Hyper-Converged Infrastructure Market Size, Share, Trends and Forecast by Component, Application, End Use, and Region, 2026-2034

Hyper-Converged Infrastructure Market Size and Share:

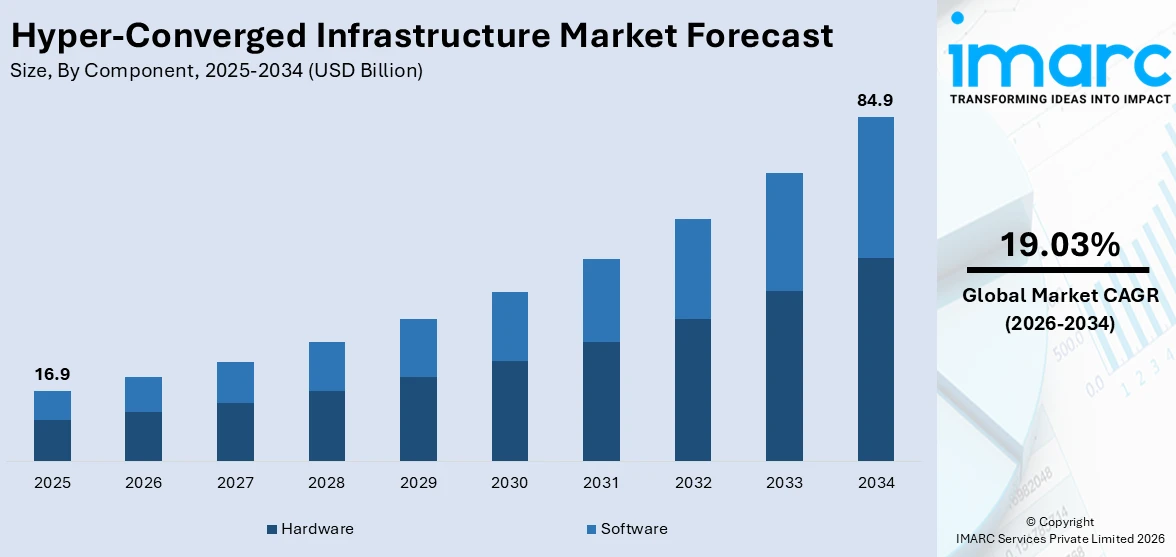

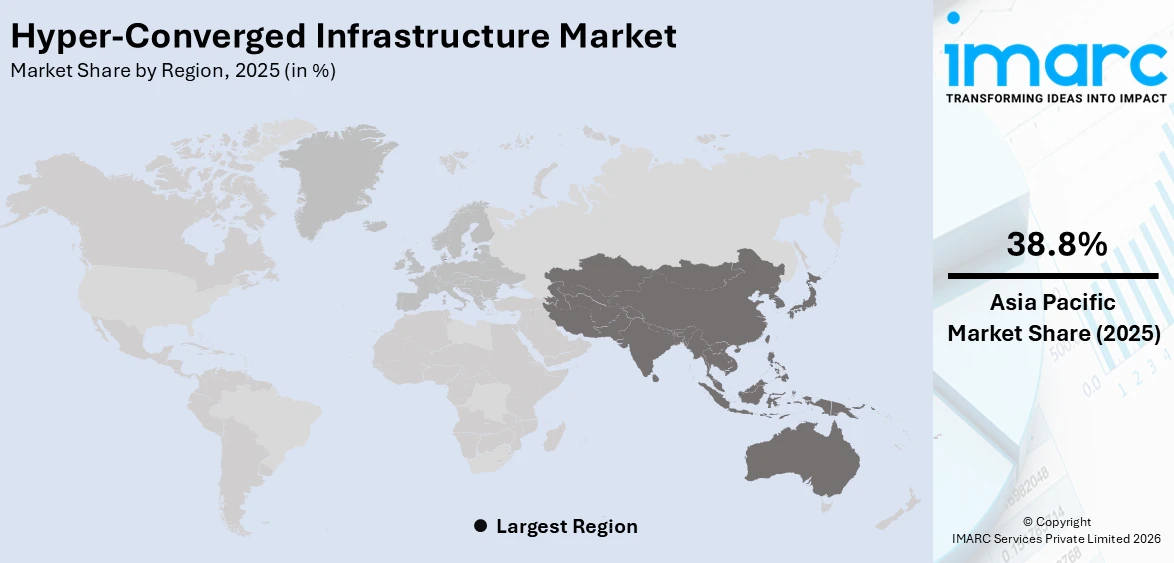

The global hyper-converged infrastructure market size was valued at USD 16.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 84.9 Billion by 2034, exhibiting a CAGR of 19.03% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of 38.8% in 2025. The market is expanding with rising demand for simplified IT operations and scalable solutions. Growing adoption of hybrid cloud strategies and enhanced security features continues to strengthen hyper-converged infrastructure market share across enterprises seeking cost efficiency and digital transformation support.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 16.9 Billion |

|

Market Forecast in 2034

|

USD 84.9 Billion |

| Market Growth Rate 2026-2034 | 19.03% |

Organizations are increasingly turning to hyper-converged platforms because they combine computing, storage, and networking into a single integrated system. The hyper-converged infrastructure market growth is being supported by enterprises that want simpler IT operations and lower costs. This reduces the complexity of managing separate hardware components and helps IT teams focus on core business needs. Cloud adoption has also encouraged many firms to use hyper-converged solutions as a bridge between traditional data centers and flexible cloud services. In the middle of this trend, businesses are investing more in virtualized workloads, backup, and disaster recovery solutions that work seamlessly with hyper-converged platforms. This added layer of automation is further driving adoption among mid-sized and large enterprises that seek efficiency without sacrificing performance.

To get more information on this market Request Sample

In the United States, hyper-converged infrastructure is gaining strong traction as enterprises shift toward hybrid cloud models. Organizations across sectors like healthcare, finance, and government are prioritizing solutions that allow them to run sensitive workloads on local data centers while maintaining seamless integration with public cloud platforms. The appeal lies in scalability and cost efficiency, as companies can expand capacity without heavy upfront investment. Security and compliance have become especially important in the US, where strict