India Ayurvedic Products Market Size, Share, Trends and Forecast by Product Type, Organized/Unorganized, and Region, 2026-2034

India Ayurvedic Products Market Summary:

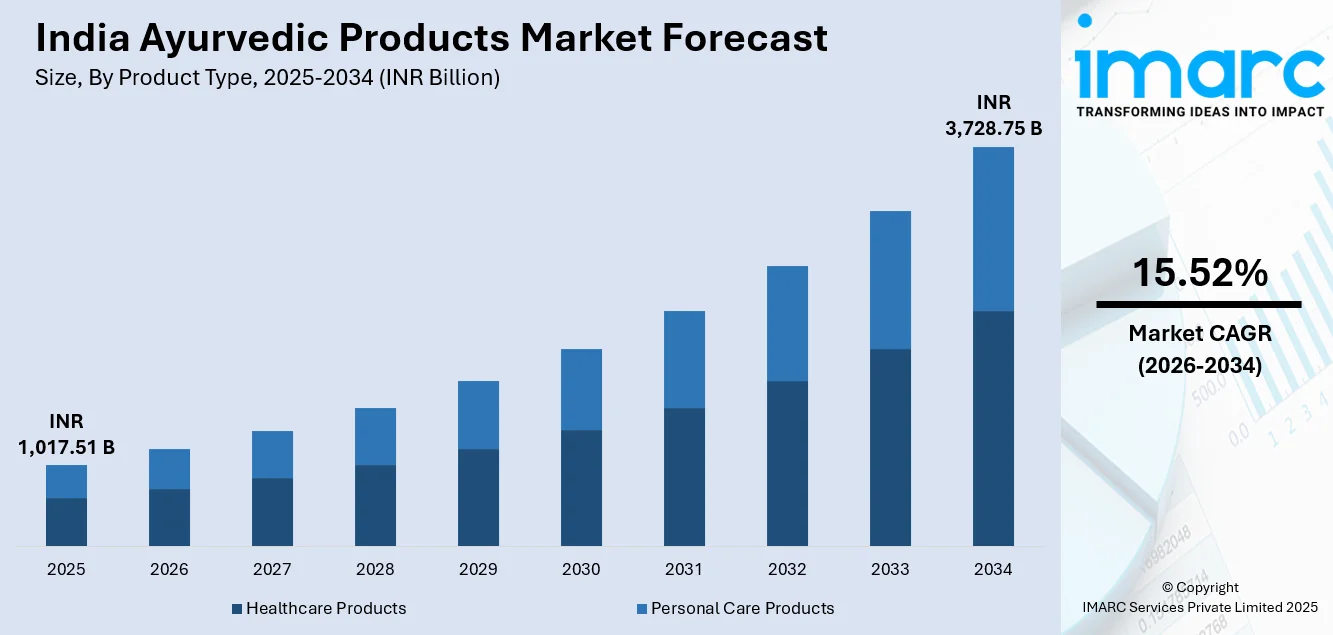

The India ayurvedic products market size was valued at INR 1,017.51 Billion in 2025 and is projected to reach INR 3,728.75 Billion by 2034, growing at a compound annual growth rate of 15.52% from 2026-2034.

The India ayurvedic products market is experiencing robust expansion driven by increasing consumer preference for natural and chemical-free wellness solutions. Rising health consciousness, growing adoption of traditional medicine systems in preventive healthcare, and expanding e-commerce platforms are accelerating market penetration. The integration of Ayurveda into mainstream wellness practices and personal care routines continues strengthening industry fundamentals across therapeutic and lifestyle applications.

Key Takeaways and Insights:

- By Product Type: Healthcare products dominate the market with a share of 58% in 2025, owing to increasing demand for ayurvedic medicines, herbal supplements, and immunity-boosting formulations. Consumers increasingly prefer chemical-free and plant-based alternatives for preventive healthcare management.

