GCC Cement Market Report by Type (Blended, Portland, and Others), End Use (Residential, Commercial, Infrastructure), and Country 2025-2033

Market Overview:

The GCC cement market size reached 94.5 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 142.8 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.7% during 2025-2033. The robust economic growth, increasing urbanization, governmental investments in mega-projects, sustainable construction practices, rising population, and the focus on affordable housing solutions are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 94.5 Million Tons |

| Market Forecast in 2033 | 142.8 Million Tons |

| Market Growth Rate 2025-2033 | 4.7% |

Cement is a versatile and essential building material used in construction. It is a fine powder made from a combination of limestone, clay, and other minerals that are heated at high temperatures in a kiln to produce clinker. This clinker is then ground into a fine powder to create cement. It acts as a binding agent when mixed with water, forming a paste that hardens over time. Cement is widely employed in the construction industry for its ability to bind various materials together, such as sand, gravel, and aggregates, to create durable structures like buildings, roads, and bridges.

The robust economic growth and increasing urbanization across the GCC countries have spurred the demand for infrastructure and construction projects. This, in turn, is facilitating the employment of cement in these structures. Concurrent with this, favorable governmental initiatives and investments in mega-projects, such as stadiums, airports, and industrial complexes, are contributing to the market growth. Moreover, the GCC's strategic geographic location has facilitated trade and export opportunities for cement manufacturers, which, in turn, is bolstering the market growth. In addition to this, the region’s rising population, coupled with a surge in the tourism and hospitality sectors, is fueling the need for additional construction activities. Furthermore, advancements in technology and sustainable practices are encouraging manufacturers to innovate and produce eco-friendly cement solutions, aligning with the region's environmental goals.

GCC Cement Market Trends/Drivers:

Robust economic growth and increasing urbanization

The GCC countries have experienced significant economic growth over the years, driven by factors such as oil exports, trade diversification, and foreign investments. This economic prosperity has led to a surge in construction activities to meet the demands of expanding urban populations and developing infrastructures. Rapid urbanization is a key consequence of this growth, with a rising number of people migrating to urban centers in search of better opportunities and improved living standards. Moreover, the growing urban population necessitates the construction of residential complexes, commercial buildings, and public infrastructure such as schools, hospitals, and transportation networks. Cement plays a vital role in these construction projects as it acts as the binding agent for various building materials, such as sand, gravel, and aggregates, ensuring the structural integrity and durability of the constructed buildings and infrastructure.

Governmental initiatives and investments in mega-projects

Governments across the GCC region have undertaken ambitious initiatives and investment programs to diversify their economies and reduce dependence on oil revenues. These efforts often involve the execution of large-scale mega-projects, such as stadiums, airports, industrial complexes, and other infrastructure developments. These mega-projects require substantial amounts of cement for their construction, further fueling the demand for the product in the region. In addition to this, governments are actively investing in projects that promote tourism, trade, and industry, attracting foreign investment and stimulating economic growth. Such projects also boost the economy by creating jobs and generating additional demand for housing and commercial properties, thereby driving the need for cement in the construction of these developments.

GCC Cement Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC cement market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on type and end use.

Breakup by Type:

- Blended

- Portland

- Others

Portland represents the most widely used type

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others. According to the report, Portland represented the largest segment.

The increasing trend towards sustainable and green building practices has driven the adoption of Portland cement due to its relatively lower carbon footprint than other types of cement. Moreover, as environmental concerns gain prominence, builders and developers are seeking eco-friendly construction materials, such as Portland cement. In addition to this, the rising population and urbanization in the region have resulted in a growing need for new infrastructures, housing, and commercial spaces, creating a favorable outlook for market expansion. Besides this, the rising adoption of Portland cement across various construction projects, including high-rise buildings, roads, and bridges due to its versatility and strength is contributing to the market’s growth. Additionally, ongoing investments in large-scale infrastructure projects, such as transportation networks and energy facilities, are bolstering the demand for Portland cement.

Breakup by End Use:

- Residential

- Commercial

- Infrastructure

Residential sector accounts for the majority of the market share

A detailed breakup and analysis of the market based on the end use has also been provided in the report. This includes residential, commercial, and infrastructure. According to the report, residential accounted for the largest market share.

The rapid population growth and increasing urbanization have led to a surge in residential construction projects across GCC countries. As more people migrate to urban centers in search of better opportunities and improved living standards, the need for residential buildings and housing complexes has escalated significantly. Cement, being a fundamental building material, is indispensable in constructing durable and sturdy structures, making it a crucial component in residential construction. Furthermore, the GCC government’s focus on providing affordable housing solutions and promoting real estate development has further intensified the demand for cement in the residential sector. Besides this, numerous governments are implementing various housing schemes and incentives to meet the growing housing needs of their populations, driving the construction of residential units. Additionally, the rise of mixed-use developments and sustainable housing projects across the region further contributes to the increasing demand for cement in the residential sector.

