Drill Bits Cost Model: The Cutting Edge Report

_11zon.webp)

What is Drill Bits?

Drill bits are specifically designed cutting instruments intended to produce cylindrical holes in various materials, ranging from soft woods and plastics to hardened steels, stone, and rock. Although they seem straightforward, drill bits consist of various specialized shapes, coatings, and materials that are designed to suit the cutting characteristics of the intended material and the requirements of the drilling task.

Key Applications Across Industries:

Drill bits fundamentally consist of a cutting face, which includes the lips and chisel edge, flutes for chip removal, and a shank that attaches to a driving spindle or drill chuck. Typical types feature twist bits for versatile metal and wood projects, masonry bits with carbide tips for brick and concrete, spade and auger bits for quick wood removal, step bits for profiling sheet metal, core and hole-saw cutters for bigger openings, along with specialized industrial tools like polycrystalline diamond (PCD) and tungsten-carbide tipped bits for tough applications in composites, rock drilling, and mineral extraction. The field of materials science is crucial: high-speed steels provide durability for intermittent cutting, carbide substrates ensure hardness and thermal resistance for high-speed cutting, whereas diamond or PCD surfaces offer exceptional wear resistance and edge longevity for abrasive materials. Accuracy in geometry like point angle, helix, lip relief, and web thickness affect chip formation, thrust forces, and hole quality; contemporary manufacturing integrates CNC grinding, powder metallurgy, and brazing to attain precise tolerances and consistent performance. Coatings and surface treatments like TiN, TiAlN, and DLC enhance longevity by minimizing friction and thermal stress. Modern drill bits are extensively optimized components, and their choice and specifications involve an engineering decision that balances material characteristics, hole quality, machining efficiency, and tool longevity across various sectors including construction, automotive, aerospace, and oil & gas.

What the Expert Says: Market Overview & Growth Drivers

The global drill bits market reached a value of USD 5.9 Billion in 2024. According to IMARC Group, the market is projected to reach USD 10.35 Billion by 2033, at a projected CAGR of 5.8% during 2025-2033. The global demand for drill bits is shaped by a mix of industrial activity, technological progress in materials and manufacturing, and evolving end-user requirements for productivity, precision, and cost-efficiency. First, construction and infrastructure development are the primary anchors of consumption: building, civil works, and utilities all require a continuous flow of drilling operations for anchors, fasteners, pipework, and foundation works. Likewise, manufacturing sectors such as automotive, aerospace, heavy machinery, and electronics drive needs for precision tooling, as part geometries tighten, surface-finish expectations rise, and cycle times shorten. The oil, gas, and mining industries exert strong influence, especially on heavy-duty, rock-drilling, and long-life tool segments, where fluctuations in exploration and production activity translate into purchases of specialized downhole and percussion drill bits.

Technological advances form a second, persistent driver: progress in substrate metallurgy for example, ultra-fine carbides coating chemistries, and diamond-based cutting faces increases tool life and cutting speeds, promoting end-users to upgrade tooling to gain productivity and lower total cost of ownership. Additive manufacturing and precision grinding technologies enable bespoke geometries and rapid prototyping of novel bit designs, expanding applications. Third, the shift toward automation and digital manufacturing CNC machining centers, robotic drilling cells, and integrated tool-life monitoring changes procurement patterns: buyers look for tool systems with predictable life, consistent tolerances, and traceable performance data. Sustainability and waste reduction priorities also nudge buyers toward longer-life, regrindable tools and recyclable materials. Finally, supply-chain and manufacturing geography considerations influence sourcing: proximity to major end-users, lead time sensitivity, and regional standards shape where and how drill-bit suppliers expand production or service networks. Collectively, these factors like sectoral demand from construction/manufacturing/mining, material and tooling innovation, automation, sustainability, and supply-chain dynamics drive both incremental product innovation and strategic capacity decisions across the global drill-bit industry.

Case Study on Cost Model of Drill Bits Manufacturing Plant:

Objective

One of our clients reached out to us to conduct a feasibility study for setting up a medium scale drill bits manufacturing plant.

