From Farm to Fuel: Sustainability Trends Shaping the Future of Vegetable Oils

Market Snapshot: Growth, Innovations, and Sustainability Drivers

Vegetable oils remain among the world’s most widely used agricultural products, essential to food manufacturing, biofuels, cosmetics, and industrial goods. As climate policies tighten and consumers demand healthier, ethically sourced ingredients, the sector faces growing pressure to prove it can operate responsibly. From new deforestation laws to digital supply chain tracking and stricter certification standards, producers are changing the way they grow, process, and distribute vegetable oils.

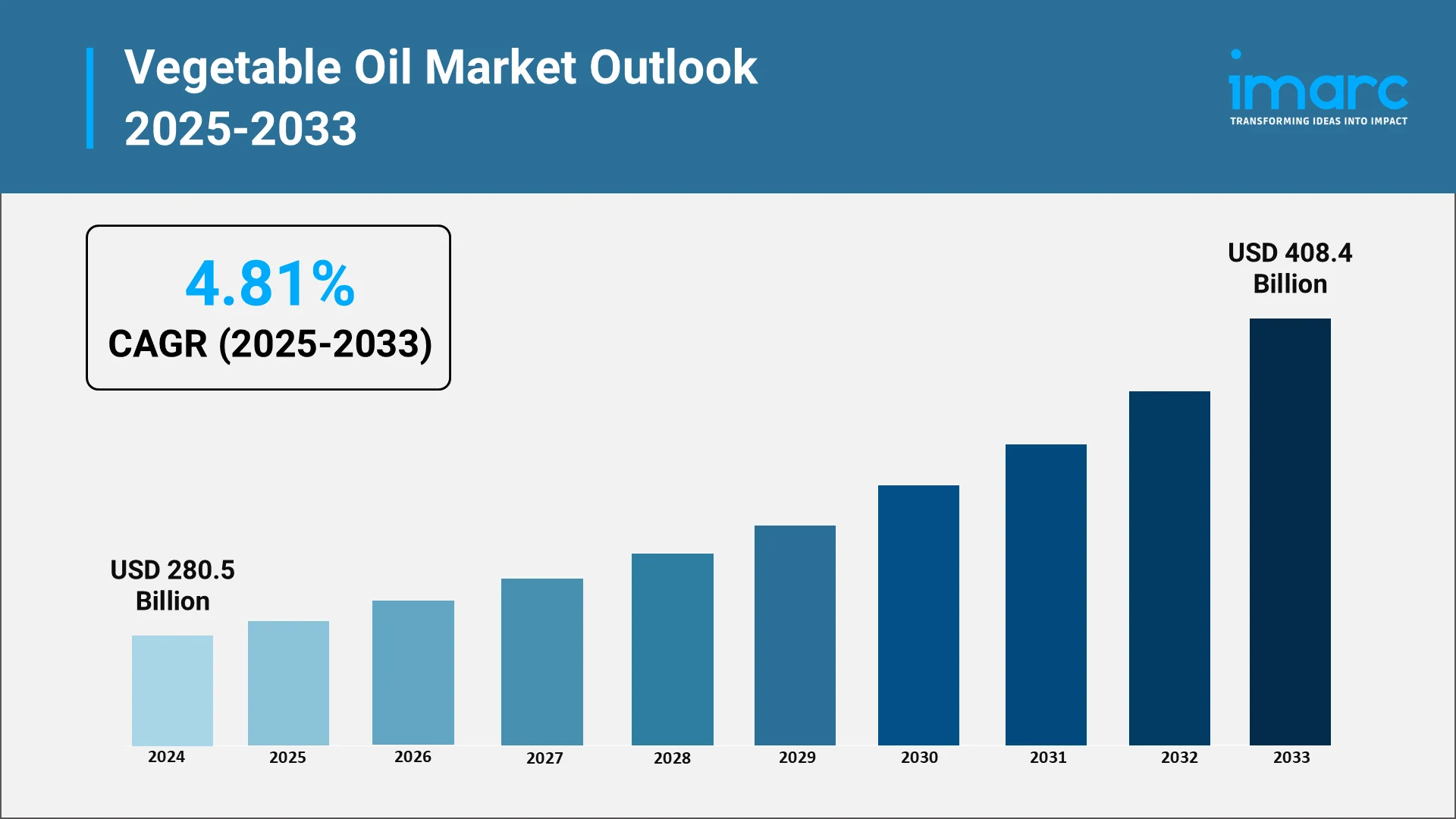

The global vegetable oil market has grown steadily for two decades, driven by rapid urbanization, rising food demand, and industrial uses. According to an IMARC Group report, the market was valued at USD 280.5 Billion in 2024. Producers are adjusting sourcing and production to cut emissions and meet ethical standards. This shift is influenced by:

- Urbanization and Consumption

- The urban population, now over 4 Billion, drives demand for processed and fried foods, boosting vegetable oil use in emerging markets. India, China, Indonesia, and Sub-Saharan Africa lead this growth.

