How AI is Shaping Cryptocurrency Exchange Industry in Australia?

Introduction:

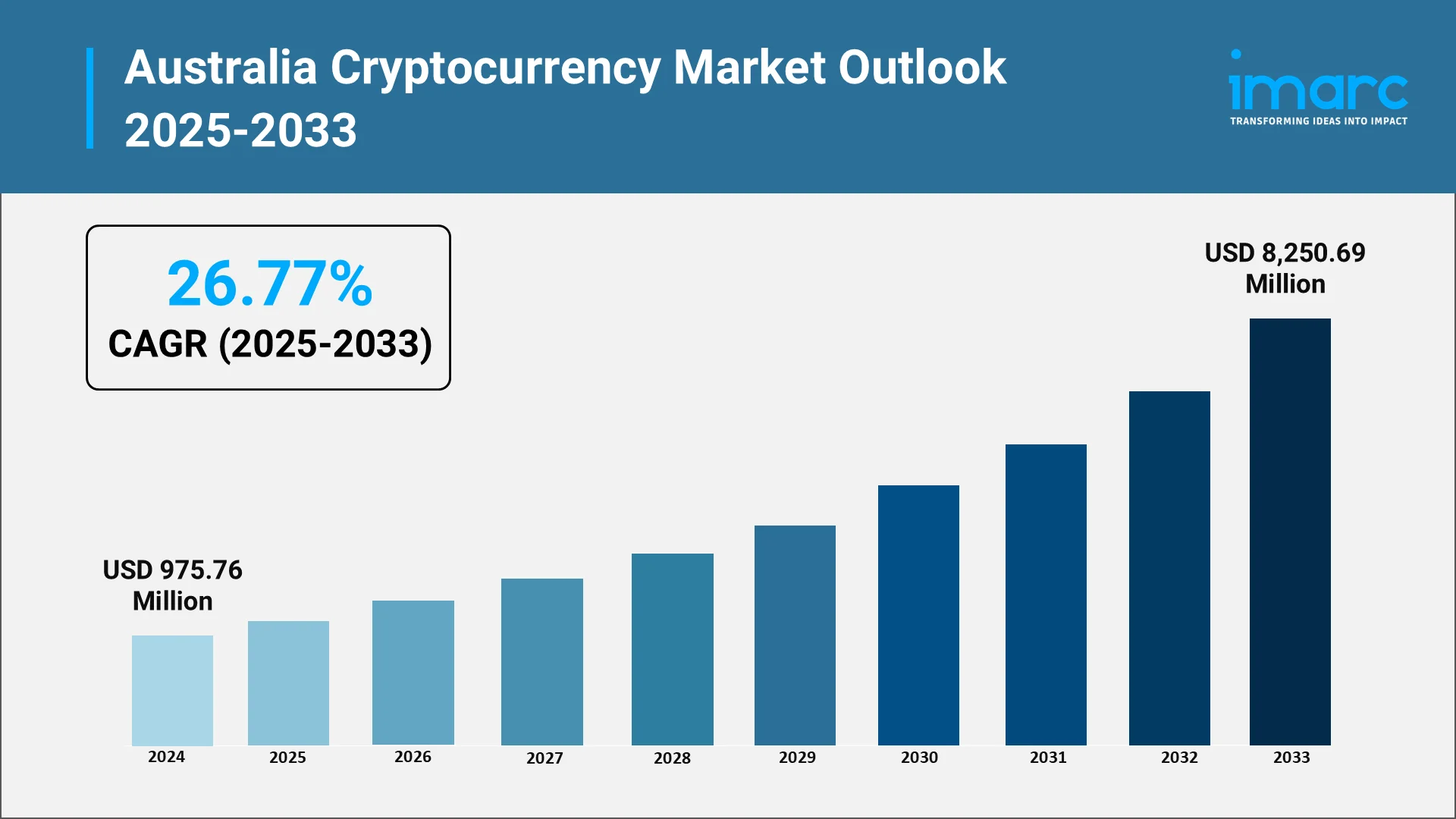

The Australian cryptocurrency market is experiencing significant growth, with the rise of digital assets capturing both public and institutional interest. Driven by technological innovation, evolving regulations, and increasing institutional adoption, the Australia cryptocurrency exchange market was valued at USD 975.76 Million in 2024, stated by the IMARC Group. As the industry matures, artificial intelligence (AI) is emerging as a pivotal technology reshaping the landscape of cryptocurrency exchanges by enhancing exchange efficiency, optimizing trading, and improving security, while the government's evolving regulatory framework overseen by AUSTRAC ensures compliance and fosters trust.

