Australia Fintech Industry: Key Growth Factors, Challenges, and Top Innovators

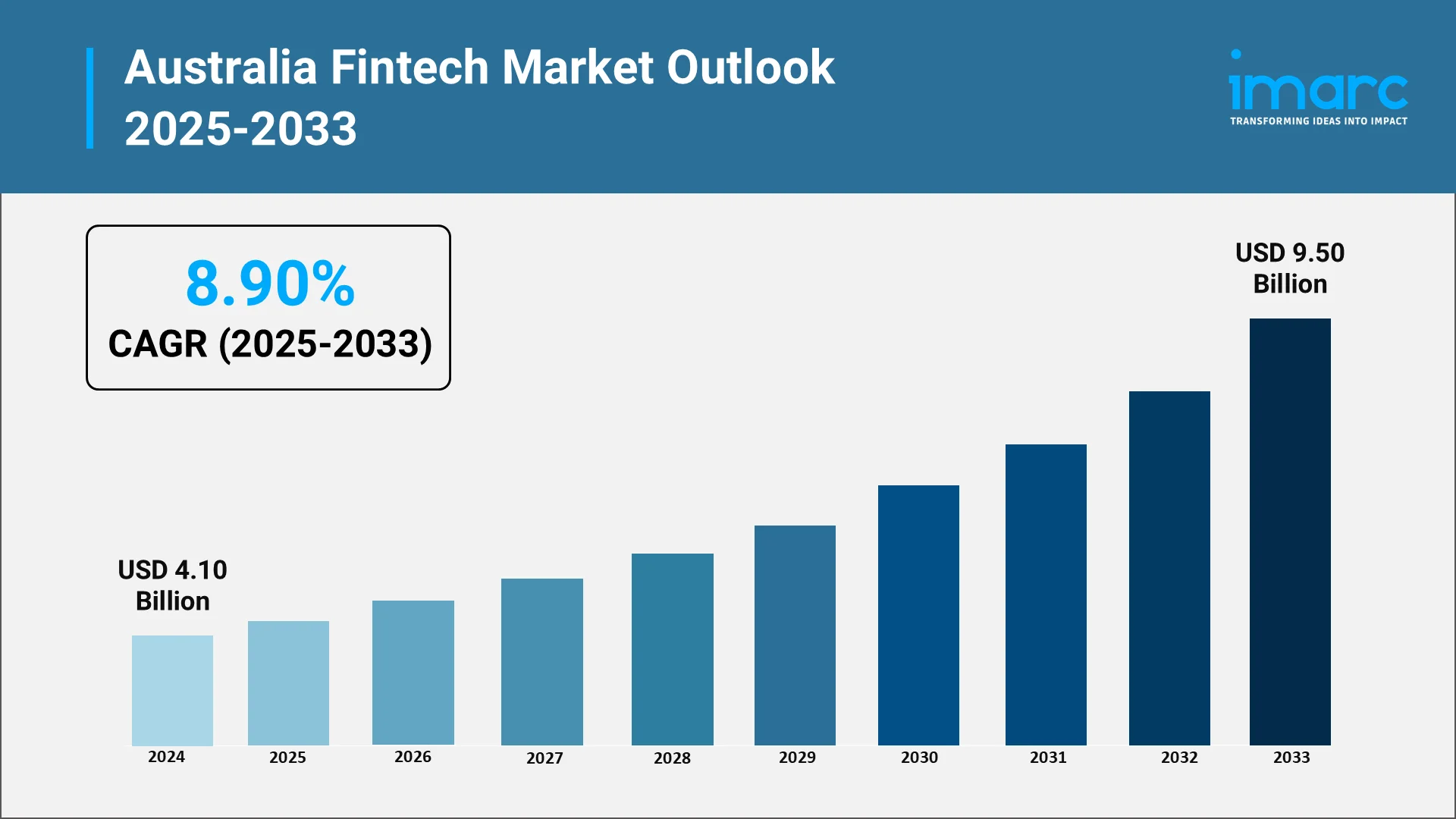

The Australian fintech industry stands as one of the most dynamic and rapidly expanding financial technology ecosystems in the Asia-Pacific region. The market reached USD 4.10 Billion in 2024 and is projected to surge to USD 9.50 Billion by 2033, representing a compound annual growth rate (CAGR) of 8.90%. This remarkable trajectory positions Australia as a global fintech powerhouse, with around 767 companies operating across major capital cities including Sydney, Melbourne, and Brisbane.

