Cost Dynamics of Aluminum Alloy Wheel Manufacturing: A Comprehensive Cost Model

What is Aluminum Alloy Wheel?

Aluminum alloy wheels are high-performance, lightweight, and durable components widely used in the automotive industry. Their superior strength-to-weight ratio enhances vehicle efficiency, fuel economy, and handling, making them a preferred choice for both passenger and commercial vehicles.

Key Applications Across Industries:

Beyond their functional benefits, aluminum alloy wheels contribute to vehicle aesthetics, offering sleek designs and customization options that appeal to consumers. Their corrosion resistance and thermal conductivity further enhance braking performance and longevity. With increasing demand for fuel-efficient and stylish vehicles, aluminum alloy wheels play a crucial role in the global automotive sector, catering to OEMs, aftermarket suppliers, and performance vehicle manufacturers.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global aluminum alloy wheel market reached US$ 20.7 Billion in 2024. Looking ahead, the market is expected to grow at a CAGR of approximately 6.8% from 2025 to 2033, reaching a projected size of US$ 37.6 Billion by 2033. The global market for aluminum alloy wheels is driven by several key factors.

The rising demand for fuel-efficient and lightweight vehicles has significantly boosted market growth, particularly in regions with strong automotive manufacturing industries. Their essential role in electric vehicles (EVs) further supports expansion, as automakers seek to reduce vehicle weight and enhance battery efficiency. Additionally, the growing preference for aesthetically appealing and high-performance wheels in the luxury and sports car segments has fueled demand. Advancements in manufacturing technologies, including improved casting and forging techniques, have enhanced durability, safety, and environmental sustainability. As the automotive industry continues evolving with stricter emission regulations and increased electrification, aluminum alloy wheels remain a crucial component in meeting modern transportation needs.

Case Study on Cost Model of Aluminum Alloy Wheel Manufacturing Plant

Objective

One of our clients has approached us to conduct a feasibility study for establishing a mid to large-scale aluminum alloy wheel manufacturing plant in Turkey.

IMARC Approach: Comprehensive Financial Feasibility

We have developed a detailed financial model for the plant's setup and operations. The proposed facility is designed with a production capacity of 200,000 pieces per year.

