India Baby Care Products Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2026-2034

India Baby Care Products Market Summary:

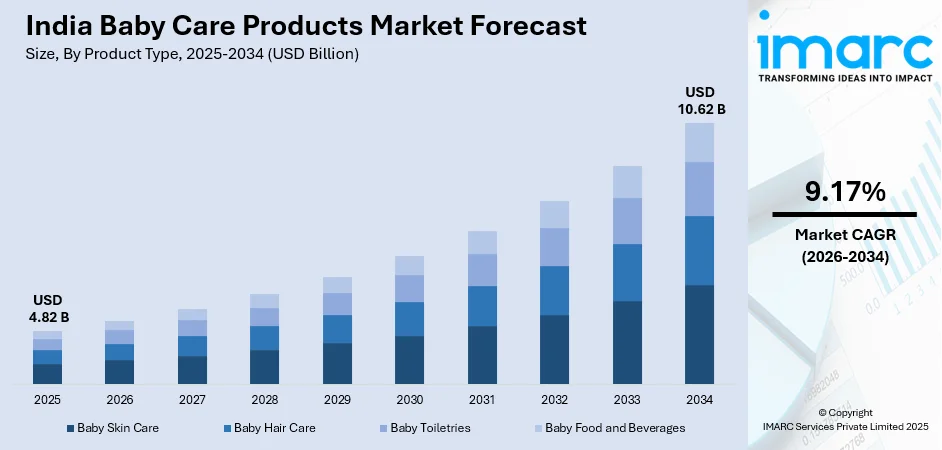

The India baby care products market size was valued at USD 4.82 Billion in 2025 and is projected to reach USD 10.62 Billion by 2034, growing at a compound annual growth rate of 9.17% from 2026-2034.

The India baby care products market is witnessing strong expansion driven by rising parental awareness regarding infant hygiene and wellness. Increasing urbanization, growing nuclear families, and higher disposable incomes are propelling demand for quality baby care solutions. The market benefits from expanding retail infrastructure, growing e-commerce penetration, and heightened focus on dermatologically tested, safe, and natural formulations tailored to Indian climatic conditions and consumer preferences.

Key Takeaways and Insights:

- By Product Type: Baby toiletries dominate the market with a share of 40% in 2025, owing to increasing awareness of infant hygiene practices, rising adoption of disposable diapers and wipes, and growing preference for gentle, dermatologically tested formulations. Expanding availability through modern retail and e-commerce channels continues to fuel segment growth.

- By Category: Mass leads the market with a share of 80.0% in 2025. This dominance is driven by affordability considerations among price-sensitive consumers, extensive distribution through general trade outlets, and widespread availability of competitively priced products across urban and rural markets nationwide.

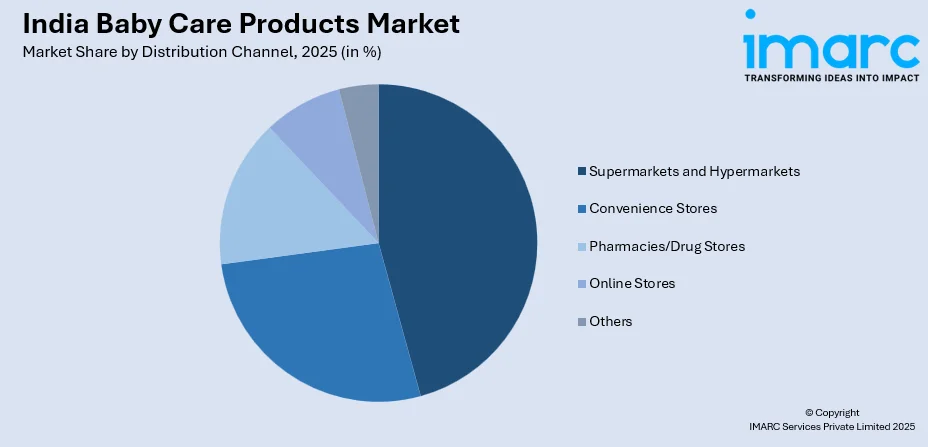

- By Distribution Channel: Supermarkets and hypermarkets represent the biggest segment with a market share of 45.5% in 2025, reflecting consumer preference for one-stop shopping experiences, organized retail formats, and promotional offers that enhance product accessibility and purchasing convenience for parents.

