Indian Bakery Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Indian Bakery Market Summary:

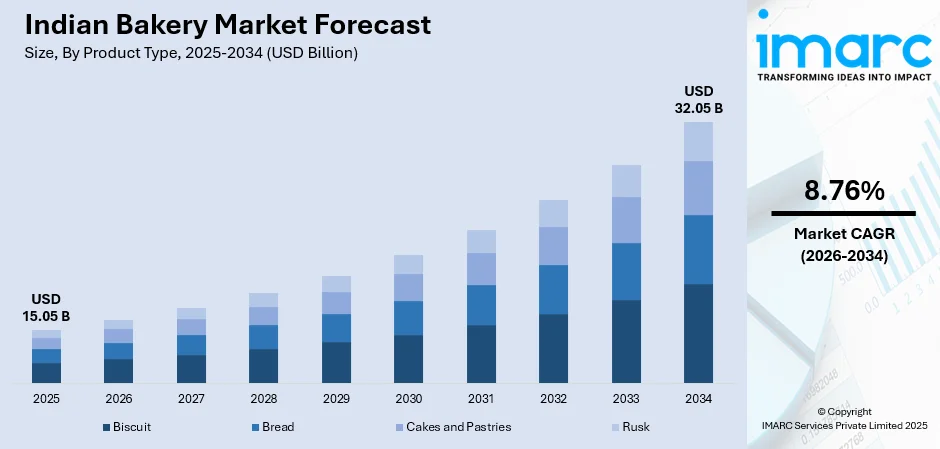

The Indian bakery market size was valued at USD 15.05 Billion in 2025 and is projected to reach USD 32.05 Billion by 2034, growing at a compound annual growth rate of 8.76% from 2026-2034.

This growth is fueled by rapid urban developments, rising disposable incomes, evolving consumption patterns, and the widespread adoption of convenient ready-to-eat options among time-constrained consumers. The expanding organized retail landscape, coupled with increasing health awareness and demand for premium artisanal offerings, continues to reshape traditional bakery consumption, while government initiatives promoting millet-based and nutritionally enriched products are accelerating product diversification across urban and semi-urban markets, thereby expanding the Indian bakery market.

Key Takeaways and Insights:

- By Product Type: Bread dominates the market with a share of 36% in 2025, driven by institutional demand, fortified variants gaining traction in schools and hospitals, and consistent household consumption patterns across income segments.

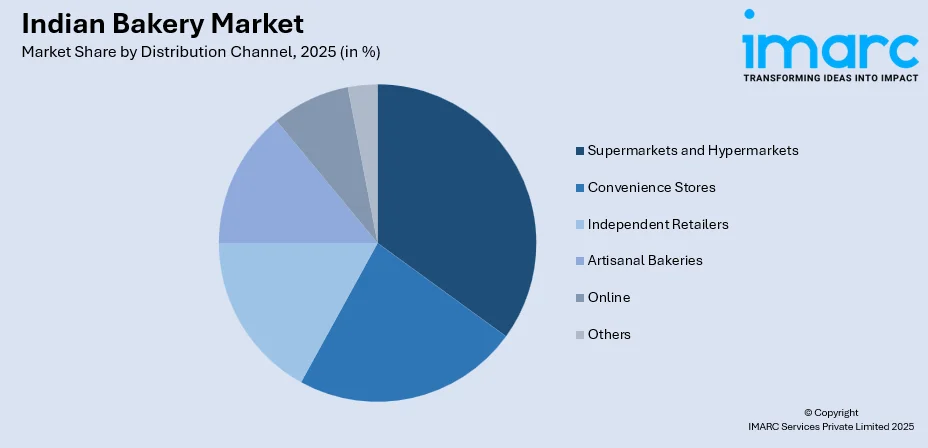

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 35% in 2025, attributed to one-stop shopping convenience, competitive pricing, extensive product variety, and strategic placement in high-footfall urban locations.

- By Region: North India represents the largest segment with a market share of 30% in 2025, supported by dense urban populations in Delhi NCR, higher per capita consumption of western bakery formats, and concentration of manufacturing facilities.

