Australia Stock Industry: Leveraging AI to Drive Growth and Innovation

Introduction:

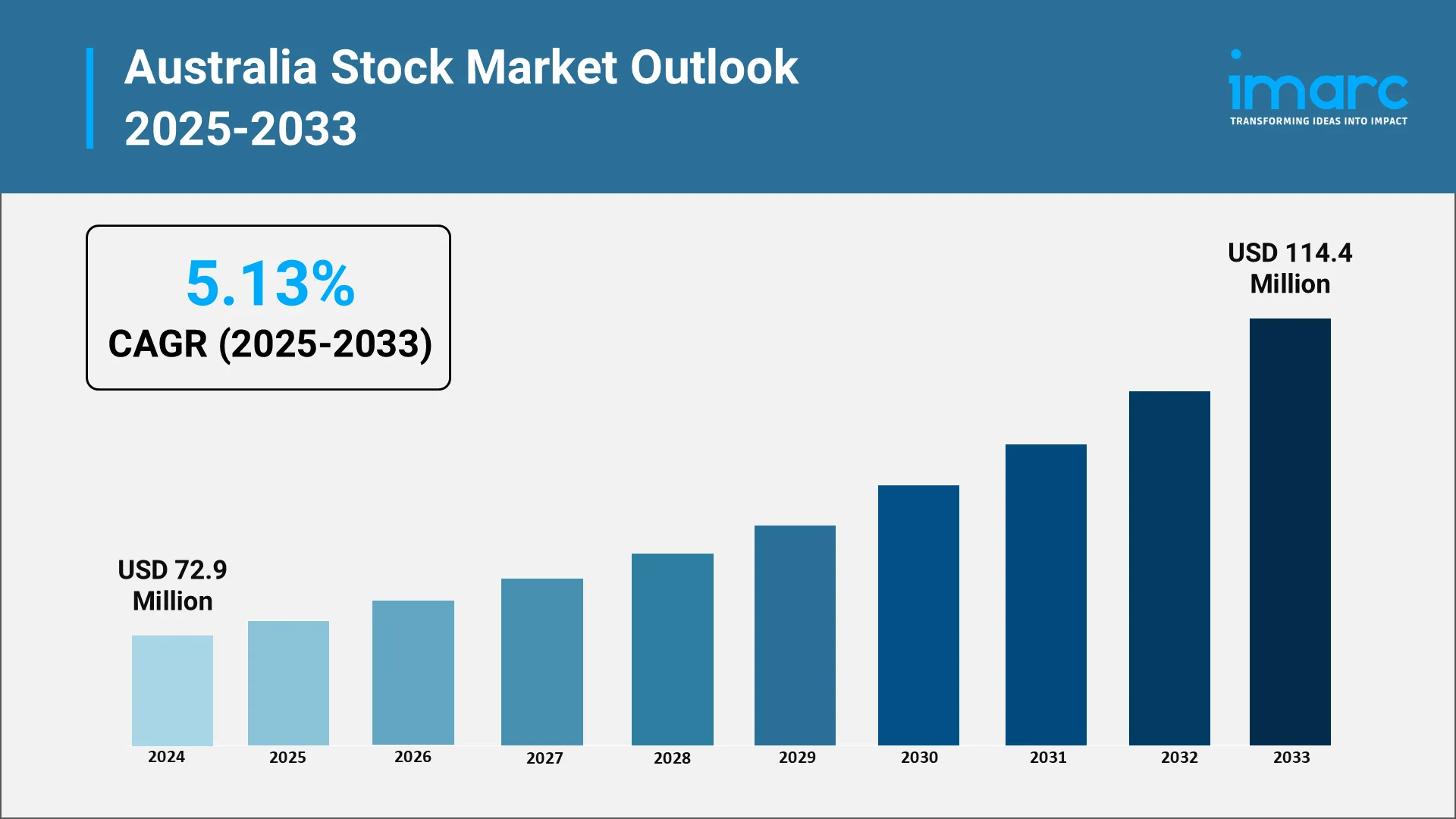

Australia’s equity market is leaning into artificial intelligence as a practical lever for returns, liquidity, and product innovation. By size, the Australia stock market reached USD 72.9 Million in 2024 and is projected to hit USD 114.4 Million by 2033 at a 5.13% CAGR (2025–2033). Those headline figures sit on top of an economy where listed companies already deploy AI in operations, compliance, and customer-facing tools, while market plumbing: data centers, cloud, and connectivity, ramps for GPU-heavy workloads.

Momentum has been visible on the boards. The S&P/ASX 200 set five all-time highs by early April 2024 as risk appetite returned, even before the second-half rally kicked in. And by August 15, 2025, the index closed at a fresh record 8,938.6, pushing the market value above AUD 2.9 trillion.

Explore in-depth findings for this market, Request Sample

The Role of AI, Impact, and Benefits in the Australian Stock Market:

AI is now a staple across the equity value chain. Quant teams blend machine learning with macro and sentiment inputs; exchanges and brokers pilot anomaly detection for trade surveillance; fund managers apply NLP on transcripts and disclosures; issuer-facing SaaS uses AI to automate deal rooms, board workflows, and compliance. In Australia, this is showing up in both regulation and infrastructure: A national framework for the assurance of AI in government, agreed on 21 June 2024, lays out how public bodies should assure AI systems against ethics principles. While written for government, its language and practices are already informing financial-services governance and procurement.

