India Flavors Market Size, Share, Trends and Forecast by Product Type, Form, Application, and Region, 2025-2033

Market Overview:

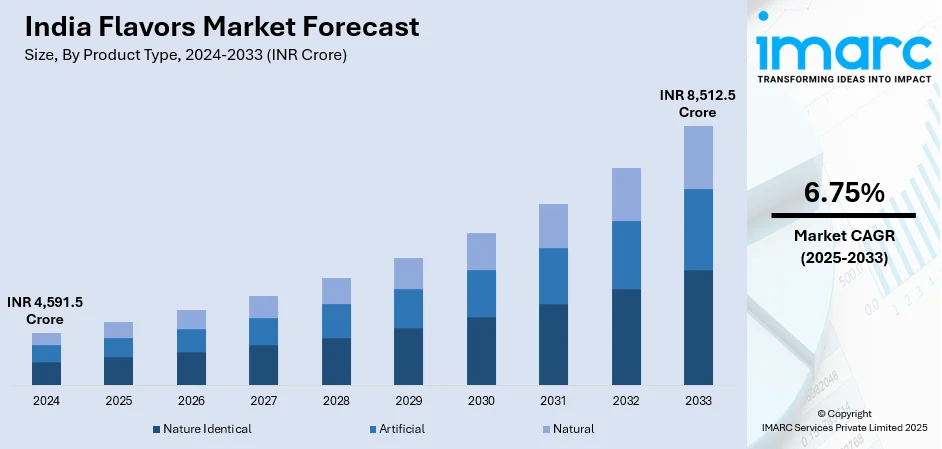

The India flavors market size reached INR 4,591.5 Crore in 2024. Looking forward, IMARC Group expects the market to reach INR 8,512.5 Crore by 2033, exhibiting a growth rate (CAGR) of 6.75% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 4,591.5 Crore |

|

Market Forecast in 2033

|

INR 8,512.5 Crore |

| Market Growth Rate 2025-2033 | 6.75% |

Flavors refer to additive compounds that are widely used to enhance the smell and taste of numerous products ranging from confectionery items to health supplements. Based on the derivates, flavors are categorized into nature identical, artificial, and natural variants. Some of the commonly used natural ingredients of flavors include spices, herbs, barks, flowers, etc., whereas chemical additives comprise of ethyl maltol, diacetyl, ethyl propionate, etc. Flavors are extensively utilized in baked goods, dairy products, beverages, packaged snack items, pharmaceuticals, etc. Apart from this, they are also adopted for non-food applications, including personal care products, cosmetics, pet food, animal feed, etc.

To get more information on this market, Request Sample

India Flavors Market Trends:

The expanding food processing industry, along with the increasing demand for packaged, ready-to-eat food items and beverages, is primarily driving the India flavors market. Moreover, the rising utilization of flavoring ingredients in bakery and confectionery items, ice-creams, smoothies, energy drinks, etc., is also propelling the market growth in the country. Additionally, the elevating levels of urbanization and increasing penetration of numerous western food trends are further augmenting the demand for flavoring agents. The escalating popularity of processed and shelf-stable food products, such as noodles, soups, cake mix, RTD tea and coffee, juices, etc., particularly among the millennial consumers, is catalyzing the market for flavors in India. Besides this, the introduction of several stringent norms by the Food Safety and Standards Authority of India (FSSAI) regarding the quality of flavors used in processed food products is acting as another significant growth-inducing factor. Additionally, the elevating number of quick-service restaurants (QSRs) and the emerging café culture are further bolstering the demand for flavors. Moreover, the rising consumer concerns towards the negative health impact of chemical-based flavoring agents are propelling the adoption of natural ingredients-based flavors. In line with this, the emergence of various healthier product variants, including vegan and organic flavors, that contain 100% plant-based derivatives is expected to drive the India flavors market in the coming years.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India flavors market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, form and application.

