India Lingerie Market Size, Share, Trends and Forecast by Product Type, Material, Price Range, Distribution Channel, and Region, 2026-2034

India Lingerie Market Summary:

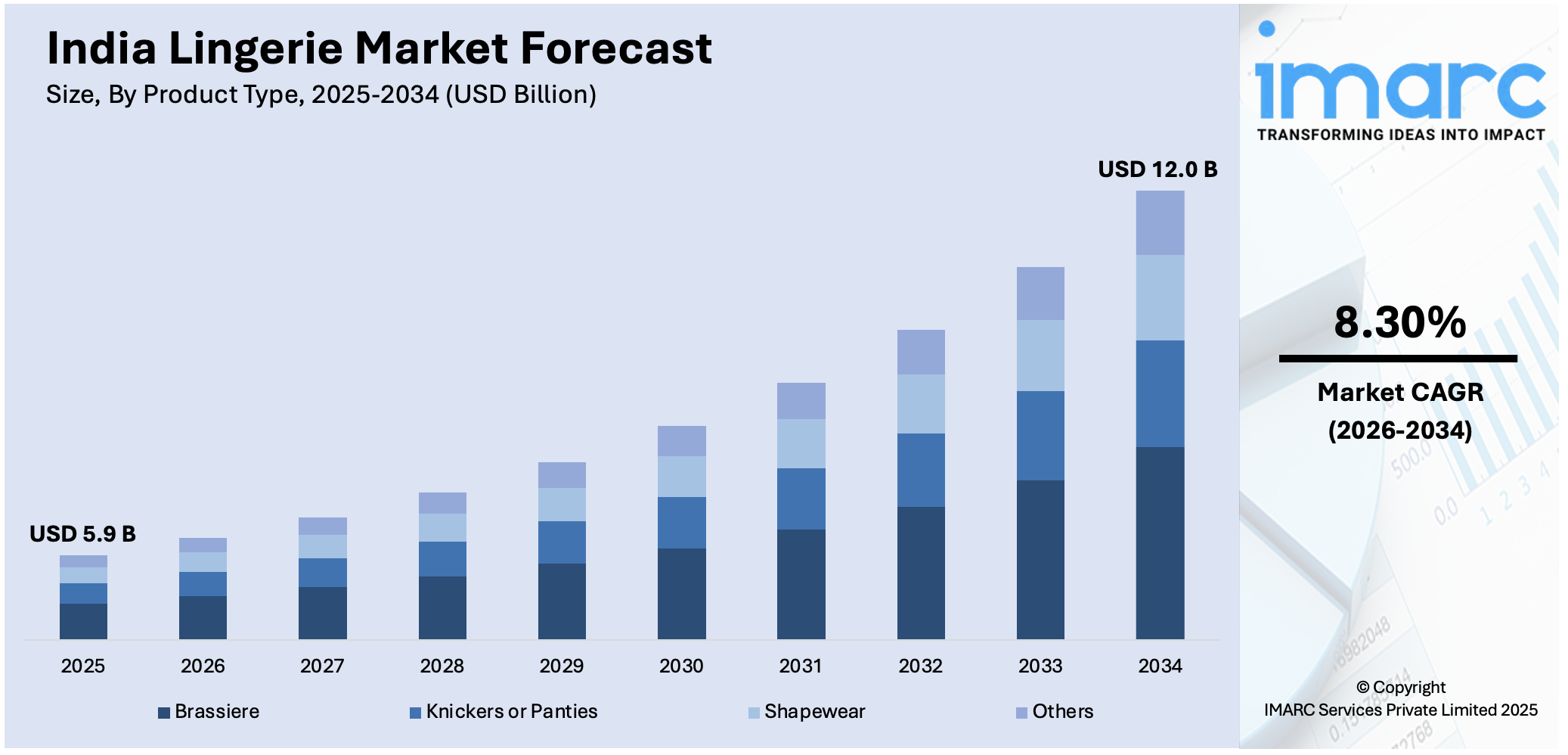

The India lingerie market size was valued at USD 5.9 Billion in 2025 and is projected to reach USD 12.0 Billion by 2034, growing at a compound annual growth rate of 8.30% from 2026-2034.

