India Esports Market Size, Share, Trends and Forecast by Revenue Source, Games, Platform, and Region, 2025-2033

India Esports Market Size and Share:

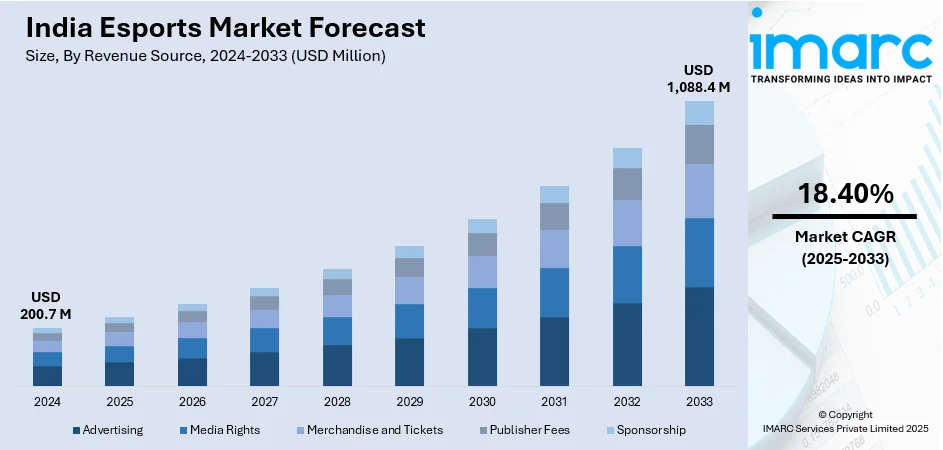

The India esports market size reached USD 200.7 Million in 2024. The market is expected to reach USD 1,088.4 Million by 2033, exhibiting a growth rate (CAGR) of 18.40% during 2025-2033. The market growth is attributed to the increasing popularity of mobile and PC-based video games among the millennials, shifting consumer preference for participation in online and mobile gaming tournaments as a recreational activity, lucrative opportunities offered by esports organizers such as international prize pools, streaming revenues and one-to-one sponsorships, widespread adoption of the free-to-play (F2P) gaming model, increasing penetration of high-speed internet especially in rural areas.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East India.

- On the basis of revenue source, the market has been divided into advertising, media rights, merchandise and tickets, publisher fees, and sponsorship.

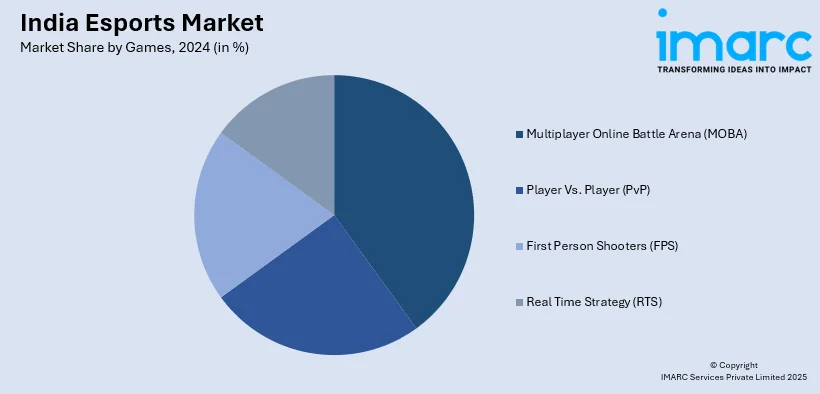

- On the basis of games, the market has been divided into multiplayer online battle arena (MOBA), player vs. player (PvP), first person shooters (FPS), and real time strategy (RTS).

- On the basis of platform, the market has been divided into pc-based esports, consoles-based esports, and mobile and tablets.

Market Size and Forecast:

- 2024 Market Size: USD 200.7 Million

- 2033 Projected Market Size: USD 1,088.4 Million

- CAGR (2025-2033): 18.40%

Esports, or electronic sports, are competitive video game tournaments organized through online gaming platforms. These games can be played by amateurs and professional gamers for leisure or professional championships on personal computers (PC), consoles, mobiles and tablets. The games are commonly available in multiplayer online battle arena (MOBA), player vs player (PvP), first-person shooters (FPS) and real-time strategy (RTS) formats. Esports are majorly played by gamers sponsored by organizations for advertisements, tickets, merchandise and media rights. The tournament is managed through various software that are also used for scheduling and promoting events, managing user registration, run branding campaigns and facilitate prize pools. The audiences can also watch the players compete and interact through a human-computer interface.

To get more information on this market, Request Sample

The India Esports market is primarily being driven by the increasing popularity of mobile and PC-based video games among the millennials. Moreover, the shifting consumer preference for participation in online and mobile gaming tournaments as a recreational activity is providing a thrust to the market growth. The esports revenue in India continues to expand as organizers offer lucrative opportunities, such as international prize pools, streaming revenues and one-to-one sponsorships, to game developers, gamers and influencers, which is also favoring the market growth. Additionally, the widespread adoption of the free-to-play (F2P) gaming model which enables the players to participate in games free of charge, is acting as another growth-inducing factor for the market. Players use specialized live streaming platforms to stream the game and connect directly with the opponents, team players and audiences. The esports market size in India reflects significant potential as factors including the increasing penetration of high-speed internet, especially in the rural areas, along with the widespread adoption of Esports in the education industry for enhancing the cognitive abilities of the students, are anticipated to drive the market toward growth.