- Key Players: The Indian bakery market exhibits moderate competitive intensity, with established domestic players and multinational corporations competing across value and premium segments through continuous innovation, distribution excellence, and strategic partnerships. Some of the key market players include Anmol Industries Limited, Bonn Group, Britannia Industries Limited, ITC Limited, Mondelēz International, Mrs Bectors Food Specialities Ltd, Parle Products Pvt. Ltd., Ravi Foods Pvt Ltd, and Surya Food & Agro Limited.

To get more information on this market Request Sample

The market is experiencing significant changes as health-oriented consumers are increasingly looking for functional ingredients, clean-label products, and substitutes for conventional refined flour options. Urban modifications continue to drive demand for convenience-oriented bakery items, while the proliferation of quick-commerce platforms and modern retail formats is enhancing product accessibility beyond metropolitan centers. Government support through cold chain infrastructure development and food processing schemes is enabling manufacturers to maintain freshness and extend reach into tier-two and tier-three cities. For instance, CK's Bakery under CavinKare Group inaugurated a flagship outlet in Bengaluru in April 2025, marking its expansion beyond Tamil Nadu with plans to open 25 additional stores supported by quick-commerce partnerships. Additionally, the growing penetration of artisanal bakeries and premium café formats is elevating consumer expectations around taste, texture, and ingredient transparency.

Indian Bakery Market Trends:

Health-Conscious Product Reformulation Accelerating Mainstream Adoption

The traditional bakery range is being quickly substituted by functional variants with whole grains, millets, oats, multigrain flours, and natural sweeteners in urban and tier-one cities. Protein and fiber-enriched, superfood-enhanced bakery products, including gluten-free, vegan, and low-sugar variants, have moved from the health food segment to mainstream bakery sales. Gluten-free, vegan, and low-sugar bakery products have shifted from the specialty to the mainstream bakery segment, especially in the premium and artisanal bakery segment, where ingredient openness drives purchasing decisions. Large players are investing heavily in R&D to develop innovative products that address nutritional needs while meeting consumer preferences for taste, and government support through FSSAI’s Eat Right Mela and Smart Food programs is driving the acceptance of healthier alternatives. In 2024, Wellness’ Sugar Free, a well-known sugar substitute brand, entered the packaged foods market with the launch of Sugar Free D’lite cookies. With this new product, the brand aims to offer consumers options that have no added sugar and enable them to satisfy their cravings for sweet foods. To further establish its link with people who live a guilt-free and healthy lifestyle, Sugar Free partnered with popular Bollywood superstar Shahid Kapoor.

Omnichannel Retail Transformation Reshaping Distribution Dynamics

The bakery industry is undergoing a paradigm shift in distribution patterns as conventional retailing channels are converging with digital technology to provide seamless experiences for consumers. Quick-commerce tie-ups are facilitating the delivery of fresh bakery products in minutes, while subscription services are helping to generate consumer loyalty through repeat purchases of premium bakery products. Conventional retail stores are being transformed into experiential destinations that integrate café concepts with product displays, enabling consumers to experience products before making a buying decision. This shift was witnessed when ITC Sunfeast Baked Creations opened its first bakery café at the FabIndia Experience Store in Whitefield, Bengaluru, in September 2024, as the company made a conscious transition from its previous cloud kitchen delivery model to an omnichannel retail platform offering premium products developed by culinary experts.

Premium Segment Growth Driven by International Collaborations

Multinational companies are entering into strategic partnerships in order to tap into the growing Indian premium bakery market. Global companies are moving from import-based business models to local production facilities, capitalizing on the manufacturing prowess of India and its distribution networks to enter the Indian market faster. These partnerships are bringing global premium brands to the Indian market at affordable prices and also allowing for rapid expansion in the urban and tier one markets through partnerships with key retailers and modern trade. Mondelez International signed a licensing agreement with the Belgian company Lotus Bakeries in June 2024 to develop and enhance the Lotus Biscoff cookie brand in India, moving from its import-based business model to affordable local production.

