India Vinyl Flooring Market Size, Share, Trends and Forecast by Sector, Segment, Imports and Domestic Manufacturing, Product Type, and Region, 2025-2033

Market Overview:

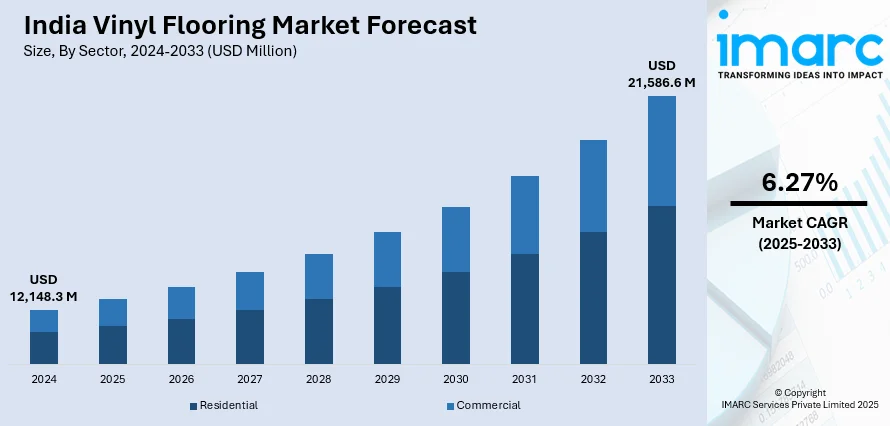

The India vinyl flooring market size reached USD 12,148.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 21,586.6 Million by 2033, exhibiting a growth rate (CAGR) of 6.27% during 2025-2033. The rapid urbanization activities, increasing disposable income, recent development of innovative vinyl flooring products, and the implementation of supportive policies by the Government of India (GoI), are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12,148.3 Million |

|

Market Forecast in 2033

|

USD 21,586.6 Million |

| Market Growth Rate 2025-2033 | 6.27% |

Vinyl flooring refers to a synthetic flooring solution made from polyvinyl chloride (PVC) resin, plasticizers, stabilizers, pigments, fillers, and various additives to achieve color, pattern, and texture. It is widely used in kitchens, bathrooms, hallways, and high-traffic areas because of its water-resistant properties and ease of maintenance. Vinyl flooring is a cost-effective and versatile product that enhances aesthetic appeal and provides protection against spills and stains. Its cushioned underlayer also provides comfort underfoot and reduces noise, which aids in creating a comfortable indoor environment.

To get more information of this market, Request Sample

The growing awareness regarding the benefits of vinyl flooring over traditional flooring options, such as durability, water resistance, and ease of installation, is boosting the market growth. Furthermore, the widespread product utilization in high-traffic and moisture-prone areas, such as kitchens, bathrooms, and commercial establishments, is acting as another growth-inducing factor. Additionally, aggressive marketing and promotional activities by manufacturers and retailers through social media and paid advertisement to increase awareness about product offerings and improve brand visibility are contributing to the market growth. Moreover, the implementation of supportive policies by the Government of India (GoI) to promote infrastructure development activities in urban and semi-urban areas is favoring the market growth. Other factors, including rising expenditure capacities of consumers, increasing investment in the development of advanced products, and growing influence of home décor trends and ideas through digital platforms and social media, are anticipated to drive the market growth.

India Vinyl Flooring Market Trends/Drivers:

Rapid urbanization and increased disposable income

India is currently witnessing an unprecedented phase of urbanization, with a significant number of people moving from rural to urban areas. Furthermore, the rapid economic growth has resulted in a considerable rise in disposable income, particularly among the middle-class population, which led to an increased demand for improved living standards and housing facilities. Apart from this, the significant growth in the construction industry is resulting in a heightened demand for durable, stylish, and cost-effective flooring solutions, such as vinyl flooring. Moreover, the expanding commercial sector, which includes offices, retail spaces, and the hospitality industry, also fuels this demand as businesses seek to enhance the aesthetics and functionality of their spaces. Besides this, vinyl flooring provides the ability to mimic materials, such as wood and stone, which is further contributing to the market growth.