Breakup by Product Type:

- Nature Identical

- Artificial

- Natural

Breakup by Form:

- Liquid

- Dry

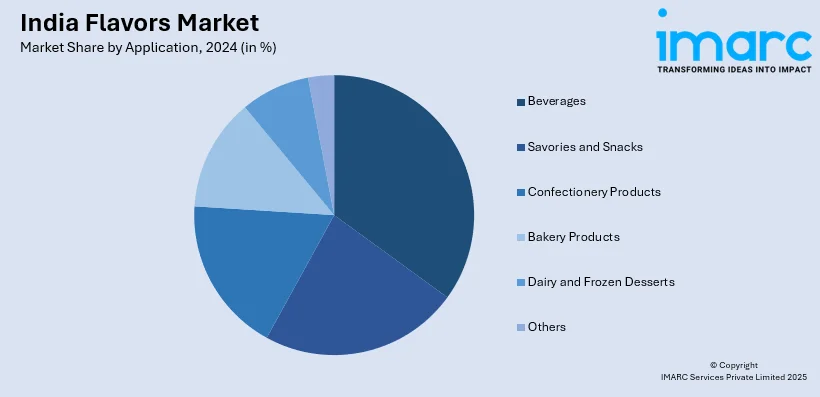

Breakup by Application:

- Beverages

- Savories and Snacks

- Confectionery Products

- Bakery Products

- Dairy and Frozen Desserts

- Others

Breakup by Region:

- South India

- North India

- West and Central India

- East India

Competitive Landscape:

The report has also analysed the competitive landscape of the market with some of the key players being Doehler India Pvt. Ltd, Firmenich Aromatics (India) Private Limited, Flavaroma Flavors and Fragrances Private Limited, Givaudan (India) Private Limited (Givaudan SA), Gupta & Company (P) Limited, International Flavors and Fragrances India Pvt. Ltd, Kerry Ingredients India (P) Ltd, Keva Flavours Pvt. Ltd. (S. H. KELKAR & Co. Ltd.), MANE Flavor & Fragrance Manufacturer, Oriental Aromatics Limited, Sacheerome Private Limited, Symrise Private Limited (Symrise AG), Synthite Industries Ltd, and Ultra International Limited.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Crore |

| Segment Coverage | Product Type, Form, Application, Region |

| Region Covered | South India, North India, West and Central India, East India |

| Companies Covered | Doehler India Pvt. Ltd, Firmenich Aromatics (India) Private Limited, Flavaroma Flavors and Fragrances Private Limited, Givaudan (India) Private Limited (Givaudan SA), Gupta & Company (P) Limited, International Flavors and Fragrances India Pvt. Ltd, Kerry Ingredients India (P) Ltd, Keva Flavours Pvt. Ltd. (S. H. KELKAR & Co. Ltd.), MANE Flavor & Fragrance Manufacturer, Oriental Aromatics Limited, Sacheerome Private Limited, Symrise Private Limited (Symrise AG), Synthite Industries Ltd, and Ultra International Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India flavors market was valued at INR 4,591.5 Crore in 2024.

We expect the India flavors market to exhibit a CAGR of 6.75% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic has led to the shifting consumer preferences from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of various flavor variants.

The rising preference towards natural ingredients-based, vegan, and organic flavors to enhance the smell and taste of numerous food items, owing to the growing consumer concerns regarding negative health impact of chemical-based flavoring agents, is primarily driving the India flavors market.

Based on the product type, the India flavors market can be categorized into nature identical, artificial, and natural. Currently, nature identical type holds the majority of the total market share.

Based on the form, the India flavors market has been segmented into liquid and dry, where liquid form currently accounts for the largest market share.

Based on the application, the India flavors market can be bifurcated into beverages, savories and snacks, confectionery products, bakery products, dairy and frozen desserts, and others. Among these, beverages account for the majority of the total market share.

On a regional level, the market has been classified into South India, North India, West and Central India, and East India, where North India currently dominates the India flavors market.

Some of the major players in the India flavors market include Doehler India Pvt. Ltd, Firmenich Aromatics (India) Private Limited, Flavaroma Flavors and Fragrances Private Limited, Givaudan (India) Private Limited (Givaudan SA), Gupta & Company (P) Limited, International Flavors and Fragrances India Pvt. Ltd, Kerry Ingredients India (P) Ltd, Keva Flavours Pvt. Ltd. (S. H. KELKAR & Co. Ltd.), MANE Flavor & Fragrance Manufacturer, Oriental Aromatics Limited, Sacheerome Private Limited, Symrise Private Limited (Symrise AG), Synthite Industries Ltd, Ultra International Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)