India Plant-Based Milk Market Size, Share, Trends and Forecast by Product, Formulation, Category, Form, Distribution Channel, and Region, 2025-2033

Market Overview:

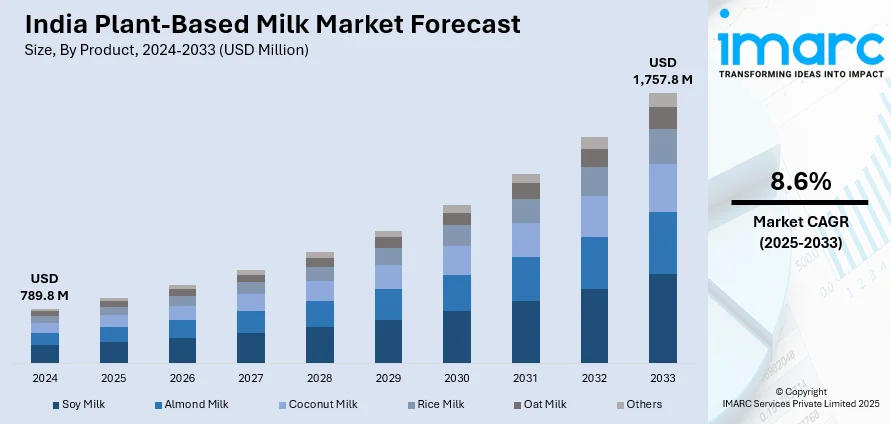

The India plant-based milk market size reached USD 789.8 Million in 2024. The market is projected to reach USD 1,757.8 Million by 2033, exhibiting a growth rate (CAGR) of 8.6% during 2025-2033. The market growth is driven by continual advancements in plant-based food technology, rising health and environmental awareness among the masses, growing cases of lactose intolerance, and increasing adoption of vegan diets.

Market Insights:

- The regional segmentation covers North India, West and Central India, South India, and East and Northeast India.

- The market is segmented by product into soy milk, almond milk, coconut milk, rice milk, oat milk, and others.

- The formulation segmentation includes unflavored and flavored variants.

- Based on category, the market is divided into organic and conventional.

- Based on form, the market is categorized into liquid and powder.

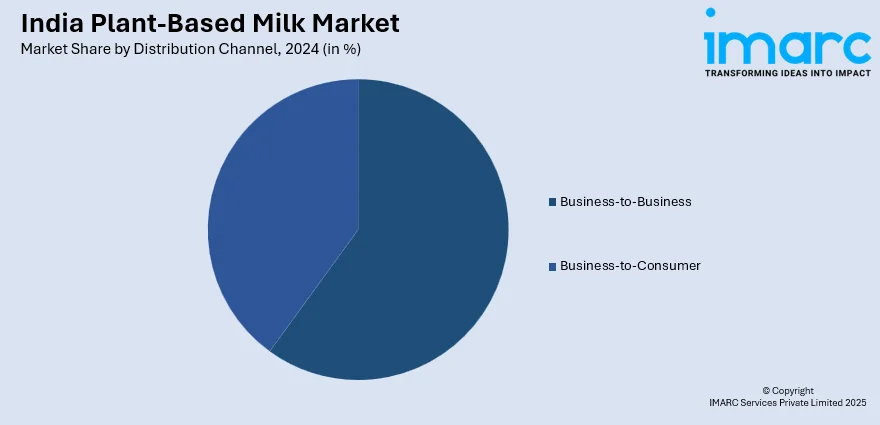

- The distribution channel includes business-to-business and business-to-consumer.

Market Size & Forecast:

- 2024 Market Size: USD 789.8 Million

- 2033 Projected Market Size: USD 1,757.8 Million

- CAGR (2025–2033): 8.6%

Plant-based milk refers to non-dairy alternatives created from plants, offering a lactose-free and vegan-friendly option to traditional animal milk. Common sources include soy, almond, coconut, oats, and rice. These alternatives are often fortified with essential nutrients like calcium and vitamin D to mimic the nutritional profile of cow's milk. Plant-based milk has gained popularity due to various reasons, including lactose intolerance, ethical concerns, and environmental sustainability. These alternatives often have a distinct flavor and texture, providing a diverse range of options for consumers with different taste preferences. Plant-based milk is not only a choice for those following a vegan lifestyle but also appeals to individuals seeking a more sustainable and cruelty-free approach to their dietary habits. As the demand for plant-based options continues to rise, the market for these alternatives expands, offering consumers a broader selection of plant-derived milk products.

