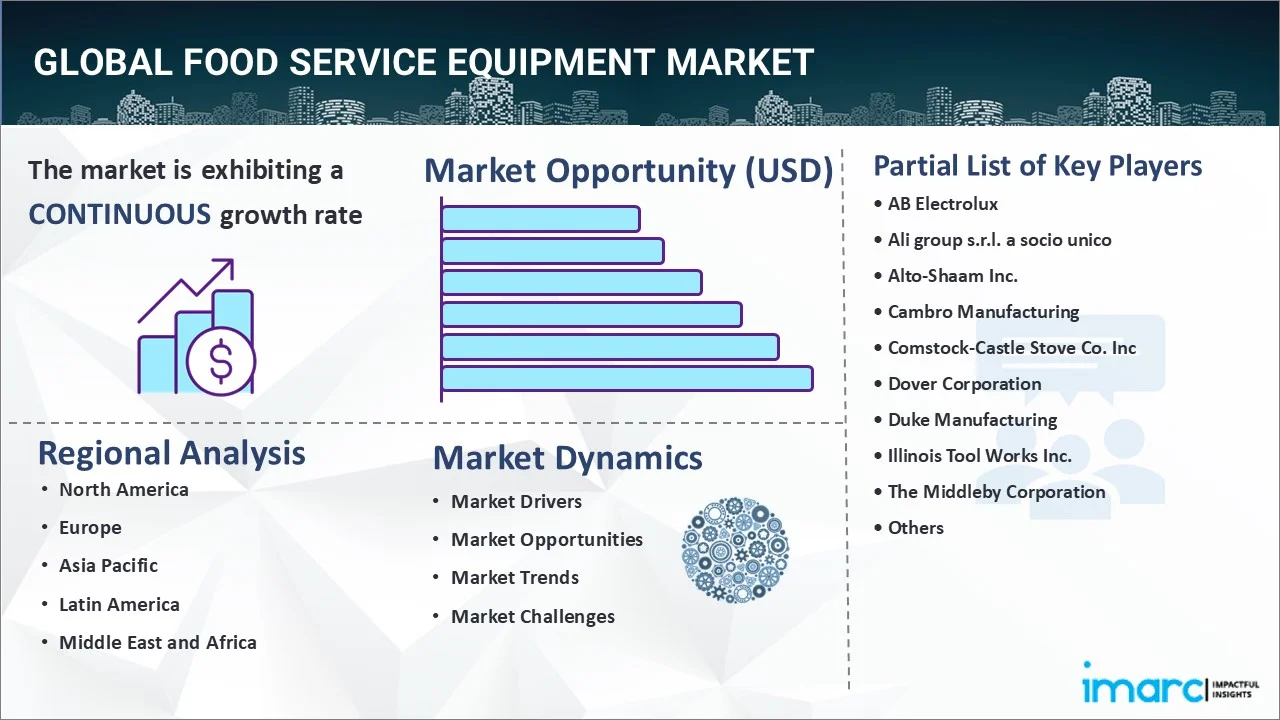

Food Service Equipment Market Report by Product Type (Cooking Equipment, Storage and Handling Equipment, Warewashing Equipment, Food and Beverage Preparation Equipment, Serving Equipment), Distribution Channel (Online, Offline), End Use (Full-service Restaurants and Hotels, Quick-service Restaurants and Pubs, Catering), and Region 2025-2033

Food Service Equipment Market Size:

The global food service equipment market size reached USD 40.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 59.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033. North America currently dominates the market in 2024. The market is driven by the rising demand for energy efficiency, enhanced consumer preferences for gourmet and healthy food options, growing focus on sustainability and waste reduction, heightened utilization of automation to address labor shortages, and significant expansion in tourism across the globe.

Market Size & Forecasts:

- Food service equipment market was valued at USD 40.1 Billion in 2024.

- The market is projected to reach USD 59.6 Billion by 2033, at a CAGR of 4.5% from 2025-2033.