- By Region: South India is the largest region with 35.0% share in 2025, driven by higher literacy rates, greater awareness about child health, advanced retail infrastructure, and strong preference for premium and natural baby care products in urban centers like Bengaluru, Chennai, and Hyderabad.

- Key Players: Key players drive the India baby care products market by expanding product portfolios, improving safety and comfort technologies, and strengthening nationwide distribution networks. Their investments in research, innovation, sustainability, and strategic partnerships with healthcare providers boost awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments. Some of the key players operating in the market include Artsana S.p.A., Dabur India Ltd., Himalaya Global Holdings Ltd., Johnson & Johnson, Kimberly-Clark Corporation, Me N Moms Private Ltd., Nestle S.A, Pigeon Corporation, Procter & Gamble Company, and Unicharm Corporation.

To get more information on this market Request Sample

The India baby care products market is experiencing significant momentum driven by the convergence of favorable demographic trends, evolving consumer preferences, and expanding retail infrastructure. Rising urbanization and the proliferation of nuclear families have created heightened demand for convenient, ready-to-use baby care solutions that simplify childcare routines for working parents. The growing middle-class population with increasing disposable incomes is demonstrating greater willingness to invest in premium, safe, and dermatologically tested products for their infants. Parental awareness regarding infant hygiene, nutrition, and overall well-being has intensified, supported by pediatrician recommendations and digital health information accessibility. The expansion of e-commerce platforms and modern retail formats has enhanced product accessibility across urban and semi-urban regions, enabling brands to reach broader consumer bases and driving overall India baby care products market share.

India Baby Care Products Market Trends:

Rising Preference for Natural and Ayurveda-Inspired Formulations

Indian parents are increasingly gravitating toward natural, organic, and Ayurveda-inspired baby care products, prioritizing chemical-free and toxin-free formulations for their infants' sensitive skin. This shift reflects growing health consciousness and preference for traditional remedies combined with modern science. In 2024, Himalaya BabyCare introduced its Pure Cow Ghee range, featuring formulations free from harsh chemicals and designed to improve the skin barrier and protect the natural microbiome for newborns and babies with sensitive skin.

Expansion of Quick Commerce and Digital Distribution Channels

The rapid growth of quick commerce platforms is transforming how Indian parents purchase baby essentials, with curated assortments and rapid delivery becoming key differentiators. E-commerce penetration continues expanding into tier-two and tier-three cities, enabling broader product accessibility. In August 2025, baby care focused startup Peeko secured USD 3.2 Million funding, positioning itself as a vertical quick commerce platform promising curated baby product assortments and rapid delivery services to address instant parental demand.

Growing Focus on Dermatologically Tested and Sensitive Skin Solutions

Increased parental concern about infant skin safety and ingredient transparency is driving demand for dermatologically tested, hypoallergenic baby care products designed for sensitive skin. Manufacturers are responding with specialized formulations addressing conditions like dryness, eczema, and diaper rash. In August 2024, Minimalist extended its skincare range by introducing Minimalist Pediatrics, a fresh baby care range featuring diaper rash cream, lotion, cleanser, and massage oil created for sensitive skin and pediatrician-approved.

Market Outlook 2026-2034:

The India baby care products market is poised for sustained expansion throughout the forecast period, driven by favorable demographic dynamics, rising consumer awareness, and continuous product innovation. The growing participation of women in the workforce, increasing urbanization, and expanding middle-class population are expected to fuel demand for convenient and high-quality baby care solutions. The market generated a revenue of USD 4.82 Billion in 2025 and is projected to reach a revenue of USD 10.62 Billion by 2034, growing at a compound annual growth rate of 9.17% from 2026-2034. Government initiatives promoting maternal and child health, expansion of organized retail infrastructure, and growing e-commerce penetration are anticipated to enhance product accessibility and drive market growth across both urban and rural regions throughout India.

