Top Factors Driving Growth in the India Online Food Delivery Market

Introduction:

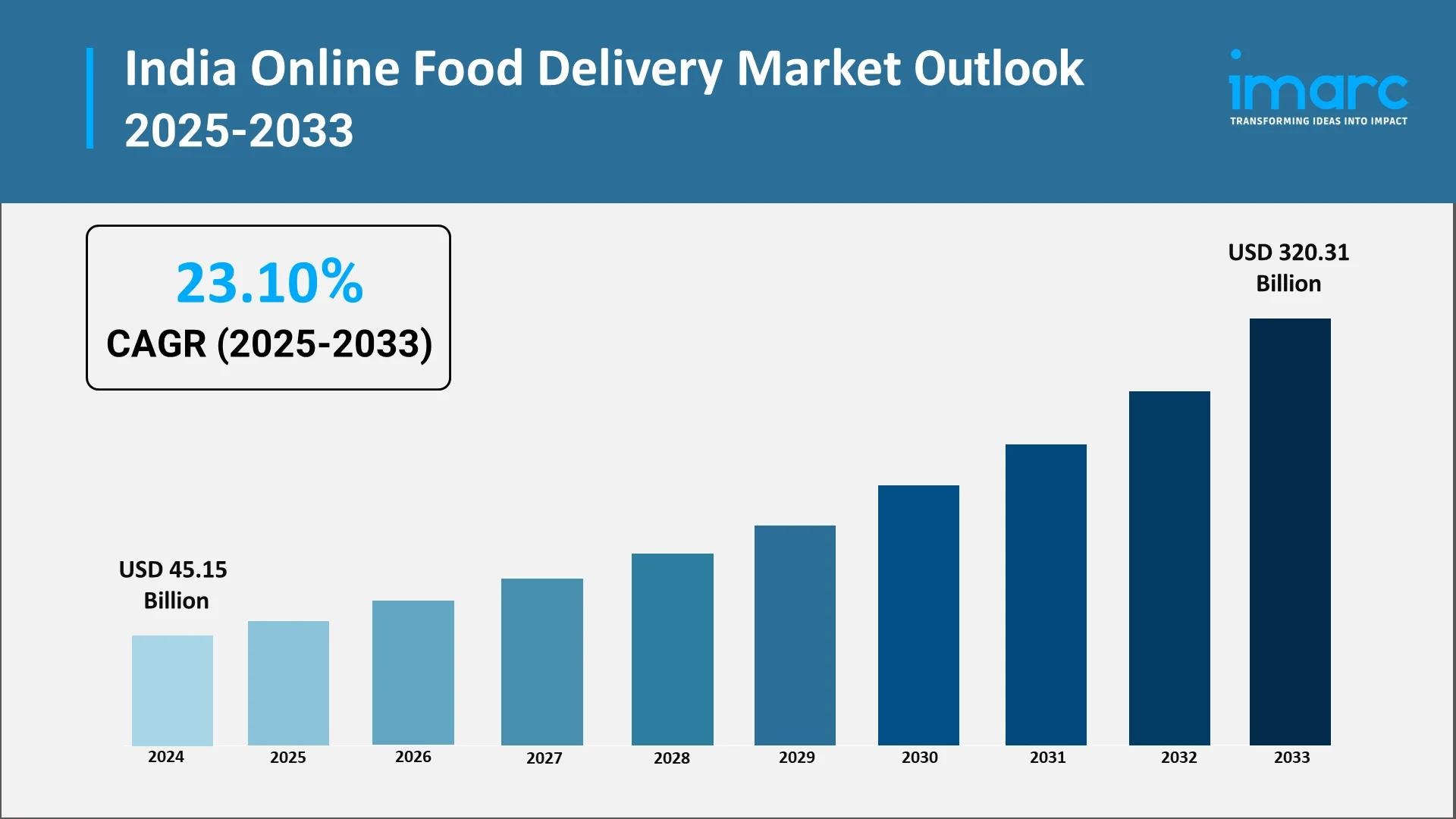

The Indian online food-delivery ecosystem is undergoing a rapid expansion, propelled by multiple structural shifts in technology, consumer behaviour, and delivery infrastructure. According to a recent report by Bain & Company and Swiggy, the overall food-services market in India is projected to grow from roughly INR 5.5 lakh crore in 2023 to around INR 9–10 lakh crore by 2030. Within this, the online food-delivery segment is expected to outpace the market: penetration rising from approximately 12 % in 2023 to about 20 % by 2030, with a CAGR of around 18% over the coming years. In this article, we unpack eight key factors driving this growth, each rooted in Indian market dynamics and technological advancement, and then conclude with strategic take-aways and outlook for businesses operating or looking to enter this space. According to the IMARC Group, the India online food delivery market size was valued at USD 45.15 Billion in 2024. Looking forward, the market is expected to reach USD 320.31 Billion by 2033, exhibiting a CAGR of 23.10% from 2025-2033.

Explore in-depth findings for this market, Request Sample

Digital Transformation & Smartphone Penetration:

One of the foundational enablers of the online food delivery boom in India is the widespread adoption of smartphones and mobile internet access. Affordable handsets, cheaper data tariffs and an expanding network infrastructure have made it possible for large segments of the population to access food-delivery apps. Besides access, user engagement is improving: platforms are investing in better UI/UX, faster payment systems (including Unified Payments Interface – UPI) and app-based tracking.

Key implications:

- A broader base of first-time users from non-metro cities now able to order food online.

- Lower entry barriers for platform adoption (fewer obstacles to getting started).

- The “app as first decision point” model is now mainstream.

Changing Consumer Lifestyle & Urbanisation:

India is increasingly urbanised, and with that comes busier lives, smaller households (especially nuclear families), higher participation of women in the workforce, and less time for traditional meal preparation. Additionally, the post-COVID-19 era accelerated changes: people became more comfortable ordering in rather than dining-out, and the notion of food-delivery shifted from a “treat” to a convenient everyday activity.