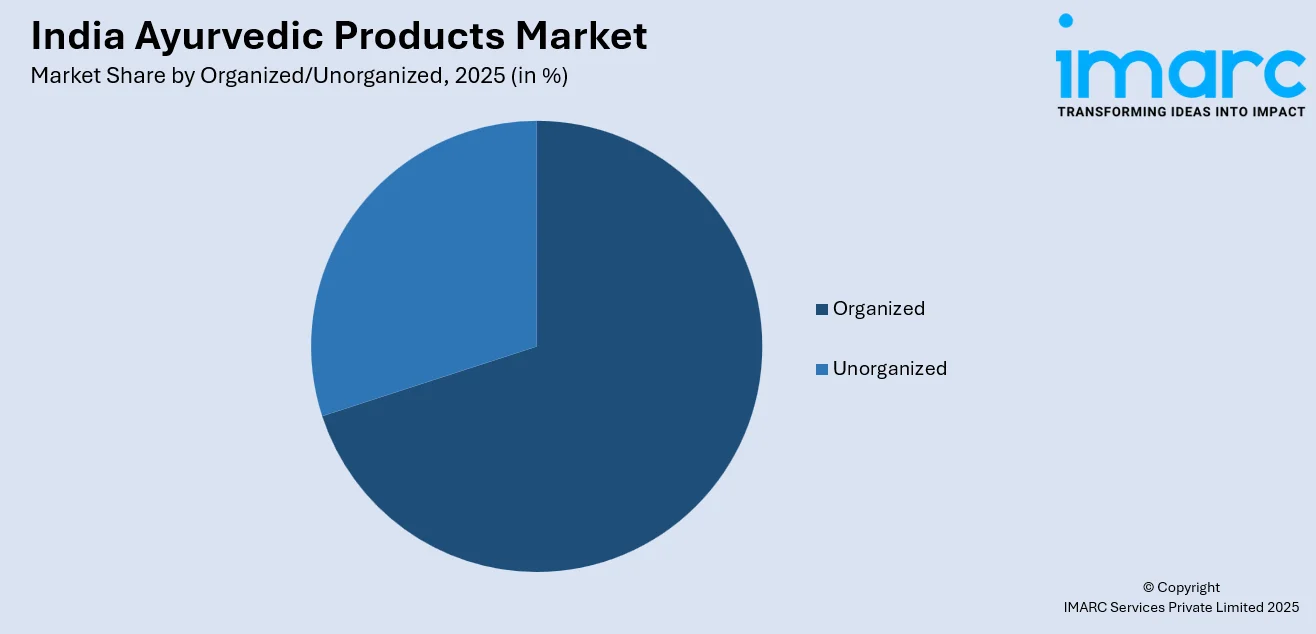

- By Organized/Unorganized: Organized leads the market with a share of 70% in 2025. This dominance is driven by established brand presence, quality certifications, modern manufacturing facilities, wider distribution networks, and consumer preference for standardized products with assured efficacy.

- By Region: North India represents the largest region with 35% share in 2025, driven by high population density, established manufacturing hubs, traditional ayurveda consumption patterns, and considering the existence of significant industrial facilities in Uttar Pradesh and Uttarakhand.

- Key Players: Key players drive the India ayurvedic products market by expanding product portfolios, investing in research and development, and strengthening nationwide distribution networks. Their strategic focus on digital marketing, premium product launches, and partnerships with healthcare providers accelerates consumer awareness and market penetration across diverse regional and demographic segments. Some of the key players operating in the industry are Amrutanjan Health Care Ltd., Biotique (Bio Veda Action Research Co.), Charak Pharma Pvt. Ltd., Dabur Ltd., Emami Ltd., Herbal Hills Wellness, Himalaya Wellness Company, Maharishi Ayurveda, Patanjali Ayurved Limited, Shahnaz Husain Group and Viccolabs.