IMARC Approach: Comprehensive Financial Feasibility

We developed a comprehensive financial model for the setup and operation of a proposed drill bits manufacturing plant in India. This plant is designed to manufacture 150,000 units of drill bits annually.

Manufacturing Process: Drill bit manufacturing involves a sequence of precision operations joining advanced metallurgy, machining, and coating technologies in creating tools that can operate under high stress, temperature, and wear conditions. The process starts with raw material selection, which could include high-speed steel, tungsten carbide, cobalt alloys, or diamond composites based on the field of application. These are generally produced as rods or blanks by methods of powder metallurgy or sintering, both of which ensure a fine-grained, uniform microstructure. After the blanks are ready, they are cut to length and then forged or machined for the initial geometry of the drill bit, including the shank and flute zones.

Then comes flute formation, which is an important process by which chip evacuation efficiency is determined, and this can be done on a CNC grinding machine or helical flute milling machine. Grinding shapes the spiral grooves along the bit, regulating parameters like helix angle, web thickness, and flute depth. The tip geometry is then precision-ground to form the cutting lips and chisel edge, whereby drilling performance and accuracy depend. After the geometry is formed, the bits are then heat-treated in controlled furnaces to improve hardness, toughness, and wear resistance by incorporating quenching and tempering cycles based on the alloy composition. Following heat treatment, the surface finishing process removes burrs and ensures dimensional accuracy in the bits. Many of them are coated with advanced materials like titanium nitride (TiN), titanium aluminum nitride (TiAlN), or diamond-like carbon (DLC) for friction reduction and tool life extension. Eventually, the drill bits go through inspection, balancing, and testing for concentricity, edge sharpness, and hardness before being cleaned, laser-marked, and prepared for packaging and distribution. This multi-step process integrates precision engineering, material science, and quality control to ensure that every bit gives good cutting performance and reliability for demanding drilling operations.

