Food Packaging Market Expansion: Innovating Safety and Shelf Life

Introduction: Market Landscape and Future Growth

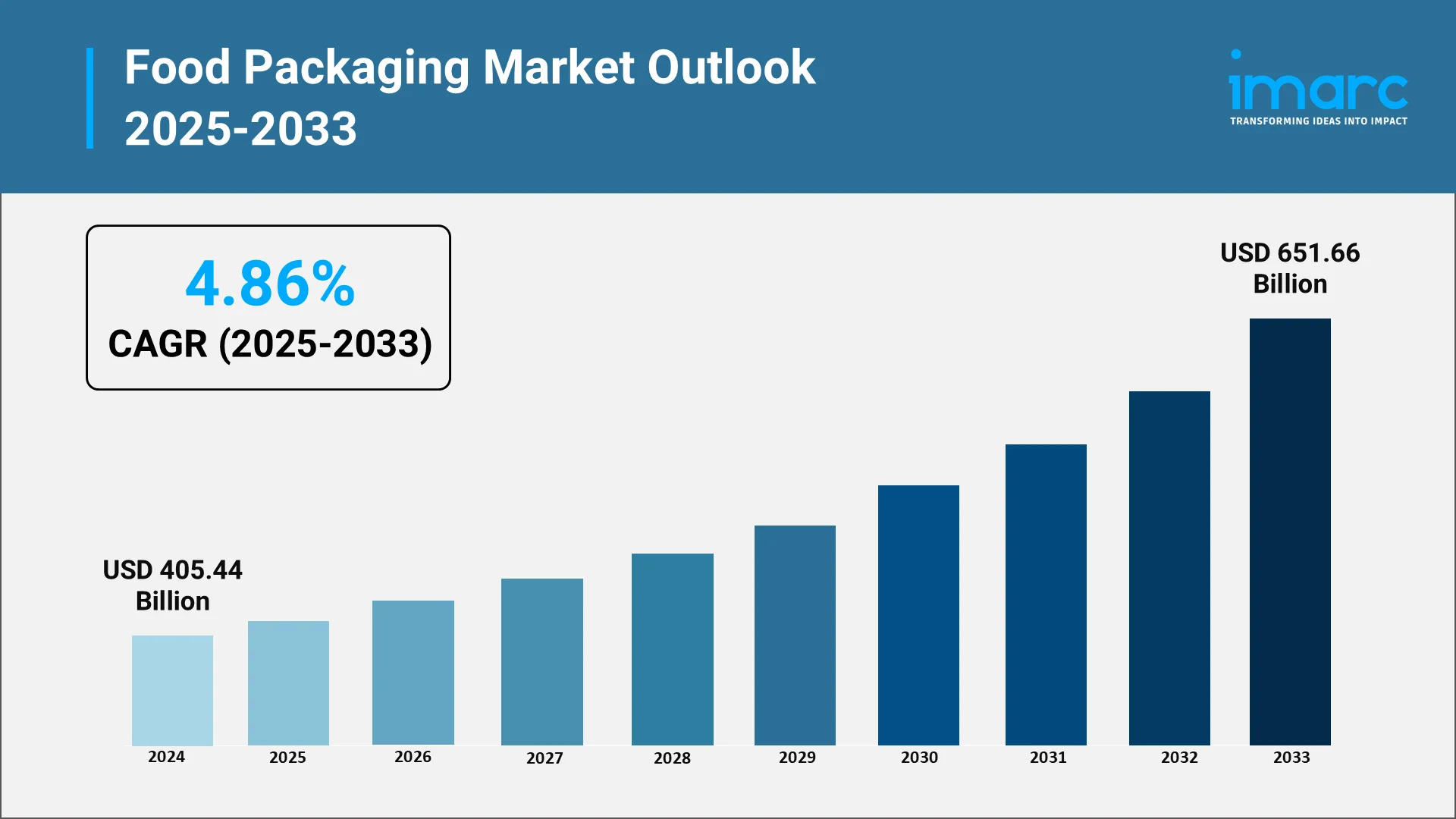

The global food packaging market is evolving as consumer expectations, sustainability concerns, and technological advancements redefine the way food is kept safe, secure, and delivered. Packaging is no longer merely a container; it has transformed into a critical enabler that drives purchase decisions, improves product shelf life, and communicates brand values. As demand for ready-to-eat, convenience, and packaged foods grows, packaging has emerged to convey sustainability, safety, and innovation. As per the IMARC Group report, the global food packaging market size was valued at USD 405.44 Billion in 2024. This robust growth is due to the increasing need for eco-friendly packaging solutions, innovative food preservation methods, and user-friendly packaging designs. From biodegradable packaging to smart packaging systems, the industry is undergoing a transformation that will define the future of global food consumption.

Explore in-depth findings for this market, Request Sample

Keeping It Fresh: How Packaging Impacts Product Quality and Shelf Life

Packaging plays a crucial role in maintaining the freshness, flavor, and nutritional value of food. Advanced technologies such as vacuum packaging, modified atmosphere packaging (MAP), and multi-layer barrier films are designed to slow spoilage and extend shelf life. Industry findings indicate that vacuum packaging can preserve food up to three to five times longer than traditional methods by minimizing moisture loss, reducing microbial growth, and protecting against oxygen exposure. For instance, vacuum-packed raw meat can last up to 10 days, compared to 3–5 days when unsealed, and when frozen, it may retain quality for 1 to 3 years, far longer than the 1 to 12 months typical of non-sealed meat.

For manufacturers and retailers, extended shelf life reduces waste and enhances supply chain efficiency, boosting profitability. For consumers, it ensures safer, longer-lasting products. With rising urbanization and busier lifestyles, innovative packaging solutions are increasingly vital to global food preservation and convenience.

Future-Forward Packaging: Combining Innovation with Environmental Responsibility

