India Snacks Market Size, Share, Trends and Forecast by Product Type, Pack Type, Pack Size, Distribution Channel, and State, 2026-2034

India Snacks Market Summary:

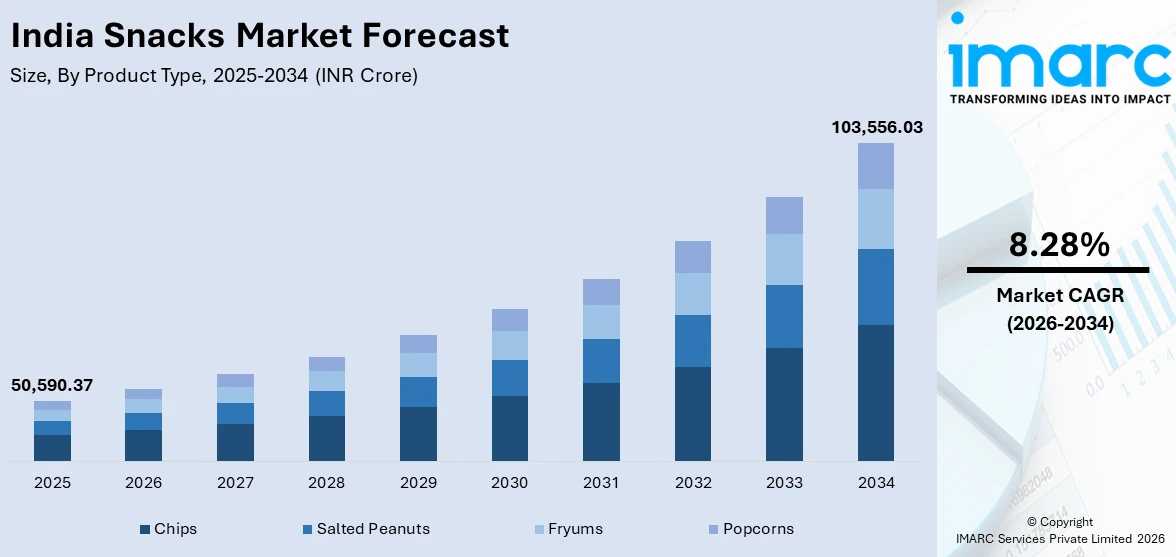

The India snacks market size was valued at INR 50,590.37 Crore in 2025 and is projected to reach INR 103,556.03 Crore by 2034, growing at a compound annual growth rate of 8.28% from 2026-2034.

Swift urban growth, along with increasing disposable incomes and changing lifestyle trends, is transforming consumer choices towards easy, ready-to-eat snack alternatives. The growing youthful population, shaped by Western dietary trends and rising health awareness, is boosting the need for varied flavor profiles and creative product formats. Classic snacks are being transformed with contemporary packaging and improved health formulas, as government backing through food processing programs and the encouragement of millet-based goods continue to expand India's snack market share.

Key Takeaways and Insights:

- By Product Type: Chips dominate the market with a share of 42% in 2025, driven by their universal appeal across age groups, extensive flavor variety, and continuous innovation including healthier baked and multigrain variants.

- By Pack Type: Pouch leads the market with a share of 68% in 2025, owing to its convenience for on-the-go consumption, lightweight portability, superior freshness preservation, and cost-effectiveness for both manufacturers and consumers.

- By Pack Size: 50-100 gm represents the largest segment with a market share of 45% in 2025, appealing to consumers seeking balanced value propositions for sharing occasions, family consumption, and flavor experimentation without excessive commitment.

