Green Coatings Market Report by Type (Waterborne, Powder, High Solid, UV Cured), Application (Architectural Coatings, Industrial Coatings, Automotive Coatings, Wood Coatings, Packaging Coatings, and Others), and Region 2025-2033

Market Overview:

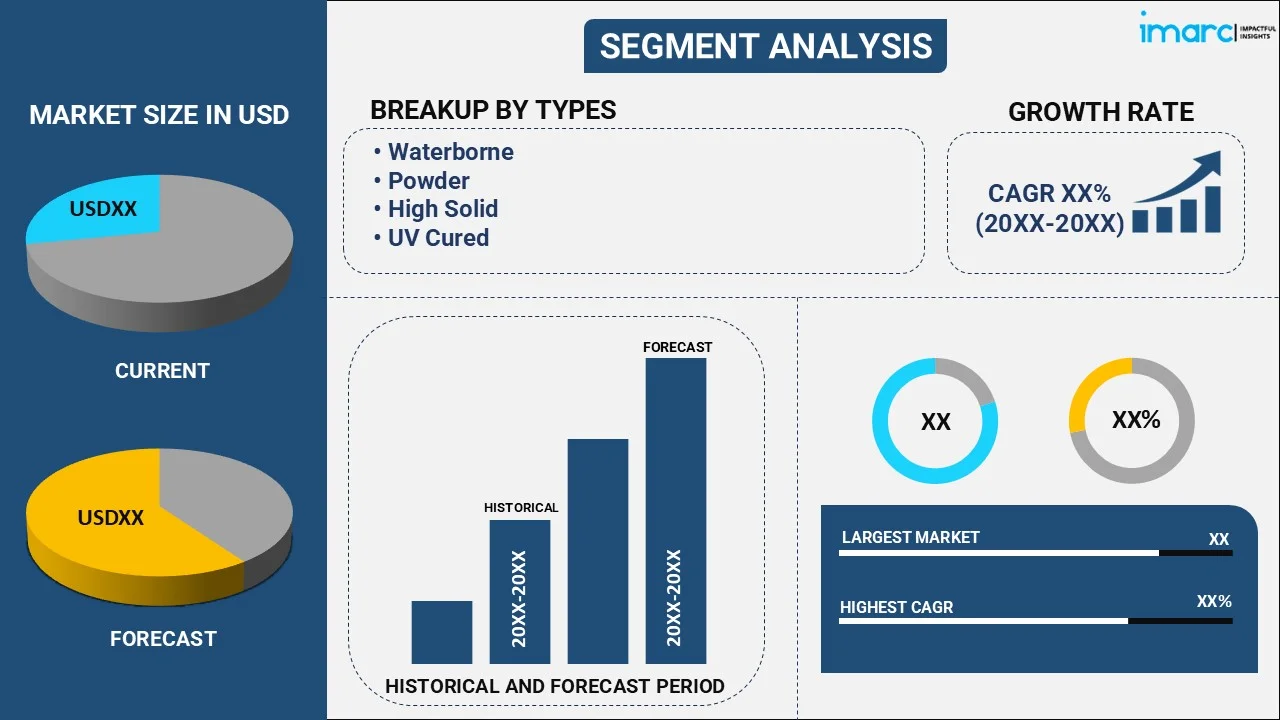

The global green coatings market size reached USD 93.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 132.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.73% during 2025-2033. The growing number of stringent environmental regulations and policies, the widespread implementation of occupational health and safety measures, and the emerging trend towards green construction and sustainable architecture are some of the major factors propelling the market demand. At present, Europe holds the largest market share, driven by increasing sustainability practices..

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 93.4 Billion |

|

Market Forecast in 2033

|

USD 132.2 Billion |

| Market Growth Rate 2025-2033 | 3.73% |

Green Coatings Market Analysis:

- Market Growth and Size: The global green coatings market is experiencing steady growth, driven by factors like stringent environmental regulations and the growing inclination towards sustainable products.

- Major Market Drivers: Primary drivers include stringent environmental legislation demanding lower volatile organic compounds (VOC) emissions and a rise in preference for eco-friendly products. The construction and automotive sectors are rapidly adopting green coatings to align with global sustainability trends and enhance their market appeal.

- Key Market Trends: A notable trend is the shift towards waterborne and powder coatings, known for their low environmental impact. Innovations focusing on enhancing durability and efficiency, along with the development of bio-based alternatives, are steering the market towards significant ecological and economic benefits.

- Geographical Trends: Europe dominates the market, driven by increasing construction activities, industrial growth, and stringent environmental policies. However, North America is emerging as a fast-growing market on account of the strong emphasis on sustainability and regulatory frameworks favoring eco-friendly products.

- Competitive Landscape: The market is marked by fierce competition, with major players emphasizing technological innovations, strategic alliances, and broadening product ranges to secure a competitive advantage. Businesses are progressively allocating resources to research operations aimed at creating innovative, sustainable coating solutions that comply with strict environmental regulations.

- Challenges and Opportunities: Challenges involve the expensive nature of raw materials and technological limitations in attaining the best performance with environmentally friendly components. However, the chances for market participants to create and implement affordable, high-performance solutions, thus enhancing market competitiveness, are expected to surpass these obstacles.

