GCC E-Learning Market Size, Share, Trends and Forecast by Learning Type, Sector, Product Type, Technology, and Country, 2025-2033

GCC E-Learning Market Size and Share:

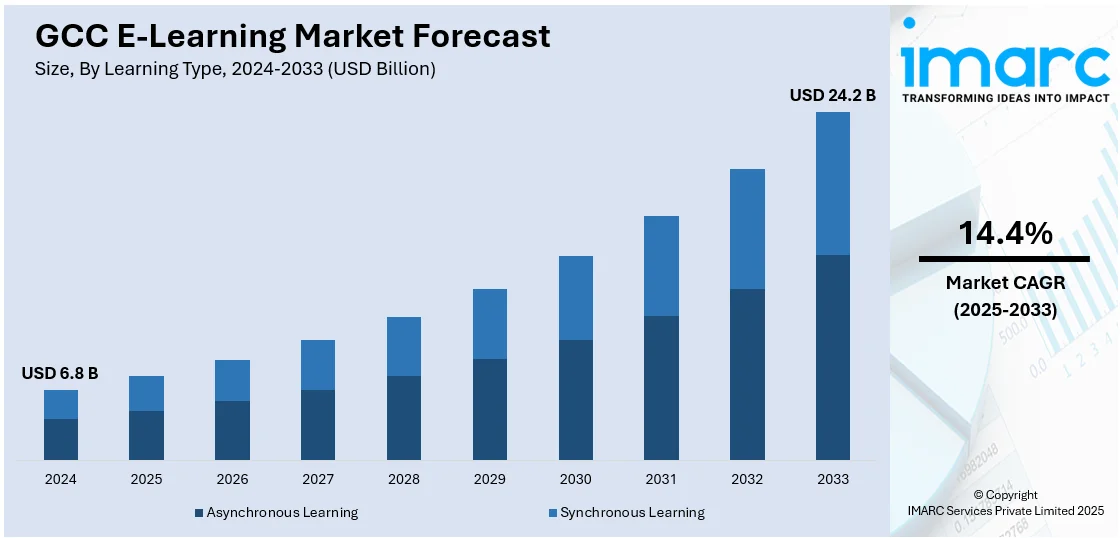

The GCC E-learning market size was valued at USD 6.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.2 Billion by 2033, exhibiting a CAGR of 14.4% from 2025-2033. The surging digital transformation, increasing government initiatives for education modernization, widespread adoption of the internet, and the growing emphasis on skill development, are some factors impelling the market growth in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.8 Billion |

|

Market Forecast in 2033

|

USD 24.2 Billion |

| Market Growth Rate (2025-2033) | 14.4% |

The GCC e-learning market is witnessing robust growth due to the increased government support towards digital learning. In line with this Saudi Arabia’s Vision 2030 and the United Arab Emirates (UAE) Smart Education are transforming the conventional forms of learning, by endorsing the use of the internet and supporting skills in information technology (IT). For instance, in May 2024, Bengaluru-based e-learning startup 90+ My Tuition App, which offers syllabus and textbook-oriented digital classes, announced the enrollment of over 1,000 paying students within the first year of operations in the UAE. Moreover, the increased deployment of the internet along with the implementation of smart devices in the region are significantly contributing to the market expansion. Furthermore, the rising trend of upskilling and reskilling the existing workforce with the rising trend of individualized and flexibility based learning solutions in the higher education and corporate world are thereby catalyzing the market growth.

Concurrently, the integration of advanced technological innovations such as artificial intelligence (AI), virtual reality (VR) and gamification is revolutionizing the e-learning process in the GCC, boosting the market demand. For example, in March 2024, Ziyyara, an online tuition platform, expanded to the UAE to address the growing demand for flexible and effective e-learning solutions in the country's educational landscape. Besides this, the increased activity and effectiveness, especially in education, and field-related courses is impelling the market growth. Additionally, the adoption of online learning in the corporate sector is enhancing the productivity and compliance levels of the employees, driving the market growth. In confluence with this, the surging role of technology-based learning is making distance learning a standard method for students at all levels, providing an impetus to the market. Apart from this, the increasing population of young people in the market who are open to new forms of learning is thereby propelling the market forward.

GCC E-Learning Market Trends:

Integration of advanced technologies

The GCC e-learning market is experiencing significant growth due to the wide use of technology solutions such as AI, VR, and games to develop and enrich the experience of learners. In addition to this, by utilizing AI in platforms, individuals are provided with their personalized learning curriculum, and study content, along with feedback which are presented based on their performance. Moreover, the integration of VR and augmented reality (AR) applications in immersive training such as healthcare, oil and gas, and aviation is encouraging learners to adopt e-learning in the region. Furthermore, through instituting rewards and engaging tasks, there is a rising shift in the education and business-related e-learning environments, which is leading to improved participation, aligning with knowledge compliance, thus supporting the market growth.