Dominant Segments:

- Product Type: Cooking equipment leads the market, based on product type, because it is essential for meal preparation across all food service formats. High demand for ovens, fryers, grills, and stoves is making it a core investment for efficient operations.

- Distribution Channel: Offline represents the biggest market share since buyers prefer to physically inspect large, costly equipment before purchasing. Offline channels also offer installation support, after-sales service, and stronger relationships with suppliers, making them a trusted choice.

- End Use: Full-service restaurants and hotels dominate the market due to their extensive kitchen needs. They require high-capacity, reliable, and diverse equipment to serve large menus and ensure consistent food quality and guest satisfaction.

- Region: North America leads the market, driven by its developed food service industry, strong presence of major equipment manufacturers, high technology adoption, and consistent demand from restaurants, hotels, and institutional kitchens across the region.

Key Players:

- The leading companies in food service equipment market include AB Electrolux, Ali group s.r.l. a socio unico, Alto-Shaam Inc., Cambro Manufacturing, Comstock-Castle Stove Co. Inc, Dover Corporation, Duke Manufacturing, Illinois Tool Works Inc., The Middleby Corporation, Welbilt, etc.

Key Drivers of Market Growth:

- Broadening of the Food Service Industry: The thriving food service industry is catalyzing the demand for reliable, high-performance kitchen tools across restaurants, hotels, cafes, and catering services, as more people are dining out and businesses are scaling up to meet rising customer expectations.

- Rise of Cloud Kitchens and Food Delivery Services: The expansion of cloud services is driving the demand for compact, efficient, and high-volume appliances designed for delivery-focused operations, helping businesses meet fast service expectations within limited space and staffing constraints.

- Increasing Focus on Food Safety and Hygiene: Businesses are investing in advanced tools like self-cleaning ovens, touchless faucets, and automated controls to meet strict health standards, reduce contamination, and ensure regulatory compliance.

- Rising Artificial Intelligence (AI) Integration: AI aids in optimizing cooking times, managing energy use, predicting maintenance needs, and improving overall efficiency, helping food businesses enhance productivity, consistency, and customer service quality.

- Increasing Disposable Incomes: As more consumers are dining out, the demand for restaurants and cafes is high. This is leading businesses to invest in modern, efficient equipment to meet higher service expectations and expand their food service operations.

Future Outlook:

- Strong Growth Outlook: The food service equipment market is set to see sustained expansion, driven by rising demand from restaurants, hotels, and cloud kitchens. Technological advancements and changing user habits continue to support steady growth across global and regional markets.

- Market Evolution: The sector is anticipated to shift from basic manual tools to advanced, automated, and energy-efficient appliances. It is adopting smart technology, modular designs, and sustainability features to meet the changing needs of modern kitchens and fast-paced food service environments.

The food service equipment market is growing steadily owing to a combination of shifting consumer habits, expanding food service formats, and technological improvements. Rapid urbanization activities and busy lifestyles are leading more people to dine out or rely on food delivery, encouraging restaurants, cafés, and cloud kitchens to invest in efficient and reliable kitchen equipment. The rising popularity of quick service restaurants (QSRs) and casual dining formats is creating consistent demand for high-volume cooking and storage appliances. Increased disposable incomes are motivating people to spend more on dining experiences, enabling food establishments to upgrade and expand their kitchen capabilities. Strict food safety and hygiene regulations are encouraging businesses to adopt advanced equipment like touchless systems, self-cleaning ovens, and antimicrobial surfaces to ensure compliance and customer trust. The growing trend of cloud kitchens and delivery-only models is catalyzing the demand for compact, high-performance, and space-saving appliances. Small and medium-sized businesses (SMEs) are seeking affordable, multifunctional tools to maximize output within limited space and budgets. Continuous innovations in design and energy-efficient technology support long-term savings and sustainability goals. Replacement and upgrade cycles are also contributing to steady sales as operators replace aging equipment with modern alternatives.