The India lingerie market is experiencing robust growth driven by evolving consumer preferences, rising fashion consciousness, and increasing acceptance of intimate apparel as essential wardrobe staples. Expanding e-commerce platforms, growing urbanization, and improving retail infrastructure are enhancing product accessibility across diverse demographics. The convergence of comfort-centric designs with contemporary aesthetics continues reshaping purchasing patterns, positioning the sector for sustained expansion in the India lingerie market share.

Key Takeaways and Insights:

- By Product Type: Brassiere dominates the market with a share of 46% in 2025, owing to its essential role in providing support, comfort, and shaping for women across all age groups. Growing product diversification including sports bras, wireless designs, and T-shirt bras is fueling consumer adoption.

- By Material: Cotton leads the market with a share of 40% in 2025. This dominance is driven by consumer preference for breathable, skin-friendly fabrics suited to India's tropical climate. Cotton's natural moisture-wicking properties and affordability strengthen its market position.

- By Price Range: Economy represents the biggest segment with a market share of 69% in 2025, reflecting strong consumer demand for affordable yet quality intimate apparel. Price sensitivity among middle-income households and widespread availability through mass retail channels sustain segment leadership.

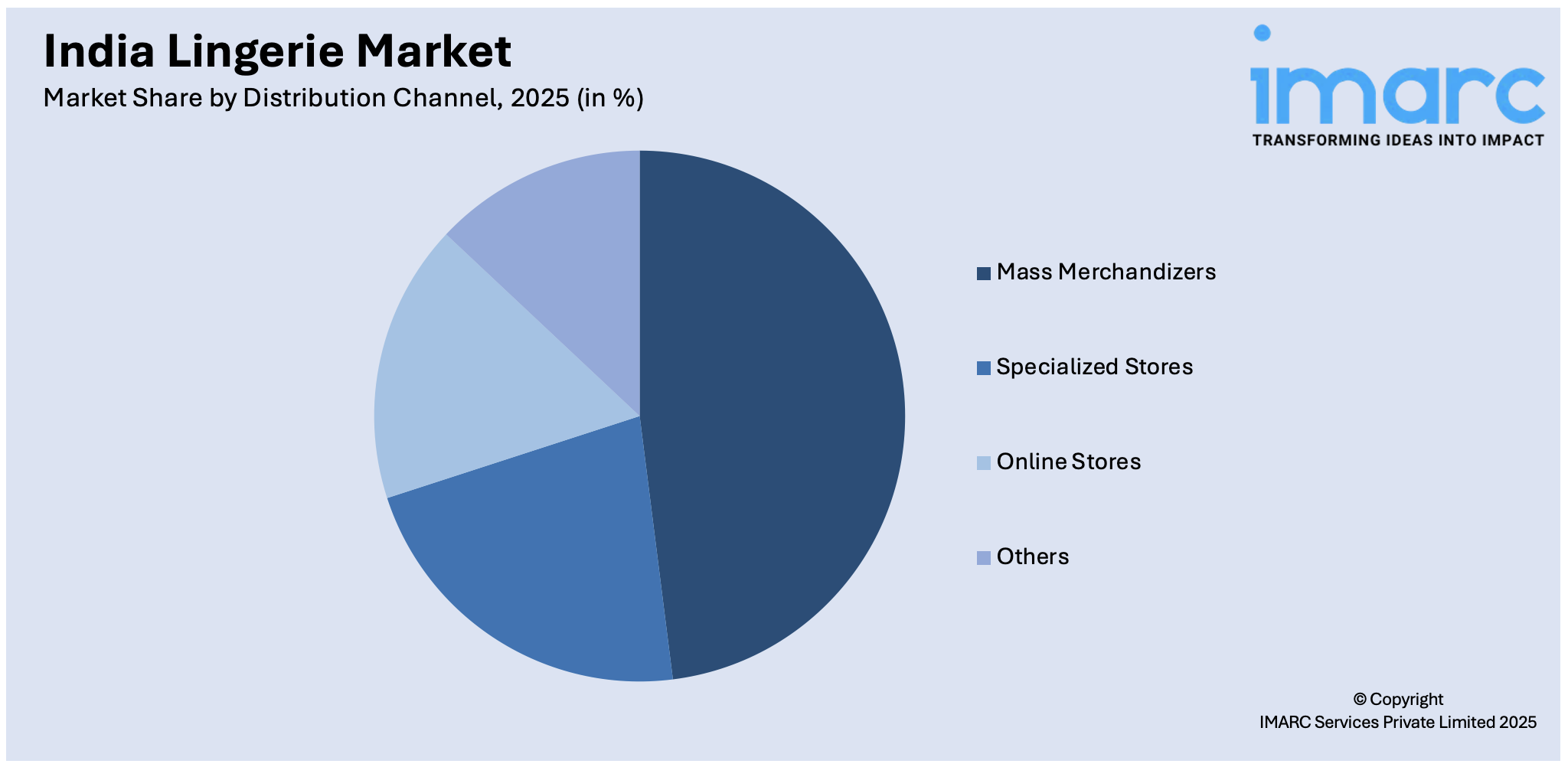

- By Distribution Channel: Mass merchandizers dominate the market with a share of 47% in 2025, owing to their extensive geographic reach, competitive pricing strategies, and ability to offer diverse product assortments that cater to varied consumer preferences across urban and semi-urban regions.

- By Region: North India is the largest region with 33% share in 2025, driven by higher population density, elevated disposable incomes, and advanced retail infrastructure in metropolitan centers including Delhi-NCR, Punjab, and Uttar Pradesh.

- Key Players: Key players drive the India lingerie market by expanding product portfolios, improving comfort technologies, and strengthening distribution networks. Their investments in digital marketing, omnichannel strategies, and partnerships with e-commerce platforms boost brand awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

As cultural attitudes change, fashion consciousness rises, and more women enter the job, the Indian lingerie business is expanding. The demand for high-end, branded intimate clothing is rising due to urbanization trends, as urban consumers are beginning to view lingerie as fashion statements rather than just practical clothing. Customers in smaller cities can now explore products that were previously exclusive to major metropolitan areas thanks to the growth of structured retail formats and advanced e-commerce platforms. Growing female employment is directly linked to increased purchasing power and rising demand for high-quality undergarments because financially independent women are more willing to spend money on cozy and fashionable undergarments. This demographic shift, along with aggressive social media brand promotion, celebrity endorsements, and tailored shopping experiences via AI-powered recommendation engines, creates an environment that is conducive to long-term market growth in both established urban centers and developing tier-two cities across the nation.

