India Renewable Energy Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

India Renewable Energy Market Summary:

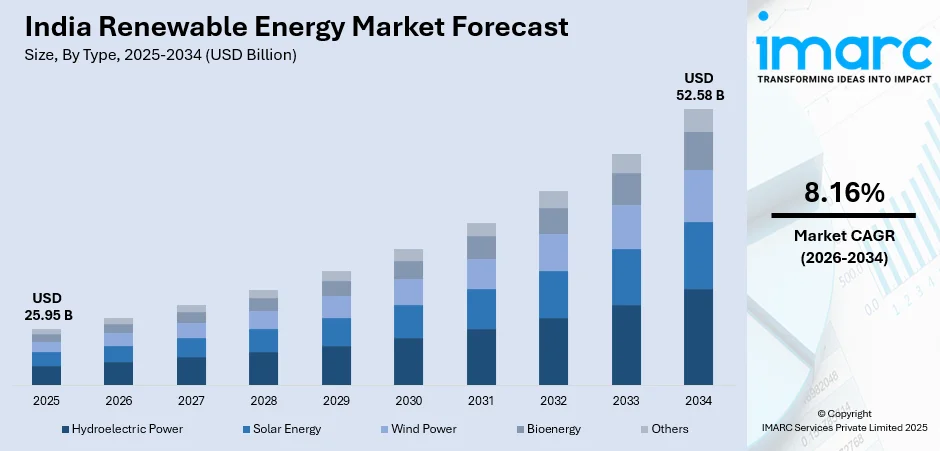

The India renewable energy market size was valued at USD 25.95 Billion in 2025 and is projected to reach USD 52.58 Billion by 2034, growing at a compound annual growth rate of 8.16% from 2026-2034.

The renewable energy sector in India is poised for transformational growth, driven by ambitious government policies, a steady rise in environmental awareness, and the country's commitment to sustainable development. Solar, wind, hydroelectric, and bioenergy sources are all in its domain and contribute to India's stride for energy independence, with a corresponding reduction in carbon emissions. Favorable regulatory frameworks, declining technology costs, and heavy infrastructure development remain key accelerators for clean energy adoption across residential, commercial, and industrial applications in the country.

Key Takeaways and Insights:

- By Type: Wind power dominates the market with a share of 33.18% in 2025, owing to India’s exceptional wind resources across coastal and elevated regions. The segment benefits from mature turbine technologies, established manufacturing ecosystems, and supportive policy mechanisms that have positioned wind energy as a cornerstone of the country’s renewable portfolio.

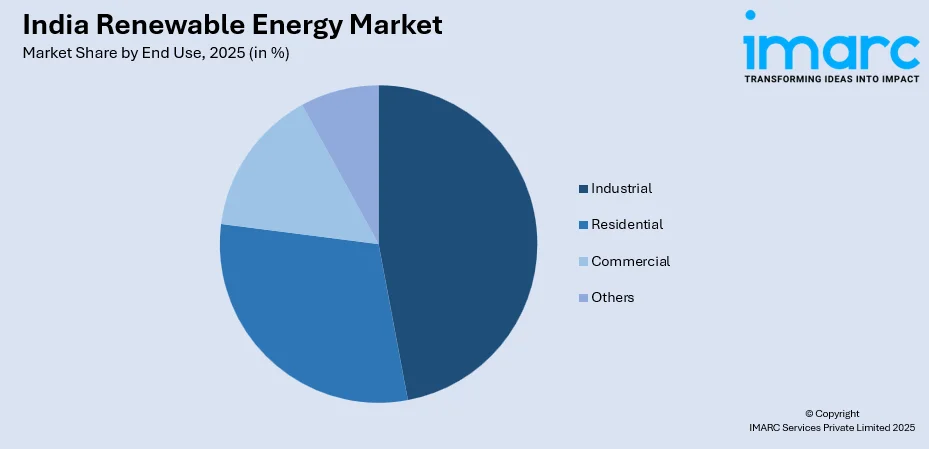

- By End Use: Industrial leads the market with a share of 47.09% in 2025. This dominance is driven by manufacturing sector’s growing sustainability commitments, corporate renewable energy procurement strategies, and the economic advantages of captive power generation for energy-intensive operations across India’s industrial corridors.