Australia’s fintech landscape is defined by a unique blend of technological innovation, robust regulatory support, and high consumer adoption rates. New South Wales dominates the market, driven by rising digital banking adoption, favorable regulatory reforms such as the Consumer Data Right (CDR), and increasing demand for cashless transactions. The convergence of these factors has created a fertile environment where startups and established financial institutions collaborate to reshape traditional banking, payments, lending, and wealth management services. Moreover, from Buy Now, Pay Later (BNPL) innovations to blockchain applications and artificial intelligence integration, Australian fintech companies are pioneering solutions that extend far beyond domestic borders, capturing international attention and investment.

Explore in-depth findings for this market, Request Sample

Role of AI, Impact, and Benefits in the Australia Fintech Industry:

Artificial intelligence has emerged as a transformative force within Australia's fintech sector, fundamentally altering how financial services are delivered, consumed, and secured. Around 76% of Australian financial firms are already using or testing AI for financial reporting, positioning Australia third globally after Canada and the UK in terms of leveraging AI in fintech. This statistic underscores the nation's commitment to embracing cutting-edge technology to maintain competitive advantage.

The impact of AI spans multiple dimensions of fintech operations. In fraud detection, machine learning algorithms analyze behavioral biometrics including typing speed, swipe patterns, and geolocation data alongside transaction information to identify fraudulent activities in milliseconds. For credit assessment, AI-driven platforms automate credit scoring by integrating cloud-accounting feeds. This enables faster loan approvals while reducing default risks for lenders serving small and medium-sized enterprises (SMEs).

A recent survey reveals that 72% of Australian financial firms are actively using AI tools, with 42% reporting that AI meets their expectations and 20% experiencing results that exceed initial projections. These adoption rates signal a fundamental shift from experimental deployment to operational integration across the fintech value chain.

The benefits of AI implementation extend to customer experience enhancement, where intelligent recommendation engines analyze individual cash flow patterns to suggest personalized savings strategies, investment opportunities, and spending optimizations. With unified, real-time access to bank-wide data, AI agents can understand and interpret contextual information to provide personalized responses, enabling financial institutions to segment customers at granular levels and deliver tailored experiences at key life stages.

Looking ahead, generative AI adoption is accelerating rapidly. While only 9% of Australian companies currently use generative AI, over 52% expect it to become their top technology priority for financial reporting by 2027, demonstrating the industry's confidence in AI's potential to automate reporting, detect anomalies, and enhance overall operational efficiency.

Recent Market News & Major Research and Development:

The Australian fintech sector has witnessed significant developments throughout 2024 and into 2025, marked by strategic acquisitions, regulatory advancements, and innovative product launches that collectively signal industry maturation and consolidation.

Major Acquisitions and Strategic Moves

Banking Circle's acquisition of Australian Settlements Limited in January 2025 marked a pivotal moment in payments infrastructure consolidation, strengthening real-time clearing capabilities. This transaction exemplifies how global players recognize Australia's strategic importance in the Asia-Pacific payments ecosystem.

In October 2024, Banked acquired Australian fintech Waave and partnered with Chemist Warehouse to launch Pay by Bank solutions in early 2025, showcasing the growing trend of embedded finance solutions. Meanwhile, Deputy achieved unicorn status in March 2024 with a valuation exceeding USD 1 billion, becoming Australia's first tech unicorn since early 2022.