India Lingerie Market Trends:

Digital Transformation Reshaping Consumer Engagement

Lingerie retail in India has undergone a revolution thanks to the quick growth of e-commerce platforms, which have democratized access to a wide range of products across geographical boundaries and removed long-standing obstacles related to intimate apparel purchase. Online channels are particularly tempting to customers who desire discreet shopping experiences for personal things since they provide privacy, convenience, and a wide range of products that physical retail formats cannot match. Without investing in traditional retail infrastructure, digital platforms have made it possible for direct-to-consumer firms to develop a market presence. This has encouraged innovation and competition, which benefits customers through better products and competitive pricing. As digital adoption picks up speed, the Indian fashion e-commerce sector is showing a robust development trajectory, with loungewear and innerwear serving as important expansion categories. Artificial intelligence-powered fit technologies, virtual try-on capabilities, and tailored suggestions are all integrated to improve online shopping experiences and boost consumer confidence when buying intimate clothing online.

Body Positivity and Size Inclusivity Movements

Growing consumer awareness around body positivity is driving brands to expand their size offerings and develop inclusive product lines that accommodate diverse body types. Manufacturers are recognizing the underserved plus-size market segment and responding with dedicated collections featuring extended size ranges. This trend reflects broader cultural shifts toward celebrating body diversity and rejecting restrictive beauty standards. In September 2024, Clovia launched its first collection of plus-size bras featuring sizes from 32B to 44F, demonstrating industry commitment to inclusivity and addressing unique consumer needs.

Comfort-First Design Philosophy Gaining Prominence

Wireless bras, seamless designs, and breathable fabrics are in high demand as modern customers place a higher priority on comfort than aesthetics. Preferences for loungewear-inspired intimate clothing that works well in both home and informal outdoor situations have increased due to the trend toward remote work arrangements. Fabric technological advancements, such as moisture-wicking fabrics and antimicrobial treatments, are meeting practical needs without sacrificing aesthetic appeal. In order to improve all-day wearability, industry makers are spending in research and development to produce adaptive designs that intelligently mold to individual body forms.