Sustainability is reshaping the global food packaging industry as both consumers and regulators push for environmentally responsible alternatives. Traditional plastic packaging, though practical, has long contributed to landfill overflow and ecological harm. As per industry reports, every day, the volume of plastic waste entering oceans, rivers, and lakes equals 2,000 garbage truckloads. Over their life cycle, plastics are responsible for 3.4% of worldwide greenhouse gas emissions.

In response, manufacturers are increasingly turning to recyclable, biodegradable, and compostable materials that reduce environmental impact while maintaining functionality. Innovations such as plant-based polymers, recycled paper, and edible films are gaining momentum as substitutes for single-use plastics. Leading food companies are pledging to make all packaging recyclable within the next decade. By adopting greener solutions, the industry is addressing ecological challenges, meeting policy demands, strengthening brand value, and advancing toward a circular economy.

Key Industry Trends Redefining the Food Packaging Landscape:

Green Revolution: The Rise of Biodegradable and Compostable Packaging

Biodegradable and compostable packaging is rapidly becoming one of the most prominent growth areas in the food packaging sector. Materials such as polylactic acid (PLA), starch-based blends, and bagasse fibers are increasingly being used to create trays, wraps, and containers that naturally decompose, reducing long-term waste. Notably, in February 2025, TIPA, a global leader in compostable packaging, introduced the 312MET Premium, a home-compostable metallized high-barrier film designed to provide ultra-thin protection against salt, oil, and moisture without the need for extra sealant layers. Available worldwide in reel format, the film can be laminated with paper or cellulose to create one of the thinnest 2-ply compostable solutions for snacks and chips, offering both extended shelf life and sustainability. Moreover, growing consumer preference for eco-friendly packaging and government bans on single-use plastics are accelerating adoption. With foodservice players, especially quick-service and takeaway chains, integrating these solutions, biodegradable packaging is set to achieve mainstream acceptance.

