the report, microorganisms represented the largest segment.

Microbial enzymes, derived mainly from bacteria, fungi, and yeasts, have shown a remarkable ability to operate under a wide range of pH levels and temperatures. This makes them highly adaptable and suitable for various food processing conditions. For instance, microbial proteases are widely used in the cheese-making process, while microbial amylases are integral in the production of baked goods, including bread and pastries. Also, advanced biotechnological methods have made it possible to cultivate these microorganisms in large fermentation tanks, making the production process both scalable and cost-effective. This is particularly advantageous for meeting the high demand for food enzymes in the rapidly growing processed food industry. Additionally, microbial enzymes can be genetically engineered to exhibit specific characteristics such as increased heat stability or enhanced catalytic activity, making them even more desirable for specialized applications. Sustainability also plays a role in making microorganisms the largest source segment for food enzymes.

Breakup by Formulation:

- Powder

- Liquid

- Others

Powder dominates the market

The report has provided a detailed breakup and analysis of the market based on the formulation. This includes powder, liquid, and others. According to the report, powder represented the largest segment.

Powdered enzymes are more stable and less susceptible to environmental factors such as temperature and humidity. This stability not only prolongs the product's shelf life but also reduces the risk of enzymatic activity loss over time. For manufacturers, this means that the potency and effectiveness of the enzyme remain consistent, thereby ensuring a uniform quality in the final food product. Ease of handling and transportation is another advantage that makes powdered enzymes the go-to choice for many food producers. They are lightweight, easy to package, and require less storage space, making them cost-effective to ship and store. In an industry where operational efficiency and cost-effectiveness are critical, these logistical benefits can have a significant impact on the overall profitability of food manufacturing operations. Moreover, the versatility of powdered enzymes makes them suitable for a wide range of applications.

Breakup by Application:

- Beverages

- Processed Foods

- Dairy Products

- Bakery Products

- Confectionery Products

- Others

Processed foods dominate the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes beverages, processed foods, dairy products, bakery products, confectionery products, and others. According to the report, processed foods represented the largest segment.

The role of enzymes in processed foods is not just confined to improving taste and texture; they also contribute to the overall efficiency of the production process. For example, enzymes can accelerate fermentation in bread-making or curdling in cheese production, thus reducing the time and energy required for these processes. This heightened efficiency is of immense value to manufacturers who aim to meet growing consumer demands while minimizing production costs. As processed foods continue to dominate the market, the need for enzymes that can optimize production and improve product quality is stronger than ever. Regulatory compliance also influences this segment. Regulatory bodies have set stringent guidelines to ensure that enzymes used in food processing are safe for consumption. These guidelines provide a framework that builds consumer trust in processed foods, thus impelling demand even further. In a world increasingly concerned about food safety, this regulatory oversight plays a crucial role in shaping market dynamics.

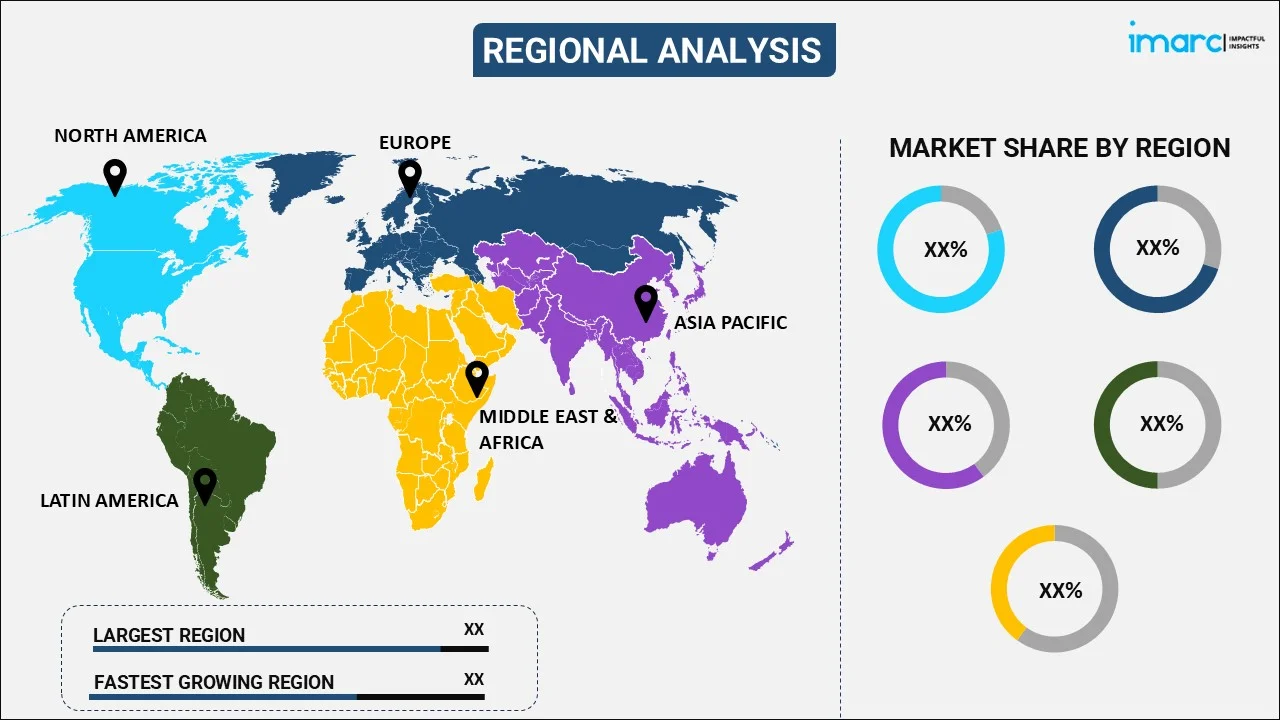

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

North America exhibits a clear dominance, accounting for the largest food enzymes market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, North America accounted for the largest market share.