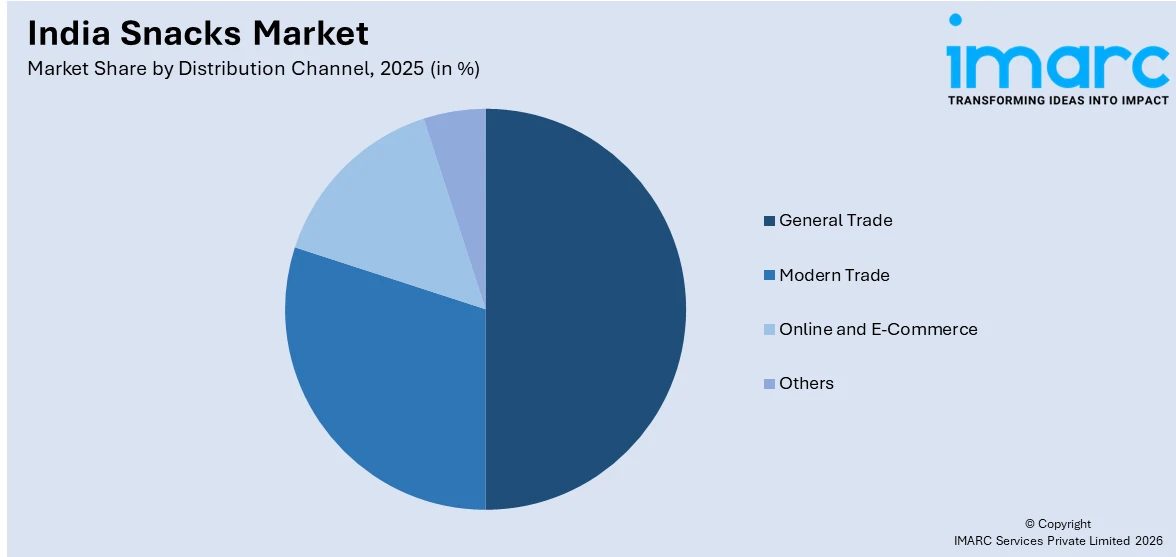

- By Distribution Channel: General trade leads the market with a share of 50% in 2025, sustained by the extensive network of kirana stores providing unmatched last-mile connectivity, affordable pricing, impulse purchase opportunities, and deep penetration in both urban and rural markets.

- Key Players: The India snacks market exhibits intense competitive dynamics, with established multinational corporations competing alongside dominant regional players across diverse price segments and distribution channels. Some of the key market players include Balaji Wafers & Namkeens, Bikaji Foods International Limited, Bikanervala, Haldiram Snacks Food Pvt. Ltd., ITC Limited, Parle Products Pvt. Ltd, PepsiCo, Prataap Snacks Limited, Sundrop Brands Limited, and TTK Foods.

To get more information on this market Request Sample

The changing nature of the snack market is part of a larger transformation of the Indian food ecosystem in which traditional snacks can now be easily enjoyed by modern day consumers. Small-sized, low-cost packs of snacks continue to be an important source of sales volume, allowing them to be sold through neighbourhood stores and therefore drive impulse buying across all economic classes. Millet-based snack forms have become more popular since the introduction by the government of the "Shree Anna" initiative, which aims to create awareness about the health benefits of these ancient grains. The preference for localised tastes remains evident with North Indians favouring spicy namkeen and bhujia snacks, South Indians preferring crispy banana chips and murukku and consumers in Western India preferring pre-packaged products. With the emergence of a larger number of organised snack manufacturers increasingly competing against unbranded small-scale manufacturers, India is positioned among the most dynamic economies in the world for snacking opportunities. The growth of e-commerce platforms in conjunction with traditional retail is making it easier for small snack manufacturers to reach consumers throughout the country, while premium priced products continue to be supported in metropolitan markets. According to IMARC Group, India's e-commerce market is expected to reach USD 651.10 billion by 2034.

India Snacks Market Trends:

Health-Conscious Snacking and Millet Integration

By promoting millets as "Shree Anna," the Government of India has been an integral part of the product development process, with an increasing number of manufacturers using jowar, bajra, and ragi as part of mainstream snack companies' product offerings. As consumers become increasingly aware of the health benefits of consuming more natural foods, they are looking for "natural" products that are healthier for them. In 2025, PepsiCo India introduced Kurkure Jowar Puffs, a baked, millet-based snack made with jowar. This introduction addresses the growing preference for healthy and traditional-based ingredients. In addition to using millets, there has also been a rise in the use of roasted nuts, baked chips, and protein-packed snacks. Consumers are actively reading food labels for low-fat and high-protein claims. The trend toward wellness products is not limited to the product ingredients but also to the style of preparation with baked and air-fried versions of various fried snack products being marketed as guilt-free alternatives.