Market Outlook 2026-2034:

The Indian bakery market demonstrates robust expansion potential driven by structural consumption shifts, retail modernization, and product innovation that aligns with evolving lifestyle patterns and nutritional preferences across demographic segments. Organized retail expansion into smaller cities creates distribution infrastructure that supports branded bakery product adoption, while rising per capita incomes enable trading up from unpackaged local bakery items to branded, hygienically packaged alternatives. The market generated a revenue of USD 15.05 Billion in 2025 and is projected to reach a revenue of USD 32.05 Billion by 2034, growing at a compound annual growth rate of 8.76% from 2026-2034. Government initiatives supporting food processing industries, coupled with technological advancements in automated baking systems and ingredient innovation, will enable manufacturers to scale operations while maintaining quality standards.

Indian Bakery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Bread |

36% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

35% |

|

Region |

North India |

30% |

Product Type Insights:

- Biscuit

- Cookies

- Cream Biscuits

- Glucose Biscuits

- Marie Biscuits

- Non Salt Crackers Biscuits

- Salt Crackers Biscuits

- Milk Biscuits

- Others

- Bread

- Sandwich Breads

- Hamburgers

- Croissants

- Others

- Cakes and Pastries

- Packed Cupcakes

- Pastries

- Muffins

- Layer Cakes

- Donuts

- Swiss Roll

- Others

- Rusk

Bread dominates with a market share of 36% of the total Indian bakery market in 2025.

Bread's commanding market position reflects its transformation from occasional Western-influenced consumption to daily staple status across Indian households, driven by convenience advantages that align with accelerated morning routines and nuclear family structures where traditional breakfast preparation becomes time-prohibitive. The segment benefits from universal acceptability across age groups and regional preferences, serving multiple consumption occasions from breakfast sandwiches to evening snacks. Product diversification within bread categories addresses varied consumer needs, with white bread appealing to children, brown bread attracting health-conscious adults, and specialty variants like multigrain and oats bread capturing premium segments.

The bread segment's growth trajectory is supported by cold chain infrastructure development that enables extended shelf life and wider distribution reach, allowing manufacturers to penetrate semi-urban and rural markets where modern retail presence is expanding. Packaging innovations incorporating resealable closures and portion control features enhance product convenience while reducing waste, addressing practical household concerns. Regional flavor adaptations, such as spiced bread variants in southern markets and sweet bread formulations in eastern regions, demonstrate how manufacturers localize products to capture diverse taste preferences while maintaining the fundamental bread format.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Convenience Stores

- Supermarkets and Hypermarkets

- Independent Retailers

- Artisanal Bakeries

- Online

- Others

Supermarkets and hypermarkets leads with a share of 35% of the total Indian bakery market in 2025.

Supermarkets and hypermarkets dominate distribution by offering comprehensive bakery product assortments under controlled environmental conditions that maintain product freshness and quality, addressing consumer concerns about hygiene and shelf life that limit purchases from traditional unorganized retail. These modern retail formats provide visual merchandising advantages through dedicated bakery sections that stimulate impulse purchases and cross-category shopping, while promotional activities and combo offers drive volume uptake. The air-conditioned shopping environment and organized product displays create purchasing experiences that align with aspirational consumption behaviors among upwardly mobile middle-class consumers.

The channel's leadership position is reinforced by in-store bakery counters that offer freshly baked products alongside packaged items, creating differentiation through warm bread availability and customization options for cakes and pastries. Strategic store locations in residential catchment areas ensure convenient access, while extended operating hours accommodate diverse shopping schedules for working professionals and dual-income households. Private label bakery offerings enable retailers to capture value-conscious consumers while maintaining margin advantages, though branded products continue dominating through established consumer trust and consistent quality perceptions.

Region Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 30% share of the total Indian bakery market in 2025.

North India's market leadership stems from concentrated urban population centers in the National Capital Region, Punjab, and Uttar Pradesh where bakery consumption patterns are deeply entrenched through historical exposure to Western food influences and wheat-based dietary traditions that facilitate bread adoption. The region benefits from extensive distribution networks developed by major manufacturers who established production facilities to serve these high-density markets, creating competitive advantages through logistics efficiency and supply chain proximity. Higher per capita incomes in metropolitan areas support premium product uptake and frequent purchase behavior across bakery categories.

Cultural factors including breakfast westernization among professional classes and acceptance of convenience foods align with bakery product propositions, while the region's position as a commercial hub attracts working population segments whose time-constrained lifestyles favor ready-to-eat bakery items. Modern retail penetration reaches saturation levels in major cities, providing multiple touchpoints for consumer engagement and product trial, while tier-two cities demonstrate accelerating adoption as organized retail expands and income levels rise, suggesting sustained growth momentum for the regional market.