regulations drive demand for infrastructure that embeds advanced protection and monitoring features. A notable development in the market is the collaboration between leading US-based HCI vendors and global cloud providers, creating smoother workload migration and unified management platforms. These advancements are enabling American businesses to modernize legacy systems, improve disaster recovery, and accelerate digital transformation. With cloud spending on the rise, the US remains one of the fastest-growing regions for hyper-converged adoption.

Hyper-Converged Infrastructure Market Trends:

Increasing Need for Data Protection

The rising requirement for high-performance and reliable storage systems is augmenting the hyper-converged infrastructure market demand, as it offers an efficient and secure solution by integrating storage, networking, and computation into a single system. The elevating number of data breaches is expanding applications of HCI. For example, according to the IBM Data Breach's recent report, the average cost of data breaches increased by 2.6%. Furthermore, 1,802 data breaches were reported in the US in 2022, impacting over 422 Million individuals. Besides this, a survey around Data Privacy and Ethics was conducted by using data from Publishers Clearing House (PCH) consumer insights, revealing the lack of knowledge among people aged 25 and above about their digital privacy. Additionally, the shifting preferences from traditional storage solutions towards hyper-converged infrastructure, owing to the increasing adoption of connected devices and the introduction of the Internet of Things (IoT), are acting as significant growth-inducing factors. According to the GSMA, 5G connections are expected to reach 2 billion by 2025. With the development of advanced technologies, including GenAI, there is an escalating concern towards cybersecurity attacks. For instance, according to the HackerOne 2023 "Hacker-Powered Security Report," 61% of hackers planned to use GenAI for hacking tools and to find more vulnerabilities. In addition to this, as per the data cited by Anne Neuberger, U.S. Deputy National Security Advisor for cyber and emerging technologies, the annual average cost of cybercrimes is predicted to hit more than USD23 Trillion in 2027. These figures showcase the escalating need for HCI, as it gathers and stores analytics in a centralized management system, thereby positively influencing the hyper-converged infrastructure market outlook.

