India Soap Market Size, Share, Trends and Forecast by Type, Form, Product, Distribution Channel, and Region, 2025-2033

Market Overview:

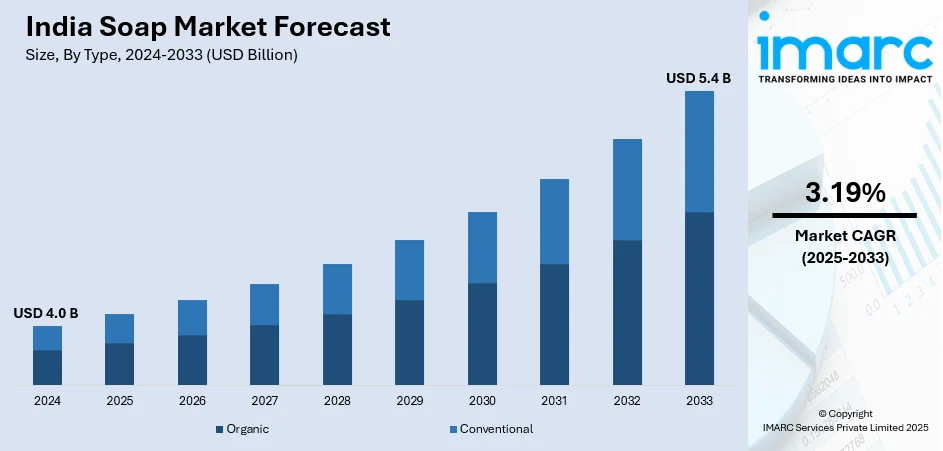

The India soap market size reached USD 4.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.19% during 2025-2033. The rising awareness about hygiene, increasing occurrence of various infectious diseases, and the growing utilization of sustainable soap packaging represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.0 Billion |

|

Market Forecast in 2033

|

USD 5.4 Billion |

| Market Growth Rate 2025-2033 | 3.19% |

Soaps are cleaning and emulsifying agents manufactured with sodium or potassium salts and contain glycerin, essential oils, and colorants. They are produced in liquid and bar forms and comprise a wide variety of fragrances, such as rosemary, lavender, rose, lemon, sandalwood, patchouli, lemongrass and strawberry. They can include shea, mango seed and cocoa butter and wax, which provides moisturization to the skin. They help in removing sweat and sebum from the body, preventing the clogging of pores and reducing the occurrence of acne-causing bacteria. Soaps are extensively utilized for washing and sanitizing hands before eating to prevent the spread of contagious viruses. They effectively sanitize surfaces and floors by killing harmful microorganisms, such as staphylococcus aureus, corynebacterium diptheroides, klebsiella pneumonia and escherichia coli. They also aid in washing kitchen utensils and various tableware items. As they are affordable, easy to use, and readily available, soaps find extensive applications in the textile, food and beverage (F&B), chemical, ceramics and paint industries across India.

To get more information on this market, Request Sample

India Soap Market Trends:

At present, there is an increase in the demand for soaps among the masses to maintain hygiene and prevent the occurrence of body odors. This, coupled with the rising utilization of medicated soaps by surgeons and nurses to sanitize hands before initiating a surgical procedure and preventing the spread of hospital-acquired infections (HAIs), is influencing the market positively in India. Besides this, the growing number of e-commerce brands selling handmade ayurvedic soaps infused with various natural exfoliating agents, such as ground coffee and sugar, is offering a favorable market outlook in the country. In addition, key market players are manufacturing chemical-free soaps with sustainable packaging to reduce their carbon footprint, avoid the usage of plastics, and decrease contamination of water bodies. They are also producing soaps incorporated with organic herbs and aromatherapeutic properties. Apart from this, the rising employment of soaps in paper processing mills to manufacture and recycle paper is contributing to the growth of the market. Additionally, the increasing availability of vegan soaps due to the rising environmental awareness and animal welfare activities is strengthening the market growth. Furthermore, the Government of India is undertaking initiatives to promote cleanliness and hygiene, which is bolstering the market growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India soap market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type, form, product and distribution channel.

Type Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the India soap market based on the type. This includes organic and conventional. According to the report, conventional represented the largest segment.

Form Insights:

- Liquid

- Solid

- Others

A detailed breakup and analysis of the India soap market based on form has also been provided in the report. This includes liquid, solid and others. According to the report, solid accounted for the largest market share.

Product Insights:

- Bath Soap

- Kitchen Soap

- Medicated Soap

- Laundry Soap

- Others

A detailed breakup and analysis of the India soap market based on product has also been provided in the report. This includes bath, kitchen, medicated, laundry and other soaps. According to the report, bath soap accounted for the largest market share.

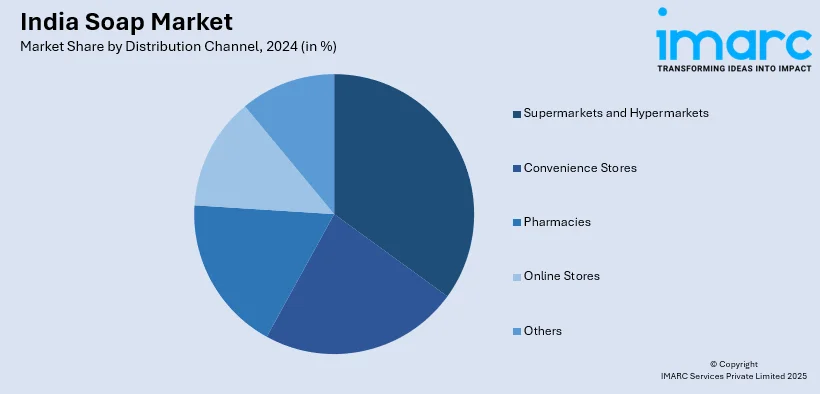

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies

- Online Stores

- Others

A detailed breakup and analysis of the India soap market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmacies, online stores and others. According to the report, convenience stores accounted for the largest market share.

Regional Insights:

- North India

- West and Central India

- South India

- East India

The report has also provided a comprehensive analysis of all the major regional markets that include North, West and Central, South, and East India. According to the report, West and Central India was the largest market for soap. Some of the factors driving the West and Central India soap market include the increasing awareness among people about hygiene in rural parts, rising initiatives by state government of various countries to maintain cleanliness, the growing number of distributing channels, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India soap market. Detailed profiles of all major companies have also been provided. Some of the companies covered include Colgate Palmolive (India) Ltd., Godrej Consumer Products Limited, Himalaya Wellness Company, Hindustan Unilever Limited, ITC Limited, Jyothy laboratories Ltd., Karnataka Soaps and Detergents Limited, Patanjali Ayurved Limited, Reckitt Benckiser (India) Ltd., Wipro Consumer Care & Lighting. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Type, Form, Product, Distribution Channel, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Colgate Palmolive (India) Ltd., Godrej Consumer Products Limited, Himalaya Wellness Company, Hindustan Unilever Limited, ITC Limited, Jyothy Laboratories Ltd., Karnataka Soaps and Detergents Limited, Patanjali Ayurved Limited, Reckitt Benckiser (India) Ltd., and Wipro Consumer Care & Lighting |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India soap market performed so far and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India soap market?

- What are the key regional markets?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the form?

- What is the breakup of the market based on the product?

- What is the breakup of the market based on the distribution channel?

- What is the competitive structure of the India soap market?

- Who are the key players/companies in the India soap market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India soap market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India soap market.

- The study maps the leading as well as the fastest growing regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India soap industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)