Development of innovative vinyl flooring products

Technological advancements have allowed manufacturers to produce innovative vinyl flooring designs that effectively imitate higher-end materials, such as hardwood and natural stone. These high-quality replicas provide the luxury feel and aesthetics of expensive flooring options but at a significantly lower cost. Furthermore, the increasing demand for cost-effective vinyl flooring in the Indian market, as consumers are increasingly seeking affordable yet sophisticated home décor solutions, is propelling the market growth. In addition to this, the development of advanced vinyl flooring solutions that offer superior features, such as enhanced durability, water resistance, and easy maintenance, which makes them an increasingly popular choice for both residential and commercial applications, is strengthening the market growth. Besides this, the continuous innovation in product design and functionality is a significant driving force behind the vinyl flooring market growth in India.

India Vinyl Flooring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India vinyl flooring market report, along with forecasts from 2025-2033. Our report has categorized the market based on sector, segment, imports and domestic manufacturing, product type, LVT market breakup by type, LVT market breakup by application sector, Vinyl Sheet market breakup by contract type and Vinyl Sheet market breakup by application.

Breakup by Sector:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the sector. This includes residential and commercial.

The residential segment remains a significant contributor to the vinyl flooring market, due to the growing need for durable and cost-effective flooring in homes. Furthermore, rising urbanization, increasing disposable income, and a shifting trend towards nuclear families have spurred housing construction and renovation activities, thus driving the demand for vinyl flooring. Moreover, the variety in design, texture, and color that vinyl flooring offers makes it highly appealing to homeowners who desire aesthetically pleasing yet affordable home décor solutions.

Vinyl flooring is widely used in commercial establishments, such as offices, retail spaces, the hospitality industry, healthcare facilities, and educational institutions, due to its high durability and low maintenance characteristics. In addition, the resilience of vinyl flooring to wear and tear makes it a highly suitable choice for places where high foot traffic is common. Additionally, the availability of vinyl flooring in a variety of designs and patterns that allows businesses to maintain a sophisticated and professional appearance is contributing to the market growth.

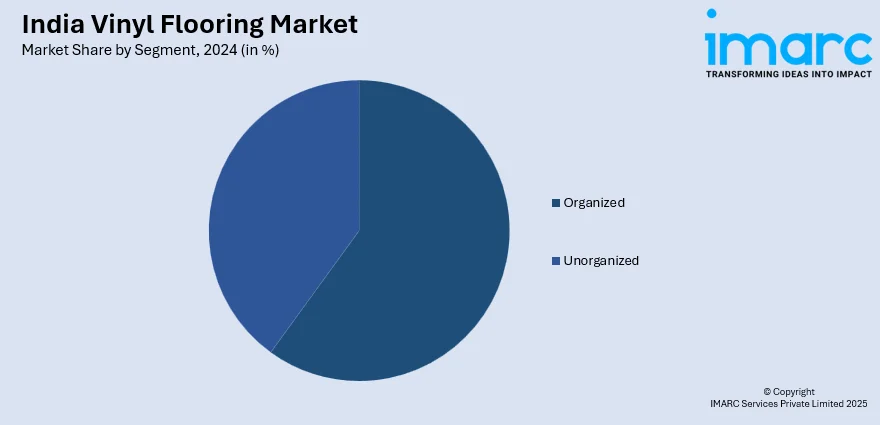

Breakup by Segment:

- Organized

- Unorganized

Unorganized account for the majority of the market share

A detailed breakup and analysis of the market based on the segment has also been provided in the report. This includes organized and unorganized. According to the report, the unorganized segment accounted for the largest market share.

The unorganized sector operates on a smaller scale and has lower overhead costs compared to organized players. They generally do not comply with regulatory requirements or invest heavily in marketing and branding campaigns, which allows them to offer vinyl flooring at lower prices, thus attracting price-sensitive consumers. Furthermore, the unorganized sector is more flexible in terms of product customization and quick response to changing customer demands. They can readily adapt their products to suit specific customer requirements, offering a wider variety of designs, patterns, and sizes. Moreover, they have established relationships with retailers, contractors, and suppliers in their respective regions, making it easier for them to reach customers in both urban and rural areas. Apart from this, the unorganized sector builds trust and reputation through personal relationships and recommendations from satisfied customers. This grassroots marketing approach resonates with Indian consumers who value personal connections and testimonials.