India Baby Care Products Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Baby Toiletries |

40% |

|

Category |

Mass |

80.0% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

45.5% |

|

Region |

South India |

35.0% |

Product Type Insights:

- Baby Skin Care

- Baby Hair Care

- Baby Toiletries

- Baby Bath Products and Fragrances

- Baby Diapers and Wipes

- Baby Food and Beverages

Baby toiletries dominate with a market share of 40% of the total India baby care products market in 2025.

The baby toiletries segment encompasses essential hygiene products including diapers, wipes, bath products, and fragrances that form the cornerstone of daily infant care routines. The segment's dominance reflects increasing parental awareness about hygiene practices and the convenience offered by disposable products for busy modern parents. Rising adoption of premium diapers with enhanced absorption capabilities and skin-friendly features continues driving segment growth. In February 2024, MamyPoko Pants launched Extra Absorb Pants featuring patented technologies offering enhanced thigh leak protection and extended absorption capabilities for uninterrupted sleep.

The baby toiletries market continues benefiting from innovations in product design, materials, and formulations tailored to Indian climatic conditions and consumer preferences. Manufacturers are increasingly focusing on developing products that combine effectiveness with gentleness, addressing concerns about skin sensitivity and chemical exposure. The expansion of organized retail and e-commerce channels has improved product accessibility across urban and semi-urban regions. In April 2025, Swara Baby Products launched India's first tree-free diaper technology under its Baby Hug Pro brand, significantly reducing wood pulp usage and promoting environmental sustainability in the baby hygiene segment.

Category Insights:

- Premium

- Mass

Mass leads with a share of 80.0% of the total India baby care products market in 2025.

The mass segment encompasses affordable, value-oriented baby care products accessible to the broader consumer base across India's diverse economic landscape. This category includes basic products like baby oils, powders, lotions, and nutrition supplements available at competitive prices through general trade outlets, supermarkets, pharmacies, and rural distribution networks. The segment's dominance reflects price sensitivity among middle-income and lower-income households who prioritize cost-effectiveness while maintaining product quality standards. In October 2024, Millennium Babycares raised INR 122 crore from Bharat Value Fund to strengthen its domestic presence in baby and adult diaper manufacturing.

Mass market baby care products benefit from extensive distribution networks covering both urban and rural areas, ensuring widespread availability and accessibility for price-conscious consumers. Manufacturers in this segment are continuously improving product quality while maintaining competitive pricing to meet increasing consumer expectations for safety and effectiveness. Economy diapers, soaps, and wipes serve as entry points for first-time buyers, particularly in smaller cities and semi-urban areas where affordability remains paramount. Manufacturers strategically tune pack sizes and grammage enabling consumers to test products without heavy upfront spending, thereby building brand loyalty and driving repeat purchases.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies/Drug Stores

- Online Stores

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 45.5% share of the total India baby care products market in 2025.

Supermarkets and hypermarkets serve as powerful distribution channels providing convenient one-stop shopping platforms for parents seeking comprehensive selections of baby products under one roof. These organized retail formats offer neat shelf configurations, discount offers, and availability of both premium and mass-market brands that attract parents valuing ease of access and product variety. The channel's dominance is particularly pronounced in urban and tier-one cities where modern retail infrastructure is well-developed and consumers appreciate the convenience of comparing multiple product options before making informed purchasing decisions.

The supermarkets and hypermarkets channel continues benefiting from accelerating urbanization and increasing modern retail infrastructure expansion across tier-one and tier-two cities. These formats enable product sampling and provide opportunities for brands to conduct promotional activities, educational sessions, and demonstrations that build consumer trust and product awareness. In-store promotions, loyalty programs, and bundled packages further enhance consumer engagement and drive sales volumes. The structured format of organized retail ensures appropriate product storage, handling, and display, maintaining product integrity for sensitive baby care items and enhancing overall shopping experience.