- Key Players: The competitive landscape of India’s renewable energy sector is shaped by rapid capacity expansion, technological innovation, cost optimization, and strategic project development. Intense competition drives efficiency, accelerates adoption of solar and wind solutions, and encourages investment in large-scale and distributed renewable projects.

To get more information on this market Request Sample

The India renewable energy market is driven by supportive government policies, ambitious capacity expansion, and rising electricity demand from urbanization and industrial growth. In 2026, NLC India Ltd. received in-principle approval to list its renewable energy subsidiary, NLC India Renewables, reflecting growing investor interest and government support in the sector. Technological advancements have lowered generation costs, making renewables competitive with fossil fuels. Environmental concerns, corporate sustainability initiatives, and international climate commitments further boost adoption. Financial incentives like tax benefits, accelerated depreciation, and preferential tariffs enhance project feasibility, attracting both domestic and foreign investments. Collectively, these factors create a favorable landscape for clean energy development, positioning India as a key player in the global transition toward sustainable energy.

India Renewable Energy Market Trends:

Hybrid Energy Solutions Gaining Momentum

Integration of solar and wind power installations within single projects is becoming increasingly prevalent across India. For example, Adani Green Energy Ltd. has operationalized over 2.14 GW of solar-wind hybrid projects in Rajasthan’s Jaisalmer district, one of the largest hybrid clusters globally, enhancing the predictability and utilization of renewable output. Hybrid configurations optimize land utilization, enhance grid stability, and ensure consistent power generation throughout varying weather conditions. This approach maximizes infrastructure investments while delivering reliable baseload electricity to consumers.

Decentralized Generation Expansion

Rooftop solar installations and distributed generation models are transforming electricity consumption patterns across urban and semi-urban areas. In 2025, Tata Power Renewables reported a record 45,500 rooftop solar installations totalling about 220 MW in just Q1 FY26, helping push its cumulative installations past 3.4 GW and illustrating strong corporate momentum in decentralised solar adoption. Residential and commercial consumers increasingly adopt behind-the-meter solutions, reducing grid dependency while contributing to overall renewable capacity. This democratization of energy generation empowers end-users with greater control over electricity costs.

Energy Storage Integration Accelerating

Battery storage deployment alongside renewable installations is emerging as a critical enabler for grid modernization. For example, NLC India Renewables Ltd. secured a 500 MWh battery energy storage project in Tamil Nadu in 2025 to support renewable generation flexibility and grid reliability, highlighting corporate momentum in storage integration with India’s clean energy build-out. Storage solutions address intermittency concerns inherent to solar and wind generation, enabling round-the-clock renewable power supply. Advanced storage technologies facilitate peak demand management and enhance overall system reliability across transmission networks.

Market Outlook 2026-2034:

The India renewable energy market is projected to see very positive growth in terms of revenue over the forecasted years, fueled by continued policy support and private sector engagement. The number of projects in the utility scale solar, wind, and hybrid sector remains strong, and this will help decrease costs due to competition from auctions and bidding. The industrial and commercial sectors will be major drivers of this market, as companies seek to implement captive solar and wind power projects due to lower production costs. Residential sales will be driven by government subsidy programs that will facilitate rooftop solar market penetration. The market generated a revenue of USD 25.95 Billion in 2025 and is projected to reach a revenue of USD 52.58 Billion by 2034, growing at a compound annual growth rate of 8.16% from 2026-2034.

India Renewable Energy Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Wind Power |

33.18% |

|

End Use |

Industrial |

47.09% |

Type Insights:

- Hydroelectric Power

- Solar Energy

- Wind Power

- Bioenergy

- Others

The wind power dominates with a market share of 33.18% of the total India renewable energy market in 2025.

Wind power dominates India’s renewable energy landscape, holding the largest market share due to mature technology and established infrastructure. In 2025, India regained its spot as the world’s third-largest wind energy market, driven by record capacity additions and a roughly 60% increase in turbine orders, reaching 8 GW. Coastal regions and high-wind zones provide optimal conditions, enabling large-scale installations. Government policies, including competitive auctions, feed-in tariffs, and financial incentives, have accelerated capacity addition. Investment from both domestic and international players has strengthened the sector, making wind energy a reliable and cost-effective contributor to India’s clean energy transition.