Consequences for the online food-delivery market:

- Growth in delivery demand beyond just weekends or special occasions.

- Opportunity to serve more “meal occasions” (lunch, dinner, snacks) rather than only one main meal.

- Shift in menu-mix: people increasingly look for variety, health-oriented meals, and ready-to-eat formats.

Rising Internet Accessibility & UPI Integration:

Alongside smartphone penetration, the growth of high-speed mobile internet (4G, now moving toward 5G) and seamless payment infrastructure have eased the ordering process. Many platforms now integrate UPI, digital wallets and one-tap payments, creating friction-free ordering experiences. Digital payments also support subscription models, loyalty programmes and cashless delivery, all of which boost repeat orders and customer stickiness.

Why this matters:

- Reduced payment-related drop-offs (ease of checkout).

- Greater acceptance among older or less-digital segments who were earlier cash-centric.

- Enables platforms to run promotions, dynamic pricing and bundling more easily.

Technological Advancements & AI-Driven Personalisation:

Modern food delivery platforms are leveraging data analytics, machine learning and AI to optimise everything from route planning and delivery logistics to personalised menu recommendations and push notifications. For instance, one source notes that AI & data-analytics integration is “shaping the India online food-delivery market”. Features such as predictive order timing, dynamic dispatch, “what you might like” suggestions, and hyper-local offers are increasingly common.

Benefits:

- Improved operational efficiency (faster delivery, lower costs).

- Better customer experience (relevance, repeat usage).

- Higher conversion and retention rates, thus greater revenue per user.

Expansion of Cloud Kitchens & Quick-Commerce Formats:

To meet growing demand and improve unit economics, many food-delivery players are adopting cloud kitchens (also called “ghost kitchens”) which are delivery-only kitchens without dine-in service. Additionally, rapid-delivery or “quick-commerce” integrals (10–30 minute delivery models) are gaining traction. According to recent commentary, these formats are part of the growth engine in India’s food-delivery ecosystem.

Implications:

- Lower overheads versus full dine-in restaurants → better margin potential for delivery.