Regional Insights:

- North India

- West and Central India

- South India

- East India

South India represents the leading segment with 35.0% share of the total India baby care products market in 2025.

South India dominates the baby care products market owing to higher literacy rates, greater awareness about child health and hygiene, and relatively higher disposable incomes in states including Tamil Nadu, Karnataka, Kerala, and Telangana. The region benefits from strong urbanization, advanced retail infrastructure, and widespread availability of premium baby care brands across organized retail formats. Urban centers like Bengaluru, Hyderabad, Chennai, and Kochi demonstrate high adoption of premium diapers, organic lotions, and imported-style toiletries reflecting sophisticated consumer preferences shaped by exposure to international trends and health-conscious parenting practices.

The South India market continues expanding supported by higher parental awareness, strong healthcare networks, and a long tradition of using oils and herbal remedies for infant care that aligns with the growing demand for natural and Ayurveda-inspired formulations. Digital penetration and e-commerce adoption in the region have enhanced accessibility to diverse baby product ranges, enabling parents to compare options and access premium brands conveniently. In December 2024, Popees Baby Care Products announced plans to open 42 additional stores in the 2026 financial year, targeting key markets including Tamil Nadu, Karnataka, Andhra Pradesh, and Telangana.

Market Dynamics:

Growth Drivers:

Why is the India Baby Care Products Market Growing?

Rising Parental Awareness and Health Consciousness

Increasing awareness among Indian parents regarding infant health, hygiene, and nutrition is fundamentally reshaping purchasing patterns and driving market expansion. Modern parents are increasingly prioritizing products that ensure safety, comfort, and optimal development for their children, supported by pediatrician recommendations and digital health information accessibility. The growing emphasis on using specialized products designed specifically for infant care has elevated demand across all baby care categories. Parents are demonstrating greater willingness to invest in quality products featuring dermatological testing, safety certifications, and natural ingredients. The prevalence of dual-income households and nuclear families has intensified focus on convenient, ready-to-use solutions that simplify childcare routines.

Expanding E-commerce and Digital Retail Infrastructure

The rapid expansion of e-commerce platforms and digital retail channels is transforming baby care product distribution across India, enhancing accessibility and driving market growth. Online retail offers unmatched convenience, enabling parents to shop from home and access wide product varieties including premium and imported brands unavailable in physical stores. E-commerce platforms provide competitive pricing, doorstep delivery, and detailed product information that facilitate informed purchasing decisions. The proliferation of specialized baby care e-commerce platforms and quick commerce services is addressing instant parental demand with rapid delivery capabilities. Digital penetration in tier-two and tier-three cities has opened new market opportunities, enabling brands to reach previously underserved consumers.

Increasing Disposable Incomes and Premiumization Trends

Rising disposable incomes across India's expanding middle-class population are enabling greater investments in premium, specialized baby care products that ensure superior quality and safety. The growing affluence of urban and semi-urban households has created demand for advanced formulations, organic ingredients, and innovative product designs that offer enhanced benefits for infant health and development. Parents are increasingly willing to pay premium prices for products featuring safety certifications, natural compositions, and brand trustworthiness. The premiumization trend reflects evolving consumer expectations for quality over cost, particularly among millennial and digitally-savvy parents. The expansion of organized retail and premium baby care boutiques has improved access to high-end products across metropolitan and tier-one cities.

Market Restraints:

What Challenges the India Baby Care Products Market is Facing?

High Price Sensitivity in Rural and Lower-Income Segments

Affordability concerns in lower-income and rural segments limit the adoption of premium baby care products across significant portions of the Indian market. Many consumers outside metropolitan cities prioritize cost over brand value or quality, viewing specialized baby care items as luxury rather than necessity. The dominance of low-cost unbranded alternatives in local markets challenges premium brand penetration, while high production costs and limited pricing flexibility constrain market expansion in price-sensitive regions.