Market Outlook 2026-2034:

The India lingerie market demonstrates strong fundamentals for sustained expansion throughout the forecast period, supported by favorable demographic trends, rising disposable incomes, and evolving consumer attitudes toward intimate apparel. Increasing female workforce participation and growing urbanization continue strengthening demand across product categories. The market generated a revenue of USD 5.9 Billion in 2025 and is projected to reach a revenue of USD 12.0 Billion by 2034, growing at a compound annual growth rate of 8.30% from 2026-2034. E-commerce expansion into tier-two and tier-three cities presents significant growth opportunities, while product innovations addressing comfort, inclusivity, and sustainability requirements position manufacturers to capture evolving consumer preferences. Strategic investments in omnichannel distribution, personalized marketing, and technology integration will differentiate market leaders.

India Lingerie Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Brassiere |

46% |

|

Material |

Cotton |

40% |

|

Price Range |

Economy |

69% |

|

Distribution Channel |

Mass Merchandizers |

47% |

|

Region |

North India |

33% |

Product Type Insights:

- Brassiere

- Knickers or Panties

- Shapewear

- Others

Brassiere dominates with a market share of 46% of the total India lingerie market in 2025.

Because of their vital role in supporting, comforting, and shaping women of all ages and lifestyles, brassieres are the cornerstone of the Indian lingerie business and command a lot of customer attention. With manufacturers launching specialized designs like sports bras for active lives, wireless choices for everyday comfort, and T-shirt bras for seamless aesthetics under fitted apparel, the market benefits from ongoing product innovation. Because of their versatility in design, bras can accommodate a wide range of events, body shapes, and fashion tastes, making them vital pieces for any wardrobe.

The desire for inclusive brassiere alternatives that accommodate different breast sizes and shapes has increased because to the growing emphasis on body acceptance and the celebration of diversity. Leading manufacturers have expanded their product portfolios to include plus-size collections that appeal to previously underserved consumer categories as a result of brands realizing the importance of providing wide size ranges to reach larger client bases. Customers are increasingly drawn to high-quality brassieres that blend practicality and modern style due to growing awareness of appropriate fitting and its effects on posture and general health, further solidifying sector leadership in the intimate apparel market.

Material Insights:

- Cotton

- Silk

- Satin

- Nylon

- Others

Cotton leads with a share of 40% of the total India lingerie market in 2025.

Cotton maintains undisputed leadership in the India lingerie market material segment, driven by its natural breathability, skin-friendly properties, and excellent suitability for the country's predominantly tropical climate. Indian consumers demonstrate strong preference for cotton intimate apparel due to its moisture-wicking capabilities, hypoallergenic characteristics, and durability through multiple wash cycles. The material's affordability compared to synthetic alternatives further strengthens its market position, making quality lingerie accessible to price-conscious middle-income households across urban and rural regions.

Emerging trends in sustainable fashion are reinforcing cotton's dominance as environmentally conscious consumers gravitate toward natural fibers over synthetic alternatives. Fabrics like organic cotton and bamboo are increasingly gaining popularity over synthetic materials in the Indian undergarment market, reflecting growing consumer awareness about textile sustainability. Manufacturers are responding by introducing innovative cotton blends incorporating antibacterial and antimicrobial treatments, enhancing functional benefits while preserving the material's inherent comfort advantages. This combination of traditional comfort attributes with modern technological enhancements positions cotton as the preferred choice for health-conscious and environmentally aware consumers seeking reliable everyday intimate apparel solutions.

Price Range Insights:

- Economy

- Premium

Economy exhibits a clear dominance with 69% share of the total India lingerie market in 2025.

The economy segment's commanding position reflects the fundamental price sensitivity characterizing the Indian consumer landscape, where value-conscious purchasing decisions dominate household spending patterns. Mass-market brands have successfully penetrated this segment by offering quality products at competitive price points, leveraging efficient manufacturing processes and economies of scale to maintain affordability without compromising essential functional attributes. The segment benefits from extensive distribution through mass merchandizers and multi-brand retailers ensuring widespread product availability across diverse geographic markets.