To get more information on this market, Request Sample

Food Service Equipment Market Trends:

Growth of the hospitality sector

The growth of the hospitality sector is positively influencing the market. According to industry reports, in 2024, the worldwide hospitality industry expanded to around USD 4.9 Trillion. The hospitality industry is broadening its dining services to meet diverse culinary expectations. This is leading to greater investments in commercial kitchen equipment that ensures speed, consistency, hygiene, and the ability to serve large volumes of food. From buffet setups to room service kitchens, hotels require a wide range of reliable appliances, including cooking, refrigeration, storage, and dishwashing units. The need to deliver a premium guest experience is also encouraging hotels to adopt modern, energy-efficient, and aesthetically appealing kitchen equipment. As hospitality continues to grow across urban regions, it is significantly contributing to the steady demand for advanced food service equipment across various segments.

Digitalization and smart kitchens

As food service businesses are aiming for greater precision, speed, and consistency, they are adopting smart equipment integrated with digital controls, sensors, and connectivity features. These technologies, including the Internet of Things (IoT), enable real-time monitoring of cooking processes, automated temperature control, energy management, and predictive maintenance, reducing manual errors and downtime. As per industry reports, the global IoT market size was valued at 64.8 Billion in 2024. Smart appliances also support data analytics, helping operators optimize performance, manage inventory, and lower food waste. Integration with cloud-based systems and mobile apps allows remote access and control, enhancing flexibility and operational oversight. As digital transformation is becoming a priority in the food industry, more establishments are investing in connected, intelligent kitchen equipment to improve efficiency, meet customer expectations, and stay competitive.

Increasing tourism activities

Rising tourism activities are offering a favorable market outlook. According to the IBEF, by the year 2028, it is anticipated that global tourist arrivals will hit 30.5 Billion and create earnings surpassing USD 59 Billion. As more travelers are seeking diverse culinary experiences, the hospitality industry is expanding its food service operations to meet varying tastes and service expectations. This expansion is leading to greater investments in commercial kitchen equipment that can handle high volumes, maintain food quality, and operate efficiently under pressure. Restaurants, cafes, and catering services in tourist hubs require reliable cooking, refrigeration, and dishwashing appliances to serve large numbers of guests daily. Seasonal tourism also encourages businesses to adopt versatile and quick-to-deploy equipment. The need to offer hygienic, fast, and quality food service to both domestic and international tourists is motivating establishments to upgrade or expand their kitchens, catalyzing the demand for food service equipment.

Key Growth Drivers of Food Service Equipment Market:

Expansion of the food service industry

The expansion of the food service industry is stimulating the market growth. As more restaurants, cafes, hotels, catering units, and institutional kitchens are opening across the globe, the demand for commercial-grade equipment is rising. This broadening reflects changing consumer lifestyles, with more people dining out or depending on ready-to-eat (RTE) meals. As a result, food service operators are wagering on advanced equipment to ensure fast service, consistent quality, and hygiene. The rise of QSRs and full-service restaurants (FSRs) is further driving the demand for specialized appliances, such as fryers, ovens, refrigerators, and dishwashers. Operators are seeking solutions that support high-volume operations while meeting safety and efficiency standards. This ongoing industry expansion is directly supporting steady growth in the food service equipment market.

Rise of cloud kitchens and food delivery services

The rise of cloud kitchens and food delivery services is positively influencing the market. As online food ordering and delivery platforms are growing in popularity, more businesses are establishing cloud kitchens. These are the facilities that focus entirely on preparing meals for delivery without dine-in services. These kitchens require reliable and high-performance equipment to support fast-paced, high-volume operations within limited space. From rapid-cook ovens and space-saving refrigeration units to multi-functional prep stations and automated fryers, every appliance is selected to maximize output and efficiency. Since cloud kitchens often operate with fewer staff and limited footprints, they rely on smart, easy-to-maintain, and durable tools to ensure consistent food quality and timely service. This shift in food service models is significantly catalyzing the demand for advanced equipment.