Premium and Fusion Flavor Innovation

Manufacturers are bridging traditional Indian spice profiles with international flavor formats, creating distinctive fusion products that appeal to increasingly adventurous urban palates. This trend reflects the growing influence of global food culture through travel, social media, and exposure to international cuisines. In January 2025, PepsiCo India partnered with Tata Consumer Products' Ching's Secret to launch Kurkure Schezwan Chutney flavor, blending Kurkure's signature crunch with the bold, tangy flavors of Ching's Schezwan Chutney. Regional variations are being reimagined with contemporary twists including barbeque, peri peri, and cheese seasonings. Premium positioning through exotic flavors, artisanal packaging, and clean-label formulations targets affluent consumers willing to pay price premiums for differentiated experiences. Limited-edition seasonal offerings and celebrity collaborations further enhance brand visibility and create urgency around new product launches, particularly among younger demographics active on social media platforms.

E-Commerce Transformation and Quick Commerce

The rapid digitalization of India's retail landscape is fundamentally restructuring snack distribution networks, with online platforms enabling unprecedented reach and convenience. Traditional brick-and-mortar dominance is being complemented by quick-commerce models promising ultra-fast delivery, particularly in metropolitan areas where time-pressed consumers value immediacy. India added 125 million online shoppers in the past three years, with another 80 million expected by 2025, according to the Indian Brand Equity Foundation. The integration of digital payments, subscription models, and personalized recommendations based on purchase history is enhancing consumer engagement. However, traditional kirana stores continue adapting by partnering with delivery aggregators, allowing neighborhood retailers to maintain relevance while benefiting from digital visibility.

Market Outlook 2026-2034:

The India snacks market is poised for robust expansion, driven by continuing urbanization, demographic shifts, and evolving consumption patterns that favor convenient, portable food formats. Rising female workforce participation and nuclear family structures are reducing time available for traditional meal preparation, positioning snacks as meal substitutes rather than merely indulgent treats. The market generated a revenue of INR 50,590.37 Crore in 2025 and is projected to reach a revenue of INR 103,556.03 Crore by 2034, growing at a compound annual growth rate of 8.28% from 2026-2034. The organized sector is expected to gain share from unbranded local producers as consumers increasingly prioritize hygiene, quality assurance, and consistent taste profiles that packaged products deliver. Government initiatives supporting food processing infrastructure through mega food parks, cold chain development, and production-linked incentive schemes will enhance manufacturing capabilities and reduce wastage.

India Snacks Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Chips |

42% |

|

Pack Type |

Pouch |

68% |

|

Pack Size |

50-100 gm |

45% |

|

Distribution Channel |

General Trade |

50% |

Breakup by Product Type:

- Chips

- Salted Peanuts

- Fryums

- Popcorns

Chips dominate with a market share of 42% of the total India snacks market in 2025.

Chips command dominant market positioning through their universal appeal spanning all age demographics, from children attracted to playful packaging and mild flavors to adults seeking sophisticated taste experiences. The segment benefits from continuous innovation cycles introducing regional flavor profiles alongside international variants including peri peri, sour cream and onion, and barbeque. In October 2024, Lay's India introduced Red Chilli flavor to its Wafer Chips line, inspired by India's preference for bold and authentic tastes, backed by a television commercial featuring brand ambassador Mahendra Singh Dhoni. Manufacturers leverage potato sourcing advantages from agricultural belts in Punjab, Uttar Pradesh, and West Bengal, ensuring consistent raw material supply while supporting farmer incomes through contract cultivation arrangements.

The chips category's dominance extends beyond traditional fried potato variants to encompass healthier baked formulations, multigrain alternatives, and vegetable-based options using sweet potato, beetroot, and cassava. Premium positioning through thicker-cut chips, kettle-cooked variants, and artisanal packaging attracts affluent urban consumers, while affordable small packs priced at INR 5 and INR 10 maintain mass-market accessibility. Distribution strength across channels from neighborhood kirana stores to modern hypermarkets ensures product availability at every touchpoint. Brands continuously engage consumers through limited-edition flavors tied to festivals, sporting events, and regional celebrations, creating excitement and driving trial. The segment benefits from strong brand recall built through decades of aggressive advertising, celebrity endorsements, and sponsorship of popular entertainment properties including cricket tournaments and reality television shows.