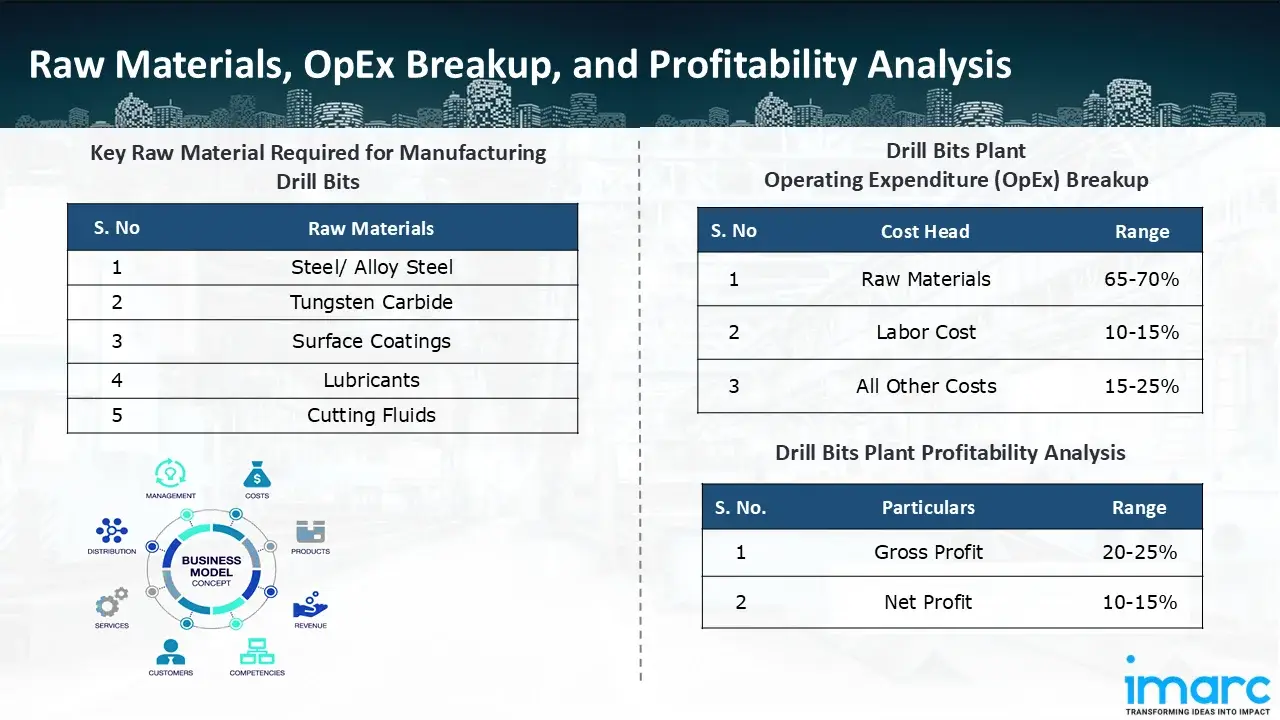

Raw Material Required:

The basic raw materials required for drill bits manufacturing include:

- Steel/ Alloy Steel

- Tungsten Carbide

- Surface Coatings

- Lubricants

- Cutting Fluids

Machineries Required:

- Automatic Sawing Machine / Band Saw

- Optical Comparator / Micrometer / Hardness Tester

- Annealing Furnace

- Cold Heading / Hot Forging Press

- CNC Lathe / Center Drilling Machine

- CNC Lathe / Automatic Lathe

- CNC Flute Grinding Machine

- Surface Grinding / Cylindrical Grinding Machine

- Rotary Polishing / Vibratory Finishing Machine

- CNC Drill Point Grinding Machine

- Same CNC Grinder / Specialized Lip Grinder

- Vibratory Deburring Machine

- Induction Furnace / Batch Hardening Furnace

- Tempering Oven / Continuous Belt Furnace

- Cryogenic Chamber

- Vibratory Finishing Machine

- PVD / CVD Coating Machine

- Laser Marking Machine

- Micrometer, Caliper, CMM (Coordinate Measuring Machine)

- Rockwell / Vickers Hardness Tester

- Drilling Test Bench

- Magnifying Lens / Microscope

- Automatic Counting Machine / Vibratory Feeder

- Blister Packing Machine / Cartoning Machine

- Label Printer / Barcode Printer

- Compressed Air System

- Dust Extraction System / Coolant Filtration

- Temperature-Controlled Oil / Water-Based Coolant System

- Storage & Material Handling (Racks, Conveyors, and Robotic Feeders)

Techno-Commercial Parameter:

- Capital Expenditure (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth. Furthermore, raw material cost in a drill bits manufacturing plant ranges between 65-70%, labor cost ranges between 10% to 15%, and all other costs ranges between 15-25% in the proposed plant.

- Profitability Analysis Year on Year Basis: We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins lie between a range of 20-25%, and net profit lie between the range of 10-15% during the income projection years, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the drill bits manufacturing plant was meticulously developed to meet the client’s objectives, providing an in-depth analysis of production costs, including raw materials, manufacturing, capital expenditure, and operational expenses. By addressing the specific requirements of manufacturing 150,000 units of drill bits annually, we successfully identified key cost drivers and projected profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model equipped the client with valuable insights into strategic decision-making, demonstrating our commitment to delivering high-quality, client-focused solutions that ensure the long-term success of large-scale manufacturing ventures.

Latest News and Developments:

- In September 2024, a groundbreaking ceremony for an expansion of Epiroc's rock drilling tool manufacturing facility is being held in Hyderabad, India. Epiroc is a leading productivity and sustainability partner for the mining and construction industries. Additionally, Epiroc is opening a brand-new innovation and technology centre in Hyderabad today. The investment is a component of Epiroc's increasing emphasis on India as a vital centre for production and R&D to serve clients across the region.

- In September 2024, Mincon Group plc unveiled its next- generation rotary drill bit range, the XP+ Series, at this year’s Minexpo in Las Vegas. The XP+ rotary drill bits are made to provide longer bit life and improved durability in the world's most difficult drilling circumstances, building on the Mincon XP Series' established dependability.

- In September 2024, leading Malaysian drilling, completion, and wellhead part designer and manufacturer OMNI Oil Technologies announced the introduction of Malaysia's first VDP PDC Steel Body Drill Bits, which are made locally and have received an award from Petronas to spur advancements in upstream oilfield equipment technology in Malaysia.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104