Regulatory Developments

The regulatory environment is always changing to strike a balance between consumer protection and innovation. A December 2024 consultation paper from the Australian Securities and Investments Commission suggested revisions to INFO 225, which offers guidelines for cryptocurrency offerings and how crypto assets are handled under financial services regulations. It is anticipated that these regulatory clarifications would lessen ambiguity and encourage innovation in the field of digital assets.

Numerous established fintech companies will be impacted by the requirement that many major Australian corporations and financial institutions publish yearly sustainability reports on required climate-related financial disclosures as of January 2025.

Research Breakthroughs and Innovation

FinTech Australia released its first major report exploring the tangible economic impact of the fintech industry, revealing that over half (56%) of small businesses leverage fintech providers for in-person transactions, with average benefits totaling $9 billion across all fintech solutions. This research quantifies fintech's transformative effect on Australia's business ecosystem, particularly for small and medium enterprises.

The deployment of PayTo and the Confirmation of Payee system represents significant technological advancement. Australian Payments Plus rolled out Confirmation of Payee in Australia in July 2025, enhancing payment security and reducing misdirected transactions.

Top Companies in the Australia Fintech Industry:

Australia's fintech ecosystem boasts several globally recognized innovators that have redefined financial services delivery. These companies represent diverse specializations from payments and lending to digital banking and cross-border transactions.

- Airwallex

Founded in Melbourne in 2015, Airwallex provides cross-border payment infrastructure serving businesses across 120+ countries to which one can make local transfers, with a valuation $220b+ in global payments processed annually (USD) by Airwallex. The company's API-driven platform integrates payments, treasury, expense cards, and multi-currency accounts, making it indispensable for businesses with international operations.

- Judo Bank Pty Ltd (Judo Capital Holdings)

Judo Bank operates as a challenger bank specializing in small and medium-sized enterprise lending, becoming Australia's third-largest business lender by focusing on relationship-driven banking and character-based loan assessments rather than solely relying on credit scores.

Opportunities and Challenges in the Australia Fintech Industry:

Opportunities:

- Open Banking and Consumer Data Right: Phase-3 Consumer Data Right APIs are driving bank-fintech embedded finance partnerships, enabling data-driven product innovation and personalized financial services. This regulatory framework lowers barriers for new entrants and facilitates collaboration between traditional banks and fintech disruptors.

- SME Financing Gap: A persistent small-business credit shortfall is propelling alternative lending platforms, with companies like Prospa and Moula automating credit assessments through cloud-accounting integrations. This represents a significant addressable market as SMEs seek faster, more flexible financing options beyond traditional banking channels.

- Cross-Border Payments: Cross-border ecommerce spending is projected to reach USD 7.9 trillion globally by 2030, with Australia playing a significant role in this expansion as Australian merchants account for more than 25% of total ecommerce transactions.

- Sustainable Finance: Growing investor preferences for sustainable investing create opportunities for fintechs to assist businesses by collating and analyzing environmental, social, and governance data, particularly as mandatory climate disclosures take effect.

Challenges:

- Regulatory Complexity: Due to persistent inflation, the volume and average size of fintech transactions fell in 2024, posing a challenge for regulators to adjust current financial regulations to new goods and services while striking a balance between innovation and consumer safety. Managing intricate licensing requirements, data privacy laws, and changing compliance standards requires a substantial investment of resources.

- Talent Acquisition and Retention: The fintech sector faces intense competition for skilled professionals in software development, data science, and cybersecurity, with talent shortages constraining growth potential.

- Funding Constraints: Securing funding remains challenging for early-stage fintech startups, especially those developing unproven technologies or targeting niche markets, although venture capital interest rebounded in late 2024.

- Profitability Pressures: Many neobanks and fintech platforms operate on razor-thin margins, prioritizing customer acquisition over sustainable revenue models. BNPL legislation requiring firms to hold credit licenses by June 2025 compresses fee headroom and increases compliance costs, with scale players better positioned to absorb these changes while smaller entrants may exit.