To get more information on this market Request Sample

The India ayurvedic products market is witnessing transformative growth propelled by the convergence of traditional wellness wisdom and modern consumer demands. The increasing burden of lifestyle diseases, including diabetes, obesity, and hypertension, has shifted consumer focus toward preventive healthcare solutions that ayurvedic formulations inherently provide. The government's robust support through AYUSH initiatives, including substantial budgetary allocations and policy frameworks promoting traditional medicine integration, has strengthened institutional foundations. In the fiscal year 2024-25, the government allocated approximately INR 3,712 Crore to the Ministry of AYUSH, representing a significant increase over the previous year, demonstrating strong policy-level commitment to ayurveda promotion. The proliferation of direct-to-consumer brands and e-commerce platforms has democratized access to authentic Ayurvedic products, particularly among younger demographics seeking fusion products combining ancient formulations with modern delivery mechanisms. Innovation in product development, including effervescent tablets, gummies, and serums infused with ayurvedic herbs, continues expanding the consumer base and category boundaries.

India Ayurvedic Products Market Trends:

Integration of Technology with Traditional Ayurvedic Practices

The ayurvedic products sector is witnessing significant technological integration, transforming traditional practices into accessible wellness solutions. Artificial intelligence and machine learning are enabling personalized ayurvedic recommendations based on individual body constitutions and health profiles. Mobile applications offering dosha assessments and customized product suggestions are gaining popularity among digitally savvy consumers. This technological evolution is making ayurvedic principles comprehensible to modern audiences while preserving ancient therapeutic wisdom through contemporary digital platforms. In July 2025, the World Health Organization (WHO) released a technical brief titled "Mapping the Application of Artificial Intelligence in Traditional Medicine," acknowledging India's pioneering efforts in integrating AI with AYUSH systems, including predictive diagnostics using Prakriti-based machine learning models and the groundbreaking Ayurgenomics project combining genomics with ayurvedic principles.

Sustainable and Clean-Label Product Development

Environmental consciousness is reshaping the ayurvedic products landscape with manufacturers prioritizing sustainable sourcing, biodegradable packaging, and transparent supply chains. Brands are implementing farm-to-shelf traceability programs and digital authentication systems enabling consumers to verify ingredient origins. The circular economy approach, combined with cruelty-free testing protocols and sustainably sourced botanicals, positions ayurvedic products as environmentally responsible alternatives. This sustainability focus aligns with global conscious consumerism trends attracting ethically minded purchasers. According to APEDA (Agricultural and Processed Food Products Export Development Authority), as of 2024, India has 7.3 million hectares under organic certification including aromatic and medicinal plants, with the country ranking second globally in organic agricultural land and first in total number of organic producers.

Mainstream Wellness and Personal Care Adoption

Ayurveda is making the move from specialized traditional medicine to popular personal care and wellness methods. Younger consumers actively seek out herbal-based dietary supplements, skincare products, and haircare products that combine traditional formulas with modern ease. Product acceptance and visibility are being greatly increased by wellness influencer suggestions and celebrity endorsements on social media. Fusion products, which successfully adapt to changing lifestyle choices and consumption patterns, combine ayurvedic ingredients with contemporary delivery methods.

Market Outlook 2026-2034:

The market forecast for ayurvedic products in India remains strong, supported by favorable demographic trends, rising disposable incomes, and growing healthcare infrastructure that supports traditional medical systems. Accessibility and credibility are being improved by the methodical incorporation of ayurveda into public healthcare frameworks through wellness centers and hospital departments. With the growing demand for proven traditional treatments across the globe, the export potential of ayurvedic products offers significant growth prospects. It is anticipated that sustained government investments in research infrastructure, quality standardization, and international marketing campaigns would maintain market momentum and bolster India's standing as a world leader in holistic wellness solutions. The market generated a revenue of INR 1,017.51 Billion in 2025 and is projected to reach a revenue of INR 3,728.75 Billion by 2034, growing at a compound annual growth rate of 15.52% from 2026-2034.