Explore in-depth findings for this market, Request Sample

The Role of AI, Impact, and Benefits in the Cryptocurrency Exchange Industry in Australia:

AI is no longer a futuristic concept—it is at the core of the modern crypto ecosystem. In the Australian context, AI technologies are being rapidly deployed across the entire crypto exchange value chain, from user onboarding to trade execution and fraud prevention.

AI-Powered Trading Algorithms

Artificial intelligence has reshaped the way traders engage with cryptocurrency markets. AI-powered trading algorithms can scan enormous amounts of data, identify patterns, and make real-time predictions about market swings. These algorithms focus on improving trading strategies by considering past price action, liquidity levels, and other outside factors.

Improved Security and Fraud Prevention

Security remains a critical concern for cryptocurrency exchanges given the high-profile hacks and fraud cases that have affected the industry. AI is helping to address these concerns by enhancing security measures on exchanges. Through machine learning algorithms, exchanges can detect unusual patterns in trading activity, identify fraudulent behavior, and block suspicious transactions in real-time.

Enhanced Customer Experience

Customer support is an important aspect of the user experience when it comes to cryptocurrency exchanges. AI chatbots and virtual assistants are now standard features used by exchanges in Australia to offer 24/7 customer support to users. The AI systems can answer common questions, help manage accounts, and respond to issues in real-time, offering a smoother and more interactive customer support experience.

Predictive Analytics and Market Insights

AI also plays a key role in providing predictive analytics and real-time market insights to traders. By leveraging AI to analyze large sets of market data exchanges can deliver real-time information on market trends, volatility, and price forecasts. This helps traders in the Australia crypto exchange market make more informed decisions by identifying profitable opportunities and potential risks.

Regulatory and Policy Environment of the Cryptocurrency Exchange Industry in Australia:

Australia has developed one of the most progressive regulatory frameworks for cryptocurrency. The Australian Securities and Investments Commission (ASIC) and AUSTRAC continue to update guidelines to accommodate innovation while maintaining investor protection.

- Evolving Regulatory Framework: Australia's cryptocurrency exchange industry operates under a clear and evolving regulatory framework designed to balance innovation with investor protection. Recent reforms have aimed at providing regulatory clarity making it easier for exchanges to comply with financial laws while encouraging the growth of digital assets.

- Compliance with AML and CTF Regulations: Cryptocurrency exchanges in Australia are required to comply with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations enforced by the Australian Transaction Reports and Analysis Centre (AUSTRAC). This regulatory oversight ensures that exchanges adhere to strict reporting and monitoring protocols reducing the risk of money laundering and financial crimes.

- Increasing Institutional Confidence: The clear and well-established regulatory environment in Australia has been instrumental in attracting institutional investors to the cryptocurrency exchange market. As the government continues to implement policies that regulate digital assets, institutional players including banks and hedge funds are more likely to enter the market.

- Regulatory Innovations for Future Growth: The Australian government is actively working on further regulatory innovations to ensure the cryptocurrency industry can evolve responsibly. These include refining the tax treatment of digital assets, creating licensing frameworks for exchanges and addressing the challenges of stablecoins and crypto derivatives.

Top Cryptocurrency Exchange Companies in Australia:

Several cryptocurrency exchanges are currently dominating the Australian market, offering a variety of trading options and services for both retail and institutional investors.

- CoinSpot: In June 2024, CoinSpot, Australia’s largest cryptocurrency exchange, integrated PayPal for seamless deposits and withdrawals. With over 2.5 million users, the partnership allows funds to move in real-time enhancing accessibility for investors. This integration aims to simplify crypto transactions leveraging PayPal's trusted security for enhanced customer experience.

- Swyftx: In July 2025, Brisbane-based crypto exchange Swyftx announced its plans to acquire US-focused brokerage Caleb & Brown for over USD 100 Million marking a significant expansion. This deal aims to enhance Swyftx’s access to wealthy US investors and strengthen their global presence bringing the total group workforce to nearly 300 employees post-acquisition.

Other most prominent players operating in the Australia cryptocurrency exchange market include, Cointree, CoinJar, Independent Reserve, BTC Markets, Digital Surge, Coinstash.

Major Research and Development in the Cryptocurrency Exchange Industry in Australia:

AI-related R&D in the Australia cryptocurrency market is accelerating, supported by universities, fintech startups, and government initiatives. Key areas of R&D in Australia include:

- The University of New South Wales (UNSW) and RMIT have launched joint programs researching blockchain-AI integration for financial applications.

- Startups like Koinly, a crypto tax automation platform, are investing heavily in AI to streamline reporting and compliance.

- The Australian Government Innovation Fund allocated AUD 50 million in 2025 toward blockchain and AI research, with a significant focus on improving crypto exchange infrastructure.