India Esports Market Trends:

Cutting-Edge Technology Integration and Innovation Trends

The esports market in India is experiencing revolutionary changes through the integration of cutting-edge technologies that are reshaping competitive gaming experiences. Virtual Reality (VR) and Augmented Reality (AR) technologies are being increasingly adopted by esports organizers to create immersive tournament environments and enhance spectator engagement. Advanced gaming hardware, including high-refresh-rate displays, mechanical keyboards, and precision gaming mice, are becoming more accessible to Indian gamers, thereby elevating the overall competitive standard. Furthermore, cloud gaming platforms are democratizing access to high-end gaming experiences, allowing players from rural and semi-urban areas to participate in competitive esports without requiring expensive gaming hardware setups. The Indian esports industry is witnessing significant investments in blockchain technology for secure transaction processing, digital asset management, and the creation of non-fungible tokens (NFTs) for exclusive gaming collectibles. These technological innovations are transforming how tournaments are conducted, how prize pools are distributed, and how fans interact with their favorite esports personalities.

Regulatory and Policy Development Landscape

The industry is being significantly bolstered by progressive regulatory and policy developments that are providing a structured framework for the industry's expansion. Government recognition of esports as a legitimate sport has opened up new avenues for institutional support, including the establishment of training facilities, coaching programs, and academic courses focused on esports management and game development. The India esports market share is expanding as various state governments are implementing supportive policies for esports infrastructure development, including dedicated gaming arenas and incubation centers for esports startups. Taxation policies are being refined to create a more favorable environment for esports organizations, tournament organizers, and professional players. Legal recognition of esports athletes has enabled them to access benefits similar to traditional sports athletes, including visa facilitation for international tournaments, sponsorship opportunities, and government grants. The India esports market growth is further accelerated by the formalization of player contracts, standardization of tournament regulations, and the establishment of anti-doping policies specific to esports competitions. These regulatory developments are creating a more professional and structured ecosystem that attracts both domestic and international investments in the Indian esports sector.

Growth, Opportunities, and Challenges in the India Esports Market:

- Growth Drivers of the India Esports market: The primary growth drivers include the exponential increase in smartphone penetration and affordable high-speed internet connectivity across urban and rural areas, as per the India esports market analysis. The rising disposable income among millennials and Gen Z demographics, coupled with their preference for digital entertainment, is significantly boosting market expansion. Government initiatives supporting digital infrastructure development and recognition of esports as a legitimate sporting activity are creating favorable conditions for sustained industry growth.

- Opportunities in the India Esports market: The market presents substantial opportunities through the integration of traditional sports franchises and Bollywood entertainment with esports platforms, creating hybrid engagement models. The emergence of regional language gaming content and localized tournament formats offers significant potential for market penetration in tier-II and tier-III cities. Educational institutions incorporating esports programs and skill development courses are opening new revenue streams and talent development pathways.

- Challenges in the India Esports market: The industry faces challenges including inconsistent internet infrastructure in remote areas and the need for standardized regulatory frameworks across different states. Limited awareness about esports career opportunities among parents and educational institutions creates barriers to talent development. The market also confronts challenges related to monetization models, sustainable revenue generation for smaller organizations, and competition from international gaming platforms.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India esports market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on revenue source, games and platform.

Breakup by Revenue Source:

- Advertising

- Media Rights

- Merchandise and Tickets

- Publisher Fees

- Sponsorship

Breakup by Games:

- Multiplayer Online Battle Arena (MOBA)

- Player Vs. Player (PvP)

- First Person Shooters (FPS)

- Real Time Strategy (RTS)

Breakup by Platform:

- PC-Based Esports

- Consoles-Based Esports

- Mobile and Tablets

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- In March 2025, the Indian esports organization S8UL became the first Indian club to qualify for the prestigious Esports World Cup 2025, competing against the world’s top teams in PUBG Mobile and VALORANT. This milestone brought global exposure to Indian esports talent and elevated the country's position in the international gaming community.

- In February 2025, the WAVES Esports Championship (WESC 2025) featured over 35,000 participants competing in games like eFootball and World Cricket Championship. Winners from multiple phases moved on to grand finale events with opportunities for international representation, reflecting India’s expanding esports ecosystem bolstered by governmental and federation backing.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Revenue Source, Games, Platform, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the India Esports market to exhibit a CAGR of 18.40% during 2025-2033.

The growing demand for online and mobile gaming tournaments, coupled with introduction of numerous rewards, such as international prize pools, streaming revenues, and one-to-one sponsorships, are primarily driving the India Esports market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing demand for Esports among the millennials, owing to the temporary restrictions on outdoor recreational activities during the lockdown scenario across the nation.

Based on the revenue source, the India Esports market can be categorized into advertising, media rights, merchandise and tickets, publisher fees, and sponsorship. Among these, advertising accounts for the majority of the total market share.

Based on the games, the India Esports market has been segregated into Multiplayer Online Battle Arena (MOBA), Player Vs. Player (PvP), First Person Shooters (FPS), and Real Time Strategy (RTS). Currently First Person Shooters (FPS) game holds the largest market share.

Based on the platform, the India Esports market can be bifurcated into PC-based Esports, consoles-based Esports, and mobile and tablets. Among these, mobile and tablets exhibit a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominate the India Esports market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)