India Ayurvedic Products Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Healthcare Products |

58% |

|

Organized/Unorganized |

Organized |

70% |

|

Region |

North India |

35% |

Product Type Insights:

- Healthcare Products

- Ayurvedic Nutraceuticals and Dietary Supplements

- Ayurvedic Medicines

- Personal Care Products

- Skin Care

- Oral Care

- Hair Care and Fragrances

Healthcare products dominate with a market share of 58% of the total India ayurvedic products market in 2025.

The healthcare products segment encompasses ayurvedic medicines, nutraceuticals, and dietary supplements designed to address therapeutic and preventive health needs. This segment's dominance reflects deep-rooted consumer trust in plant-based remedies for managing chronic conditions, boosting immunity, and supporting digestive health. Urban consumers increasingly rely on ayurvedic formulations for stress management and lifestyle disorder prevention. In February 2025, the National Institute of Ayurveda under the Ministry of AYUSH launched plant-based cosmetic products including foot care cream, aloe vera gel, and herbal soaps, demonstrating continued institutional support for product innovation.

Growing scientific validation of ayurvedic substances through pharmacological and clinical studies demonstrating therapeutic efficacy helps this market. As consumers prioritize preventive healthcare measures, demand for immunity-boosting formulas has remained steady. Product credibility and regulatory compliance are improved when traditional expertise is combined with contemporary standardization procedures. In India's nutritional supplement market, direct-to-consumer wellness companies are progressively entering the ayurvedic supplement market, taking advantage of consumers' growing desire for traditional formulations and natural wellness therapies.

Organized/Unorganized Insights:

Access the comprehensive market breakdown Request Sample

- Organized

- Unorganized

Organized leads with a share of 70% of the total India ayurvedic products market in 2025.

The organized sector includes established manufacturers with strong brand recognition, quality certification, compliance with Good Manufacturing Practices, and extensive distribution networks covering modern retail formats and online shopping platforms. The demand for standardized products with verified ingredient sourcing, transparent supply chains, and consistent formulation quality fuels the growth of the segment. The organized sector receives significant investments in marketing, celebrity endorsements, digital transformation, and partnerships with healthcare providers to improve market reach across the country.

The competitive environment prevailing in this segment is marked by R&D efforts for standardization of formulations and maintaining the authenticity of ayurveda. Expansion through exclusive brand stores and e-commerce platforms help reach deeper into the rural and semi-urban areas of India, where the demand for authentic wellness products is steadily rising. Digitalization initiatives, such as authentication by QR code, blockchain traceability, and AI-based personal recommendations helps to enhance consumer trust and authenticity of the brand among different consumer groups.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 35% share of the total India ayurvedic products market in 2025.

North India leads the market driven by high population density, established manufacturing hubs in Haridwar and Uttarakhand, and traditional consumption patterns deeply embedded in regional cultural practices. States including Uttar Pradesh, Delhi, Punjab, and Haryana demonstrate strong demand for health and personal care ayurvedic products. The region's historical association with ancient ayurvedic knowledge systems and presence of renowned wellness destinations reinforces consumer trust in traditional formulations and therapeutic remedies.

The presence of large retail outlet networks covering modern trade formats and traditional pharmacy channels in the region makes it easy for products to reach the market. The growing inclusion of ayurveda in modern healthcare setups through AYUSH wings and integrative healthcare centers is accelerating the growth of the market. The increasing awareness about health in the middle-class population, the growing demand for chemical-free personal care products, and the growing penetration of e-commerce further consolidate North India's leading position in the country's ayurvedic products market.

Market Dynamics:

Growth Drivers:

Why is the India Ayurvedic Products Market Growing?