Rise of corporate e-learning solutions

The rising corporate world is enhancing the e-learning market, as organizations prioritize workforce development and skill enhancement. In addition, businesses are increasingly leveraging e-learning to provide scalable, cost-effective training for compliance, leadership, and technical skills. For instance, the statistics from the Hays Middle East's GCC Salary Guide 2024 indicated that employers in the Gulf region are divided on the use of AI technologies or tools in the workplace, with less than 41% recommending their usage. Besides this, the shift towards hybrid and remote working models has increased the need for digital learning tools tailored to professional growth. Apart from this, industry-specific courses, microlearning modules, and multilingual content are addressing the diverse needs of the workforce, driving the growth of customized corporate e-learning solutions, thereby aiding in the market expansion.

Growth in K-12 and higher education digital platforms

The GCC e-learning market is growing, primarily driven by educational institutions, as they are integrating IT information technology in teaching as a supplement to the conventional classroom approach. Furthermore, this shift is attributed to government policies, increasing demand of the students for flexibility, and continuity of classes during emergencies. For example, institutions like King Abdullah University of Science and Technology (KAUST) and Qatar University are integrating digital tools to enhance academic delivery and research capabilities. Concurrently, digital classes, digital textbooks, and AI-based analytical tools are being implemented in K-12 and college curriculums for better performance. In conjunction with this, the growth of Massive Open Online Courses (MOOCs) and collaborations with universities and e-learning companies are developing broad and affordable material for students, which is fueling the market demand.

GCC E-Learning Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC e-learning market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on learning type, sector, product type, and technology.

Analysis by Learning Type:

- Asynchronous Learning

- Synchronous Learning

Synchronous learning is flourishing in the GCC region, driven by the widespread use of virtual classrooms and real-time collaboration tools. This interactive format is prevalent in K-12 education and corporate training, offering live discussions, webinars, and instant feedback. It also enhances engagement, fosters collaboration, and ensures effective communication between learners and instructors. Moreover, the demand for flexible learning solutions and the growing acceptance of digital learning platforms have surged the adoption of synchronous learning. Additionally, the integration of advanced technologies, such as AI and VR, is enhancing the learning experience, making it more immersive and personalized, thus providing an impetus to the market.

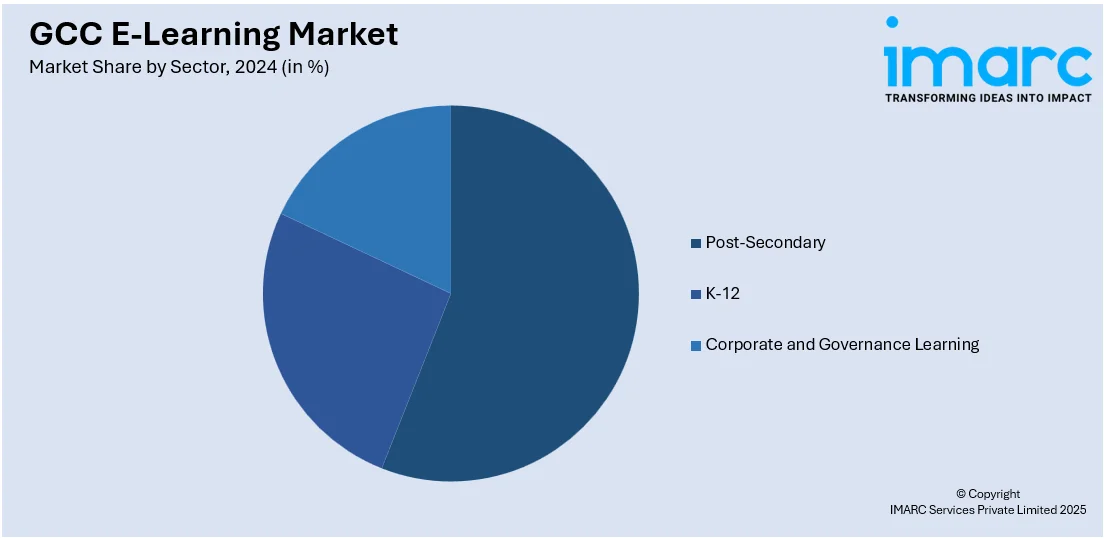

Analysis by Sector:

- Post-Secondary

- K-12

- Corporate and Governance Learning

Post-secondary e-learning in the GCC is growing, primarily due to rising partnerships between universities and digital education platforms. In line with this, advanced technologies like AI and VR support interactive courses, aligning with academic goals and addressing the increasing demand for accessible and affordable higher education. Also, the integration of these technologies improves the student engagement and provides personalized learning experiences, catering to diverse learning styles. Concurrently, the flexibility of online courses is appealing to working professionals seeking education without disrupting their careers, thus aiding in the market expansion.

Analysis by Product Type:

- Packaged Content

- Platforms

- Services

The e-learning in packaged content is leading the market because of its ready-made appearance, which offers complete content for students or other learning professionals. Concurrently, these modules are pre-designed, and standardized courses are widely available to meet the requirements for training different types of participants. Besides this, the convenience of accessing these modules anytime and anywhere adds to their appeal, especially in fast-paced industries. Moreover, the scalability of packaged content allows organizations to train large numbers of employees efficiently, contributing to cost savings and fostering the market growth.