Breakup by Pack Type:

- Pouch

- Others

Pouch leads with a share of 68% of the total India snacks market in 2025.

Pouch packaging dominates through its superior convenience attributes perfectly aligned with contemporary consumption occasions emphasizing portability and spontaneity. The lightweight, flexible format enables easy storage in bags, backpacks, and vehicles, making pouches ideal for office snacking, travel consumption, and outdoor activities. Pouches provide excellent barrier properties protecting contents from moisture, air, and light contamination, thereby preserving flavor profiles and extending shelf life without refrigeration requirements. Manufacturers benefit from cost efficiencies as pouches require less material than rigid containers while offering versatile printing surfaces for vibrant graphics, nutritional information, and promotional messaging that enhance shelf appeal.

Technological advancements have introduced resealable zip-lock closures, tear notches, and spout features enhancing user experience and product freshness after initial opening. Sustainable packaging innovations incorporating biodegradable materials, recyclable laminates, and reduced plastic content address growing environmental consciousness among urban consumers. Single-serve pouches cater to portion control preferences among health-conscious segments, while family packs ranging from 100 gm to 200 gm serve sharing occasions and household consumption. The format's flexibility allows varied pack sizes targeting different price points and consumption contexts, from impulse purchases at INR 5 to premium offerings exceeding INR 100. E-commerce growth further amplifies pouch advantages as the format withstands shipping handling better than rigid packaging while minimizing dimensional weight charges. Quick-commerce platforms stocking pouches enable last-mile delivery within 10-15 minutes, meeting urban consumers' expectations for immediate availability.

Breakup by Pack Size:

- Less than 50 gm

- 50-100 gm

- More than 100 gm

50-100 gm exhibits a clear dominance with a 45% share of the total India snacks market in 2025.

The 50-100 gm pack size strikes an optimal balance between affordability and perceived value, making it the preferred choice across diverse consumer segments and consumption occasions. This range accommodates individual consumption while enabling sharing among 2-3 people, positioning it ideally for family settings, social gatherings, and workplace snacking. Pricing typically falls between INR 20 to INR 50, representing an accessible splurge for middle-income households while remaining economical enough for frequent purchases. The segment benefits from its versatility, serving as both impulse purchases at retail checkout counters and planned purchases for specific occasions including movie nights, picnics, and children's lunch boxes.

From a manufacturer perspective, 50-100 gm packs optimize inventory turnover while maintaining gross margins superior to smaller formats that require proportionally higher packaging costs. Retailers favor this size as it commands prime shelf positions, generates consistent footfall, and offers reasonable per-unit margins even at competitive price points. Distribution efficiency benefits from manageable carton sizes that kirana stores can accommodate without excessive inventory investment. The format allows brands to showcase product quality and flavor profiles comprehensively, encouraging consumer trial and potential brand switching. Promotional strategies including multipack offerings, bundled combos, and festive season discounts leverage this pack size to drive volume growth. Regional preferences influence specific weight preferences within the range, with certain markets favoring 75 gm as the sweet spot while others prefer standardized 50 gm or 100 gm denominations.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- General Trade

- Modern Trade

- Online and E-Commerce

- Others

General trade leads with a share of 50% of the total India snacks market in 2025.

General trade, comprising the extensive network of small local grocers known as kirana stores, maintains its commanding position through unparalleled last-mile connectivity that penetrates both urban neighborhoods and remote rural settlements. These neighborhood retailers leverage deep community relationships, personalized service, and credit facilities that foster customer loyalty across generations. Kirana stores' hyperlocal presence enables impulse purchase opportunities as consumers frequently visit for daily essentials, with snacks positioned strategically near checkout counters to capture spontaneous buying decisions. The channel's dominance is particularly pronounced in semi-urban and rural areas where modern retail infrastructure remains limited and consumers prioritize affordability and familiarity over shopping experience.

Traditional retailers demonstrate remarkable adaptability, increasingly partnering with delivery aggregators to offer doorstep convenience while maintaining their neighborhood advantage. The channel's inventory flexibility allows stocking of regional brands and local favorites that might not receive shelf space in standardized modern retail formats, thereby serving diverse taste preferences. Credit mechanisms permit consumption smoothing among lower-income segments, with shop owners often maintaining informal ledgers for regular customersQuick inventory turnover and modest infrastructure requirements enable competitive pricing that matches or undercuts organized retail.