To get more information on this market, Request Sample

The plant-based milk market in India is experiencing robust growth, primarily driven by the increasing regional awareness of health and environmental concerns. Consumers are increasingly opting for plant-based alternatives, a trend underscored by a growing preference for dairy-free options. Furthermore, the surge in lactose intolerance cases and the rising number of individuals adopting vegan lifestyles contribute significantly to the market's expansion. In addition to health considerations, sustainability plays a pivotal role in propelling the plant-based milk market forward. Concerns about climate change and the environmental impact of traditional dairy farming have led consumers to seek more sustainable choices. As a result, plant-based milk options are perceived as environmentally friendly alternatives, fostering their widespread adoption. The diversification of plant-based milk varieties also fuels market growth. Innovations in plant-based technologies have given rise to a plethora of alternatives, such as almonds, soy, oats, and coconut milk, catering to diverse consumer preferences. These options provide not only choice but also nutritional benefits, addressing specific dietary needs and preferences. Consequently, the dynamic interplay of health consciousness, sustainability, and product innovation serves as a powerful force driving the flourishing plant-based milk market.

India Plant-Based Milk Market Trends:

Growth Drivers and Product Evolution in India’s Plant-Based Milk Market

Several factors are driving plant-based milk consumption in India. Growing awareness of lactose intolerance, common among large sections of the adult population, is prompting a shift to non-dairy options. At the same time, plant-based milks are gaining acceptance among health-conscious consumers due to their lower cholesterol and calorie content compared to dairy. Flexitarian eating is spreading across metros and younger demographics, especially among those experimenting with sustainable and cruelty-free choices. Environmental awareness, especially among the Gen Z population, is also pushing consumers toward lower-carbon footprint products, and plant-based milk aligns well with that goal, which is supporting the India plant-based milk market growth. There’s a noticeable dual consumption trend: households using dairy for traditional dishes while switching to plant-based options for smoothies, cereals, and coffee. This behavior is especially common in double-income urban homes.

New product development is addressing wider needs, unflavored base variants for cooking, flavored options for kids, and organic SKUs for premium buyers. Fortification with calcium, vitamin D, and B12 is becoming standard across mid- to high-end brands. Format innovations include single-serve cartons, long shelf-life UHT packs, and emerging powdered variants targeting low-distribution rural belts. New sources beyond soy and almond are gaining ground. Pea and chickpea-based milks are in early stages but offer cleaner labels and better protein profiles. Several Indian brands are experimenting with blended formulas, combining oats, nuts, and pulses, to improve texture and taste, inspired by global players like Califia Farms. This diversified approach may help bridge the gap between health, flavor, and affordability for a broader set of consumers.

Challenges, Opportunities, and Government Support in India’s Plant-Based Milk Market

As per the India plant-based milk market analysis, the industry is growing steadily, but faces several hurdles. Price remains a critical barrier for mass adoption, especially in Tier II and III cities, where traditional dairy still dominates due to affordability and familiarity. Taste mismatch with cow or buffalo milk, particularly in chai or cooking, also holds back repeat purchases. At the same time, limited supply chain infrastructure, especially cold storage, and inconsistent raw material quality affect smaller brands. Despite this, the market presents strong opportunities. Urban consumers, especially those exposed to global dietary habits, are more willing to try almond, oat, or soy-based products, which is contributing to the India plant-based milk market demand. Startups have space to innovate with functional ingredients, regional positioning, and direct-to-consumer strategies. Multinational interest is rising, and modern retail formats are giving shelf space to plant-based dairy.