Limited Awareness and Traditional Remedy Preferences in Rural Areas

Cultural preferences for traditional remedies remain significant challenges in rural areas where parents continue relying on home-based practices including natural oils, herbal pastes, and cow ghee for infant care. These traditional methods are deeply ingrained in daily routines and often viewed as safer, more effective, and cost-efficient compared to commercial products. Limited awareness regarding branded and specialized baby care products combined with poor logistics infrastructure restricts market penetration in non-urban regions.

Counterfeit Products and Regulatory Compliance Challenges

The presence of counterfeit and low-quality products, particularly in rural areas, poses significant risks to consumer safety and brand credibility across the baby care market. Companies face challenges ensuring compliance with regulatory requirements and safety standards, especially for imported products. The lack of standardization and stringent regulatory frameworks for ingredient safety and labelling complicates market operations. Rising raw material costs, supply chain disruptions, and manufacturing compliance requirements impact profit margins for small and mid-sized manufacturers.

Competitive Landscape:

The India baby care products market is moderately fragmented, characterized by intense competition between established multinational corporations and agile domestic players. Global companies leverage their research expertise, advanced supply chains, and international brand recognition to maintain market presence, while domestic brands utilize their understanding of local preferences, cultural nuances, and efficient distribution networks to compete effectively. The competitive focus has shifted from price wars toward building consumer trust through authenticity, safety certifications, and innovative technology. Strategic acquisitions and partnerships are becoming increasingly common as companies aim to expand product portfolios and gain expertise in niche segments. Key players are investing significantly in product innovation, sustainable packaging, and digital marketing to appeal to environmentally aware and health-conscious consumers. The expansion of e-commerce has enabled newer entrants and direct-to-consumer brands to establish footholds by reaching consumers through online platforms, intensifying competition and driving continuous improvement in product quality and consumer offerings across all market segments.

Some of the key players include

- Artsana S.p.A.

- Dabur India Ltd.

- Himalaya Global Holdings Ltd.

- Johnson & Johnson

- Kimberly-Clark Corporation

- Me N Moms Private Ltd.

- Nestle S.A

- Pigeon Corporation

- Procter & Gamble Company

- Unicharm Corporation

Recent Developments:

- In January 2025, Panacea Biotec's wholly owned subsidiary, Panacea Biotec Pharma, launched baby diapers and wipes under the brand name 'NikoMom'. This launch marked the company's entry into the baby care segment, introducing toxin-free products designed for sensitive infant skin.

India Baby Care Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Baby Skin Care, Baby Hair Care, Baby Toiletries (Baby Bath Products and Fragrances, Baby Diapers and Wipes), Baby Food and Beverages |

| Categories Covered | Premium, Mass |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies/Drug Stores, Online Stores, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Artsana S.p.A., Dabur India Ltd., Himalaya Global Holdings Ltd., Johnson & Johnson, Kimberly-Clark Corporation, Me N Moms Private Ltd., Nestle S.A, Pigeon Corporation, Procter & Gamble Company and Unicharm Corporation. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India baby care products market size was valued at USD 4.82 Billion in 2025.

The India baby care products market is expected to grow at a compound annual growth rate of 9.17% from 2026-2034 to reach USD 10.62 Billion by 2034.

Baby toiletries dominated the market with a share of 40%, driven by increasing adoption of disposable diapers and wipes, rising hygiene awareness, and growing preference for convenient baby care solutions.

Key factors driving the India baby care products market include rising parental awareness about infant hygiene, increasing disposable incomes, expanding e-commerce penetration, and growing preference for natural and safe formulations.

Major challenges include high price sensitivity in rural and lower-income segments, limited awareness about branded products in non-urban areas, cultural preferences for traditional remedies, counterfeit product concerns, and regulatory compliance complexities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)