Future Outlook: Australia Fintech Industry

The Australia fintech sector stands at a transformative inflection point, with convergent forces of regulatory reform, technological innovation, and industry consolidation shaping its trajectory through 2030 and beyond.

Market Growth Projections

The Australia fintech market is valued at USD 4.10 Billion in 2024 and forecast to reach USD 9.50 Billion by 2033, exhibiting a CAGR of 8.90% during 2025-2033.

Regulatory Transformation

Major regulatory reforms pertaining to payments, BNPL, digital assets, artificial intelligence, and anti-money laundering frameworks will be implemented and solidified over the course of the next few years. Given the high costs of compliance and the crucial significance of scale, these reforms are likely to spur consolidation and transaction activity.

With more distinct lines drawn between regulators such as ASIC, the Reserve Bank of Australia, and the Australian Prudential and Regulatory Authority, a new payments license structure is expected to revolutionize the payments industry.

Technological Innovations

- Blockchain and Asset Tokenization: Many anticipate migration of assets on-chain through asset tokenization, driving the need for strong user on-ramps, intuitive interfaces, and better integration between decentralized finance (DeFi) and traditional finance (TradFi), with stablecoins serving as key drivers in this ecosystem.

- PayTo Adoption: PayTo is proving helpful for automating salary distribution, bill payments, and subscriptions despite early difficulties. By the end of 2025, 20 million PayID registrations are anticipated, thanks to improved security features and ease of use.

- AI Integration: AI is rapidly becoming the tool of choice for customer service, operational efficiencies, and risk mitigation, with proliferation of different AI tools and integrations across financial and credit services.

Industry Consolidation

The Australian fintech sector is consolidating as it matures. Strategic investments and M&A activity are common, driven by the need for mid-sized players to either "build or partner" to manage rising compliance costs and achieve volume synergies. Secondary trading of venture capital securities is also gaining momentum.

Concurrently, consumer behavior is rapidly digitizing: Digital wallets are the preferred payment method, and over 99% of Australian banking transactions are now online or mobile, accelerating fintech adoption.

Globally, Australia, with its concentrated ecosystem, is a key leader and an ideal hub for Asian regional headquarters, with local fintechs showing a strong appetite for international expansion.

The overall outlook remains cautiously optimistic. Sustainable growth will favor companies that successfully balance innovation with compliance, strategically leverage AI, and focus on achieving profitable scale and cybersecurity resilience.

Choose IMARC Group for Unmatched Expertise and Comprehensive Services:

- Data-Driven Market Research: Deepen your understanding of fintech adoption rates, technological innovations, payment ecosystem evolution, and digital transformation trends through comprehensive market research reports covering regulatory frameworks, blockchain applications, AI integration, and emerging business models across global regions.

- Strategic Growth Forecasting: Predict emerging trends in financial technology, from embedded finance and real-time payment systems to AI-driven risk management, neobanking expansion, and policy changes affecting digital asset regulation and consumer data rights by analyzing regional market dynamics.

- Competitive Benchmarking: Analyze competitive forces within the fintech market, review product pipelines, and monitor breakthroughs in payments infrastructure, alternative lending platforms, wealth management technologies, and cybersecurity solutions across traditional banks and innovative disruptors.

- Policy and Regulatory Advisory: Stay ahead of evolving regulatory paradigms, government-sponsored innovation programs, licensing requirements, and compliance standards affecting fintech operations, cross-border payments, cryptocurrency frameworks, and open banking implementations.

- Custom Reports and Consulting: Obtain tailored insights aligned with your organizational objectives—whether launching innovative financial products, investing in fintech ventures, evaluating acquisition opportunities, or building digital infrastructure for next-generation financial services.

At IMARC Group, our mission is to empower fintech leaders, financial institutions, and investors with the clarity and intelligence required to navigate Australia's dynamic financial technology landscape. Join us in shaping the future of finance—because every innovation matters. Contact IMARC Group today to discover how our strategic insights can accelerate your fintech growth and competitive positioning.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)