India Microinsurance Market Size, Share, Trends and Forecast by Product Type, Provider, Model Type, and Region, 2025-2033

Market Overview:

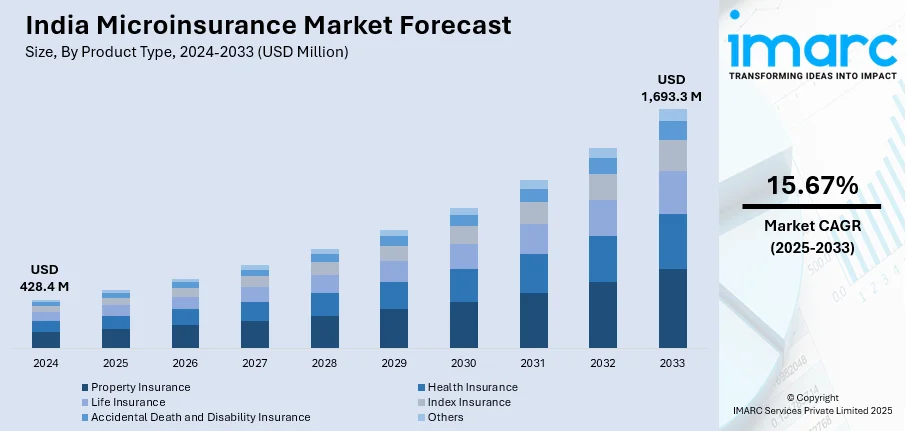

The India microinsurance market size reached USD 428.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,693.3 Million by 2033, exhibiting a growth rate (CAGR) of 15.67% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 428.4 Million |

|

Market Forecast in 2033

|

USD 1,693.3 Million |

| Market Growth Rate (2025-2033) | 15.67% |

Microinsurance refers to a microfinance component that offers coverage to households with limited income access and low-valued assets. It formulates tailor-made plans for individuals who belong to the weaker section of the society with a low premium rate and offers compensation in case of illness, injury, disabilities and death. It also covers property risk against crops, cattle, and fires. Microinsurance merges various small financial units into a massive structure to provide a safety net against unexpected losses and exorbitant interest rates charged by unorganized money lenders.

To get more information on this market, Request Sample

India represents one of the largest markets for microinsurance. Various finance industry stakeholders, including non-governmental organizations, microfinance institutions, and donors, are becoming interested in adding microinsurance as an adaptation measure. This is one of the major factors propelling the growth of the market. Furthermore, with recent advancements, microinsurance can be delivered through the partner-agent, full-service, community-based and provider-driven models to the target users. Furthermore, microinsurance policies are gaining prominence across the country due to the easy availability of flexible products and end-to-end digital experience, ensuring transparency. For instance, SEWA Bank offers all self-employed poor women a choice of three microinsurance schemes covering death, health and assets. Another innovative feature is that the insurance is integrated with SEWA’s savings accounts. It also provides policies with limited risks involved while having effective control that reduces the overall costs.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India microinsurance market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on product type, provider and model type.

Breakup by Product Type:

- Property Insurance

- Health Insurance

- Life Insurance

- Index Insurance

- Accidental Death and Disability Insurance

- Others

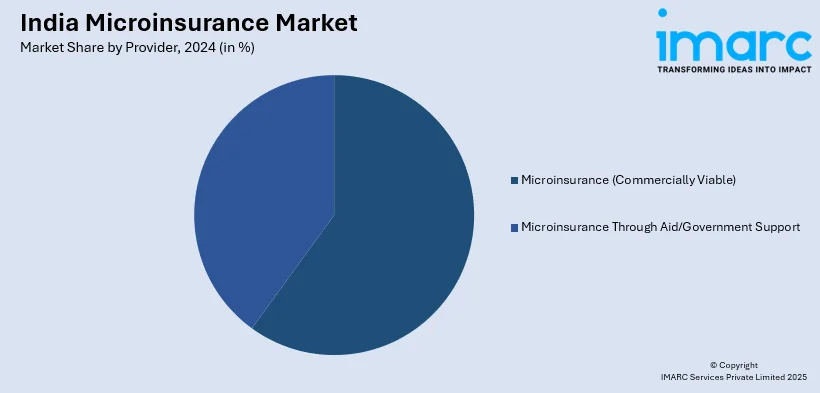

Breakup by Provider:

- Microinsurance (Commercially Viable)

- Microinsurance Through Aid/Government Support

Breakup by Model Type:

- Partner Agent Model

- Full-Service Model

- Provider Driven Model

- Community-Based/Mutual Model

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product Type, Model Type, Provider, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India microinsurance market was valued at USD 428.4 Million in 2024.

We expect the India microinsurance market to exhibit a CAGR of 15.67% during 2025-2033.

The growing adoption of microinsurance, as it helps individuals belonging to the financially weaker section of the society by formulating a tailored plan with low premiums and provides compensation for illness, injury, disabilities, death, etc., is primarily driving the India microinsurance market.

The sudden outbreak of the COVID-19 pandemic has led to the rising utilization of microinsurance by numerous organizations across the nation to provide cover for medical expenses incurred during the treatment of the coronavirus infection.

Based on the provider, the India microinsurance market can be bifurcated into microinsurance (commercially viable) and microinsurance through aid/government support. Currently, microinsurance (commercially viable) holds the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where North India currently dominates the India microinsurance market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)