North America’s robust food and beverage industry acts as a driving force for the demand for food enzymes. The United States, has a highly developed processed food sector, impelled by a consumer culture that values convenience and variety. This creates an enormous market for enzymes that enhance food quality, extend shelf life, and improve nutritional content. Furthermore, North American companies are leading the way in biotechnological advancements, which includes enzyme technology. The emphasis on innovation provides a conducive environment for the development of new and more effective food enzymes. This technological edge gives the region a competitive advantage in the global market. Regulatory support also plays a critical role in the region's market dominance. Agencies such as the Food and Drug Administration (FDA) in the United States have well-established guidelines for food additives, including enzymes. This regulatory framework not only ensures consumer safety but also augments confidence among manufacturers and suppliers. In a market where safety and efficacy are paramount, strong regulatory oversight is a valuable asset.

Competitive Landscape:

Companies are focussing on developing new enzyme formulations that are more effective, versatile, and compliant with regulatory standards. Many are also looking into enzymes that cater to specific health concerns, including lactose intolerance or celiac disease. Also, to expand their global footprint and diversify product portfolios, some companies are acquiring or merging with other businesses. This enables them to enter new markets more rapidly and take advantage of synergies in product development and marketing. Numerous companies are setting up operations in emerging markets where the food and beverage sector is growing. This involves establishing local partnerships, distribution channels, and sometimes even production facilities to cater to local tastes and regulatory requirements. With the rise of online shopping, companies are developing robust e-commerce platforms. This enables them to reach a broader customer base and offer a wider range of products directly to consumers.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- DuPont de Nemours, Inc.

- Amway

- BASF

- DSM

- Novozymes

- Chr. Hansen

- Kerry Group

- Biocatalysts

- Puratos Group

- Advanced Enzyme Tech

- Sequence Biotech

- Amano Enzyme

- Aum Enzymes

- Bioseutica

- Dyadic International Inc.

Recent Developments:

- In January 2023, BASF and Cargill expanded their partnership to offer high-performance enzyme solutions to animal protein producers. They are committed in bringing innovative enzyme-based solutions to the market and generating distinctive value for animal feed customers.

- In May 2022, Chr. Hansen launched new VEGA™ Boost cultures allowing development of a breakthrough dairy-free cream cheese. It helps producers meet consumer demands for plant-based products delivering on taste, nutrition, and sustainability.

- In December 2020, DuPont de Nemours, Inc. launched enzymes For Sweet Baked Goods in Japan. Enzymes offers improver houses and industrial bakeries an outstanding anti-staling solution that provides a unique texture, premium softness and a longer-lasting freshness to cakes, breads, sweet rolls, and buns whilst maintaining their shape.

Food Enzymes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Sources Covered | Microorganisms, Plants, Animals |

| Formulations Covered | Powder, Liquid, Others |

| Applications Covered | Beverages, Processed Foods, Dairy Products, Bakery Products, Confectionery Products, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | DuPont de Nemours, Inc., Amway, BASF, DSM, Novozymes, Chr. Hansen, Kerry Group, Biocatalysts, Puratos Group, Advanced Enzyme Tech, Sequence Biotech, Amano Enzyme, Aum Enzymes, Bioseutica, Dyadic International Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the food enzymes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global food enzymes market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the food enzymes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global food enzymes market was valued at USD 3.9 Billion in 2024.

We expect the global food enzymes market to exhibit a CAGR of 5.81% during 2025-2033.

The rising consumer preference towards natural, organic, and chemical-free food, along with the increasing demand for food enzymes in improving the flavor, texture, and fragrance of the products, is primarily driving the global food enzymes market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for food enzymes.

Based on the type, the global food enzymes market has been divided into carbohydrase, protease, lipase, and others. Among these, carbohydrase currently exhibits a clear dominance in the market.

Based on the source, the global food enzymes market can be categorized into microorganisms, plants, and animals. Currently, microorganisms account for the majority of the global market share.

Based on the formulation, the global food enzymes market has been segregated into powder, liquid, and others, where powder currently holds the largest market share.

Based on the application, the global food enzymes market can be bifurcated into beverages, processed foods, dairy products, bakery products, confectionery products, and others. Currently, processed foods exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global food enzymes market include DuPont de Nemours, Inc., Amway, BASF, DSM, Novozymes, Chr. Hansen, Kerry Group, Biocatalysts, Puratos Group, Advanced Enzyme Tech, Sequence Biotech, Amano Enzyme, Aum Enzymes, Bioseutica, Dyadic International Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)