The dominance of wind power is reinforced by its scalability and grid integration potential. Modern turbines with higher efficiency and hybrid wind-solar systems enhance output and reliability. Industrial and commercial adoption further supports demand, while declining levelized costs make wind projects increasingly attractive. Strategic state-level policies, combined with private sector participation, continue to expand capacity, consolidating wind power’s position as a cornerstone of India’s renewable energy mix.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

- Others

The industrial leads with a share of 47.09% of the total India renewable energy market in 2025.

Large industrial consumers will be India’s major players in the renewable energy sector due to high electricity demand, and industries have started investing in solar, wind, and hybrid plants on their own premises to lower operational costs and achieve energy security. The government’s tax benefits like accelerated depreciation rates and favorable tariff rates will boost these investments by industries leveraging renewable energy resources. Sectors like ‘manufacturing, chemical, and textiles' will be at the forefront of sustainability objectives by exploiting renewable energy resources to offset conventional fossil fuel-driven power.

The industrial sector’s renewable energy expansion is driven by economic as well as government-related factors. The fluctuating energy demand, alongside increasing costs, encourages industries to look for diverse sources of energy. The sector is driven by corporate sustainability goals, energy, and government frameworks that favor large-scale projects. Industries with higher energy requirements have shown interest in power purchase, captive capacities, and hybrid models, making the industrial sector the major contributor to the overall renewable energy sector in the country.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India represents a significant renewable energy hub, benefiting from substantial solar irradiance across Rajasthan and favorable wind corridors in hilly terrains. The region leverages extensive land availability for utility-scale installations and benefits from proximity to major demand centers in Delhi-NCR. Government initiatives promoting rooftop solar adoption in urban areas further strengthen regional market positioning.

West and Central India dominates the renewable energy landscape, driven by Gujarat's exceptional solar and wind resources alongside Maharashtra's industrial demand for captive power generation. The region hosts major renewable energy parks and benefits from well-developed transmission infrastructure connecting generation sites to consumption centers. Favorable state policies and streamlined approval processes accelerate project implementation across these states.

South India maintains a leading position in wind power installations, with Tamil Nadu, Karnataka, and Andhra Pradesh contributing substantially to national capacity. The region benefits from consistent coastal wind patterns and strong solar potential throughout the year. Industrial clusters across southern states increasingly adopt captive renewable installations, supported by progressive open access regulations enabling direct power procurement.

East India presents emerging growth opportunities within the renewable energy sector, with states gradually expanding solar capacity through dedicated parks and distributed generation projects. The region benefits from untapped hydroelectric potential in northeastern territories and increasing government focus on extending clean energy access. Industrial development initiatives are expected to drive future renewable energy demand across eastern states.

Market Dynamics:

Growth Drivers:

Why is the India Renewable Energy Market Growing?

Supportive Government Policy Framework and National Energy Transition Goals

India’s comprehensive policy architecture supporting renewable energy development serves as a fundamental growth catalyst. National missions targeting substantial non-fossil fuel capacity additions by the end of the decade provide clear directional guidance for industry stakeholders. Notably, India achieved 50% of its total installed electricity capacity from non-fossil fuel sources five years ahead of its 2030 target, reflecting the effectiveness of these policies and reinforcing confidence in the clean energy transition. State-level renewable purchase obligations mandate minimum clean energy procurement by distribution utilities, creating assured demand. Production-linked incentive schemes for domestic solar and wind equipment manufacturing strengthen supply chain resilience while generating employment opportunities.

Declining Technology Costs and Improved Economic Viability

Continuous technological advancements have dramatically reduced renewable energy generation costs, fundamentally altering competitive dynamics with conventional power sources. Solar photovoltaic module efficiencies have improved substantially while manufacturing costs have declined through economies of scale and process innovations. In October 2025, the Solar Energy Corporation of India’s (SECI) 2 GW solar-plus-storage auction discovered a record-low tariff of ₹2.86 per kWh for hybrid solar and energy storage projects, marking the first time such configurations in India have fallen below ₹3 per kWh and highlighting how integrated technologies and competitive bidding are driving cost reductions. Wind turbine designs incorporating larger rotor diameters and taller hub heights extract greater energy from available wind resources, improving capacity utilization factors. Competitive auction mechanisms for utility-scale projects have driven tariff discoveries to levels competitive with coal-based generation.

