Global Dairy Market Report by Product Type (Liquid Milk, Flavored Milk, Cream, Butter, Cheese, Yoghurt, Ice Cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder (WMP), Whey Protein, Lactose Powder, Curd, Paneer), and Region 2025-2033

Dairy Market Size:

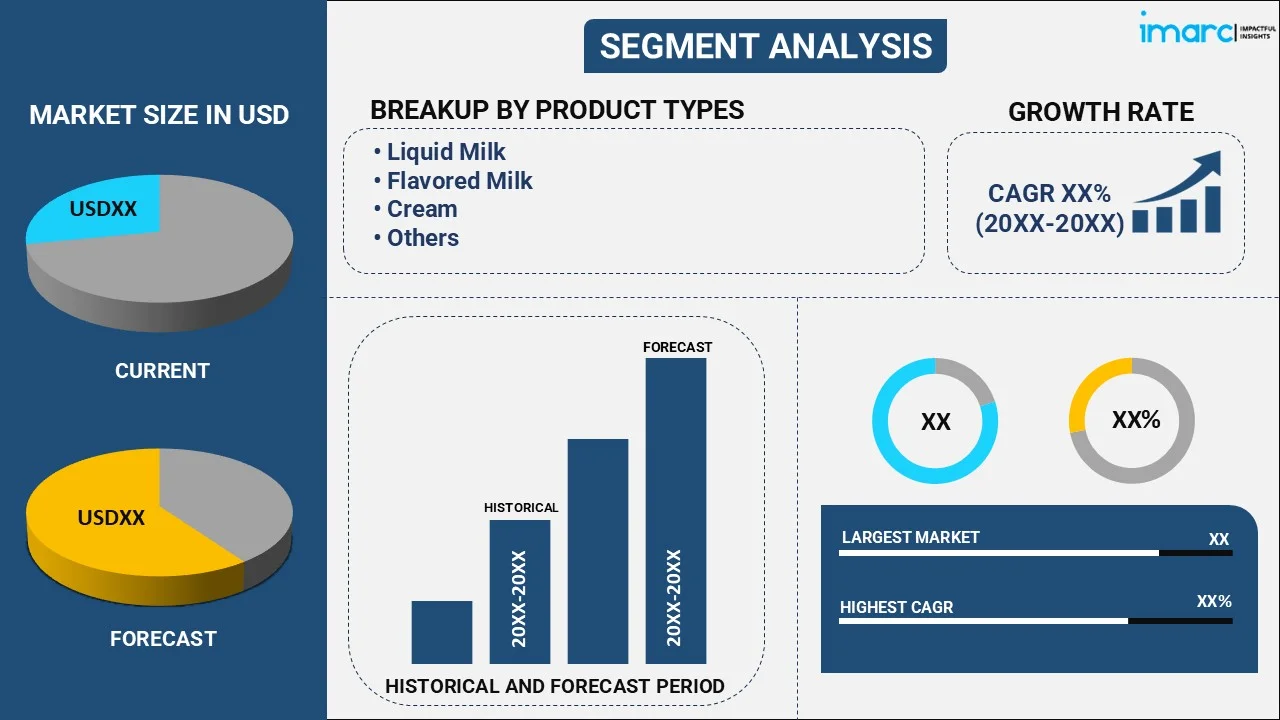

The global dairy market size reached USD 991.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,505.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.75% during 2025-2033. The rapid urbanization, increasing awareness about health and nutrition, significant technological advancements, rising popularity of dairy-based snacking, shifting dietary preferences and favorable government policies and regulations are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 991.5 Billion |

| Market Forecast in 2033 | USD 1,505.8 Billion |

| Market Growth Rate 2025-2033 | 4.75% |

Dairy Market Analysis:

- Major Market Drivers: The market is experiencing stable growth on account of changing dietary patterns of individuals. It can also be attributed to technological advancements in dairy farming, including automated milking systems and precision feeding techniques.

- Key Market Trends: Rising global population, rapid urbanization, and increasing awareness among individuals about health and nutrition are some of the key trends in the global dairy industry.

- Geographical Trends: India leads the global dairy market statistics, driven by favorable government initiatives. However, China is emerging as a fast-growing market on account of increasing preferences for online purchasing of milk and its related products.