Several Collaborations

Prominent players are expanding their market presence on account of the continuous advancements in infrastructure services. They are entering into partnerships that usually involve hardware manufacturers, technology providers, and service companies working together to deliver comprehensive solutions that address complex business needs. For example, in April 2022, Dell and Equinix collaborated to provide hyper-converged data center offerings. These new solutions aimed to deliver improved capabilities and performance by combining Dell's advanced hardware with Equinix's robust bare metal infrastructures. Apart from this, in March 2022, Kyndryl, one of the world's largest IT infrastructure services providers, and Lenovo, an industry leader in PCs, storage, and server performance and reliability, announced an expansion of their global partnership to deliver and develop scalable hybrid cloud solutions and edge computing implementations. Similarly, in February 2023, Huawei announced its plans to accelerate the digital transformation of enterprises by adopting advanced technologies, such as artificial intelligence, edge computing, big data, intelligent manufacturing, etc. Furthermore, to support this hyper-converged infrastructure market trends, Huawei also introduced its hyper-convergence strategy by launching novel product offerings, such as Blue Whale Application Mall, Kunpeng Hyperconvergence, and supporting tools. As a result, according to the hyper-converged infrastructure market overview, such partnerships help companies to stay competitive in a rapidly evolving market.

Growing Hybrid Multi-Cloud Integration

The increasing cloud computing activities of companies to elevate operational flexibility and delegate routine tasks are strengthening the market. The widespread integration of HCI with hybrid multi-cloud models, as it enables businesses to manage data workflows more effectively from end-to-end, thereby ensuring easy accessibility of data for AI applications, is positively impacting the hyper-converged infrastructure market revenue. For instance, in January 2024, HCLTech, one of the leading global technology companies, in partnership with Cisco, introduced a hybrid multi-cloud networking solution that simplifies cloud management and also optimizes operations. In line with this, in April 2024, Azure Arc, one of the cloud-based services, extended the Azure Resource Manager-based management model to non-Azure resources like Kubernetes clusters, virtual machines, containerized databases, etc. Similarly, IBM, one of the multinational technology companies headquartered in New York, offers multi-cloud networking solutions, such as Hybrid Cloud Mesh, to deliver secure and predictable network connectivity. Besides this, extensive investments in AI technologies are projected to bolster the market over the forecasted period.

Hyper-Converged Infrastructure Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Hyper-Converged Infrastructure market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on component, application, and end use.

Analysis by Component:

- Hardware

- Software

As per the hyper-converged market outlook, in 2025, hardware segment led the market accounted for the market share of 55.2%. Hardware-based hyper-converged infrastructure is gaining extensive traction, as it enables high levels of optimization and integration, which can vastly improve key performance in vital areas, such as storage-to-CPU data transfers. In line with this, hardware HCI can be ideal when high performance is important for workloads, including real-time data analytics tasks, and when hardware scalability and modularity are important for the business. Moreover, some of the common examples of hardware based HCI include the HPE SimpliVity 380 and 2600 platforms and Dell EMC VxRack System Flex, among others. As such, Nutanix, one of the cloud computing companies, offers a range of HCI hardware under the NX Series, specifically designed to simplify data center management and operations. They integrate storage and networking into a single platform, providing flexible and scalable infrastructure solutions.

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Remote Office or Branch Office

- Virtualization Desktop Infrastructure (VDI)