Green Coatings Market Trends/Drivers:

Consumer Awareness and Demand

The growing awareness among users about environmental sustainability has resulted in a notable surge in the demand for eco-friendly products, such as green coatings. People are gaining greater awareness of the detrimental impacts of conventional coatings, including air pollution and health hazards associated with VOC exposure. Consequently, they are progressively looking for environmentally friendly options for both industrial and home use. The increasing user demand serves as a strong market motivator, forcing businesses to invest in the creation and promotion of eco-friendly coatings. In addition to this, strong demand boosts sales and fosters innovation in the industry. As individuals grow more selective, eco-friendly coatings need to continuously advance in order to satisfy demands for effectiveness, cost-effectiveness, and sustainability, thus supporting the green coatings market growth.

Increasing Economic Incentives

Besides meeting regulatory requirements and consumer demands, businesses are finding that adopting green coatings can offer various economic benefits. Some governments offer tax incentives or grants for companies that implement sustainable practices, including the use of eco-friendly coatings. Additionally, green coatings often have longer lifespans and higher resistance to wear, and tear compared to their traditional counterparts, resulting in lower maintenance costs over time. In confluence with this, the use of green coatings can also be a market differentiator, enhancing a company's brand image as socially responsible and environmentally conscious. This can lead to increased customer loyalty and market share, thereby acting as a key driver for the industry. Moreover, companies are also starting to recognize that a commitment to sustainability can make them more competitive in the global market, particularly as consumers become more environmentally conscious.

Continuous Technological Advancements

In recent years, the green coatings industry has benefited from numerous technological advancements that have enhanced product performance and application methods. Along with this, innovations in nanotechnology, waterborne technologies, and high-solid materials have led to the development of green coatings with improved durability, corrosion resistance, and finish quality. These technical improvements are increasingly making green coatings a viable and often superior alternative to traditional products. For instance, some green coatings now offer added functionalities, such as self-cleaning and anti-microbial properties. These technological advancements serve as a strong market driver by broadening the range of applications for green coatings, from automotive finishes to protective industrial coatings, thus expanding market reach and potential green coatings market revenue streams.

Green Coatings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with green coatings market forecast at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type and application.

Breakup by Type:

- Waterborne

- Powder

- High Solid

- UV Cured

Waterborne dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes waterborne, powder, high solid, and UV cured. According to the green coatings market statistics, waterborne represented the largest segment.

The green coatings industry is experiencing significant growth, driven primarily by increased environmental awareness and stringent government regulations aimed at reducing volatile organic compounds (VOCs). Waterborne coatings, a subcategory within green coatings, are gaining prominence as they meet both sustainability objectives and performance criteria. One of the key market drivers for waterborne types is the escalating demand from the automotive and construction sectors, which require coatings that are not just durable but also eco-friendly. Besides this, technological advancements have also fueled this trend, with new waterborne formulations offering comparable or superior qualities to traditional solvent-based coatings. Furthermore, public perception favoring green products is steering both consumers and industries toward more sustainable options. Another driver is the economic benefit; while the initial cost may be higher, the long-term operational and disposal costs are often lower, making it a cost-effective choice in the long run. Thus, the convergence of environmental concerns, technological innovation, economic feasibility, and industrial demand is offering a favorable green coatings market outlook.

Breakup by Application:

- Architectural Coatings

- Industrial Coatings

- Automotive Coatings

- Wood Coatings

- Packaging Coatings

- Others

Architectural coatings hold the largest share in the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. These include architectural coatings, industrial coatings, automotive coatings, wood coatings, packaging coatings, and others. According to the report, architectural coatings accounted for the largest market share.

The market for green coatings in architectural uses is experiencing growth, driven by a mix of regulatory, environmental, and consumer-oriented elements. Regulatory standards, especially those aimed at lowering emissions of volatile organic compounds (VOCs), are urging industries to implement greener alternatives. This has resulted in green coatings, particularly waterborne and high-solids types, becoming more sought after in architectural uses, such as in residential and commercial constructions. Furthermore, personal consciousness regarding sustainability acts as an important motivator; there is an increasing inclination towards sustainable buildings and environmentally friendly residences, which consequently enhances the need for green architectural coatings. Moreover, technological advancements are crucial, as developments in formulation chemistry have led to eco-friendly coatings that provide excellent performance, longevity, and visual attractiveness, all while ensuring environmental safety is maintained. The drive for energy-efficient structures is also promoting the adoption of reflective or insulating eco-friendly coatings that aid in achieving long-term cost reductions.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe exhibits a clear dominance, accounting for the largest green coatings market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represented the largest market share.

In Europe, the green coatings industry is experiencing robust growth, fueled by technological innovations, and rising consumer consciousness about environmental sustainability. Regulations have set stringent standards for chemical substances, including volatile organic compounds (VOCs) commonly found in traditional coatings. This regulatory landscape is a key market driver, steering industries towards adopting eco-friendly green coatings. Additionally, Europe's ambitious sustainability goals and climate action plans further amplify the green coatings market demand.