- Competitive Landscape: Some of the major market players in the dairy industry include Nestlé S.A., Fonterra Cooperative Group, Royal FrieslandCampina N.V., Arla Foods amba, Danone S.A., and Lactalis Group, among many others.

- Challenges and Opportunities: While the market faces challenges, such as animal welfare issues, it also encounters opportunities due to the rising focus on sustainable farming practices.

.webp)

Dairy Market Trends:

Rising Population Growth

As the global population continues to grow, so does the demand for essential nutrients, such as calcium and protein, which are abundantly found in dairy products. For example, as per the U.S. Census Bureau, after a historically low rate of change between 2020 and 2021, the US resident population increased by 0.4%, or 1,256,003, to 333,287,557 in 2022. Additionally, more people are transitioning from traditional diets to modern ones that include processed foods and dairy products, which is bolstering the market growth.

Rapid Urbanization

With more and more people are moving to cities for opportunities and leading busy lifestyles, convenience has become a key factor in food choices. According to United Nations Conference on Trade and Development (UNCTAD), the share of urban population has projected to increase to 56.9% in 2022. It is higher in the developed parts (79.7%) than in the developing regions (52.3%). Besides this, dairy companies have capitalized on this trend by offering a wide range of packaged, ready-to-eat (RTE), and on-the-go dairy options. Urban consumers are increasingly looking for quick and nutritious meals, making dairy an attractive choice due to its nutritional content and versatility in various recipes. As a result, the urbanization trend is propelling the future of global dairy market.

Increasing Health and Nutrition Awareness

Dairy products play a pivotal role in a balanced diet due to their rich calcium content and assistance in bone health and development. Additionally, dairy is a valuable source of protein, vitamins (such as vitamin D and B12), and minerals (like potassium and magnesium). As consumers are becoming more health-conscious and seeking wholesome and nutrient-dense foods, the global dairy market demand increases. In addition to this, the growing awareness about lactose intolerance and milk allergies is resulting in the growing need for lactose-free and plant-based dairy alternatives, thereby shaping the market dynamics. Dairy companies operating in the industry are also responding by fortifying products with additional nutrients, catering to the demand for functional foods that support overall well-being. For instance, on 17 August 2023, Skyrrup announced the launch of lactose free Greek yogurt with a protein content of 7.5 grams. It is made from A2 cow milk and not only provides essential nourishment but also offers a delightful taste.

Dairy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and country levels for 2025-2033. Our report has categorized the market based on product type.

Breakup by Product Type:

- Liquid Milk

- Flavored Milk

- Cream

- Butter

- Cheese

- Yoghurt

- Ice Cream

- Anhydrous Milk Fat (AMF)

- Skimmed Milk Powder (SMP)

- Whole Milk Powder (WMP)

- Whey Protein

- Lactose Powder

- Curd

- Paneer

Liquid milk accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes liquid milk, flavored milk, cream, butter, cheese, yoghurt, ice cream, anhydrous milk fat (AMF), skimmed milk powder (SMP), whole milk powder (WMP), whey protein, lactose powder, curd, and paneer. According to the report, liquid milk represented the largest segment.

Liquid milk is the largest segment in the global dairy market analysis due to its widespread consumption among individuals worldwide. As a primary dairy product, liquid milk is sourced directly from mammals like cows, goats, and sheep, making it readily available and accessible to consumers. One of the key factors driving the dominance of liquid milk is its versatility. It serves as a standalone beverage, a vital ingredient in various recipes, and a base for producing other dairy products like butter, cheese, and yogurt. It is widely utilized in cooking, baking, and preparing dairy derivatives. Furthermore, liquid milk is perceived as a wholesome and nutritious option, rich in calcium, protein, vitamins, and minerals, all of which are essential for human growth and development. The availability of different milk variants, such as whole, skimmed, and lactose-free milk, caters to a broader consumer base with varying dietary preferences. As a result, there is a rise in the demand for liquid milk for various purposes among individuals. For instance, according to The Organization for Economic Cooperation and Development (OECD), world milk production is projected to grow at 1.6% per annum over the projection period (2020-2029) to 997 Mt by 2029, faster than most other main agricultural commodities.