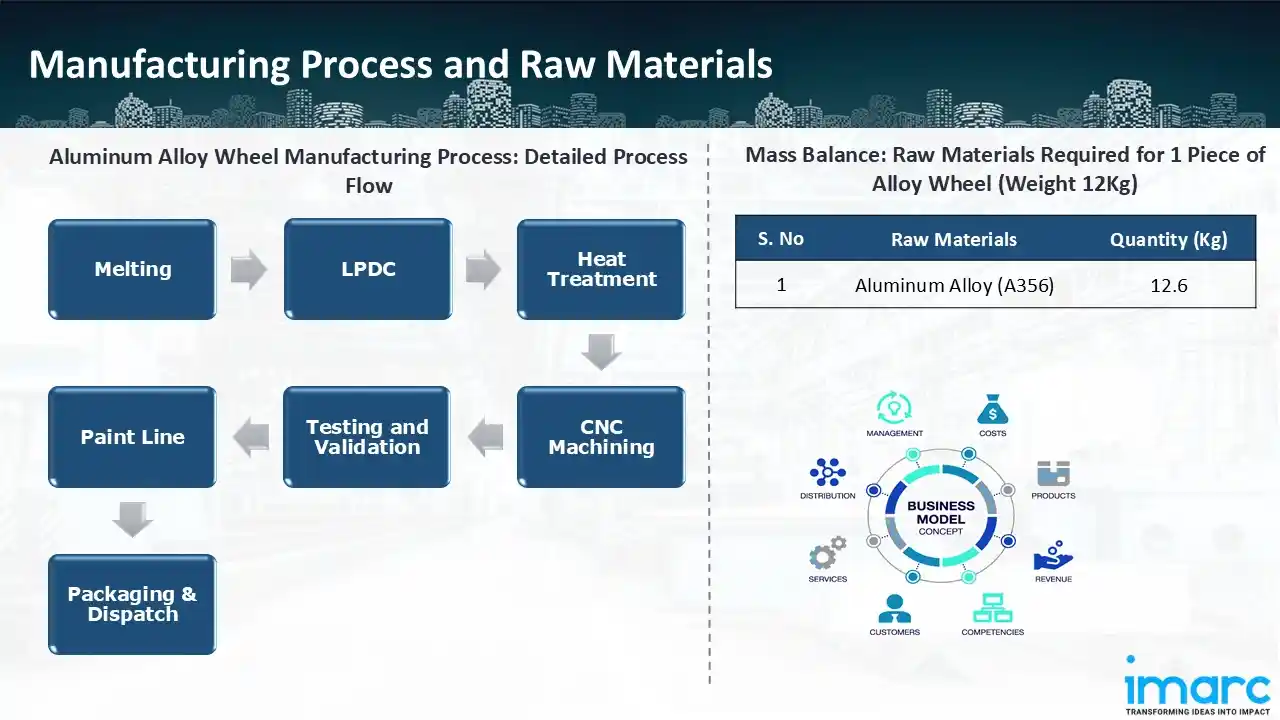

Manufacturing Process: The manufacturing of aluminum alloy wheels involves several precise steps to ensure quality, durability, and performance. It begins with melting, where A356 aluminum alloy ingots are heated in a furnace, and the molten metal undergoes degassing to remove trapped gases. Preheated dies are then mounted onto Low-Pressure Die Casting (LPDC) machines, where molten aluminum is cast into wheel shapes under controlled conditions, minimizing air entrapment. After casting, the wheels undergo heat treatment, including controlled heating and rapid cooling to enhance mechanical properties, followed by shot-blasting for surface refinement. Next, CNC machining ensures precise shaping by milling key dimensions such as bolt holes, center bore, and Pitch Circle Diameter (PCD). The wheels are then subjected to rigorous testing, including radial fatigue, impact resistance, wheel balancing, and air leak inspections. For painted wheels, surface treatment and coating provide durability and aesthetic appeal. Finally, packaging and dispatch ensure safe transportation to customers, with minimal material loss factored into efficiency calculations.

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials utilized in the aluminum alloy wheel manufacturing plant include aluminum alloy (A356). To produce 1 piece of alloy wheel (weight 12kg), we require 12.6 Kg of aluminum alloy (A356).

List of Machinery:

The following equipment was required for the proposed plant:

- Casting Line

- Heating Treatment

- CNC Machining

- Inspection and Testing

- Surface Treatment and Finishing

- Assembly and Balancing

- Quality Control

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

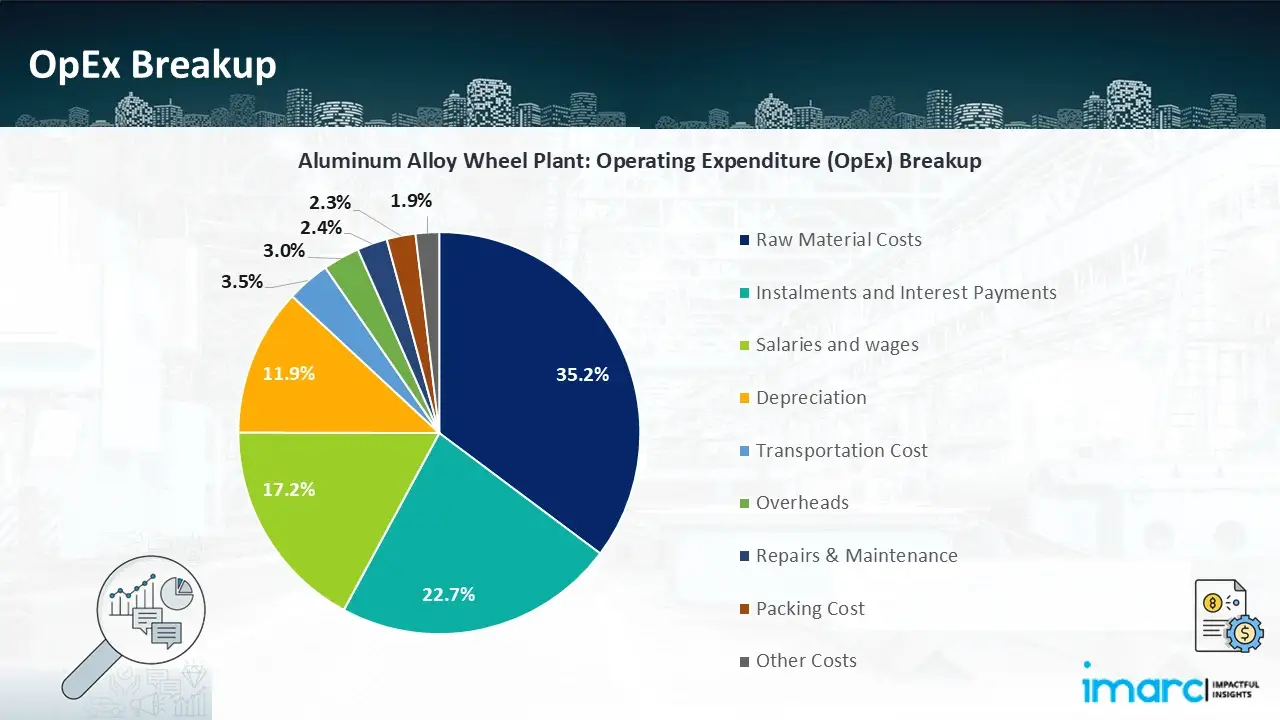

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. OpEx in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