- Data Center Consolidation

- Backup Recovery/Disaster Recovery

- Critical Applications Virtualization

- Others

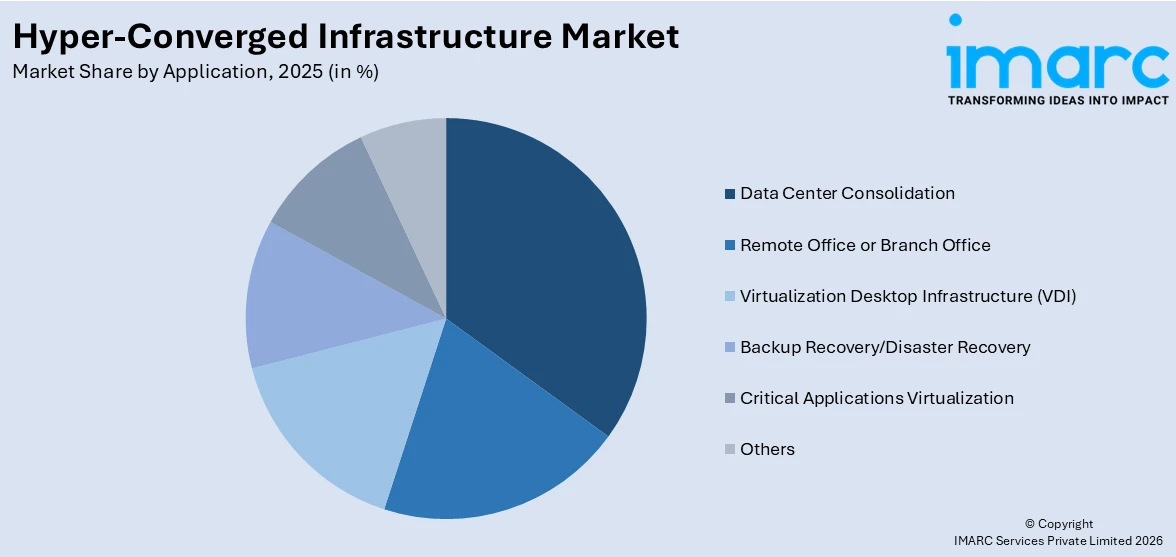

As per the hyper-converged market forecast, in 2025, the data center consolidation led the hyper-converged market accounted for the market share of 35.0%. Data center consolidation plays a significant role in fueling the adoption of hyper-converged infrastructure (HCI) solutions, thereby driving the segment's growth. Data center consolidation generally involves combining various data centers into fewer, more centralized locations. Moreover, HCI solutions simplify this process by minimizing the complexity of managing disparate infrastructure components across multiple data centers. Apart from this, it can lead to cost savings by reducing hardware footprint, optimizing resource utilization, streamlining operations, etc. These benefits will continue to bolster the hyper-converged infrastructure market growth over the foreseeable future.

Analysis by End Use:

- BFSI

- IT and Telecommunications

- Government

- Healthcare

- Manufacturing

- Energy and Utilities

- Education

- Others

In 2025, the BFSI led the hyper-converged market. The expanding banking, financial services, and insurance (BFSI) sector is contributing to the global market. Additionally, the widespread adoption of online payment methods to make cashless payments is acting as another significant growth-inducing factor. Besides this, various financial institutions are focusing on rapidly modernizing and scaling up infrastructures to drive operational efficiency and customer engagement. Moreover, the rising inclination towards digital banking, especially in India, has made banking a transparent and smooth process. These institutions are leveraging advanced IT solutions, such as HCI, thereby stimulating the hyper-converged infrastructure market price. For instance, RBL Bank, one of the private sector banks in India, is using HCI and upgrading its operating platform system to a more agile system capable of addressing numerous challenges. In addition to this, in September 2020, RBL Bank partnered with Nutanix to create an agile private cloud environment that could quickly respond to business VM requests.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, the Asia Pacific led the hyper-converged market accounted for the market share of 38.8%. The increasing popularity of utilizing Infrastructure-as-a-Service (IaaS) solutions is primarily propelling the market in the Asia Pacific. Besides this, the rising awareness among individuals towards managing data via a common interface at a reduced cost of ownership is also contributing to the growth of the market across the region. Furthermore, according to the hyper-converged infrastructure market statistics, the growing investments by key players in advanced technologies are acting as significant growth-inducing factors. Apart from this, the elevating number of data centers, in countries, such as Japan, is catalyzing the regional market. Matthew Young, senior vice president of Nutanix in APAC, noted that HCI is used, on account of the hybrid cloud deployments across the region. Moreover, the inflating popularity of desktop virtualization will continue to drive the market in Asia Pacific in the coming years.