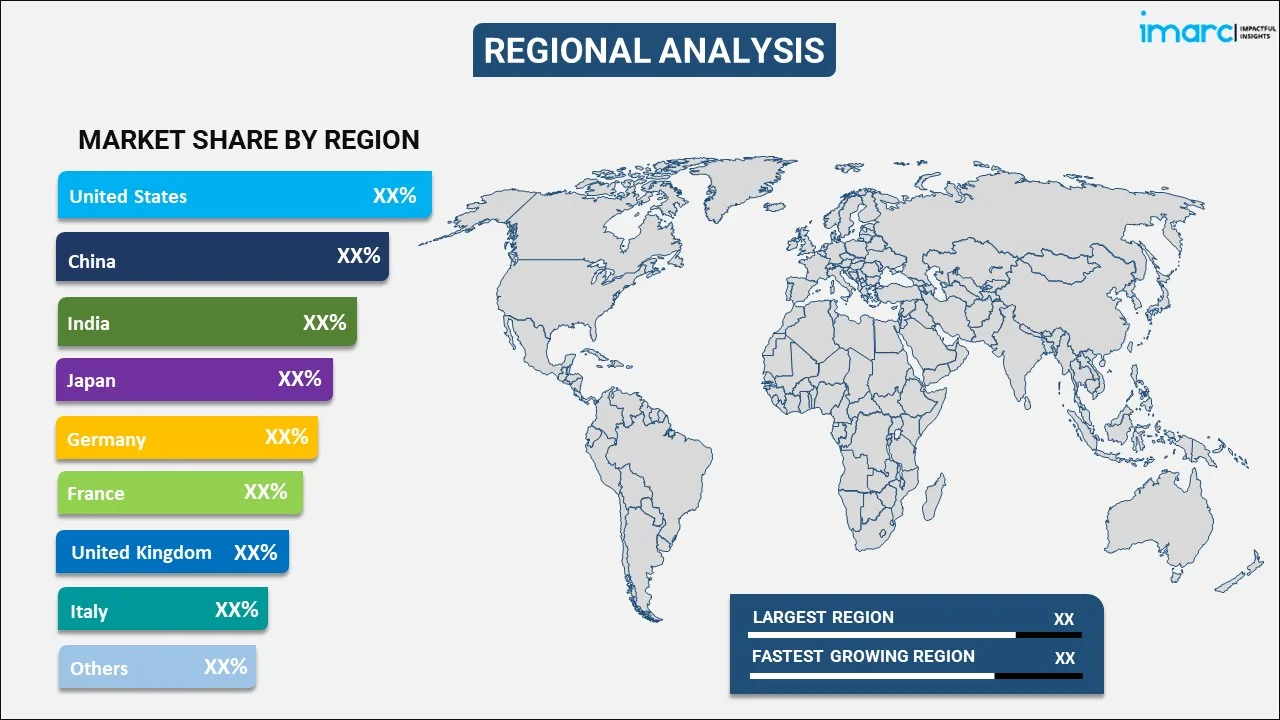

Breakup by Region:

- United States

- China

- India

- Japan

- Germany

- France

- United Kingdom

- Italy

- Spain

- Australia

- New Zealand

- Canada

- Brazil

- Mexico

- Turkey

India leads the market, accounting for the largest dairy market share

The report has also provided a comprehensive analysis of all the major country markets, which include the United States, China, India, Japan, Germany, France, the United Kingdom, Italy, Spain, Australia, New Zealand, Canada, Brazil, Mexico, and Turkey. According to the report, India represents the largest regional market for dairy.