Breakup by States:

- Maharashtra

- Uttar Pradesh

- Delhi

- Gujarat

- Karnataka

- Andhra Pradesh

- Telangana

- Goa

- Others

Maharashtra, as India's second-most populous state with large urban centers including Mumbai and Pune, contributes significantly to snack consumption driven by high disposable incomes, cosmopolitan food culture, and strong modern retail presence that facilitates rapid adoption of new product innovations.

Uttar Pradesh, the country's most populous state, represents massive volume potential with strong preferences for traditional namkeen varieties including bhujia and mixture, while growing urbanization in cities like Noida, Lucknow, and Kanpur is expanding consumption of packaged Western-style snacks among younger demographics.

Delhi, as the national capital territory with the highest per capita income among Indian states, demonstrates sophisticated consumer preferences favoring premium and international flavors, serving as a crucial market for new product launches and brand positioning strategies that often set trends for broader national rollout.

Gujarat's strong entrepreneurial culture and predominantly vegetarian population create unique opportunities for plant-based and traditional Indian snack formats, with cities like Ahmedabad and Surat showing robust demand for both regional specialties and packaged convenience products.

Karnataka, anchored by Bengaluru's thriving technology sector, exhibits high adoption of convenient snacking formats among the city's young, affluent workforce while the state's diverse geography supports varied regional preferences from coastal Mangaluru's seafood-inspired flavors to North Karnataka's spicier variants.

Andhra Pradesh shows strong preference for spicy, fried, and traditional snacks. Local flavours, chilli-heavy profiles, and regional brands play a key role. Demand is driven by home consumption and festivals, with packaged snacks gaining ground through expanding retail networks and improving cold-chain logistics.

Telangana’s snacks market is led by Hyderabad, where demand spans traditional snacks, bakery items, and packaged savouries. Busy urban lifestyles support ready-to-eat formats, while regional taste preferences remain strong. Quick commerce and modern retail are accelerating product trials and premium segment growth.

Goa, despite its smaller population, punches above its weight through tourism-driven consumption and cosmopolitan preferences that drive trials of premium and international snack brands, with the state serving as a testing ground for products targeting leisure and indulgence occasions.

Other states collectively represent significant untapped potential as improving infrastructure, rising incomes, and expanding retail penetration bring packaged snacks to previously underserved markets, particularly in the Eastern region including West Bengal, Bihar, and the Northeastern states where traditional eating habits are gradually incorporating modern snacking formats alongside regional specialties.

Market Dynamics:

Growth Drivers:

Why is the India Snacks Market Growing?

Rapid Urbanization and Evolving Lifestyle Patterns

India's ongoing urban transformation, with cities growing at unprecedented rates, is fundamentally altering consumption behaviors and creating sustained demand for convenient food formats. Urban living characterized by long commutes, demanding work schedules, and smaller living spaces reduces time and inclination for elaborate meal preparation, positioning packaged snacks as practical solutions for quick energy replenishment between meals. According to the International Monetary Fund's (IMF) 2025 World Economic Outlook, India's nominal per capita income was estimated to be around 2,818 dollars. The demographic dividend of a predominantly young population, with median age under 29 years, creates a consumer base naturally inclined toward novel flavor experiences, international food influences, and brands that resonate with aspirational lifestyles. Nuclear family structures replacing traditional joint family systems increase per capita consumption as individual preferences take precedence over collective meal planning. Office culture embracing flexible work arrangements creates new snacking occasions during work-from-home scenarios, while the return to offices sustains demand for portable formats. Rising female workforce participation correlates with higher household incomes and reduced capacity for traditional cooking, making packaged snacks practical meal complements or replacements. Entertainment patterns centered on streaming services, gaming, and social media foster snacking during leisure consumption, particularly among teenagers and young adults.