Growing focus on food safety and hygiene

Increasing focus on food safety and hygiene is propelling the market growth. To meet these expectations, food service operators are investing in advanced equipment that minimizes contamination risks and maintains cleanliness. This includes features like self-cleaning ovens, antimicrobial surfaces, touchless faucets, and automated temperature controls that help maintain proper cooking and storage conditions. Efficient warewashing machines are also essential for ensuring sanitized utensils and dishware. These innovations not only support compliance with health codes but also build customer trust and enhance operational efficiency. As food establishments continue to prioritize hygiene to protect both customers and staff, the demand for modern, safe, and easy-to-clean equipment is high, fueling steady growth in the food service equipment market.

Food Service Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end use.

Breakup by Product Type:

- Cooking Equipment

- Storage and Handling Equipment

- Warewashing Equipment

- Food and Beverage Preparation Equipment

- Serving Equipment

Cooking equipment accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cooking equipment, storage and handling equipment, warewashing equipment, food and beverage preparation equipment, and serving equipment. According to the report, cooking equipment represented the largest segment.

As per the food service equipment market analysis and outlook, cooking equipment constituted the largest segment. It includes several products, such as ovens, ranges, fryers, grills, and cooktops, that are essential for the preparation of various dishes. Moreover, the critical nature of cooking processes in food service operations, that require efficiency, reliability, and food safety standards is fueling the market growth. Besides this, the surge in demand for specialized equipment designed for ethnic cuisines and gourmet cooking, reflecting broader consumer taste preferences and dietary trends, is positively impacting the food service equipment market revenue.

Breakup by Distribution Channel:

- Online

- Offline

Offline holds the largest share of the industry

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline. According to the report, offline accounted for the largest market share.

Based on the food service equipment market forecast and trends, offline channels accounted for the largest market share. They include brick-and-mortar stores such as specialized commercial kitchen equipment shops, wholesale distributors, and direct sales from manufacturers. The high value and complex nature of the equipment, prompting customers to physically inspect products and engage in face-to-face consultations to ensure compatibility with their specific operational needs, is bolstering the market growth. Moreover, retailers and distributors offer additional services such as installation, maintenance, and after-sales support, which are critical for the effective operation of the equipment.

Breakup by End Use:

- Full-service Restaurants and Hotels

- Quick-service Restaurants and Pubs

- Catering

Full-service restaurants and hotels represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use. This includes full-service restaurants and hotels, quick-service restaurants and pubs, and catering. According to the report, full-service restaurants and hotels represented the largest segment.

According to the food service equipment market overview and report, full-service restaurants and hotels emerged as the largest segment. The extensive and diverse requirements for high-quality and durable food service equipment in these establishments that handle a wide range of culinary demands and high-volume operations are fueling the market growth. Full-service restaurants and hotels need a comprehensive array of equipment, such as advanced cooking appliances, refrigeration units, specialized serving, and warewashing equipment, to ensure operational efficiency and customer satisfaction is catalyzing the market growth. Moreover, the competitive nature of the hospitality industry, driving continuous upgrades and technological enhancements in equipment to improve service delivery, enhance food quality, and optimize operational costs, is fueling the food service equipment market share.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest food service equipment market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for food service equipment.

Based on the food service equipment market research report and segmentation, North America accounted for the largest market share, driven by a well-established food service industry characterized by high standards of quality, safety, and efficiency. Moreover, the presence of numerous leading equipment manufacturers, a strong culture of dining out, and the rapid adoption of technological innovations in kitchen appliances and operations are boosting the market growth. Additionally, the continuous demand for new and upgraded equipment to cater to evolving consumer preferences, such as healthier eating options and gourmet cuisine, is enhancing the market growth. Furthermore, the imposition of stringent food safety regulations, necessitating the use of advanced equipment that can comply with these standards, is positively impacting the food service equipment market's recent opportunities and developments.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the food service equipment industry include:

- AB Electrolux

- Ali group s.r.l. a socio unico

- Alto-Shaam Inc.

- Cambro Manufacturing

- Comstock-Castle Stove Co. Inc

- Dover Corporation

- Duke Manufacturing

- Illinois Tool Works Inc.