With over 1.3 billion people, there is a massive consumer base for dairy products in India. As the population continues to rise, the demand for essential nutrients provided by dairy products also accelerates. Besides this, the agricultural nature of the country ensures a significant presence of livestock, particularly cows and buffaloes. This abundance of milk-producing animals facilitates a steady supply of raw milk for dairy processing and production. Additionally, the Indian dairy industry has witnessed significant modernization and infrastructure development, which has enhanced milk collection, processing, and distribution capabilities. This has made dairy products more accessible to consumers across urban and rural areas, driving the global dairy market outlook. Moreover, the Government of India is providing various schemes, subsidies, and incentives related to dairy, which is supporting the global dairy market growth. For example, the Government of India launched National Programme for Dairy Development (NPDD) scheme to improve the quality of milk and its products and increase share of organized milk procurement. The scheme will be implemented in India for the period of five year from 2021-22 to 2025-26.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the dairy industry include Nestlé S.A., Fonterra Cooperative Group, Royal FrieslandCampina N.V., Arla Foods amba, Danone S.A., and Lactalis Group.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Leading dairy companies continuously invest in research and development to create innovative dairy products that cater to evolving consumer preferences. This includes introducing new flavors, formats, and packaging to appeal to a broader customer base. Moreover, companies focus on developing value-added dairy products with functional benefits, such as probiotic-enriched yogurt or fortified milk, to meet health-conscious consumers' demands. Additionally, key players often expand their market presence by entering new geographical regions or penetrating untapped markets. This expansion may involve setting up new production facilities, distribution centers, or forming strategic partnerships with local businesses to strengthen their supply chain. For instance, f'real by Rich's launched the cinnamon churro milkshake. f'real shakes and smoothies are a blend-it-yourself treat available in over 24,000 locations worldwide, including convenience stores. Other than this, in response to growing environmental concerns, major dairy companies are implementing sustainable practices throughout their operations. This includes adopting eco-friendly farming techniques, reducing greenhouse gas (GHG) emissions, and promoting animal welfare. Besides this, robust marketing strategies are employed to build brand awareness and connect with consumers. Furthermore, key players invest in advertising campaigns, social media presence, and influencer partnerships to engage their target audience effectively.

Dairy Market News:

- 29 November 2023, Nestlé S.A. launched N3 milk that is made from cow milk and has all the essential nutrients found in milk, such as proteins, vitamins, and minerals. It also contains prebiotic fibers and has a low lactose content and 15% fewer calories.

- 10 July 2023, Arla Foods amba partnered with Blue Ocean Closures to create a fibre-based cap for its milk cartons. It will reduce plastic consumption of the company by more than 500 tonnes annually.

- 5 July 2022, Danone S.A. launched its dairy and plants blend baby formula, in response to desire for vegetarian and flexitarian options for the baby. It is a nutritionally complete formulation that combines the best of both dairy and plants. The new baby formula is the 1st specifically created for a vegetarian diet and is the 1st blended formula for healthy babies in which more than half the required protein is derived from soy.

Dairy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons, Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Liquid Milk, Flavored Milk, Cream, Butter, Cheese, Yoghurt, Ice Cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder, (WMP), Whey Protein, Lactose Powder, Curd, Paneer |

| Countries Covered | United States, China, India, Japan, Germany, France, United Kingdom, Italy, Spain, Australia, New Zealand, Canada, Brazil, Mexico, Turkey |

| Companies Covered | Nestlé S.A., Fonterra Cooperative Group, Royal FrieslandCampina N.V., Arla Foods amba, Danone S.A., Lactalis Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 26 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dairy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and global dairy market opportunities.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dairy industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global dairy market was valued at USD 991.5 Billion in 2024.

We expect the global dairy market to exhibit a CAGR of 4.75% during 2025-2033.

The rising consumer awareness towards several health benefits of consuming dairy and dairy-based products, such as supporting body growth, building and repairing muscle tissues, maintaining strong bones, and regulating blood pressure, is primarily driving the global dairy market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of dairy and dairy-based products.

Based on the product type, the global dairy market can be bifurcated into liquid milk, flavored milk, cream, butter, cheese, yoghurt, ice cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder (WMP), whey protein, lactose powder, curd, and paneer. Currently, liquid milk exhibits a clear dominance in the market.

On a regional level, the market has been classified into United States, China, India, Japan, Germany, France, United Kingdom, Italy, Spain, Australia, New Zealand, Canada, Brazil, Mexico, and Turkey, where India currently dominates the global market.

Some of the major players in the global dairy market include Nestle, Fonterra, FriesandCampina, Arla Foods, Danone, Lactalis, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)