Despite economy segment dominance, premiumization trends are gradually reshaping consumer preferences as rising disposable incomes enable aspirational purchasing behaviors among urban and semi-urban consumers. The India premium lingerie market demonstrates strong growth potential, indicating growing consumer willingness to invest in superior quality fabrics, innovative designs, and branded products that offer enhanced comfort, durability, and style differentiation compared to basic economy offerings. This evolving landscape suggests a gradual shift toward quality-focused purchasing as consumers become increasingly aware of the long-term benefits associated with investing in well-constructed intimate apparel that delivers superior fit, comfort, and longevity.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Mass Merchandizers

- Specialized Stores

- Online Stores

- Others

Mass merchandizers represent the leading segment with 47% share of the total India lingerie market in 2025.

Mass merchandizers maintain dominant market position through their extensive geographic footprint, competitive pricing strategies, and ability to aggregate diverse product assortments from multiple brands under single retail destinations. These retail formats appeal to value-seeking consumers who prioritize convenience and affordability, offering one-stop shopping experiences that simplify purchasing decisions. Their established supply chain networks enable consistent product availability across metropolitan centers and emerging tier-two cities throughout the country.

While mass merchandizers lead current distribution, online channels represent the fastest-growing segment driven by digital transformation across Indian retail. E-commerce platforms including specialized lingerie retailers have democratized access to diverse intimate apparel options, particularly benefiting consumers in smaller towns where physical retail infrastructure remains limited. The India fashion e-commerce market demonstrates substantial growth momentum, with innerwear representing a key expansion category as consumers increasingly embrace online shopping for intimate apparel. Digital platforms offer privacy, convenience, and extensive product variety that traditional retail formats cannot match, enabling brands to reach previously underserved consumer segments across diverse geographic regions and accelerating overall market penetration.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India holds the largest share with 33% of the total India lingerie market in 2025.

North India exhibits strong market dominance supported by a combination of higher disposable incomes, heightened fashion awareness, and developed retail infrastructure concentrated in major metropolitan centers. The region's urban centers including Delhi-NCR, Punjab, Haryana, and Uttar Pradesh serve as trend incubators, hosting sophisticated branded retail outlets and premium shopping destinations that attract fashion-conscious consumers. Growing female workforce participation in northern metropolitan areas, combined with expanding middle-class populations and improved access to diverse product assortments through both physical and online retail channels, reinforces the region's leadership position in the India lingerie market.

The presence of international and domestic brands establishing flagship stores in northern cities further elevates consumer expectations and drives demand for quality intimate apparel. Additionally, cultural shifts toward viewing lingerie as essential fashion items rather than mere functional necessities are particularly pronounced in these cosmopolitan urban centers. Strong e-commerce penetration and efficient logistics networks ensure seamless product delivery across the region, enabling consumers in smaller northern cities to access branded products previously available only in major metros.

Market Dynamics:

Growth Drivers:

Why is the India Lingerie Market Growing?

Rising Female Workforce Participation and Economic Independence

The substantial increase in female labor force participation across India represents a fundamental driver of lingerie market growth, as economically independent women demonstrate greater purchasing power and willingness to invest in quality intimate apparel. Working women prioritize comfort, functionality, and professional aesthetics in their wardrobe choices, driving demand for diverse lingerie categories ranging from everyday essentials to specialized products for active lifestyles. This demographic shift creates sustained demand for products addressing varied occasions, from office-appropriate seamless designs to athletic-performance brassieres. The Pradhan Mantri Jan Dhan Yojana has facilitated opening 52.3 Crore bank accounts, of which 55.6% are women account holders as of May 2024, reflecting growing financial inclusion that strengthens purchasing capabilities across consumer segments.

Rapid Urbanization and Evolving Consumer Lifestyles

India's accelerating urbanization is transforming consumer attitudes toward intimate apparel, with metropolitan residents increasingly viewing lingerie as fashion statements rather than mere functional necessities. Urban consumers demonstrate greater exposure to international fashion trends through social media platforms, celebrity endorsements, and influencer marketing, driving aspirational purchasing behaviors that favor branded and premium products. The concentration of organized retail infrastructure in urban centers provides convenient access to diverse product assortments, while improved digital connectivity enables consumers to explore options previously unavailable in local markets. India's expanding urban population demonstrates sustained growth momentum, with rising teledensity and broadband connectivity enabling urban consumers to enjoy seamless exposure to digital fashion trends and platforms that shape intimate apparel purchasing decisions across metropolitan and emerging city markets.