Breakup by Imports and Domestic Manufacturing:

- Imports

- Domestic Manufacturing

Imports hold the largest share in the market

A detailed breakup and analysis of the India vinyl flooring market has been provided based on imports and domestic manufacturing. According to the report, imports accounted for the largest market share.

Imported vinyl flooring holds the majority of market share due to its lower production costs, economies of scale, and advanced manufacturing technologies. Furthermore, it offers a wider range of designs, patterns, and textures compared to domestic manufacturing, which aids in attracting Indian consumers who seek diverse and aesthetically appealing options. Additionally, foreign manufacturers have access to advanced technologies and production techniques that result in high-quality vinyl flooring, which offers superior durability, wear resistance, and ease of installation. Moreover, India has entered into various trade agreements with countries that are major producers of vinyl flooring. These agreements lower import tariffs and trade barriers, making it more economically viable for Indian businesses to import vinyl flooring products. Apart from this, the presence of limited domestic manufacturing capacity, which struggles to meet the rising consumer demands in India, is acting as another growth-inducing factor.

Breakup by Product Type:

- Vinyl Sheet

- Luxury Vinyl Tile (LVT)

- Vinyl Composition Tile (VCT)

Vinyl sheet account for the majority of the market share

A detailed breakup and analysis of the market based on the product type has also been provided in the report. This includes vinyl sheet, luxury vinyl tile (LVT), and vinyl composition tile (VCT). According to the report, the vinyl sheet segment accounted for the largest market share.

Vinyl sheet flooring is more cost-effective compared to other types of vinyl flooring, such as luxury vinyl tiles (LVT) and vinyl planks. It is also less expensive to produce, install, and maintain, making it an affordable option for a wide range of consumers. Furthermore, it is available in large rolls, which allows for seamless installation over large areas. It can also be easily cut and fitted to match the dimensions of any room, thus minimizing the number of seams and creating a cohesive look. Additionally, vinyl sheet flooring is known for its durability and resilience, as it can withstand heavy foot traffic, making it suitable for high-traffic areas such as commercial buildings. Moreover, it offers realistic imitations of various materials, such as wood, stone, and tile, thus providing consumers with a broad range of aesthetic options to match their preferences and interior design.

LVT Market Breakup by Type:

- Traditional LVT

- WPC

- SPC

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes traditional LVT, WPC, and SPC.

Traditional LVT is designed to mimic the look of materials such as hardwood, stone, or ceramic tiles. It offers a high level of realism in terms of texture, color, and pattern, making it an attractive option for consumers who desire the aesthetic appeal of natural materials without the associated maintenance and cost. Furthermore, traditional LVT is known for its low-maintenance characteristics, which makes it appealing to consumers who prefer hassle-free flooring solutions.

Wood plastic composite (WPC) is engineered with a waterproof core, which makes it suitable for areas susceptible to moisture, such as bathrooms, kitchens, and basements. Furthermore, it is constructed with a combination of wood fibers and thermoplastic materials, providing increased stability and resistance to deformation due to temperature changes. Additionally, WPC flooring is available in click-lock and floating installation systems, which simplify and expedite the installation process.

LVT Market Breakup by Application Sector:

- Commercial

- Healthcare

- Education

- Hospitality

- Retail

- Corporate

- Sports

- Others

- Residential

A detailed breakup and analysis of the market based on the application sector has also been provided in the report. This includes commercial (healthcare, education, hospitality, retail, corporate, sports, and others) and residential.

LVT is widely used in commercial spaces, such as retail stores, boutiques, department stores, and supermarkets, to provide a visually appealing and durable flooring solution that can withstand heavy foot traffic and offer a comfortable walking surface for shoppers. Additionally, it is extensively used in office settings as it can handle the movement of office chairs while providing a professional and stylish appearance. Moreover, LVT is a suitable choice for hospitals, clinics, and other healthcare settings, as it is easy to maintain and offers antimicrobial properties.