Apart from this, technological advancements in the formulation of high-performance, low-VOC, and waterborne coatings offer alternatives that meet both environmental and performance criteria, thus attracting industries, including automotive, construction, and maritime. Consumer preference is another influential factor. European consumers are increasingly opting for products that align with green values, including eco-friendly homes and automobiles, thereby boosting the market for green coatings. Furthermore, Europe's well-established infrastructure and investment in R&D activities provide an ideal platform for the green coatings market to flourish.

Competitive Landscape:

The global market for green coatings is witnessing considerable expansion driven by the increasing user emphasis on sustainability. Businesses are involved in informing the market about the advantages of green coatings via marketing campaigns, case studies, and thought leadership materials. In addition, the rising investments in research and development in R&D aimed at creating high-quality, low-VOC, and waterborne coatings that comply with environmental regulations and provide exceptional performance are greatly bolstering the market. Moreover, alliances with suppliers and research organizations are being established to hasten the creation of innovative green coating solutions, serving as another catalyst for growth. Furthermore, producers are pursuing third-party certifications for their products to authenticate their environmentally friendly qualities, thus fostering trust among users and industrial purchasers. This is having a positive impact on the market. Moreover, the incorporation of digital technologies for improved supply chain management, predictive upkeep, and real-time analysis is enhancing the market. Research on the green coatings market offers detailed insights, revealing changing trends, user needs, and technological innovations that are shaping the industry's move towards environmental sustainability.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Akzo Nobel N.V.

- Asian Paints Limited

- Axalta Coating Systems Ltd.

- BASF SE

- Hempel A/S

- Jotun

- Kansai Paint Co. Ltd.

- Koninklijke DSM N.V.

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc

- The Sherwin-Williams Company

Recent Developments:

- January 2025: Cloverdale Paint collaborated with Celanese Corporation to incorporate carbon capture and utilization (CCU) technology into its paint manufacturing process. This partnership seeks to transform CO2 emissions into sustainable feedstocks, notably minimizing carbon emissions during production. The collaboration highlights the dedication of both companies to sustainability and circular economy principles.

- May 2024: AkzoNobel introduced a fresh range of bio-based paints, using renewable materials such as plant-derived oils and natural colorants. These paints seek to minimize greenhouse gas emissions, enhance indoor air quality by containing lower VOC levels, and provide sustainable, high-performance options compared to conventional coatings. This advancement represented an important move towards sustainability in the coatings sector.

- April 2024: WEG Coatings (Brazil) and GIT Coatings (Canada) revealed a collaboration aimed at enhancing their global marine coating services. The partnership centered on innovation and sustainability, utilizing GIT's graphene-derived solutions to improve fuel efficiency and decrease the carbon footprint in the maritime sector. This collaboration will speed up the implementation of environmentally friendly coatings in the marine sector.

- March 2024: Berger Paints declared its dedication to sustainability by collaborating with Ramakrishna Mission Vidyamandira to create paint stabilizers utilizing green ammonia production. The company aimed to replace traditional stabilizers with eco-friendly options through green hydrogen-free methods. This move supported sustainable manufacturing and reduces the environmental impact while enhancing productivity.

- January 2024: Sherwin-Williams launched its SHER-WOOD EA Hydroplus technology, a water-based wood finish created for various environmental conditions. This top-notch, self-sealing acrylic system provided outstanding durability, chemical resistance, and minimal VOC levels. It enabled efficient production while supporting sustainability goals with easier cleanup and safer storage.

Green Coatings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Waterborne, Powder, High Solid, UV Cured |

| Applications Covered | Architectural Coatings, Industrial Coatings, Automotive Coatings, Wood Coatings, Packaging Coatings, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akzo Nobel N.V., Asian Paints Limited, Axalta Coating Systems Ltd., BASF SE, Hempel A/S, Jotun, Kansai Paint Co. Ltd., Koninklijke DSM N.V., Nippon Paint Holdings Co. Ltd., PPG Industries Inc., The Sherwin-Williams Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the green coatings market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global green coatings market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the green coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global green coatings market was valued at USD 93.4 Billion in 2024.

We expect the global green coatings market to exhibit a CAGR of 3.73% during 2025-2033.

The rising utilization of environment-friendly coatings, such as green coatings, across the construction sector as protective and decorative paints on walls, roofs, panels, etc., is primarily driving the global green coatings market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for green coatings.

Based on the type, the global green coatings market has been segmented into waterborne, powder, high solid, and UV cured. Currently, waterborne green coatings hold the majority of the total market share.

Based on the application, the global green coatings market can be divided into architectural coatings, industrial coatings, automotive coatings, wood coatings, packaging coatings, and others. Among these, architectural coatings exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Europe currently dominates the global market.

Some of the major players in the global green coatings market include Akzo Nobel N.V., Asian Paints Limited, Axalta Coating Systems Ltd., BASF SE, Hempel A/S, Jotun, Kansai Paint Co. Ltd., Koninklijke DSM N.V., Nippon Paint Holdings Co. Ltd., PPG Industries Inc, and The Sherwin-Williams Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)