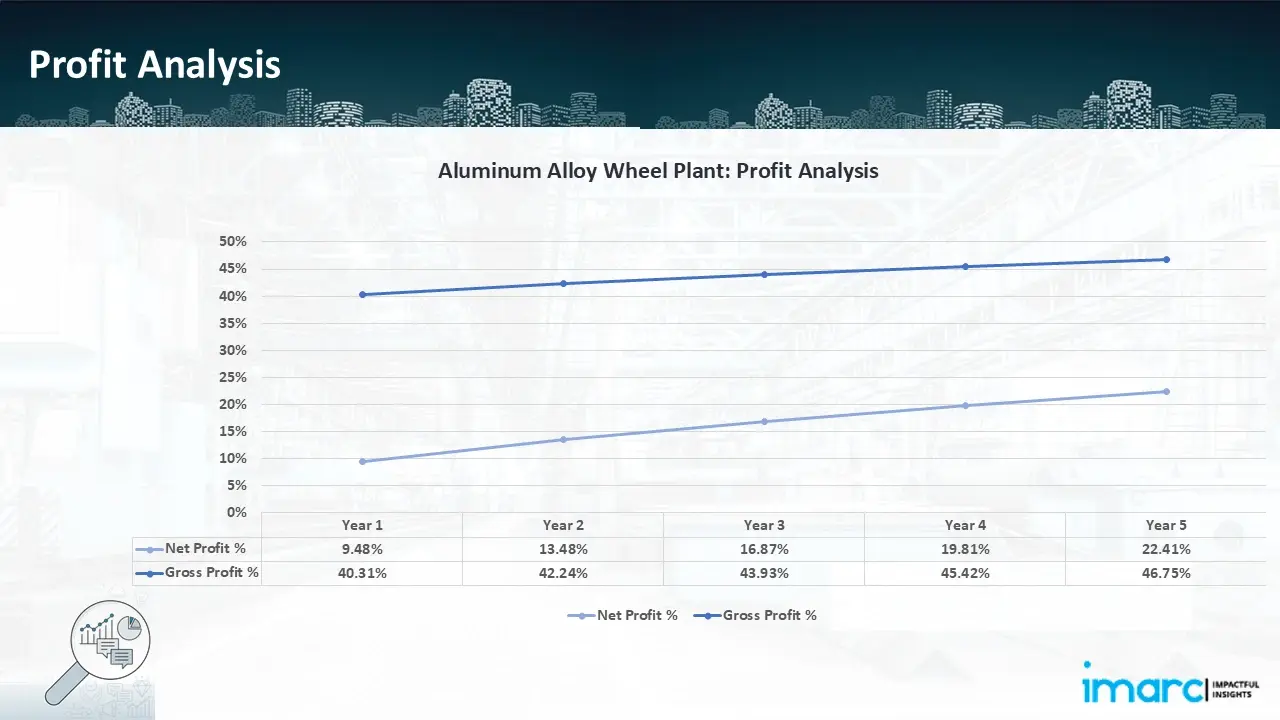

- Profitability Analysis Year on Year Basis: The proposed aluminum alloy wheel plant, with a capacity of 200,000 pieces per year, achieved an impressive revenue of USD 20.9 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the years. Gross profit margin improved from 40.31% to 46.75% throughout the years, and net profit went up from 9.48% to 22.41%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our aluminum alloy wheel manufacturing plant's financial model was meticulously modelled to satisfy the client's requirements. It provided a thorough analysis of production costs including capital expenditures, manufacturing processes, raw materials, and operating costs. The model predicts profitability while accounting for market trends, inflation, and any shifts in the price of raw materials. It was created especially to satisfy the demand of producing 200,000 pieces of aluminum alloy wheel per year. Our commitment to offering precise, client-cantered solutions that ensure the long-term success of significant industrial projects by giving the client useful data for strategic decision-making is demonstrated by this comprehensive financial model.

Latest News and Developments:

- In October 2024, Lizhong Group announced that its subsidiaries—Xintai Wheel, Mexico Lizhong, and Baoding Lizhong—have successfully secured fixed-point contracts for aluminum alloy wheel projects with two major customers. The project with Customer 1 is set to commence mass production in early 2025 and will span a 10-year lifecycle, with estimated sales reaching approximately RMB 5.24 Billion.

- In June 2024, Lizhong Sitong Light Alloys Group, a leading Chinese supplier of aluminum alloy materials and wheels, secured substantial orders worth CNY 9.2 Billion (USD 1.3 Billion) from two prominent international automakers. This reinforces the company's strong position in the global automotive supply chain, catering to the increasing demand for lightweight and durable aluminum alloy wheels.

- In April 2024, Steel Strips Wheels Ltd. (SSWL) saw a 2.57% increase in its share price to Rs 229.80 following the announcement of a new supply agreement for aluminum alloy wheels. The agreement, signed with a top passenger car manufacturer in India, marks a strategic partnership aimed at supplying aluminum alloy wheels alongside its existing steel wheel offerings.

- In March 2024, India's Finance Ministry imposed a definitive anti-dumping duty on imports of Cast Aluminum Alloy Wheels or Alloy Road Wheels (ARW) from China. The duty, which is valid for five years, ranges from USD 0.23 per kg to USD 1.71 per kg, depending on the specific Chinese producer. This move aims to protect domestic manufacturers from unfair pricing and ensure a level playing field in the Indian alloy wheel market.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory set-up services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104