Opportunities and Challenges of the Cryptocurrency Exchange Industry in Australia:

The Australia crypto exchange market presents a dynamic mix of opportunities and challenges.

Opportunities

- Institutional Investment: The increasing participation of institutional investors in the cryptocurrency market presents a major growth opportunity for exchanges. Their entry not only boosts market credibility but also enhances liquidity and trading volumes. This trend allows exchanges to expand services such as derivatives, custody, and compliance-focused products. By catering to institutional needs platforms can establish stronger trust, attract larger capital inflows and position Australia as a competitive global crypto hub.

- Blockchain Advancements: The rapid evolution of blockchain technology offers Australian exchanges the chance to diversify and strengthen their offerings. Integrating decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts creates new revenue streams while attracting a broader user base. Such innovations can enhance customer engagement and improve market efficiency. Exchanges that embrace these advancements early will gain a competitive edge, positioning themselves as leaders in driving Australia’s digital financial transformation.

Challenges

- Regulatory Uncertainty: The regulatory environment for cryptocurrency in Australia continues to evolve, creating uncertainties for exchanges. Constantly changing compliance requirements make it challenging for platforms to plan long-term strategies. Unclear rules regarding taxation, licensing, and investor protection could slow down adoption and discourage innovation. To thrive, exchanges must remain agile, invest in compliance frameworks, and maintain transparent operations to align with government expectations while ensuring investor confidence in the market.

- Cybersecurity Risks: As digital assets gain traction, the threat of cyberattacks on cryptocurrency exchanges intensifies. Hackers increasingly target platforms for financial gain, exposing vulnerabilities in security systems. A single breach could undermine trust, leading to financial losses and reputational damage. Exchanges must prioritize advanced cybersecurity measures, including multi-factor authentication, cold storage, and real-time monitoring. Ongoing investment in security infrastructure is crucial to safeguarding user funds and sustaining growth in Australia’s crypto sector.

Future Outlook for the Cryptocurrency Exchange Industry in Australia:

The future of the Australia cryptocurrency exchange market appears optimistic, with projections estimating it to reach about USD 8,250.69 Million by 2033, exhibiting a CAGR of 26.77% during 2025-2033. As AI continues to drive efficiencies and innovation, exchanges will become more streamlined, secure, and user-friendly. Rising institutional participation, alongside the integration of emergent technologies and clearer regulatory frameworks, will further have sustained expansion.

In the coming years, AI will play an increasingly prominent role—optimizing trading strategies, strengthening cybersecurity measures, and enhancing customer support—solidifying its position as a key innovation driver. With the cryptocurrency market growing ever more entwined with mainstream finance, Australia’s crypto exchanges are set to remain central to shaping the nation’s digital-asset future.

How IMARC Group is Driving Innovation in Australia’s Cryptocurrency Exchange Landscape:

IMARC Group supports stakeholders across the cryptocurrency ecosystem with strategic insights designed to navigate Australia’s fast-evolving digital asset market. Our expertise helps clients identify growth opportunities, address regulatory challenges, and embrace innovation powered by artificial intelligence (AI). Through our services, we provide clarity and direction in areas such as:

- Market Insights: Explore emerging trends in cryptocurrency, including institutional participation, blockchain integration, and AI-driven advancements in trading and security. We analyze developments such as decentralized finance (DeFi), NFTs, and evolving exchange services to help clients stay competitive.

- Strategic Forecasting: Anticipate future shifts with insights into AI-powered trading algorithms, predictive analytics, and regulatory reforms shaping Australia’s digital finance environment. Our forecasting enables organizations to prepare for change and make informed decisions in a rapidly developing market.

- Competitive Intelligence: Monitor innovations across exchanges, from enhanced custody solutions and AI-enabled fraud detection to blockchain-based settlements. We provide intelligence on evolving strategies, product offerings, and institutional adoption to keep clients at the forefront of industry transformation.

- Policy and Regulatory Analysis: Gain a clear understanding of Australia’s regulatory landscape, including AML/CTF compliance, licensing structures, and taxation policies. We help clients assess how regulations impact operations, ensuring compliance while identifying new opportunities for growth.

- Customized Consulting Solutions: From integrating AI into exchange operations to expanding product offerings and managing compliance requirements, we deliver tailored consulting solutions aligned with organizational goals. Our approach ensures businesses remain resilient and competitive in a fast-changing market.

As the cryptocurrency exchange industry in Australia continues to expand, IMARC Group stands as a trusted partner—offering actionable intelligence, driving innovation, and guiding strategic decisions to shape the future of digital assets. For detailed insights, data-driven forecasts, and strategic advice, see the complete report here: https://www.imarcgroup.com/australia-cryptocurrency-exchange-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)