Practical benefits are turning up in three places. First, efficiency: faster exception handling and reconciliations lower cost-to-serve for brokers, registries, and asset managers. Second, decision quality: models catch regime changes in commodities, FX, and rates that dominate ASX earnings cycles. Third, market integrity: surveillance tools improve detection of spoofing or cross-venue manipulation.

- GenAI in accounting and SME finance: Xero unveiled “Just Ask Xero” in June 2024, a conversational assistant that taps a business’s full Xero data set to answer finance questions and streamline tasks. That puts GenAI directly into the hands of more than a million SMEs and their advisors across Australia and beyond.

- AI in bank fraud defense: In June 2025, Commonwealth Bank announced a collaboration with Apate.ai, adding synthetic-intelligence testing and threat simulations to harden scam defenses. This is a live market integrity case for AI: stopping money loss improves consumer confidence and reduces frictions that often spill into equity risk premia for financials.

Why this matters for investors:

- Order flow quality: As dealers adopt AI-assisted execution and pre-trade checks, slippage and error rates fall, which tightens spreads for liquid names and can lower the cost of capital over time.

- Research productivity: Natural-language agents can draft base-case models, earnings recaps, and risk scenarios quickly, freeing analysts to focus on channel checks and management access.

- Surveillance: Pattern-recognition tools can flag spoofing or layering faster than rule-based systems, which supports fair dealing and keeps compliance costs contained.

- The kicker is infrastructure: The data-center layer is expanding to host training and inference, and that spending cycle spills into contractors, power, and real-estate trusts listed on the ASX.

Top Companies in the Australian Stock Market:

AI touches a wide mix of ASX-linked names: pure-play AI providers, data-center operators, enterprise software, and compliance/deal-tech vendors. A few recent company-level markers:

- Data centers | NEXTDC (ASX: NXT): NEXTDC’s FY24 results showed net revenue of AUD 307.9 Million and underlying EBITDA of AUD 204.3 Million, with contracted utilization up 41% to 172.6MW. The company guided FY25 revenue to AUD 390–405 Million and cash EBITDA to AUD 230–240 Million, plus FY25–FY26 growth capex of AUD 900 Million–AUD 1.1 Billion, reflecting hyperscale and AI demand. That capex line is effectively a forward indicator for Australian AI compute supply.

- Global logistics software | WiseTech Global (ASX: WTC): WiseTech reported FY24 revenue of AUD 1.04 Billion, up 28%, driven by its CargoWise platform, which contributed AUD 880.3 Million and maintained a 97% recurring revenue base. Underlying EBITDA rose to AUD 495.6 Million (up 28%) with an EBITDA margin of ≈50%, and a R&D investment of AUD 368.2 Million to speed product development. That spend supports AI-enhanced features that reduce manual errors in customs, rates, and bookings.

- Medical imaging software | Pro Medicus (ASX: PME): Pro Medicus keeps winning large U.S. health-system deals that lean on its high-performance, cloud-ready imaging platform. In FY24 the company highlighted a record sales year, including a 10-year, AUD 140 Million contract with Baylor Scott & White and multiple wins across academic and IDN markets.

Put together, the pattern is clear: large caps are weaving AI into core products or infrastructure, while select mid-caps provide pure-play exposure to AI spending. The lesson for portfolio construction is to tilt toward businesses that either sell mission-critical software with pricing power or own the pipes and power for AI workloads.

Government Policy, Regulation, and Industry Initiatives in the Stock Industry in Australia:

Australia’s government maintains a strong regulatory foundation that underpins the stability and transparency of its stock market. Oversight is primarily handled by the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA), ensuring that listed entities follow strict governance and disclosure standards. The Australian Securities Exchange (ASX) operates within a framework that promotes fair trading, market integrity, and investor protection.

In recent years, policy efforts have focused on integrating technology and innovation while maintaining compliance rigor, with regulators increasingly monitoring the use of automation, digital trading systems, and algorithmic models. The government also supports business innovation through grants, R&D incentives, and programs aimed at helping smaller firms access capital markets. Together, these measures create an environment that balances investor confidence with modernization, ensuring that the Australia stock market remains both competitive and resilient in a rapidly advancing global financial landscape.

Economic Benefits, International Trade, Policy, and Regulatory Landscape in the Australian Stock Market

Australia’s policy framework remains stable and pragmatic, favoring consistent regulation that encourages investment while managing systemic risk. International trade links continue to strengthen as regional economies expand digital and data partnerships. The focus on transparency and responsible technology use enhances investor confidence and helps align local standards with global norms. Within financial markets, regulators prioritize explainable AI systems, transparent disclosures, and sound governance to protect investors and ensure accountability. As automation spreads through trading and compliance systems, maintaining fair access and operational reliability remains central. The combination of open-market policy, robust supervision, and cross-border cooperation keeps Australia positioned as a credible, innovation-driven hub for capital and technology exchange.

