India Pet Supplement Market Size, Share, Trends and Forecast by Type, Pet Type, Form, Application, Distribution Channel, and Region, 2025-2033

India Pet Supplement Market Overview:

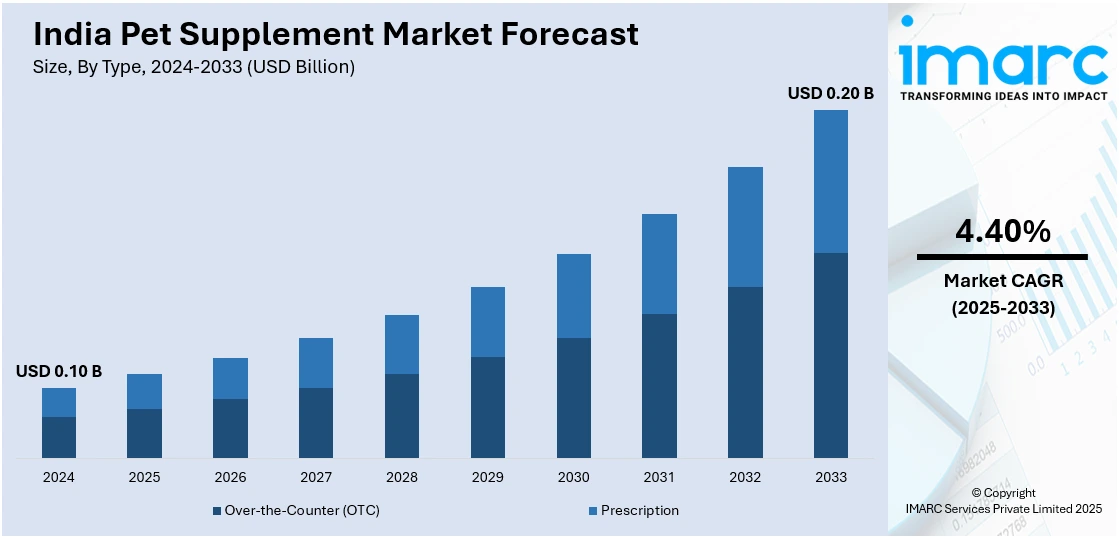

The India pet supplement market size reached USD 0.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.20 Billion by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. The market is driven by rising pet ownership, growing disposable incomes, and heightening awareness of the health of pets, leading to a surge in demand for premium, functional, and natural nutrition products for overall wellness of pets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.10 Billion |

| Market Forecast in 2033 | USD 0.20 Billion |

| Market Growth Rate (2025-2033) | 4.40% |

India Pet Supplement Market Trends:

Growing Humanization of Pets Driving Premiumization

Growing humanization of pets in India is driving the demand for premium pet supplements. Pet owners are recognizing pets as members of their families and as such, they are looking for high-quality functional supplements that address particular health requirements. For instance, in March 2023, Hermet Nutrix launched Grubby Pro, a pet supplement that uses black soldier fly larvae protein to promote pet wellness. The company aims to expand its portfolio of insect protein-based pet food and treats, bolstering sustainability in pet food. Moreover, probiotics to support gut health, omega fatty acids to promote skin and coat care, and glucosamine to maintain joint health are becoming popular. Further, natural and organic supplements without artificial additives are gaining traction as pet parents look for clean-label options. The trend is also observed in personalized nutrition, where supplements are formulated for a pet's breed, age, or health status. As disposable incomes rise and pet wellness awareness increases, Indian pet owners are ready to pay more for sophisticated formulations, fueling the premium segment of the pet supplement market. This change is also justified by veterinarians suggesting preventive health through supplementation.

To get more information on this market, Request Sample

Rise of Online Sales and Direct-to-Consumer (DTC) Brands

The widespread digital revolution in India has profoundly impacted the pet supplement industry, with online sales becoming a prominent channel of distribution. Pet owners can now make use of a variety of supplements easily available on e-commerce websites, which provide convenience, variety, and doorstep delivery. Subscription models are also becoming increasingly popular, which allow for repeat deliveries of needed supplements. Influencer and social media promotion are critical components of informing pet owners regarding supplementation benefits, helping fuel online commerce. Direct-to-consumer businesses are capitalizing on the phenomenon by providing unique formulations and attracting customers with one-on-one product suggestions. Even pet health software and online consultancy services are compelling well-informed buying choices. With growing smartphone penetration and digital payment usage, the online pet supplement market is set to grow further, bringing high-quality supplements within reach of pet parents in urban and semi-urban regions.

Increasing Demand for Functional and Natural Ingredients

Indian pet owners are increasingly making it a point to be aware of ingredient quality and functionality when it comes to making supplement choices. Natural, plant-based, and Ayurvedic ingredients that offer comprehensive health benefits are highly being sought out. Herbal extracts such as turmeric for anti-inflammatory effects, ashwagandha for stress management, and moringa for immune benefits are being added to pet supplements. Further, demand for ingredients that are functional, like prebiotics, probiotics, collagen, and omega-3 fatty acids, is on the rise because they offer scientifically verified benefits to the health of humans and animals alike. Consumers also demand grain-free, gluten-free, and free of artificial additives so that pet nutrition can promote its best well-being. It reflects the trend worldwide toward sustainable pet nutrition and clean-label consumption. As Indian pet parents focus on well-being and longevity for their pets, demand for functional and natural ingredient-based supplements will boost, defining the future of the pet supplement market in India.