Market Dynamics:

Growth Drivers:

Why is the Indian Bakery Market Growing?

Rapid Urban Developments and Evolving Lifestyle Patterns

India's accelerating urban modifications is fundamentally reshaping dietary habits and consumption patterns, with urban populations projected to reach substantial levels by 2030 as migration from rural areas continues unabated. This demographic shift is creating concentrated demand for convenient, ready-to-consume food options that fit seamlessly into fast-paced urban lifestyles characterized by long commutes, dual-income households, and limited time for traditional meal preparation. Bakery products have emerged as ideal solutions, offering portable breakfast options, quick snacks, and meal components that require no preparation while providing essential nutrients and energy. The proliferation of nuclear families in urban centers has reduced reliance on traditional joint family cooking arrangements, making packaged bakery items increasingly essential for daily consumption rather than occasional treats. Metropolitan areas are developing sophisticated food cultures that embrace western eating patterns, with bread, cakes, and pastries becoming normalized components of daily diets across age groups, while the expansion of quick-service restaurants and café chains is further normalizing bakery consumption through increased visibility and accessibility in high-traffic locations. IMARC Group predicts that the India quick service restaurants market is projected to attain USD 16.3 Billion by 2033.

Expansion of Modern Retail Infrastructure and Distribution Networks

The rapid proliferation of organized retail formats is revolutionizing bakery product distribution by providing temperature-controlled storage, attractive product displays, and strategic placement that enhances visibility and drives impulse purchases among consumers. Modern retail infrastructure development is extending beyond metropolitan centers into tier-two and tier-three cities, bringing branded bakery products to previously underserved markets through a combination of large-format stores and neighborhood convenience outlets that cater to diverse shopping preferences. This retail expansion is supported by sophisticated logistics networks that maintain product freshness during transit, enabled by substantial investments in cold chain capabilities under government schemes like the PM Kisan SAMPADA Yojana which has approved 399 cold chain projects since inception. Quick-commerce platforms are complementing physical retail by enabling delivery of fresh bakery products within 10-30 minutes of ordering, removing traditional barriers of limited shelf life and storage constraints that previously restricted consumption occasions. The emergence of 60 new shopping malls accounting for a total of 23.25 million sq. ft. in seven Indian cities between 2023 and 2025, demonstrates the infrastructure investments supporting market growth across multiple distribution channels.

Government Support for Nutritional Enhancement and Food Processing

Government initiatives promoting millet-based products and nutritional fortification are creating substantial opportunities for bakery manufacturers to develop innovative formulations that align with public health objectives while meeting consumer demand for healthier alternatives. In 2024, the Secretary of Food Processing Industries, promised that the government will tackle the issues faced by the bakery and confectionery sector, such as simplifying regulatory frameworks. An official statement indicated that during an interactive session with industry leaders, key focus areas were identified, such as regulatory simplification, sustainability, and innovation. This regulatory support is complemented by millet promotion campaigns that have normalized the use of ancient grains in bakery formats, encouraging manufacturers to invest in research and development for creating products that combine traditional ingredients with modern taste preferences, thereby expanding addressable markets while contributing to national nutritional goals.

Market Restraints:

What Challenges the Indian Bakery Market is Facing?

Health Concerns Regarding Refined Flour, Sugar Content, and Preservatives

Growing nutritional awareness among educated consumer segments raises concerns about bakery products' refined carbohydrate content, added sugars, and chemical preservatives, potentially limiting consumption frequency among health-conscious buyers who perceive traditional baked goods as detrimental to wellness objectives. Medical community messaging around diabetes prevention, obesity management, and clean eating philosophies positions conventional bakery items as discretionary indulgences rather than daily staples, creating perception challenges that manufacturers must address through reformulation and transparent communication.

Price Sensitivity in Mass Market Segments Limiting Premium Product Adoption

Significant portions of the consumer base remain highly price-conscious, particularly in semi-urban and rural areas where disposable incomes constrain spending on processed foods, creating tension between margin improvement through premiumization and volume growth through affordability. Economic volatility affecting commodity prices for wheat, sugar, and edible oils creates input cost pressures that manufacturers struggle to pass through to price-sensitive consumers, compressing margins and limiting investment capacity for product innovation and brand building activities.