Economic benefits

Capital spending on technology, renewable energy, and logistics infrastructure creates long-term value for shareholders and sustains job creation. For listed firms, this environment promotes innovation-led competitiveness, improving margins and scalability. The stock market benefits from diversified sectoral participation, as technology, healthcare, and clean energy emerge alongside traditional resources. AI has real macro upside. The government’s Dec 2024 briefing on the National AI Capability Plan relayed modelling that AI and automation could add up to USD 600 Billion/year to GDP by 2030, while tallying ~650 domestic AI firms and USD 7 Billion in foreign AI investment during the prior five years. For public markets, that translates into a thicker pipeline of tech issuers, heavier capex in data infrastructure, and productivity uplift among incumbents. Commodity cycles still steer the index, but AI weaves new cross-border ties: quant strategies, data contracts, cloud compute flows, and talent. Momentum is visible in digital infrastructure. NEXTDC’s 2024 capital raising of AUD 750 Million and 2025 utilization jump speak to Australia’s position as an AI-ready compute hub for the region, with capex stepping up to meet tenant demand.

International trade, policy and regulatory landscape

International trade links continue to strengthen as regional economies expand digital and data partnerships. The focus on transparency and responsible technology use enhances investor confidence and helps align local standards with global norms. Within financial markets, regulators prioritize explainable AI systems, transparent disclosures, and sound governance to protect investors and ensure accountability. Regulation is risk-based with a preference for guidance and existing obligations, as supervisors want explainability and governance. Two signals from 2024–2025 help frame the shift:

- Policy tailwinds: Australia’s Policy for the Responsible Use of AI in Government took effect on 1 September 2024, requiring accountable officials by November 2024 and public transparency statements by February 2025 (Digital Transformation Agency).

- Market pulse: On 30 August 2024 the ASX finished up 0.58% at ~8,092, a session dominated by scam-risk testimony from bank leaders and the liquidation of Dion Lee Enterprise.

These signals sit within a broader push to apply AI in trading, surveillance, issuer services, and the broader “picks and shovels” of infrastructure that keeps Australia investable at scale.

Implications for listed firms and market infrastructure:

- Model risk and audit: Firms using AI for trading or analysis will need rigorous model validation, continuous performance testing, and third-party audit trails to demonstrate reliability and fairness. These practices reduce systemic exposure and reinforce trust among institutional investors.

- Disclosure: Companies integrating AI into material business decisions should clearly describe system scope, limitations, and governance in annual reports. Transparent communication reduces regulatory scrutiny and builds investor confidence.

- Cross-regime alignment: Australian issuers operating globally must align AI governance with EU, US, and regional data standards. Coordination across jurisdictions simplifies compliance, protects reputation, and supports cross-border capital access.

Opportunities and Challenges in the Australian Stock Market:

Expanding Prospects Through Technology and Global Integration

The Australian stock market holds significant potential as it embraces digital transformation and global connectivity. Advancements in technology, especially in areas like data analytics, fintech, and sustainable investing, are creating new pathways for growth across sectors. Companies are diversifying into renewable energy, healthcare innovation, and digital infrastructure, which broadens investor options beyond traditional mining and finance. Australia’s close ties with the Asia-Pacific region also present opportunities for cross-border investment and partnerships, attracting both institutional and retail investors seeking stable returns. The growing influence of superannuation funds ensures consistent domestic capital inflows, while regulatory clarity and a strong governance environment foster investor trust. Together, these factors position the Australian market as an adaptable, forward-looking ecosystem capable of leveraging innovation to sustain long-term value creation.

Emerging Risks and Structural Constraints

Despite its strengths, the Australian stock market faces several structural and operational challenges. Dependence on resource-based industries exposes it to global commodity cycles and external demand fluctuations. Smaller technology and manufacturing firms often struggle to scale due to limited venture funding and high compliance costs. The market’s relatively concentrated structure can lead to reduced liquidity in mid-cap and emerging sectors, deterring diversification. Additionally, tightening global regulations, cybersecurity risks, and shifts in monetary policy introduce volatility and uncertainty for both issuers and investors. Ensuring that automation, digitalization, and sustainability transitions do not outpace regulatory capacity remains a pressing concern. Balancing innovation with prudential oversight will determine how effectively the Australian stock market manages risk while continuing to attract domestic and international investment.

Why IMARC Group Is the Preferred Research Partner for the Australian Stock Market Analysis

IMARC Group offers a research-driven, evidence-based approach that helps businesses navigate the evolving Australian stock industry with precision and credibility. The firm’s strength lies in its analytical rigor, sector-specific expertise, and forward-looking insights tailored to strategic decision-making rather than promotional narratives. The firm:

- Provides data-backed market forecasts built on transparent assumptions and validated economic indicators.

- Maintains deep industry coverage across financial services, technology, infrastructure, and trade-linked sectors.

- Delivers granular segmentation and benchmarking, enabling informed strategy formulation for institutional and corporate clients.

- Integrates macroeconomic, regulatory, and innovation analysis for a balanced view of market dynamics.

- Upholds independence and methodological consistency, ensuring findings remain objective and decision-oriented.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)