E-commerce Expansion and Digital Retail Transformation

The rapid expansion of e-commerce platforms has revolutionized lingerie retail in India, democratizing access to diverse products across geographic boundaries and overcoming traditional barriers associated with intimate apparel shopping. Online channels offer privacy, convenience, and extensive product variety that physical retail formats cannot match, appealing particularly to consumers who prefer discreet purchasing experiences for personal items. Digital platforms have enabled direct-to-consumer brands to establish market presence without traditional retail infrastructure investments, fostering innovation and competition that benefits consumers through improved products and competitive pricing. The India fashion e-commerce market demonstrates strong growth trajectory, with innerwear and loungewear representing key expansion categories as digital adoption accelerates. The integration of artificial intelligence-driven fit technology, virtual try-on features, and personalized recommendations enhances online shopping experiences and drives consumer confidence in purchasing intimate apparel through digital channels.

Market Restraints:

What Challenges the India Lingerie Market is Facing?

Cultural Sensitivities and Traditional Taboos

Cultural norms and taboos surrounding lingerie shopping in India present significant barriers to market expansion, particularly in conservative regions where societal expectations dictate modesty and privacy in discussing intimate apparel. Many consumers, especially in traditional communities, perceive lingerie as a private matter and experience discomfort when shopping openly for these products in physical retail environments. This cultural barrier can hinder market penetration in rural and semi-urban areas where conservative attitudes remain prevalent.

Price Sensitivity and Affordability Constraints

Widespread price sensitivity among Indian consumers limits adoption of premium lingerie products, constraining market growth in higher-value segments despite increasing awareness about quality benefits. Many households prioritize essential expenditures over discretionary spending on branded intimate apparel, particularly in lower and middle-income brackets. The prevalence of unorganized retail offering lower-priced alternatives further intensifies price competition, pressuring established brands to maintain affordability at the expense of margins.

Infrastructure and Distribution Limitations

Inadequate physical retail infrastructure, especially in tier-two, tier-three cities, and rural areas, limits consumer access to branded lingerie products across significant portions of the Indian market. While e-commerce has expanded reach, logistical challenges including last-mile delivery complexities and payment preference variations remain hurdles affecting market penetration. Improving distribution networks and enhancing logistical capabilities are essential for brands seeking to capture market share across diverse urban and rural geographies.

Competitive Landscape:

The India lingerie market exhibits a competitive landscape characterized by the presence of established domestic players, international brands, and emerging direct-to-consumer startups. Companies are focusing on product diversification, expanding size ranges, and enhancing distribution networks to capture evolving consumer preferences. Strategic investments in e-commerce capabilities, omnichannel integration, and personalized marketing approaches differentiate market leaders. Competition intensifies as manufacturers introduce innovative designs combining comfort with contemporary aesthetics while maintaining competitive pricing. Partnerships between brands and retail platforms, coupled with investments in technology-enabled shopping experiences, continue reshaping competitive dynamics across organized and online retail channels.

India Lingerie Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Brassiere, Knickers or Panties, Shapewear, Others |

| Materials Covered | Cotton, Silk, Satin, Nylon, Others |

| Price Ranges Covered | Economy, Premium |

| Distribution Channels Covered | Mass Merchandizers, Specialized Stores, Online Stores, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India lingerie market size was valued at USD 5.9 Billion in 2025.

The India lingerie market is expected to grow at a compound annual growth rate of 8.30% from 2026-2034 to reach USD 12.0 Billion by 2034.

Brassiere dominated the market with a share of 46%, owing to its essential role in providing support, comfort, and shaping for women across diverse age groups, combined with continuous product innovation addressing varied lifestyle needs.

Key factors driving the India lingerie market include rising female workforce participation, increasing urbanization and disposable incomes, e-commerce expansion, evolving fashion consciousness, growing body positivity awareness, and improving retail infrastructure across urban and semi-urban areas.

Major challenges include cultural sensitivities and traditional taboos surrounding intimate apparel shopping, widespread price sensitivity limiting premium segment adoption, inadequate retail infrastructure in tier-two and rural areas, and logistical complexities affecting distribution network expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)