Analysis by Technology:

- Mobile and Online Learning

- Learning Management System

- Simulation Based Learning

- Game Based Learning

Mobile and online learning drive accessibility in the region, which is supported by the high integration of smartphones. In addition, user-friendly apps and web-based platforms provide easy and quick access to interactive content for learners of all ages. Apart from this, the increasing affordability and availability of mobile devices make education more accessible to diverse socioeconomic groups, enhancing inclusion. Furthermore, mobile learning supports on-the-go access, allowing learners to engage with content anytime and anywhere, meeting the growing demand for continuous and lifelong learning, boosting the market demand.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia dominates the GCC e-learning market supported by Vision 2030 and spending on digitalization. The need for e-learning in the region is increasing the adoption of digital solutions and lean technology in learning. Moreover, continuous advancements in flexible learning systems align with the population willing to learn and develop skills necessary for the job market. Besides this, the government is embarking on the development of innovation and entrepreneurship driving the need for specialized online courses. For instance, in 2024, the average school tuition fee in second-tier cities was less than $10,000, making education more accessible and fueling the demand for affordable digital learning solutions. In addition to this, e-learning materials for users come in different categories and origins, including Arabic content, meeting the convenience demands of individuals. Furthermore, increasing partnerships between universities and private providers of e-learning are promoting easy access, improving the quality of education delivered, and expanding education delivery to match global standards and the nation’s diversification of the economy, thereby propelling the market forward.

Competitive Landscape:

The competitive landscape of the GCC e-learning market is defined by the presence of established global providers, regional companies, and emerging players targeting niche segments. Key players compete by offering diverse course libraries, advanced features like AI-powered learning paths, and cost-effective subscription models to attract users across sectors. Additionally, the integration of cutting-edge technologies such as virtual reality and gamification enhances user engagement, providing a competitive advantage. Moreover, government partnerships and compliance with national education frameworks solidify market positions. Apart from this, regional players capitalize on localized content, catering to Arabic-speaking audiences and culturally relevant training needs, ensuring continued relevance and growth.

The report provides a comprehensive analysis of the competitive landscape in the GCC e-learning market with detailed profiles of all major companies, including:

- Administrate Limited

- Capital Knowledge

- Capytech FZ LLC

- Coursera Inc.

- Docebo Inc.

- Houghton Mifflin Harcourt

- John Wiley & Sons Inc.

- Open Text Corporation

- Pearson Plc

- Webanywhere

- XpertLearning

Latest News and Developments:

- In October 2024, Docebo announced the upcoming launch of AI Authoring, a tool designed to streamline content production, attracting significant interest from enterprises.

GCC E-Learning Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Learning Types Covered | Asynchronous Learning, Synchronous Learning |

| Sectors Covered | Post-Secondary, K-12, Corporate and Governance Learning |

| Product Types Covered | Packaged Content, Platforms, Services |

| Technologies Covered | Mobile and Online Learning, Learning Management System, Simulation Based Learning, Game Based Learning |

| Countries Covered | Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain |

| Companies Covered | Administrate Limited, Capital Knowledge, Capytech FZ LLC, Coursera Inc., Docebo Inc., Houghton Mifflin Harcourt, John Wiley & Sons Inc., Open Text Corporation, Pearson Plc, Webanywhere, XpertLearning, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC E-Learning market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC E-Learning market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC E-Learning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

E-learning refers to education and training (E&T) delivered digitally through online platforms, enabling flexible, remote access to learning materials. This form of learning is widely applicable in academic courses, corporate training, skill development, and professional certifications. Moreover, it utilizes tools like virtual classrooms, video tutorials, and interactive content to enhance learning experiences across sectors and age groups.

The GCC e-learning market was valued at USD 6.8 Billion in 2024.

IMARC estimates the GCC e-learning market to exhibit a CAGR of 14.4% during 2025-2033.

Key factors driving the GCC e-learning market include government-led digital education initiatives, rising internet penetration, increasing demand for flexible and technology-driven learning solutions, integration of advanced technologies like artificial intelligence (AI) and visual reality (VR), growing corporate training needs, and a young, tech-savvy population embracing modern education methods.

Synchronous learning leads the market by learning type owing to its real-time interaction capabilities, which enhance engagement and provide immediate feedback to learners.

The post-secondary education holds the largest market by sector due to the growing demand for flexible learning solutions among universities and colleges, especially in a digital-first environment.

Packaged content dominates the market by product type because it offers cost-effective, ready-to-use learning materials that cater to diverse learning needs and easy scalability.

The mobile and online learning is leading the market by technology driven by the widespread use of smartphones and internet accessibility, allowing learners to engage from anywhere at any time.

On a regional level, the market has been classified into Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain, wherein Saudi Arabia currently dominates the market.

Some of the major players in the GCC e-learning market include Administrate Limited, Capital Knowledge, Capytech FZ LLC, Coursera Inc., Docebo Inc., Houghton Mifflin Harcourt, John Wiley & Sons Inc., Open Text Corporation, Pearson Plc, Webanywhere, and XpertLearning, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)