- The urban population, now over 4 Billion, drives demand for processed and fried foods, boosting vegetable oil use in emerging markets. India, China, Indonesia, and Sub-Saharan Africa lead this growth.

- Shift Toward Plant-Based and Vegan Diets

- More consumers are choosing plant-based diets and oils rich in unsaturated fats, such as canola, olive, and sunflower, to match clean-label and vegan preferences.

- More consumers are choosing plant-based diets and oils rich in unsaturated fats, such as canola, olive, and sunflower, to match clean-label and vegan preferences.

- Processed Food Industry Expansion

- Vegetable oils are vital for snacks, baked goods, and frozen meals. Non-GMO, organic, and certified oils are becoming procurement standards for food brands.

- Vegetable oils are vital for snacks, baked goods, and frozen meals. Non-GMO, organic, and certified oils are becoming procurement standards for food brands.

- Growing Demand for Biofuel

- Vegetable oils are key feedstocks for biodiesel and renewable diesel. Mandates like RED II (EU), RFS (U.S.), and B35 (Indonesia) are raising demand for responsibly sourced oils. Researchers have developed a low-energy process that produces biodiesel from vegetable oil. This method operates below the boiling point of water and converts about 85% of the oil into biodiesel that meets nearly all industry fuel standards for heavy machinery and transport. Concerns over life-cycle emissions and land use are steering the industry toward second-generation biofuels and certified low-carbon feedstocks.

- Vegetable oils are key feedstocks for biodiesel and renewable diesel. Mandates like RED II (EU), RFS (U.S.), and B35 (Indonesia) are raising demand for responsibly sourced oils. Researchers have developed a low-energy process that produces biodiesel from vegetable oil. This method operates below the boiling point of water and converts about 85% of the oil into biodiesel that meets nearly all industry fuel standards for heavy machinery and transport. Concerns over life-cycle emissions and land use are steering the industry toward second-generation biofuels and certified low-carbon feedstocks.

- Sustainability, Organic Products, and Regulatory Compliance

- Vegetable oil manufacturers are cutting volume and adding value, complying with tighter environmental rules and consumer pressure. Satellite tracking and blockchain help keep supply chains deforestation-free, while certifications like RSPO, ISCC, Rainforest Alliance, and Fair Trade gain ground. On 18 July 2024, the RSPO and India’s IVPA signed an MoU to promote sustainable palm oil production and imports.

Explore in-depth findings for this market, Request Sample

Key Trends Redefining the Global Vegetable Oil Market in 2025

Global Powerhouses: Top Vegetable Oil Producers and Trade Dynamics

Indonesia remains the top producer, especially in palm oil, with 47.5 Million tonnes annually. Malaysia follows with 19.2 Million tonnes, and Thailand produces 3.4 Million tonnes. China, India, and Brazil are significant players in soybean and rapeseed oil, supported by policies. These countries have favorable agro-climatic conditions, extensive arable land, and supportive agricultural policies. Indonesia, India, China, and the EU remain central players in expanding the vegetable oil market size and shaping trade trends. Supply disruptions have also encouraged some countries to diversify production.

Innovation on the Horizon: Next-Gen Vegetable Oil Extraction Technologies

Technological improvements are changing extraction methods. Enzyme-assisted pressing, ultrasonic extraction, and supercritical CO2 methods reduce waste and keep nutrients intact. A research study comparing avocado oil extraction showed supercritical CO2 yielded 40% oil with 80% antioxidant retention, versus LPG’s higher yield but lower antioxidant content. The study highlights that supercritical technology offers an efficient way to extract and preserve valuable compounds. This method is an efficient alternative to traditional mechanical pressing for avocado oil production. Several refiners are also adding automation to stages like degumming, bleaching, and deodorizing to boost throughput and product consistency.

Industry Leaders: Shaping the Future of the Vegetable Oil Market

Major players in the vegetable oil industry include Archer-Daniels-Midland Company, Bunge Limited, Cargill, Incorporated, Louis Dreyfus Company BV, and Wilmar International Ltd. These players are leveraging vertical integration, global trade networks, and research and development (R&D) activities to optimize margins and manage risk. Strategic collaborations and mergers are reshaping industry dynamics. For instance, in January 2025, Neste and Bayer announced a partnership to develop new vegetable oil sources through regenerative farming, including a winter canola supply chain in the U.S. Additionally, plant-based startup brands are emerging in premium categories, offering organic, small-batch, or specialty oils targeted at health-conscious consumers.