Government support, though indirect, is becoming more visible. FSSAI has clarified labelling for plant-based foods and supported vegan product recognition through initiatives like the “vegan logo.” The Ministry of Food Processing Industries has shown openness to proposals involving plant-based innovation, particularly in millet and nut-based beverages, which in turn is resulting in the expansion of the India plant-based milk market share. Startup India and related schemes are also helping some early-stage players access funding. Policy frameworks around food innovation and sustainability are evolving, and there’s scope for formal incentives in areas like agri-sourcing, R&D, and cold chain logistics. If these align with rising consumer demand, the ecosystem could shift faster from niche to mainstream in the coming years.

India Plant-Based Milk Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, formulation, category, form, and distribution channel.

Product Insights:

- Soy Milk

- Almond Milk

- Coconut Milk

- Rice Milk

- Oat Milk

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes soy milk, almond milk, coconut milk, rice milk, oat milk, and others.

Formulation Insights:

- Unflavored

- Flavored

A detailed breakup and analysis of the market based on the formulation have also been provided in the report. This includes unflavored and flavored.

Category Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the market based on the category. This includes organic and conventional.

Form Insights:

- Liquid

- Powder

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and powder.

Distribution Channel Insights:

- Business-to-Business

- Business-to-Consumer

- Modern Groceries

- Convenience Stores

- Specialty Stores

- Online Retail Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes business-to-business and business-to-consumer (modern groceries, convenience stores, specialty stores, online retail stores, and others).

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- June 2025: Indian dairy brand Country Delight launched its first plant-based milk alternative, Oat Beverage, made from Australian oats and priced at Rs 40 (USD 0.48) for a 400ml pack, targeting the rising demand for dairy-free products among health-conscious and lactose-intolerant consumers in India. The new oat milk product, free from chemical additives, preservatives, added sugars, soy, and nuts, is produced in an allergen-controlled facility and can be ordered via the Country Delight app.

- June 2025: HRX launched plant-based oat milk protein shakes in India, each 200ml serving delivering 25g of protein with no processed sugar, aimed at health-focused consumers. The shake is dairy-free, lactose-free, comes in glass packaging, and is available nationwide via platforms such as Swiggy, Zomato, Amazon, and HRX’s own channels.

- September 2024: Maiva Fresh launched its flagship unsweetened almond milk in Mumbai, offering four variants, natural nut, vanilla, cocoa, and mango, targeted at health-conscious consumers, diabetics, fitness enthusiasts, and those with lactose intolerance. The product is free from added sugars, cholesterol, and is fortified with Vitamin B12 and Vitamin D, and is available in modern retail stores as well as online platforms like Zepto, Swiggy Instamart, and Amazon Fresh.

- August 2024: At the 7th India International Hospitality Expo, 1.5 Degree launched a range of plant-based dairy products, including oat milk, soy milk, cold coffee, flavored milkshakes, and vegan gelato. The products are gluten-free, cholesterol-free, and 100% vegan, targeting both vegan and non-vegan consumers seeking healthy, lactose-free options. 1.5 Degree partnered with NIFTEM and the Government of India to set up a facility focused on innovation and sustainability.

India Plant-Based Milk Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Soy Milk, Almond Milk, Coconut Milk, Rice Milk, Oat Milk, Others |

| Formulations Covered | Unflavored, Flavored |

| Categories Covered | Organic, Conventional |

| Forms Covered | Liquid, Powder |

| Distribution Channels Covered |

|

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India plant-based milk market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India plant-based milk market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India plant-based milk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plant-based milk market in the India was valued at USD 789.8 Million in 2024.

The India plant-based milk market is projected to exhibit a CAGR of 8.6% during 2025-2033.

India's plant-based milk market is spurred by increasing lactose intolerance, greater awareness of health and wellness, and rising vegan and flexitarian diets. Urban consumers, particularly millennials and Gen Z, opt for high-nutrient dairy substitutes such as almond, soy, oat, and coconut milk. Sustainability concerns and moral issues also enhance demand as plant-based alternatives involve lower carbon costs and concur with sustainable consumption patterns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)