Government Support Through Food Processing Initiatives

The Indian government's strategic emphasis on strengthening the food processing ecosystem through comprehensive policy frameworks and financial incentive mechanisms is directly catalyzing snacks sector growth. The Ministry of Food Processing Industries' budget increased by approximately 30.19% in 2024-25 compared to the previous year, reflecting prioritization of the sector under Make in India initiatives. Mega Food Parks providing plug-and-play infrastructure with common processing facilities, cold chain networks, and logistics support reduce entry barriers for entrepreneurs while improving operational efficiencies. The government's promotion of millets as "Shree Anna" through awareness campaigns and procurement programs has catalyzed product innovation in millet-based snacks, with the Production Linked Incentive Scheme for Millet Based Products offering specific incentives for manufacturers incorporating these nutritious grains. Simplified regulations for foreign direct investment permitting 100% FDI in food processing attract multinational corporations bringing advanced technologies, global best practices, and market development investments. Infrastructure development including improved road connectivity, dedicated freight corridors, and agricultural market reforms reduce logistics costs and wastage.

Packaging Innovation and Convenience Revolution

Continuous advancements in packaging technologies are revolutionizing snack formats, enhancing product appeal, extending shelf life, and enabling new consumption occasions that collectively drive category expansion. Innovations such as nitrogen flushing prevent oxidation and maintain crispness, while multi-layer laminates provide moisture barriers essential in India's humid climate. Resealable zip-lock closures address portion control preferences and multi-occasion consumption, reducing product waste and enhancing perceived value. Single-serve formats enable precise calorie management for health-conscious consumers while facilitating trials of new flavors without commitment to larger packs. Eco-friendly packaging incorporating biodegradable materials, recyclable substrates, and reduced plastic content appeals to environmentally aware urban segments while positioning brands as responsible corporate citizens. In 2024, Pakka Limited, a producer of compostable packaging solutions, revealed its second partnership with Brawny Bear, a nutrition brand recognized for its date-based health food items. Through this collaboration, the brand has introduced Date Energy Bars, the first energy bar in India featuring compostable flexible packaging.

Market Restraints:

What Challenges the India Snacks Market is Facing?

Raw Material Cost Inflation and Margin Pressure

Volatile commodity prices, particularly for key inputs including edible oils, grains, and packaging materials, create persistent margin pressures that challenge manufacturer profitability and pricing strategies. Wheat, rice, and corn price fluctuations driven by monsoon variability, global trade disruptions, and government export policies introduce unpredictability in production planning. Packaging material costs tied to crude oil derivatives experience volatility that compounds margin compression. Manufacturers face difficult tradeoffs between absorbing cost increases that erode profitability versus passing costs to consumers through price increases that risk volume declines in a highly price-sensitive market. Shrinkflation strategies reducing package contents while maintaining sticker prices preserve nominal affordability but risk consumer backlash when discovered.

Intense Fragmented Competition and Pricing Pressures

The market's highly competitive landscape, characterized by numerous regional players and extensive unorganized sector participation, creates intense pricing pressures that limit profitability and constrain brand-building investments. Traditional snacks account for 56% of market volume, with significant share controlled by small-scale producers and street vendors operating with minimal overhead and offering ultra-competitive prices that organized players struggle to match. Regional champions leverage local brand loyalty, efficient distribution networks, and competitive pricing to defend home markets while expanding into territories traditionally dominated by multinational corporations. Private-label brands from supermarket chains provide cost-effective alternatives that increase competition particularly in modern trade channels. Consumers demonstrate high price sensitivity and limited brand loyalty beyond a few dominant players, readily switching brands based on price promotions and availability. The proliferation of regional and local brands creates shelf space constraints, forcing manufacturers to invest heavily in trade incentives, promotional schemes, and distributor margins to secure retail placement.

Supply Chain Constraints and Infrastructure Gaps

Persistent logistics challenges, particularly distribution complexities in rural areas and quality maintenance during transportation across India's diverse climatic zones, constrain market penetration and increase operational costs. Perishable nature of certain snack categories requires temperature-controlled logistics that remain inadequate beyond major cities, limiting geographic expansion of products with shorter shelf lives. Last-mile delivery infrastructure gaps in remote rural areas increase distribution costs disproportionately, making many markets economically unviable for organized players despite population potential. Road quality variations and seasonal disruptions during monsoons cause delivery delays and damage. Cold chain deficiencies cause post-production waste and quality degradation for sensitive formulations. Warehousing capacity shortfalls near agricultural sourcing zones necessitate inefficient long-distance transportation of raw materials.