Rising Energy Demand and Infrastructure Development Requirements

India’s expanding economy and growing population drive substantial increases in electricity consumption across all sectors. Urbanization trends concentrate energy demand in metropolitan regions requiring enhanced generation and distribution infrastructure. Industrial expansion under manufacturing-focused development programs necessitates reliable and affordable power supply for competitiveness. To address rising demand and strengthen infrastructure, the Government of India has committed to achieving 24×7 electricity for all by 2025 through major generation and transmission expansions and grid upgrades, highlighting policy focus on meeting consumption growth. Rural electrification initiatives and agricultural load growth create additional capacity requirements. Transmission network expansion connecting renewable-rich regions to demand centers enables optimal resource utilization. Smart grid deployments facilitate efficient power management and enable higher renewable penetration without compromising system stability.

Market Restraints:

What Challenges the India Renewable Energy Market is Facing?

Grid Integration and Transmission Infrastructure Constraints

Inadequate transmission infrastructure connecting renewable generation sites to consumption centers poses operational limitations. Grid congestion in high-generation states leads to power curtailment during peak production periods, affecting project economics and investor returns. Distribution network capacity constraints limit rooftop solar evacuation potential in certain urban areas. Balancing intermittent renewable generation with stable grid operation requires sophisticated forecasting and dispatch mechanisms not yet fully deployed across all regions.

Land Acquisition and Regulatory Clearance Complexities

Securing suitable land parcels for large-scale renewable installations involves navigating complex ownership structures and regulatory requirements. Environmental clearances for projects in ecologically sensitive zones require extended approval timelines. Right-of-way permissions for transmission line construction across multiple land parcels create implementation delays. Agricultural land conversion restrictions in certain states limit site selection options despite favorable renewable resource availability.

Financial Health of Distribution Utilities

Distribution utility financial constraints affect timely payment to renewable generators under long-term power purchase agreements. Accumulated receivables strain project cash flows and discourage fresh investments. Tariff revision delays prevent utilities from recovering renewable power procurement costs, perpetuating financial stress. Subsidy settlement backlogs from government programs create working capital challenges for developers, particularly affecting smaller market participants.

Competitive Landscape:

The India renewable energy market exhibits a moderately fragmented competitive structure characterized by participation from large integrated power utilities, specialized renewable energy developers, and emerging independent power producers. Market participants compete across project development, equipment manufacturing, and operations and maintenance segments. Established players leverage balance sheet strength and execution capabilities to secure utility-scale project awards through competitive bidding processes. Strategic partnerships between domestic and international entities facilitate technology transfer and project financing arrangements. Manufacturing ecosystem development has intensified competition in solar module and wind turbine component supply chains. Vertical integration strategies spanning development through operations enable participants to capture value across the project lifecycle. Consolidation activity continues as larger players acquire operational portfolios to achieve scale economies and diversify geographic presence across renewable-rich states.

Recent Developments:

- In January 2025 ENGIE announced plans to expand its Indian renewable energy portfolio from about 2.3 GW currently to 7 GW by 2030, reinforcing its long-term commitment to India’s energy transition with new solar, wind, hybrid, and storage-ready projects.

India Renewable Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Hydroelectric Power, Solar Energy, Wind Power, Bioenergy, and Others |

| End Uses Covered | Residential, Commercial, Industrial, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India renewable energy market size was valued at USD 25.95 Billion in 2025.

The India renewable energy market is expected to grow at a compound annual growth rate of 8.16% from 2026-2034 to reach USD 52.58 Billion by 2034.

Wind power holds the largest share of the India renewable energy market, accounting for 33.18% of market share, supported by established manufacturing infrastructure, favorable wind resources in coastal and elevated regions, and mature policy frameworks.

Key factors driving the India renewable energy market include supportive government policies and national clean energy targets, declining technology costs improving economic competitiveness, rising energy demand from industrial and urban expansion, environmental sustainability commitments, and favorable investment climate attracting domestic and international capital.

Major challenges include grid integration constraints and transmission infrastructure limitations, land acquisition complexities and regulatory clearance delays, financial health concerns of distribution utilities affecting payment timelines, supply chain dependencies on imported components, and intermittency management requirements for higher renewable penetration levels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)