India Freight Transportation Management Market Size, Share, Trends and Forecast by Solutions, Services, Deployment Type, Organization Size, Mode of Transport, Vertical, and Region, 2025-2033

Market Overview:

The India freight transportation management market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.9 Billion by 2033, exhibiting a growth rate (CAGR) of 10.1% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Market Growth Rate (2025-2033) | 10.1% |

Freight transportation management helps in planning, executing, and optimizing the movement of goods between the supplier and consignee. It includes an integration of technology, expertise, and human resources that ensure expeditious coordination for maintaining the supply chain. Freight transportation management system offers several benefits in improving shipping efficiency, gaining real-time supply chain visibility, reducing overhead freight expenses, increasing customer satisfaction, etc. As a result, freight transportation management is widely utilized by manufacturers, distributors, retailers, and third-party logistics (3PL) providers across various industry verticals.

To get more information on this market, Request Sample

India Freight Transportation Management Market Trends:

The rising levels of industrialization due to the emergence of the 'Make in India' initiative are catalyzing the demand for freight transportation management across diverse industry verticals, such as pharmaceuticals, FMCG, automobiles, etc. Furthermore, the increasing adoption of tank wagons for supplying various industrial materials, such as oil and gas, refined petroleum products, chemicals, etc., are also augmenting the market for freight transportation management. Apart from this, the growing investments by the Indian government in the development of dedicated freight corridors (DFC) and upgradation of the existing transportation infrastructures in the country are further propelling the market. Additionally, the expanding e-commerce sector coupled with the increasing number of warehouses and storage facilities is also bolstering the market growth in India. Moreover, a significant rise in the bilateral trade activities with several nations is further catalyzing the need for efficient freight management systems to manage international inbound and outbound shipments. In recent times, the sudden outbreak of the COVID-19 pandemic in the country has positively influenced the market for freight transportation management for various essential healthcare products, such as PPE kits, oxygen concentrators, vaccines, etc. In the coming years, the rising integration of freight transportation systems with various advanced technologies, such as Artificial Intelligence, Global Positioning System (GPS), Internet-of-Things, etc., will continue to drive the market growth in India.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India freight transportation management market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on solutions, services, deployment type, organization size, mode of transport and vertical.

Breakup by Solutions:

- Freight Transportation Cost Management

- Freight Security and Monitoring Systems

- Freight Mobility Solutions

- Freight Operation Management Solutions

- Freight 3PL Solutions

- Freight Information Management Solutions

- Warehouse Management System

Breakup by Services:

- Business Services

- Managed Services

- System Integration

- Others

Breakup by Deployment Type:

- On-Premise

- Hosted/Cloud-Based

Breakup by Organization Size:

- Small Medium Business (SMBs)

- Large Business

Breakup by Mode of Transport:

- Roadways

- Railways

- Seaways

- Airways

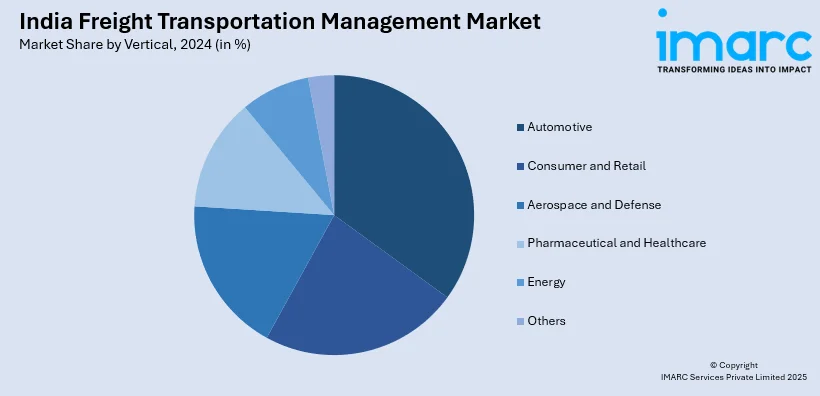

Breakup by Vertical:

- Automotive

- Consumer and Retail

- Aerospace and Defense

- Pharmaceutical and Healthcare

- Energy

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players being Accenture, Blue Yonder Group Inc. (Panasonic Corporation), BluJay Solutions Ltd., C.H. Robinson Worldwide Inc., Geodis, Manhattan Associates, Oracle, SAP, SAR Transport Systems India Private Limited and Softeon.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Solutions, Services, Deployment Type, Organization Size, Mode of Transport, Vertical, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Accenture, Blue Yonder Group Inc. (Panasonic Corporation), BluJay Solutions Ltd., C.H. Robinson Worldwide Inc., Geodis, Manhattan Associates, Oracle, SAP, SAR Transport Systems India Private Limited and Softeon. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the India freight transportation management market to exhibit a CAGR of 10.1% during 2025-2033.

The emergence of the 'Make in India' initiative, along with the rising applications of freight transportation management by manufacturers, distributors, retailers, etc., for efficient supply chain operations, are primarily driving the India freight transportation management market.

The sudden outbreak of the COVID-19 pandemic has led to the rising demand for freight transportation management system across the nation for planning, executing, and optimizing the movement of various essential healthcare products, such as PPE kits, oxygen concentrators, vaccines, etc.

Based on the solutions, the India freight transportation management market has been segmented into freight transportation cost management, freight security and monitoring systems, freight mobility solutions, freight operation management solutions, freight 3PL solutions, freight information management solutions, and warehouse management system. Currently, freight transportation cost management solution holds the majority of the total market share.

Based on the services, the India freight transportation management market can be divided into business services, managed services, system integration, and others. Among these, business services currently exhibit a clear dominance in the market.

Based on the deployment type, the India freight transportation management market has been categorized into on-premise and hosted/cloud-based. Currently, on-premise deployment accounts for the majority of the total market share.

Based on the organization size, the India freight transportation management market can be segregated into Small Medium Business (SMBs) and large business, where large business currently holds the largest market share.

Based on the mode of transport, the India freight transportation management market has been bifurcated into roadways, railways, seaways, and airways. Among these, roadways currently exhibit a clear dominance in the market.

Some of the major players in the India freight transportation management market include Accenture, Blue Yonder Group Inc. (Panasonic Corporation), BluJay Solutions Ltd., C.H. Robinson Worldwide Inc., Geodis, Manhattan Associates, Oracle, SAP, SAR Transport Systems India Private Limited, and Softeon.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)