India Pet Supplement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, pet type, form, application, and distribution channel.

Type Insights:

- Over-the-Counter (OTC)

- Prescription

The report has provided a detailed breakup and analysis of the market based on the type. This includes over-the-counter (OTC) and prescription.

Pet Type Insights:

- Dogs

- Cats

- Others

A detailed breakup and analysis of the market based on the pet type have also been provided in the report. This includes dogs, cats, and others.

Form Insights:

- Pills/Tablets

- Chewables

- Powders

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes pills/tablets, chewables, powders, and others.

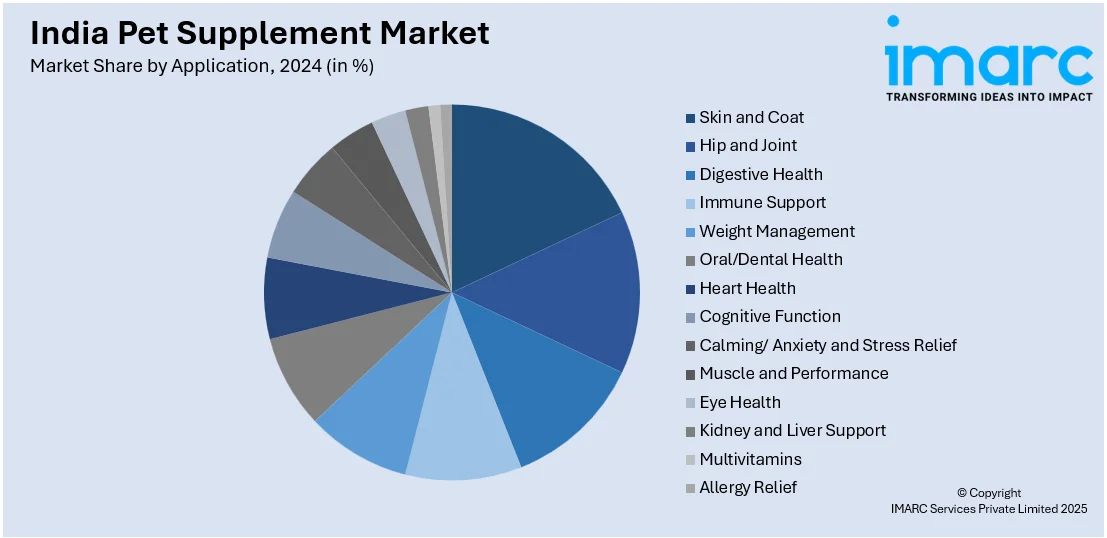

Application Insights:

- Skin and Coat

- Hip and Joint

- Digestive Health

- Immune Support

- Weight Management

- Oral/Dental Health

- Heart Health

- Cognitive Function

- Calming/ Anxiety and Stress Relief

- Muscle and Performance

- Eye Health

- Kidney and Liver Support

- Multivitamins

- Allergy Relief

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes skin and coat, hip and joint, digestive health, immune support, weight management, oral/dental health, heart health, cognitive function, calming/anxiety and stress relief, muscle and performance, eye health, kidney and liver support, multivitamins, and allergy relief.

Distribution Channel Insights:

- Online

- Offline

- Hypermarkets and Supermarkets

- Pet Specialty Stores

- Pharmacy and Drug Stores

- Convenience Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online, and offline (hypermarkets and supermarkets, pet specialty stores, pharmacy and drug stores, convenience stores and others).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pet Supplement Market News:

- In March 2025, K9 Vitality became India's fastest-growing pet supplement company, supplying science-formulated products for gut health, joint support, and immunity. Caring for 15,000+ pets, it specializes in high-quality, vet-tested formulas for boosting pet well-being, with business expansion of product innovation and social activities across India in its pipeline.

- In April 2023, Heads Up For Tails unveiled Dash Dog, a high-end pet lifestyle brand in India, catering to the emerging market for active pet care. The brand provides quality supplements, harnesses, and toys for active pets, using consumer insights to complete gaps in the market previously dominated by high-end imported products.

India Pet Supplement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Over-the-Counter (OTC), Prescription |

| Pet Types Covered | Dogs, Cats, Others |

| Forms Covered | Pills/Tablets, Chewables, Powders, Others |

| Applications Covered | Skin and Coat, Hip and Joint, Digestive Health, Immune Support, Weight Management, Oral/Dental Health, Heart Health, Cognitive Function, Calming/Anxiety and Stress Relief, Muscle and Performance, Eye Health, Kidney and Liver Support, Multivitamins, Allergy Relief |

| Distribution Channels Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pet supplement market performed so far and how will it perform in the coming years?

- What is the breakup of the India pet supplement market on the basis of type?

- What is the breakup of the India pet supplement market on the basis of pet type?

- What is the breakup of the India pet supplement market on the basis of form?

- What is the breakup of the India pet supplement market on the basis of application?

- What is the breakup of the India pet supplement market on the basis of distribution channel?

- What is the breakup of the India pet supplement market on the basis of region?

- What are the various stages in the value chain of the India pet supplement market?

- What are the key driving factors and challenges in the India pet supplement?

- What is the structure of the India pet supplement market and who are the key players?

- What is the degree of competition in the India pet supplement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pet supplement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pet supplement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pet supplement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)