Key Regional Takeaways:

United States Hyper-Converged Infrastructure Market Analysis

United States has witnessed increasing hyper-converged infrastructure adoption due to the rapid expansion of the IT and Telecommunications sector. For instance, on April 28, 2025, IBM announced it planned to invest USD 150 billion in the U.S. over five years. Organizations are upgrading their traditional data center frameworks to integrated systems that streamline workload management and enhance operational efficiency. The demand for scalable infrastructure to support cloud-native applications, edge computing, and unified management platforms is accelerating this trend. In response, IT and Telecommunications firms are increasingly embracing hyper-converged infrastructure to ensure business continuity, reduce latency, and enhance data security, especially in hybrid cloud environments. This transition is also helping enterprises optimize resource allocation and reduce total cost of ownership, further reinforcing adoption.

Asia Pacific Hyper-Converged Infrastructure Market Analysis

Asia-Pacific is experiencing a surge in hyper-converged infrastructure adoption driven by the growing number of data centers across the region. For instance, India is rapidly emerging as a global data centre hub and is projected to see an estimated demand of over 450 megawatt (MW) IT capacity across major cities in 2025. The need for compact, scalable, and integrated systems is rising as organizations aim to optimize their storage, compute, and networking resources within limited space. Emerging enterprises and hyperscale operators are investing in hyper-converged infrastructure to support virtualization and dynamic workload demands. This adoption aligns with data centers seeking improved resource utilization, energy efficiency, and simplified deployment. As demand grows for on-demand computing power and real-time data analytics, hyper-converged infrastructure is being viewed as a strategic solution.

Europe Hyper-Converged Infrastructure Market Analysis

Europe is witnessing hyper-converged infrastructure adoption accelerate alongside the growth of the BFSI sector. For instance, the German banking industry consists of about 1.500 banks. As reported, EU/EEA banks reported a return on equity (RoE) of 10.5% in 2024, an increase of 10bps compared to 2023 (11.1% in Q3 2024). Financial institutions and insurance providers are embracing hyper-converged systems to ensure seamless digital services, secure data handling, and high availability. The BFSI sector demands infrastructure capable of handling intensive transaction processing and regulatory compliance, making hyper-converged infrastructure a preferred choice. Its integration of storage, compute, and virtualization within a unified platform supports real-time analytics, fraud detection, and risk assessment. Moreover, hyper-converged solutions enable rapid scalability and centralized control, vital for BFSI organizations seeking resilience and agility.

Latin America Hyper-Converged Infrastructure Market Analysis

Latin America is seeing higher adoption of hyper-converged infrastructure due to expansion in the energy and utilities sector triggered by rising urbanization. For instance, Latin America and the Caribbean underwent a rapid urbanization process, making it one of the most urbanized regions in the world. Currently, 82% of the population lives in urban areas, compared to the global average of 58%. Growing electricity demand and utility modernization efforts require infrastructure that supports efficient data processing and remote management, thus favoring the market in the region.

Middle East and Africa Hyper-Converged Infrastructure Market Analysis

Middle East and Africa are experiencing increased adoption of hyper-converged infrastructure with the expanding healthcare and manufacturing sectors. For instance, in 2025, the UAE is currently home to over 150 hospitals and has more than 5,000 healthcare facilities These industries are integrating hyper-converged systems to streamline operations, support real-time data access, and improve uptime.

Competitive Landscape:

Companies in the hyper-converged infrastructure (HCI) market are adopting strategies to address shifting enterprise IT demands and compliance requirements. Companies are leveraging analytics and digital platforms to enhance R&D efficiency, reduce deployment timelines, and boost system performance. Automation is being integrated to streamline data center operations, improve scalability, and maintain consistent performance across diverse workloads. Investments in unified platforms are enabling better management of compliance, security, and workload optimization, supporting faster approvals and operational efficiency. These approaches strengthen adaptability to customer needs and help deliver reliable, scalable, and compliant HCI solutions in a competitive, regulation-driven market.