In residential areas, LVT is commonly installed in living rooms, family rooms, and dens to provide the look of hardwood or stone flooring without the associated maintenance and cost. Furthermore, its water resistance and ease of maintenance make it an excellent flooring choice for kitchens and bathrooms, as it can handle spills, moisture, and frequent cleaning without warping or deteriorating.

Vinyl Sheet Market Breakup by Contract Type:

- Semi-Contract Sheet Vinyl

- Contract Sheet Vinyl

- Others

A detailed breakup and analysis of the market based on the contract type has also been provided in the report. This includes semi-contract sheet vinyl, contract sheet vinyl, and others.

Semi-contract sheet vinyl is designed to withstand heavy foot traffic and wear in commercial settings. It has a thicker wear layer compared to residential sheet vinyl, providing increased durability and resistance to scratches, stains, and dents. Furthermore, it is more affordable compared to premium contract flooring options, such as luxury vinyl tiles (LVT) or vinyl composition tiles (VCT), which makes it an attractive choice for commercial projects with budget constraints.

Contract sheet vinyl is known for its smooth and non-porous surface, which makes it resistant to stains and easy to clean. Furthermore, it has inherent sound-absorbing properties that aid in minimizing sound transmission within the environment. Apart from this, contract sheet vinyl is available in various colors, patterns, and textures, allowing for customization to suit the desired aesthetic of a commercial or residential space.

Vinyl Sheet Market Breakup by Application:

- Commercial

- Healthcare

- Hospitality

- Transport

- Education

- Sports

- Retail

- Others

- Residential

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes commercial (healthcare, hospitality, transport, education, sports, retail, and others) and residential.

Vinyl sheet flooring is commonly used in commercial spaces due to its durability, cost-effectiveness, and ease of maintenance. It can also handle heavy footfall and is available in a diverse range of designs, allowing building owners to create attractive and inviting spaces. Furthermore, it offers excellent sound absorption properties, provides resistance to stains and spills, and contributes to a hygienic environment, which makes it suitable for hospitals, clinics, and assisted living facilities.

Vinyl sheet flooring is commonly used in living rooms, family rooms, and other residential living spaces as it provides a practical and affordable flooring option that can imitate the look of natural materials, such as hardwood or stone. Furthermore, it can withstand spills and moisture without warping or deteriorating, making it an ideal choice for kitchen and bathroom areas.

Competitive Landscape:

The top companies are investing heavily in research and development (R&D) to produce vinyl flooring that effectively replicates the aesthetics of high-end materials, such as hardwood and natural stone. Along with this, the development of vinyl flooring with enhanced features such as increased durability, water resistance, and improved insulation properties is acting as another growth-inducing factor. Furthermore, the growing consumer demand for sustainable products has prompted leading companies to manufacture vinyl flooring using eco-friendly processes and recyclable materials. Additionally, several key players are engaging in partnerships with other flooring companies, distributors, and suppliers to expand their product portfolio, increase their market share, and enhance their distribution networks. Moreover, companies are focusing on engaging customers through effective marketing strategies. They are leveraging digital platforms, including social media and their own websites, to showcase their product range, highlight their unique selling points, and engage directly with consumers.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vinyl flooring market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India vinyl flooring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vinyl flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India vinyl flooring market was valued at USD 12,148.3 Million in 2024.

We expect the India vinyl flooring market to exhibit a CAGR of 6.27% during 2025-2033.

The rising development of modern housing facilities, along with the introduction of vinyl flooring with high aesthetic value and sharper textures, is currently driving the India vinyl flooring market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation resulting in the temporary halt in numerous construction activities, thereby negatively impacting the demand for vinyl flooring.

Based on the sector, the India vinyl flooring market has been segmented into residential and commercial.

Based on the segment, the India vinyl flooring market can be divided into organized and unorganized, where unorganized segment currently exhibits a clear dominance in the market.

Based on the imports and domestic manufacturing, the India vinyl flooring market has been categorized into imports and domestic manufacturing. Currently, imports account for the majority of the total market share.

Based on the product type, the India vinyl flooring market can be segregated into vinyl sheet, Luxury Vinyl Tile (LVT), and Vinyl Composition Tile (VCT). Among these, vinyl sheet currently holds the largest market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)