E-Commerce Shift: Transforming Vegetable Oil Shopping and Consumer Behavior

Brick-and-mortar retail continues to be the dominant channel for vegetable oil sales, particularly in developing markets where in-store visibility and pricing promotions drive volume. At the same time, global B2C ecommerce revenue is projected to reach USD 5.5 Trillion by 2027, growing steadily at a 14.4% CAGR, reflecting how the pandemic-driven shift to digital has fueled online sales of premium, organic, and imported oils. Direct-to-consumer models and subscription services keep growing, especially among younger urban shoppers looking for convenience and verified sourcing. More buyers now read online labels, check certifications, and compare prices across apps before choosing premium or organic oils. Integrated logistics, smart packaging, and AI-driven suggestions help brands build loyalty and repeat sales.

Navigating the Storm: Global Supply Chain Challenges

Vegetable oil market price trends continue to fluctuate due to supply chain disruptions, shifting trade policies, and changing consumer demand patterns. Erratic rainfall patterns, droughts, and extreme weather events are threatening oilseed yields globally. Southeast Asian palm oil plantations are facing El Niño-related dry spells, while soybean growers in Brazil and Argentina contend with deforestation-linked environmental scrutiny. Additionally, protectionist policies, export bans, and fluctuating tariffs, particularly in response to food inflation, continue to disrupt global trade. Also, stricter sustainability regulations, especially in the EU, are increasing compliance costs for exporters. From deforestation-free supply chain mandates to carbon footprint disclosures, producers must now invest in traceability systems, satellite monitoring, and third-party certifications to maintain market access in key regions.

Beyond the Kitchen: Vegetable Oils in Food and Industrial Applications

Vegetable oils are essential in the global food industry, serving as cooking mediums, salad dressings, bakery fats, and emulsifiers. The rise of processed and convenience foods is driving steady demand across segments such as snacks, ready-to-eat meals, and plant-based dairy alternatives. Foodservice demand, particularly from quick-service restaurants, is also rebounding post-pandemic. Beyond food, vegetable oils are integral to biofuel production, where demand is growing in Europe and North America due to decarbonization goals. Soybean and canola oil are prominent feedstocks in this sector. Additionally, vegetable oils are being used in cosmetics, lubricants, plastics, and oleochemicals, supported by research and development (R&D) activities in biodegradable and non-toxic formulations.

Market Segmentation: A Deep Dive into Vegetable Oil Types, Uses, and Regional Trends

Oil Types:

- Palm Oil: The most widely produced and consumed vegetable oil worldwide. It’s valued for its versatility, long shelf life, and low production cost. Palm oil is used heavily in processed foods, confectionery, cosmetics, and biofuels.

- Soybean Oil: A staple in North and South America, soybean oil is rich in polyunsaturated fats and widely used in salad dressings, margarines, frying oils, and processed foods. Its high availability and fatty acid profile also make it a popular feedstock for biodiesel as cleaner fuels gain ground.

- Sunflower Oil: Sunflower oil is popular in household cooking and food manufacturing. Its high vitamin E and unsaturated fat content make it appealing to health-focused markets. As per industry reports, in the 2024/25 period, global sunflower seed oil consumption exceeded 20 Million metric tonnes.

Applications:

- Food and Beverage: The food industry remains the largest consumer of vegetable oils, covering applications such as cooking, baking, salad dressings, and deep-frying. Consumers are increasingly choosing oils with heart-friendly properties, low trans-fat content, and clean-label formulations. Following the FDA’s ban, effective August 2, 2024, the brominated vegetable oil market is seeing increased substitution with other vegetable oils in various food applications.

- Industrial Uses: Vegetable oils are replacing petroleum-based inputs, lubricants, surfactants, and plastics. Government mandates on biofuel blending, especially in the EU and U.S., are supporting industrial demand for oleochemical derivatives from palm and soybean oils.

- Personal Care and Cosmetics: Natural oils like coconut, olive, and sunflower are prized for their moisturizing and antioxidant properties, showing up in lotions, creams, and soaps. The clean beauty trend and preference for plant-based ingredients are boosting demand for cold-pressed, unrefined oils.

Regional Insights:

- China: A major importer and consumer of vegetable oils, especially palm and soybean. Rapid urbanization, rising incomes, and dietary diversification have pushed up demand for cooking oils, packaged snacks, and processed foods. The government is expanding domestic oilseed cultivation to cut reliance on imports, especially for rapeseed and peanut oils.