The report provides a comprehensive analysis of the competitive landscape in the hyper-converged market with detailed profiles of all major companies, including:

- Cisco Systems Inc.

- DataCore Software Corporation

- Dell Technologies Inc.

- Hewlett Packard Enterprise Company

- Hitachi Vantara Corporation

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Microsoft Corporation

- NetApp Inc.

- Nutanix Inc.

- Quantum Corporation

- Scale Computing

Latest News and Developments:

- May 2025: Pure Storage and Nutanix unveiled a new hyper-converged infrastructure in May 2025, integrating Pure’s FlashArray storage with Nutanix’s AHV platform to enhance scalability, performance, and virtual machine-level integration for enterprise workloads. This collaboration responded to rising demand for alternatives amid VMware licensing changes and aimed to support mission-critical applications with external storage flexibility.

- May 2025: DataCore Software strengthened its hyper-converged infrastructure presence in May 2025 by acquiring StarWind Software, enhancing its capabilities across edge, remote offices, and small business markets. The acquisition extended DataCore’s software-defined HCI solutions beyond core data centers, aligning with its vision to streamline operations across diverse environments.

- May 2025: Singapore-based startup Arcfra entered the hyper-converged infrastructure market and was featured in Gartner’s 2025 Market Guide for Full-Stack HCI Software less than a year after its launch. The company expanded into South Korea and Asia-Pacific, offering integrated compute, storage, networking, and disaster recovery through its Arcfra Enterprise Cloud Platform.

- March 2025: ZTE partnered with Virtuozzo to launch a hyper-converged infrastructure appliance at CloudFest 2025 in Rust, Germany, combining advanced hardware and virtualization software to empower alternative cloud providers with cost-effective, scalable cloud solutions. The HCI offering aimed to accelerate digital transformation across industries while enhancing accessibility and independence in sovereign cloud environments.

- March 2025: Sangfor Technologies and CITIC Telecom CPC announced a strategic partnership in March 2025 to launch the SmartCLOUD™ C-FUSION hybrid cloud series, integrating Sangfor’s hyper-converged infrastructure with CITIC’s cloud service capabilities to support enterprise digital transformation across global markets.

Hyper-Converged Infrastructure Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Applications Covered | Remote Office or Branch Office, Virtualization Desktop Infrastructure (VDI), Data Center Consolidation, Backup Recovery/Disaster Recovery, Critical Applications Virtualization, Others |

| End Uses Covered | BFSI, IT and Telecommunications, Government, Healthcare, Manufacturing, Energy and Utilities, Education, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cisco Systems Inc., DataCore Software, Dell Technologies Inc., Hewlett Packard Enterprise Company, Hitachi Vantara Corporation, Huawei Technologies Co. Ltd., International Business Machines Corporation, Microsoft Corporation, NetApp Inc., Nutanix Inc., Quantum Corporation, Scale Computing, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hyper-converged infrastructure market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hyper-converged infrastructure market.

- The study maps the leading as well as the fastest growing regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hyper-converged infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hyper-converged market was valued at USD 16.9 Billion in 2025.

The hyper-converged market is projected to exhibit a CAGR of 19.03% during 2026-2034, reaching a value of USD 84.9 Billion by 2034.

The hyper-converged market is driven by rising demand for simplified IT management, cost reduction, scalability, and improved data center efficiency. Growing cloud adoption, digital transformation initiatives, and the need for secure, flexible infrastructure further fuel adoption across industries including healthcare, BFSI, and manufacturing.

In 2025, Asia Pacific dominated the hyper-converged market, accounted for the market share of 38.8%, driven by rapid digitalization, cloud adoption, and expanding data center infrastructure. Strong government support, growing enterprise IT investments, and the presence of leading technology providers further strengthened the region’s market position.

Some of the major players in the global hyper-converged market include Cisco Systems Inc., DataCore Software, Dell Technologies Inc., Hewlett Packard Enterprise Company, Hitachi Vantara Corporation, Huawei Technologies Co. Ltd., International Business Machines Corporation, Microsoft Corporation, NetApp Inc., Nutanix Inc., Quantum Corporation, Scale Computing, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)