Smart and Savvy: Innovations in Active and Intelligent Packaging

Active and intelligent packaging technologies are redefining the food industry by improving safety, quality, and consumer interaction. Active packaging incorporates elements such as oxygen scavengers, antimicrobial coatings, and moisture absorbers that directly engage with food products to extend shelf life. Intelligent packaging, on the other hand, integrates features like freshness indicators, QR codes, and NFC tags, offering real-time updates on product condition and traceability. These technologies are particularly valuable in categories such as dairy, meat, and other perishable goods where freshness is critical. For consumers, they deliver transparency and confidence in product quality, while for businesses, they improve supply chain efficiency and minimize losses by detecting spoilage risks early. A significant development in the sector occurred in March 2025, when ProAmpac expanded its ProActive Intelligence platform with the Moisture Protect series, developed with Aptar CSP Technologies. These advanced films actively absorb moisture, preserving the freshness of snacks, baked goods, and dry mixes, while aligning with sustainability objectives.

Portion Perfect: Meeting the Demand for Convenient Packaging

Changing consumer lifestyles have significantly increased demand for convenient, on-the-go, and portion-controlled packaging solutions. Formats such as single-serve packs, resealable pouches, and microwave-ready containers are tailored to the needs of busy professionals, urban households, and health-conscious individuals. In addition to convenience, portion-controlled packaging aids dietary management and minimizes food waste through pre-measured servings. This trend is especially prominent in categories like snacks, beverages, frozen meals, and dairy, where packaging ensures both ease of use and product safety. Recently, in February 2025, Kraft Heinz reintroduced Capri Sun in 12-ounce resealable single-serve bottles, the brand’s first bottle format in more than two decades, offering popular flavors including Fruit Punch, Pacific Cooler, and Strawberry Kiwi. Positioned to complement the iconic pouch, the bottles target on-the-go consumers and will be available across retail and vending channels nationwide. Coupled with rising incomes, urbanization, and growth in e-commerce grocery and ready-to-eat meals, convenient packaging is becoming a key differentiator for global food brands.

Safety First: Rising Focus on Food Protection and Traceability

Food safety has become a central focus in modern packaging design, driven by increasing consumer awareness and stricter regulatory oversight. Innovations now highlight tamper-evident seals, contamination-resistant materials, and anti-counterfeit features to ensure product integrity. At the same time, digital tools such as blockchain-enabled labels and QR codes are enhancing traceability, allowing consumers to follow products from farm to table and reinforcing trust. With rising concerns over foodborne illnesses and the expansion of global trade in packaged foods, safety and transparency have become essential requirements. Regulatory measures, including the FDA’s Food Safety Modernization Act (FSMA) and EU directives, are compelling companies to meet higher standards. In line with this shift, in June 2025, BiOrigin Specialty Products launched BioGuard™, an oil and grease-resistant paper for food service packaging. Engineered with a 100% food-safe formula, BioGuard™ improves product protection, enhances converting efficiency, and maintains recyclability, strengthening both safety and sustainability in packaging.

Packaging in the Digital Age: E-Commerce Driving Design Innovation

The rapid growth of e-commerce grocery and food delivery services is reshaping packaging requirements worldwide. In the United States alone, more than a quarter of consumers (28.2%) use food delivery services at least once a week, while 44% use them less frequently. Reflecting this demand, the U.S. online food delivery market was valued at USD 31.91 Billion in 2024 and continues to expand at a strong pace. This shift has heightened the need for packaging that is durable enough to withstand shipping conditions, while also remaining compact and cost-efficient for logistics. At the same time, design appeal is vital to capture attention in digital marketplaces where visual impressions drive consumer choice. Recent innovations include insulated containers to maintain temperature, leak-proof pouches, and lightweight corrugated boxes that balance strength with sustainability. Additionally, the integration of smart labels allows brands to track freshness, improve traceability, and engage directly with customers. As online food sales accelerate globally, packaging tailored for e-commerce is set to prioritize durability, convenience, sustainability, and digital connectivity.

Breaking Down the Food Packaging Market: Key Segments and Insights

Flexible Packaging Takes the Lead in 2024: Lightweight, Sustainable, and Efficient

- Flexible packaging accounts for 49.5% of market share in 2024, It significantly reduces material usage and transportation costs compared to rigid formats, making it highly economical for large-scale distribution.

- Barrier films and multilayer laminates used in flexible packaging protect products from moisture, oxygen, and contamination, thereby enhancing product safety and shelf stability.