- United States: A highly diversified market led by soybean oil consumption. The U.S. is a top producer of soybeans. In 2024, U.S. farmers planted a total of 87.1 Million acres of soybeans, supporting both food and renewable diesel sectors. Consumer demand for non-GMO, organic, and specialty oils like avocado and algae-based oils is rising. Renewable diesel policy support is expanding industrial use.

- Europe: The market here is shaped by strict sustainability standards and a preference for non-GMO sourcing. Rapeseed and sunflower oils dominate food and biodiesel use. EU sustainability rules, including the Renewable Energy Directive and deforestation-free supply chain requirements, are driving the shift toward certified oils.

- India: India, the largest importer of vegetable oils globally, is estimated to have bought in 16 Million tonnes during the 2023–24 season, which concluded in October. High population density, a culture of fried foods, and price sensitivity sustain steady demand. The National Edible Oil Mission (NEOM) aims to boost domestic oilseed output, focusing on mustard and groundnut oils.

- Indonesia: The top producer and exporter of palm oil, supplying over half the world’s supply. While the sector is vital to the economy, it faces scrutiny over environmental and labor issues. Government-backed sustainable certification and replanting initiatives are modernizing the sector. Export policies, including temporary bans, have global impacts.

- Malaysia: The second-largest palm oil exporter, with advanced downstream refining and solid infrastructure for global shipping. In 2024, Malaysia’s palm oil exports totaled around 15.39 Million metric tonnes. Malaysia promotes its MSPO (Malaysian Sustainable Palm Oil) certification to strengthen its position as a sustainable sourcing hub for Europe and North America.

- Brazil: A major soybean oil producer, contributing heavily to both food and biofuel industries. As a top soybean exporter, Brazil is working to expand value-added oil exports and processing capacity. Environmental concerns are spurring sustainable soy farming, deforestation commitments, and climate-smart agriculture.

Market Outlook: The Path Forward for Vegetable Oils (2025-2033)

According to IMARC Group, the global vegetable oil market is expected to reach USD 408.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.81% during 2025-2033. The key drivers of growth include:

- Clean-Label and Ethically Sourced Oils: Consumers are increasingly seeking vegetable oils that are free from artificial additives, with a preference for clean-label products that emphasize transparency in sourcing and production. Ethical sourcing practices are becoming key factors in consumer purchasing decisions within the market.

- Urbanization and Foodservice Expansion in Asia and Africa: Rapid urbanization in Asia and Africa is influencing dietary patterns. There is a shift toward more processed and convenience foods, which is driving higher demand for vegetable oils in foodservice and retail. The expansion of the foodservice sector in these markets creates significant opportunities for vegetable oil producers to cater to evolving consumer preferences.

- Advancements in Eco-Friendly Oil Extraction Methods: Advancements in extraction technologies are helping vegetable oil producers reduce waste and energy consumption. These eco-efficient processes also help improve the yield and quality of oils, contributing to better margins and reducing resource consumption.

- Renewable Diesel and Sustainable Aviation Fuel: Vegetable oils are increasingly used as feedstocks for renewable diesel and sustainable aviation fuel (SAF) production, driven by the global push for cleaner energy sources. These oils, often from sustainable sources, help reduce carbon emissions from the transportation and aviation sectors.

- Resilient Crop Varieties and ESG Standards Shaping Market Dynamics: The need for climate-resilient oilseed varieties is growing due to the unpredictable impacts of climate change on crop yields. Additionally, compliance with Environmental, Social, and Governance (ESG) standards is becoming critical for businesses in the market, as consumers and investors are increasingly focused on sustainability and ethical practices in sourcing and production.

IMARC’s Vision: Paving the Way for Sustainable Growth in Vegetable Oils

IMARC Group supports stakeholders across the vegetable oil value chain with deep, forward-looking market intelligence. As sustainability becomes both a growth catalyst and a compliance necessity, our research enables clients to adapt strategies, identify opportunities, and mitigate risks.

How IMARC Adds Strategic Value:

- Decoding Market Dynamics: Understanding demand shifts, trade realignments, and sustainability-led preferences across geographies and applications.

- Innovation Tracking: Monitor emerging processing technologies, green chemistry solutions, and supply chain transparency tools.

- Regulatory Guidance and Compliance Advisory: Navigate carbon regulations, biofuel policies, import restrictions, and certification frameworks.

- Custom Strategy Development and Planning: Craft go-to-market strategies, ESG integration plans, and competitive positioning roadmaps.

- Data-Driven Forecasting: Evaluate peer performance, ESG disclosures, and long-term demand scenarios.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)