Competition from Traditional Snacking Alternatives and Regional Specialties

Deep-rooted preferences for traditional Indian snacks, homemade preparations, and regional specialties create formidable competition for bakery products, particularly in tier-two and tier-three markets where conventional food habits remain strong and cultural affinity for indigenous items limits bakery adoption. Local sweet shops and traditional snack vendors offering fresh, customized products at competitive price points capture consumption occasions that might otherwise shift to packaged bakery alternatives, while street food culture provides affordable convenient options that compete directly with biscuits and cakes.

Competitive Landscape:

The Indian bakery market demonstrates fragmented competitive dynamics where multinational corporations with extensive distribution networks and brand portfolios compete alongside established domestic players leveraging regional strengths and cost advantages, while artisanal bakeries carve specialized premium segments through product differentiation and experiential retail formats. Market leaders maintain dominance through economies of scale in manufacturing, procurement efficiency for raw materials, and marketing investments that sustain brand visibility across mass media and retail environments. Mid-tier regional players compete effectively in specific geographic markets by understanding local taste preferences and maintaining agile responses to emerging consumer trends, though they face challenges in achieving national distribution reach and competing on marketing expenditure with larger corporations. The competitive landscape reflects ongoing tension between volume-driven strategies targeting mass markets through affordability and margin-focused approaches pursuing premiumization through product innovation, health positioning, and artisanal craftsmanship that commands higher price realizations. Some of the key market players include:

Recent Developments:

- In December 2025, Sunfeast Mom’s Magic has introduced its latest Ghee Roasted Nuts cookies, inspired by beloved cooking experiences linked to ghee-roasted components. The item centers on the scent and taste of nuts fried in ghee, a method prevalent in numerous Indian homes. The brand claims the cookies are crafted from cashews and almonds, intending to replicate a flavor associated with homemade cooking.

- In October 2025, After its £22 million purchase of the South Asian sweets maker and retailer in March 2025, Cake Box has launched the next phase for Ambala. This involves a brand update and the introduction of a contemporary, fully integrated e-commerce platform, as Cake Box aims to broaden the brand’s attraction beyond its main South Asian clientele while staying loyal to its cultural heritage and principles.

- In June 2025, The Karnataka Milk Federation (KMF), through its Nandini brand, launched 18 new items in three categories - slice cake, bar cake, and muffins - to commemorate World Milk Day festivities.

Indian Bakery Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Product Types Covered |

|

|

Distribution Channels Covered |

Convenience Stores, Supermarkets and Hypermarkets, Independent Retailers, Artisanal Bakeries, Online, Others

|

|

Region Covered |

North India, West and Central India, South India, East India |

|

Companies Covered |

Anmol Industries Limited, Bonn Group, Britannia Industries Limited, ITC Limited, Mondelēz International, Mrs Bectors Food Specialities Ltd, Parle Products Pvt. Ltd., Ravi Foods Pvt Ltd, Surya Food & Agro Limited, etc. |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian bakery market size was valued at USD 15.05 Billion in 2025.

The Indian bakery market is expected to grow at a compound annual growth rate of 8.76% from 2026-2034 to reach USD 32.05 Billion by 2034.

Bread dominated the Indian bakery market with a 36% share in 2025, driven by its transformation into a daily staple across households through convenience advantages, universal acceptability across demographics, and product diversification addressing varied consumer preferences from basic white bread to premium specialty variants.

Key factors driving the Indian Bakery market include rapid urbanization and evolving lifestyle patterns that increase demand for convenient ready-to-eat options, expansion of modern retail infrastructure and distribution networks improving product accessibility, and government support for nutritional enhancement through schemes promoting millet-based products and providing cold chain subsidies that enable manufacturers to maintain freshness while expanding geographic reach into tier-two and tier-three cities.

Major challenges include health concerns regarding refined flour and preservative content limiting consumption among wellness-focused consumers, price sensitivity constraining premium product adoption in mass segments, competition from traditional snacking alternatives with deep cultural roots, and input cost volatility creating margin pressures.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)