- Increasing adoption of recyclable and bio-based flexible packaging solutions aligns with global sustainability goals and growing consumer demand for eco-friendly options.

Bakery, Confectionery, Pasta & Noodles Segment Dominates in 2024: Ensuring Freshness, Convenience, and Brand Appeal

- Bakery, confectionery, pasta, and noodles represent the largest market with a share of 24.4%, as packaging plays a vital role in maintaining freshness, preventing moisture absorption.

- Single-serve packs, resealable pouches, and on-the-go formats meet consumer demand for portability and ease of consumption.

- Attractive designs, transparent windows, and innovative printing techniques in packaging enhance shelf appeal and strengthen brand positioning in competitive retail environments.

Geographic Breakdown: Key Drivers and Trends Across Regions

Innovation First: North America Leads the Pack

North America remains the largest market for food packaging, commanding a 31.0% share in 2024, driven by high consumption of packaged food and beverages and a strong emphasis on innovation. The U.S. leads the region, supported by demand for sustainable packaging solutions and strict regulatory frameworks on food safety and labeling. Notably, in January 2024, Accredo Packaging and Fresh-Lock launched a breakthrough flexible stand-up pouch incorporating over 50% post-consumer recycled (PCR) content, combined with Fresh-Lock’s Child-Guard® slider technology. The child-resistant closure integrates at least 25% PCR while maintaining recyclability, setting a new benchmark for sustainable and safe packaging. Furthermore, e-commerce growth has accelerated demand for lightweight and durable flexible formats that lower shipping costs and improve efficiency. Meanwhile, Canada is gaining traction with growing consumer awareness of eco-friendly materials and government restrictions on single-use plastics. With advances in digital printing, recyclable materials, and smart packaging, the region continues to define global packaging standards, supported by circular economy initiatives and strong private-label growth.

E-Commerce Surges: Asia Pacific Zooms Forward

Asia Pacific is the fastest-growing packaging market, supported by urbanization, rising disposable incomes, and surging demand for convenience-oriented products. China and India are major growth engines, particularly within food and beverage packaging. In March 2025, UFlex Ltd., India’s largest flexible packaging manufacturer, became the first Indian company to receive U.S. FDA approval for its recycled polyethylene (rPE) process in food-contact applications. This milestone strengthens global adoption of sustainable packaging while supporting multinational brands in achieving their environmental goals. Apart from this, expanding e-commerce platforms have accelerated the adoption of flexible and protective packaging formats, while Japan and South Korea continue to lead in smart, eco-friendly technologies. With stricter plastic waste regulations across the region, the Asia Pacific is positioned as a cost-effective hub for large-scale sustainable packaging production.

Smart Solutions: Europe Goes Green

Europe’s packaging sector is shaped by stringent environmental policies and consumer demand for sustainable materials. The EU’s single-use plastics directive has significantly accelerated the shift toward recyclable, biodegradable, and paper-based formats. Western Europe, led by Germany, France, and the UK, remains the largest contributor to demand. In June 2024, Saica Group and Mondelez International unveiled recyclable paper-based packaging for multipack confectionery, biscuits, and chocolates. Designed for paper waste streams and adaptable to heat-sealable packing processes, the innovation supports Mondelez’s sustainability targets of reducing virgin plastic use. Central and Eastern Europe are experiencing steady growth, particularly in e-commerce and industrial applications. Europe continues to lead in circular economy practices, with smart labeling and traceability gaining widespread adoption.

Affordable Formats Rise: Latin America Grows Strong

Latin America’s packaging market is steadily expanding, fueled by urbanization, population growth, and a rising middle class. Brazil dominates with robust demand across food and beverage sectors, while Mexico benefits from proximity to the U.S. and a strong manufacturing base. The region is increasingly investing in flexible, cost-efficient formats that appeal to price-sensitive consumers. Sustainability is gradually advancing, with governments enforcing stricter recycling initiatives and new food packaging regulations. A key shift has been the adoption of front-of-pack warning labels, such as Mexico’s NOM-051, which highlight excessive sugar, sodium, or saturated fats. These labels have reduced consumption of targeted products by up to 25%, driving reformulation and healthier packaging design. Overall, Latin America presents opportunities for both consumer and industrial packaging growth.