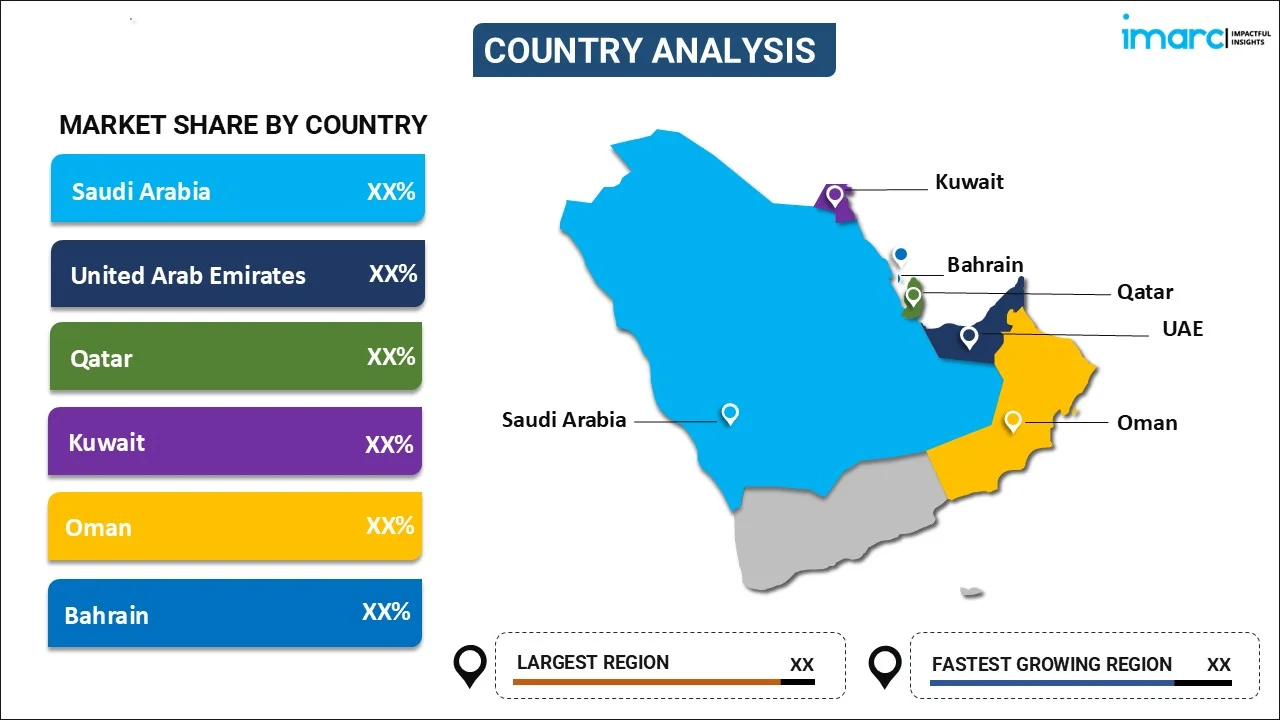

Breakup by Country:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia holds the largest share of the market

A detailed breakup and analysis of the GCC cement market has been provided based on country. This includes Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain. According to the report, Saudi Arabia accounted for the largest market share.

Saudi Arabia's ambitious Vision 2030 initiative, aimed at diversifying the economy and reducing dependence on oil, has spurred significant investments in infrastructure and construction projects. This drive to modernize and develop various sectors, including tourism, entertainment, and industry, has led to a substantial need for cement in the construction of new facilities and projects, presenting remunerative growth opportunities for the market. Furthermore, Saudi Arabia's rapidly growing population and increasing urbanization have generated a surge in residential and commercial construction. The need for housing, commercial buildings, and public infrastructure to accommodate the expanding urban centers has significantly contributed to the rising demand for cement in the country. Concurrently, the Saudi government's emphasis on sustainable development and green building practices has further boosted the use of cement in eco-friendly construction projects, strengthening the market growth.

Competitive Landscape:

The competitive landscape of the GCC cement market is characterized by intense competition among several major players and a diverse mix of regional and international cement manufacturers. The market is highly fragmented, with numerous companies vying for market share across the GCC countries. Key factors driving competition include economies of scale, product differentiation, pricing strategies, and distribution networks. Large multinational cement companies, as well as prominent regional players, dominate the market, leveraging their extensive production capacities and well-established brand presence to cater to the region's growing demand for cement. Furthermore, competitive forces also push manufacturers to focus on research and development to introduce innovative and sustainable cement solutions, meeting the increasing emphasis on environmental and green building practices.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Al Safwa Cement Company

- Cemex UAE (CEMEX S.A.B. de C.V.)

- Emirates Steel Arkan

- Gulf Cement Company

- Kuwait Cement Company (K.S.C.)

- Lafarge Emirates Cement Company LLC (Holcim Group)

- Najran Cement Company

- Oman Cement Company (s.a.o.g)

- Qatar National Cement Company

- Saudi Cement Company

- Yanbu Cement Company

GCC Cement Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End Uses Covered | Residential, Commercial, Infrastructure |

| Countries Covered | Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain |

| Companies Covered | Al Safwa Cement Company, Cemex UAE (CEMEX S.A.B. de C.V.), Emirates Steel Arkan, Gulf Cement Company, Kuwait Cement Company (K.S.C.), Lafarge Emirates Cement Company LLC (Holcim Group), Najran Cement Company, Oman Cement Company(s.a.o.g), Qatar National Cement Company, Saudi Cement Company, Yanbu Cement Company etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC cement market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC cement market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC cement market reached a volume of 94.5 Million Tons in 2024.

We expect the GCC cement market to exhibit a CAGR of 4.7% during 2025-2033.

The continuous development of mega infrastructure projects, along with the rising number of residential and commercial buildings, is primarily driving the GCC cement market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several GCC nations, resulting in the temporary halt in numerous construction activities, thereby negatively impacting the GCC market for cement.

Based on the type, the GCC cement market has been segregated into blended, Portland, and others. Among these, Portland currently exhibits a clear dominance in the market.

Based on the end use, the GCC cement market can be bifurcated into residential, commercial, and infrastructure. Currently, the residential sector holds the largest market share.

On a regional level, the market has been classified into Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain, where Saudi Arabia currently dominates the GCC cement market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)