Rising Consumer Preference for Natural and Preventive Healthcare Solutions

The Indian consumer landscape is witnessing a fundamental shift toward natural and preventive healthcare approaches, creating substantial demand for ayurvedic products across therapeutic and wellness categories. Increasing concerns over side effects associated with synthetic pharmaceuticals and chemical-based personal care products are driving consumers toward plant-based alternatives that align with ayurveda's holistic healing philosophy. The growing awareness about ayurveda's benefits for managing chronic lifestyle conditions including stress, digestive disorders, and metabolic imbalances strengthens consumer adoption across age groups. The preference for products free from harsh chemicals particularly resonates with health-conscious millennials and urban consumers seeking sustainable wellness solutions. This behavioral transformation extends beyond traditional medicine consumers to encompass individuals prioritizing preventive healthcare maintenance and long-term wellbeing optimization. The cultural acceptability of ayurvedic practices combined with modern scientific validation of herbal ingredients continues expanding the addressable consumer base and category boundaries. According to the first-ever all-India NSSO Survey on AYUSH (2022-23), approximately 95% of Indians aged 15 years and above are aware of AYUSH systems, while around 53% of urban and 46% of rural individuals used AYUSH for prevention or treatment of ailments during the survey period, with effectiveness and faith cited as primary reasons for adoption.

Strong Government Support and Policy Initiatives for Traditional Medicine

Government commitment to promoting ayurveda through the Ministry of AYUSH has created an enabling ecosystem for industry growth encompassing research funding, quality standardization, and international promotion. Policy frameworks supporting the establishment of Ayush hospitals, wellness centers, and research institutions strengthen infrastructure foundations for sustainable market expansion. Financial incentives, subsidies, and simplified funding mechanisms support both established pharmaceutical companies and emerging startups diversifying into ayurvedic product portfolios. The implementation of Good Manufacturing Practices certification requirements and pharmacopoeial standards enhances product authenticity and consumer confidence while enabling export competitiveness. Government initiatives integrating traditional medicine into public healthcare systems through dedicated departments in central government hospitals demonstrate commitment to mainstreaming ayurveda. International promotional activities including participation in global exhibitions and the establishment of the WHO Global Centre for Traditional Medicine in Gujarat position India as a global leader in traditional medicine systems. The Union Budget 2025-26 increased the allocation for the Ministry of AYUSH to INR 3,992.90 Crore from INR 3,497.64 Crore (revised estimates) in 2024-25 for advancing evidence-based traditional medicine development.

Digital Transformation and E-Commerce Expansion

The proliferation of digital platforms and e-commerce channels has revolutionized ayurvedic product accessibility, enabling manufacturers to reach previously underserved consumer segments across geographic and demographic boundaries. Direct-to-consumer brands leveraging digital marketing and social media engagement have successfully attracted younger demographics traditionally distant from ayurvedic practices. Online marketplaces providing dedicated ayurveda storefronts enhance product visibility for small businesses and emerging brands competing alongside established players. Mobile applications offering personalized dosha assessments and product recommendations based on individual health profiles democratize access to ayurvedic wisdom through contemporary technological interfaces. The convenience of online purchasing combined with detailed product information, customer reviews, and authentication mechanisms builds consumer trust in digital channels. Celebrity and wellness influencer endorsements amplified through social media platforms significantly expand brand awareness and category penetration among digitally engaged consumers seeking authentic wellness solutions.

Market Restraints:

What Challenges is the India Ayurvedic Products Market Facing?

Standardization and Quality Control Inconsistencies

The absence of uniformly enforced standardization protocols across the fragmented manufacturing landscape poses significant challenges for product quality consistency and consumer safety assurance. Ayurvedic formulations often vary considerably between manufacturers due to differing interpretations of traditional recipes and variable ingredient sourcing practices. Small and medium enterprises frequently lack resources for comprehensive quality testing infrastructure, resulting in inconsistent product efficacy and potential contamination concerns that undermine overall category credibility.