Competitive Landscape:

The India snacks market exhibits a unique competitive structure characterized by the coexistence of powerful multinational corporations, dominant regional players, and a vast unorganized sector that collectively create a highly dynamic and fragmented landscape. The competitive intensity manifests through aggressive promotional campaigns during festivals, cricket tournaments, and major entertainment events, with brands competing for consumer mindshare through multi-channel marketing encompassing television, digital platforms, out-of-home advertising, and influencer collaborations. Product innovation serves as a key differentiator, with companies racing to launch new flavors, healthier formulations, and convenient formats that capture evolving consumer preferences. The market continues witnessing consolidation efforts as larger players seek acquisitions to gain market share, distribution access, and manufacturing capabilities, while successful regional brands explore initial public offerings to fund expansion and modernization. Some of the key market players include:

- Balaji Wafers & Namkeens

- Bikaji Foods International Limited

- Bikanervala

- Haldiram Snacks Food Pvt. Ltd.

- ITC Limited

- Parle Products Pvt. Ltd

- PepsiCo

- Prataap Snacks Limited

- Sundrop Brands Limited

- TTK Foods

Recent Developments:

- In January 2026, Balaji Wafers, a major snack food brand in India, announced that it has finalized an agreement to secure a strategic investment from General Atlantic, a prominent global investor. Balaji Wafers will concentrate on enhancing essential corporate functions throughout the Company and speeding up innovation with General Atlantic’s investment. Leveraging General Atlantic's worldwide experience in the food and consumer industries, the Company aims to expedite its growth throughout India.

- In November 2025, HyFun Foods, a frozen-foods specialist from Gujarat, has launched a new retail line of ready-to-cook frozen snacks targeted at Indian families in anticipation of the winter season. The latest collection merges culinary creativity with ease, placing HyFun beyond its conventional emphasis on potato products.

- In July 2025, Lotte India, a subsidiary of the South Korean Lotte Group, enhanced its product lineup by introducing its inaugural biscuit snack, PEPERO, in India, targeting Rs 2,000 crore in revenue for the year. Offered in 'original' and 'crunchy' varieties, PEPERO is the top biscuit snack brand in Korea and has reached more than 56 countries.

India Snacks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Crore, ‘000 Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chips, Salted Peanuts, Fryums, Popcorns |

| Pack Types Covered | Pouch, Others |

| Pack Sizes Covered | Less than 50 gm, 50-100 gm, More than 100 gm |

| Distribution Channels Covered | General Trade, Modern Trade, Online and E-Commerce, Others |

| States Covered | Maharashtra, Uttar Pradesh, Delhi, Gujarat, Karnataka, Andhra Pradesh, Telangana, Goa, Others |

| Companies Covered | Balaji Wafers & Namkeens, Bikaji Foods International Limited, Bikanervala, Haldiram Snacks Food Pvt. Ltd., ITC Limited, Parle Products Pvt. Ltd, PepsiCo, Prataap Snacks Limited, Sundrop Brands Limited, TTK Foods, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India snacks market size was valued at INR 50,590.37 Crore in 2025.

The India snacks market is expected to grow at a compound annual growth rate of 8.28% from 2026-2034 to reach INR 103,556.03 Crore by 2034.

Chips dominate with approximately 42% market share in 2025, driven by their universal appeal across age groups, extensive flavor variety catering to regional preferences, continuous innovation including healthier baked and multigrain variants, and strong distribution ensuring availability from small retail shops to large supermarkets that makes them accessible to vast consumer segments nationwide.

Key factors driving the India snacks market include rapid urbanization and evolving lifestyles that prioritize convenience, rising disposable incomes enabling discretionary food spending, growing young demographic influenced by Western eating habits, government support through food processing initiatives and production-linked incentive schemes, packaging innovations enhancing convenience and shelf appeal, and expanding e-commerce platforms providing unprecedented market reach beyond traditional retail constraints.

Major challenges include volatile raw material costs particularly for edible oils which surged forcing manufacturers into difficult pricing decisions, intense fragmented competition from regional players and unorganized sector creating persistent pricing pressures, supply chain constraints including inadequate cold chain infrastructure limiting geographic expansion, limited modern retail penetration in rural areas increasing distribution costs, and evolving health consciousness requiring product reformulation investments to meet changing consumer preferences for healthier alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)