Retail Networks Expand: MEA Unwrap Potential

The Middle East and Africa (MEA) packaging market is gaining momentum, driven by growing demand for packaged foods and expanding retail infrastructure. GCC countries lead in consumption, supported by high purchasing power and rising demand for premium packaged beverages and ready-to-eat products. In Africa, urbanization and an expanding middle class, particularly in South Africa and Nigeria, are fueling steady growth. Industry reports indicate that 53% of consumers in the region purchase prepared foods or takeaway at least once a week, compared to a global average of over 30%. Sustainability initiatives are still in early development but are accelerating in the UAE and Saudi Arabia. With affordability and innovation driving adoption, MEA holds significant potential for future packaging expansion.

Global Food Packaging Landscape: Innovations and Future Outlook (2025–2033)

The global food packaging market is projected to grow at a CAGR of 4.86%, reaching USD 651.66 Billion by 2033. The following key drivers are shaping the landscape:

- Growing Demand for Packaged Food: Rising urbanization and lifestyle changes have led to higher consumption of ready-to-eat and processed foods, fueling packaging demand.

- Increasing Awareness of Food Safety and Hygiene: Post-pandemic consumer priorities have intensified focus on safe, contamination-free packaging solutions.

- Rising Disposable Income: Growing purchasing power in emerging markets is boosting demand for premium and convenient food packaging formats.

- Innovation in Packaging Technologies: Developments in intelligent, sustainable, and active packaging solutions are transforming market dynamics.

- Stringent Regulations on Food Packaging: Government policies encouraging recyclability and safety compliance are driving adoption of advanced materials and designs.

Conclusion: Redefining Food Packaging for a Sustainable Future

The global food packaging industry is undergoing a profound transformation, shaped by sustainability imperatives, safety regulations, and consumer demand for greater convenience. Innovations such as biodegradable and compostable solutions, intelligent packaging systems, and advanced barrier technologies are redefining how food is preserved, transported, and consumed.

To remain competitive in this evolving market, industry stakeholders must focus on:

- Sustainability: Transitioning to recyclable, compostable, and biodegradable materials to reduce plastic waste and align with circular economy goals.

- Safety and Compliance: Strengthening packaging standards through tamper-evident designs, traceability systems, and adherence to global regulatory frameworks.

- Consumer-Centric Innovation: Developing convenient, portion-controlled, and on-the-go formats that align with modern lifestyles.

The future of food packaging lies in balancing environmental responsibility, functionality, and innovation. Companies that embrace eco-friendly practices and invest in advanced solutions will not only enhance brand value but also contribute meaningfully to global sustainability efforts.

Connecting World: IMARC’s Strategic Intelligence for the Food Packaging Market

As the global food packaging market evolves, IMARC Group empowers manufacturers, investors, retailers, and technology developers with forward-looking insights and actionable intelligence. The transition toward eco-friendly materials, smart packaging technologies, and consumer-centric designs opens new avenues for innovation, differentiation, and strategic growth.

How IMARC Adds Value:

- Technology Trend Intelligence: Tracks advancements in biodegradable materials, active and intelligent packaging systems, and e-commerce-ready formats redefining the food packaging ecosystem.

- Consumer Behavior Insights: Analyzes changing consumption habits, sustainability preferences, and demand for portion-sized and convenient formats across global markets.

- Channel Performance Mapping: Evaluates growth in supermarket, hypermarket, convenience store, and online retail networks to optimize distribution strategies and packaging design.

- Competitive Landscape Analysis: Profiles leading players, emerging innovators, and regional challengers, offering benchmarking on cost-efficiency, sustainability practices, and product differentiation.

- Sustainability Opportunity Scanning: Assesses the adoption of recyclable, compostable, and eco-friendly packaging solutions aligned with ESG priorities and regulatory compliance.

- Regional Market Forecasting: Provides granular forecasts by material type, packaging format, application, and region to guide product innovation, supply chain alignment, and market expansion strategies.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)