- Faster service leads to higher frequency of orders (one can treat delivery almost like a convenience shop).

- Enables reaching areas beyond major metros via networked kitchens and micro-fulfilment hubs.

Strategic Collaborations, Investments & Business Models:

Online food-delivery platforms have matured their business models: aggregator-restaurant partnerships, subscription models (waived delivery charges), tie-ups with cloud-kitchens, bundling of groceries and food, cross-selling, etc. Large investments into logistics, last-mile delivery, and geographic expansion are enabling the platforms to scale fast. Even though profitability remains a challenge for many, the growth momentum is clear.

Key elements to watch:

- Restaurant partner expansion into tier-II/III cities.

- Consolidation of platforms and joint-ventures for logistics/warehousing.

- Innovations in loyalty programmes, subscription services (e.g., “free delivery for members”).

- These strategies help increase order frequency, improve monetisation and allow platforms to capture more value per user.

Government Support, Policy & Digital Ecosystem:

The Indian government’s push toward a digital economy (via programmes like Digital India) and payment linking initiatives have laid the groundwork for online services including food delivery. Additionally, regulatory reforms and infrastructure schemes (in telecom, digital payments, logistics) contribute indirectly to the sector’s growth.

Why it matters:

- Improved digital access and trust (security, compliance) encourage more users to order online.

- Better infrastructure (roads, delivery logistics) helps providers serve more geographies.

- A favourable regulatory environment lowers entry hurdles for players and encourages innovation.

Regional Insights & Tier-II / Tier-III Market Growth:

While metros (Mumbai, Delhi, Bengaluru) remain major growth centres, much of the incremental growth is expected to originate from smaller cities and towns. Reports suggest that top 50 cities still account for 70 % of consumption today, leaving large headroom for tier-II & tier-III markets. Markets in non-metros are seeing improving internet access, rising incomes, and changing lifestyles. As a result, platforms are expanding aggressively into these geographies.

Strategic laundry list for providers:

- Localised menu options and regional cuisines to cater to local tastes.

- Pricing strategies attuned to lower average order-values typical in smaller cities.

- Logistics solutions adapted for lower density and longer last-mile distances.

Conclusion and Strategic Outlook:

The online food delivery landscape in India is entering a dynamic growth phase driven by rising digital penetration, lifestyle transformation, and the structural evolution of logistics and cloud kitchens. With continuous innovation in AI-driven personalization, quick-commerce models, and UPI-based payments, the sector’s potential extends far beyond convenience, as it is reshaping how India eats.

For stakeholders, the focus must remain on unit economics, regional scalability, and customer retention. Companies that align operational efficiency with hyper-local preferences, eco-friendly initiatives, and strategic collaborations are best positioned to dominate the next growth wave. The convergence of technology, policy, and consumer behaviour indicates a long runway for expansion, both in metros and emerging markets.

Choose IMARC Group — Your Partner for Unmatched Market Intelligence and Growth Strategy.

- Data-Driven Market Research: Gain deep insights into India’s evolving online food delivery ecosystem, from platform economics, order patterns, and digital payment adoption to the role of AI in consumer engagement.

- Strategic Growth Forecasting: Identify future opportunities across quick-commerce, cloud kitchens, and tier-II/III market penetration with our advanced modelling and forecast analytics.

- Competitive Benchmarking: Evaluate leading players such as Swiggy, Zomato, and Domino’s India through detailed profiling, financial benchmarking, and strategic positioning studies.

- Policy and Infrastructure Advisory: Stay informed about regulatory updates, FDI norms, and logistics infrastructure developments shaping India’s digital food economy.

- Custom Reports and Consulting: Get tailored insights to guide your business decisions, whether you’re expanding into regional markets, scaling cloud kitchens, or optimizing your delivery operations.

At IMARC Group, our mission is to empower business leaders, investors, and policymakers with data-driven intelligence that inspires actionable growth.

Join us in unlocking the future of India’s online food delivery revolution — because the next meal opportunity is only a click away.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)