- The Middleby Corporation

- Welbilt

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

The top food service equipment companies are engaged in research and development (R&D) to introduce more innovative, energy-efficient, and technologically advanced products. These efforts are aimed at addressing the growing demands for automation, enhanced food safety, and operational efficiency within the food service industry. Moreover, major companies are expanding their geographic footprint and strengthening their distribution networks to enter emerging markets where the food service sector is experiencing rapid growth. Besides this, they are forming strategic mergers and acquisitions to broaden their product portfolios and incorporate advanced technologies, such as the Internet of Things (IoT) connectivity and artificial intelligence (AI)-driven automation, into their offerings.

Food Service Equipment Market News:

- March 2025: The School Nutrition Foundation (SNF) partnered with Vulcan Equipment, part of ITW Food Equipment, to provide an equipment grant to a school district in the US needing upgrades to its school meal kitchen facilities. The individual awarded the 2025 Vulcan Equipment Grant would obtain equipment valued at a maximum of USD 50,000.

- December 2024: FoodPrep Solutions, a leader in the cutlery sharpening and food equipment sales and service industry, launched a growth strategy in the US. The initiative sought to provide local, regional, and national customers with a single source for their cutlery sharpening needs.

- November 2024: Swiggy, a leader in food delivery and quick commerce, launched its kitchen equipment sourcing service to connect restaurant partners with reliable suppliers. The program aimed to help restaurant partners obtain high-quality equipment at reasonable costs. This would include freezers, chillers, ovens, microwaves, and more at a discounted rate for restaurants utilizing Swiggy’s platform.

- October 2024: DKSH Malaysia's Consumer Goods Business Unit unveiled its 'Food Services Test Kitchen' in Petaling Jaya, emphasizing its dedication to culinary innovation and fostering the expansion of the local F&B sector. The kitchen was equipped with contemporary cooking equipment and assistance for pastry, hot dishes, and drink preparations.

- August 2024: The Foodservice Equipment Association (FEA) published a new e-newsletter centered on the light equipment and tableware (LET) sector. It would concentrate on enhancing relationships between dealers and FEA’s LET manufacturer and supplier affiliates.

Food Service Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cooking Equipment, Storage and Handling Equipment, Warewashing Equipment, Food and Beverage Preparation Equipment, Serving Equipment |

| Distribution Channels Covered | Online, Offline |

| End Uses Covered | Full-service Restaurants and Hotels, Quick-service Restaurants and Pubs, Catering |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Electrolux, Ali group s.r.l. a socio unico, Alto-Shaam Inc., Cambro Manufacturing, Comstock-Castle Stove Co. Inc, Dover Corporation, Duke Manufacturing, Illinois Tool Works Inc., The Middleby Corporation, Welbilt, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the food service equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global food service equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the food service equipment industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global food service equipment market was valued at USD 40.1 Billion in 2024.

We expect the global food service equipment market to exhibit a CAGR of 4.5% during 2025-2033.

The rising popularity of automated multi-use food service equipment across food joints, restaurants, cafes, etc., to reduce human involvement and serve numerous customers at a time, is primarily driving the global food service equipment market.

The sudden outbreak of the COVID-19 pandemic has led to the growing integration of various advanced technologies, such as IoT and Big Data with food service equipment, to facilitate remote maintenance and minimize human involvement during food preparation.

Based on the product type, the global food service equipment market can be segmented into cooking equipment, storage and handling equipment, warewashing equipment, food and beverage preparation equipment, and serving equipment. Among these, cooking equipment holds the majority of the total market share.

Based on the distribution channel, the global food service equipment market has been divided into online and offline. Currently, offline channel exhibits a clear dominance in the market.

Based on the end use, the global food service equipment market can be categorized into full-service restaurants and hotels, quick-service restaurants and pubs, and catering. Among these, full-service restaurants and hotels account for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global food service equipment market include AB Electrolux, Ali group s.r.l. a socio unico, Alto-Shaam Inc., Cambro Manufacturing, Comstock-Castle Stove Co. Inc, Dover Corporation, Duke Manufacturing, Illinois Tool Works Inc., The Middleby Corporation, and Welbilt.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)