Limited Scientific Validation and Clinical Evidence

The requirement for robust clinical trial data and scientific documentation to validate therapeutic claims presents ongoing challenges for ayurvedic product manufacturers seeking broader market acceptance. Limited investment in rigorous pharmacological research and evidence-based clinical studies constrains the ability to compete effectively with scientifically validated pharmaceutical alternatives. Regulatory complexities related to therapeutic claims and the perception of insufficient scientific rigor among certain consumer segments limit mainstream healthcare integration.

Raw Material Supply Chain Vulnerabilities

The industry faces persistent challenges in securing consistent supplies of quality-certified herbal raw materials essential for maintaining product authenticity and standardization. Variable agricultural conditions, sustainable harvesting constraints, and insufficient cultivation infrastructure for medicinal plants create supply chain vulnerabilities affecting production consistency. The scarcity of biological active marker compounds for product standardization combined with inadequate emphasis on sustainable herb development complicates quality assurance and scaling challenges.

Competitive Landscape:

The India ayurvedic products market has a moderately consolidated competitive environment with heritage brands dominating the market space and new-age direct-to-consumer brands disrupting the market. The market leaders have diversified their product portfolios across healthcare, personal care, and wellness segments and adopted aggressive marketing plans and extensive retail networks. R&D investments are focused on standardizing product formulations while maintaining the authenticity of ayurvedic products and creating innovative delivery systems that appeal to the modern consumer. The competitive landscape is shifting towards digital transformation, premium product offerings, and distribution networks in tier-two and tier-three markets. M&A activities have accelerated the consolidation process in the industry, and companies are focusing on enhancing manufacturing capacities, geographical reach, and niche brand acquisitions. The emergence of new-age wellness startups on e-commerce platforms and personalized product offerings has increased competition while also increasing overall category awareness.

Some of the key players include:

- Amrutanjan Health Care Ltd

- Biotique (Bio Veda Action Research Co.)

- Charak Pharma Pvt Ltd

- Dabur Ltd.

- Emami Ltd.

- Herbal Hills Wellness

- Himalaya Wellness Company

- Maharishi Ayurveda

- Patanjali Ayurved Limited

- Shahnaz Husain Group

- Viccolabs

Recent Developments:

- In October 2024, Subject to regulatory approvals, Dabur India Limited stated today that it has reached a merger agreement with Sesa Care Private Limited (Sesa). As part of the deal, Dabur would pay True North, a private equity fund, Rs 12.59 Crore at face value for 51% of Sesa's total paid-up Cumulative Redeemable Preference Shares (CRPS).

India Ayurvedic Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Billion |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Types Covered |

|

| Organized/Unorganized Covered | Organized, Unorganized |

| Region Covered | North India, East India, West and Central India, South India |

| Companies Covered | Amrutanjan Health Care Ltd, Biotique (Bio Veda Action Research Co.), Charak Pharma Pvt Ltd, Dabur Ltd, Emami Ltd, Herbal Hills Wellness, Himalaya Wellness Company, Maharishi Ayurveda, Patanjali Ayurved Limited, Shahnaz Husain Group, Viccolabs, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India ayurvedic products market size was valued at INR 1,017.51 Billion in 2025.

The India ayurvedic products market is expected to grow at a compound annual growth rate of 15.52% from 2026-2034 to reach INR 3,728.75 Billion by 2034.

Healthcare products dominated the market with a share of 58%, driven by increasing demand for ayurvedic medicines, herbal supplements, and immunity-boosting formulations among health-conscious consumers.

Key factors driving the India ayurvedic products market include rising consumer preference for natural wellness solutions, strong government support through AYUSH initiatives, expanding e-commerce platforms, and growing integration of Ayurveda into mainstream healthcare practices.

Major challenges include inconsistent quality standardization across manufacturers, limited clinical evidence for therapeutic claims, raw material supply chain vulnerabilities, regulatory complexities, and competition from established pharmaceutical alternatives in mainstream healthcare.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)