Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2026-2034

Insurtech Market Size and Share:

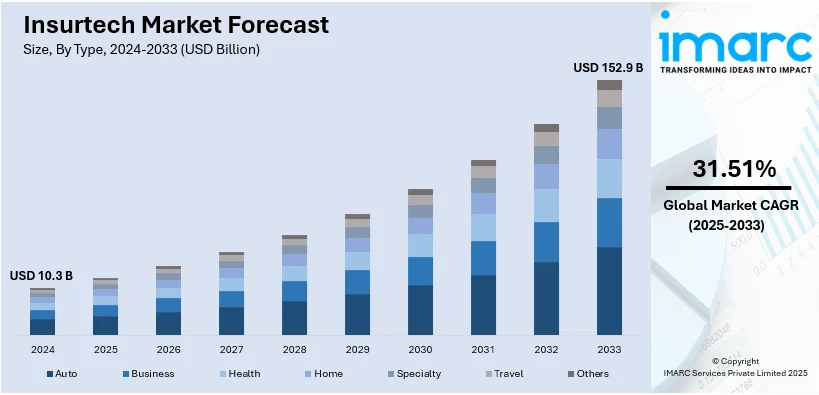

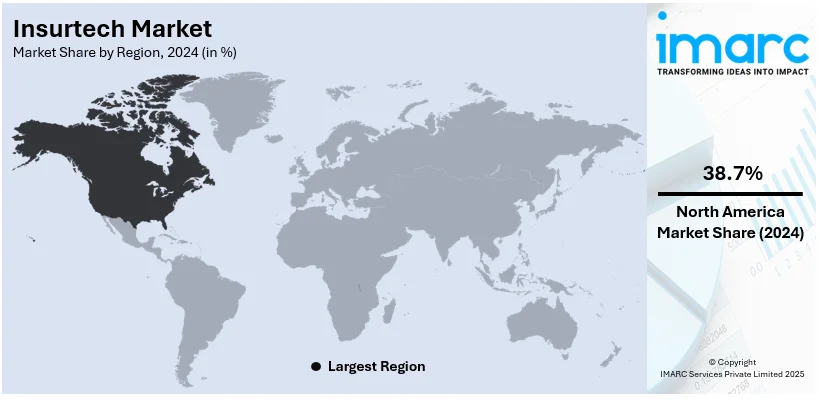

The global insurtech market size was valued at USD 10.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 152.9 Billion by 2034, exhibiting a CAGR of 31.51% from 2026-2034. North America currently dominates the market, holding a market share of over 38.7% in 2024. Increasing adoption of digital technologies within the insurance industry, changing customer expectations for seamless digital experiences, the rise of Internet of Things (IoT) devices, and the heightened need to combat insurance fraud with artificial intelligence (AI are some of the factors accelerating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 10.3 Billion |

|

Market Forecast in 2034

|

USD 152.9 Billion |

| Market Growth Rate 2026-2034 | 31.51% |

Insurtech is becoming increasingly prominent because of the swiftly evolving global insurance environment. A prominent trend in the market is the incorporation of cutting-edge technologies like artificial intelligence (AI), machine learning (ML), blockchain and the Internet of Things (IoT). These technologies assist insurers in optimizing operations, lowering expenses and improving customer experiences. AI and ML are utilized to streamline underwriting, enhance claims processing and forecast risks with greater precision. For instance, AI algorithms are capable of examining data from multiple sources in vast amounts and allow insurers to identify patterns and evaluate risk with greater accuracy. Blockchain technology is also on the rise and will establish its role in this sector as a secure and transparent way of handling policies and claims. Blockchain can enhance trust and reduce fraud in the insurance industry by providing data immutability and traceability.

The United States has emerged as a major region in the Insurtech market due to various reasons. The rise of digital insurance platforms and marketplaces is impelling the growth of the market. These platforms provide people with the ability to compare different insurance products and purchase coverage online. They also enable insurers to reach a broader customer base by reducing the need for traditional intermediaries such as agents or brokers. The regulatory environment surrounding Insurtech is evolving, and governments worldwide are taking steps to address the growing role of technology in the insurance industry. While regulation can present challenges it also provides opportunities for Insurtech companies to navigate the complexities of the industry. Insurtech startups need to ensure that they comply with the regulations governing data privacy, cybersecurity and consumer protection especially as they handle vast amounts of sensitive information. As per the predictions of the IMARC Group, the US Insurtech is expected to exhibit a growth rate (CAGR) of 6.50% during 2024-2032.

Insurtech Market Trends:

Geographical Diversification of Insurtech Market

The geographical diversification of the insurtech market is gaining momentum, driven by heightened funding and deal activity in emerging regions outside North America and traditional European hubs. Asia is witnessing a significant rise, with countries like India, China, and Southeast Asia becoming prominent growth centers due to rising insurance penetration, a large underinsured population, and advancements in digital infrastructure. For instance, in 2024, Finsall, an insurtech startup, raised ₹15 crore in a bridge funding round led by Unicorn India Ventures and Seafund. The funds will be employed to create a non-bank financial company, enhance digital interfaces, and expand partnerships with insurers, intermediaries, and lenders. Additionally, other European countries beyond the major financial centers are drawing attention from investors and startups, capitalizing on regulatory reforms and an increasing appetite for innovation in insurance services. This expansion is fostering greater global participation and collaboration, enabling the deployment of tailored insurtech solutions to address region-specific challenges. The diversification not only spreads the market's reach but also boosts competition, enhances product offerings, and increases accessibility to innovative insurance solutions, marking a shift towards a more inclusive and globalized insurtech ecosystem.

IoT and real-time data

The Internet of Things (IoT) is playing a pivotal role in offering a favorable Insurtech market outlook. IoT devices such as telematics and wearable technology are generating vast amounts of real-time data that insurers can leverage to their advantage. Telematics devices installed in vehicles for instance, provide insurers with valuable insights into driver behavior enabling personalized pricing based on actual driving habits. Wearable technology on the other hand allows insurers to monitor policyholders' health and lifestyle choices leading to more accurate underwriting and risk assessment. This access to real-time data not only enhances the accuracy of insurance pricing but also empowers insurers to develop innovative products tailored to individual needs ultimately improving customer satisfaction. Over time IoT's ability to process and send real-time data has improved. According to a study, the volume of data generated by IoT systems is predicted to reach 2.5 quintillion bytes per day and is increasing yearly.

Increasing cases of insurance fraud

The surging prevalence of insurance fraud is gaining momentum in the Insurtech arena with artificial intelligence (AI) playing a central role. Insurers have long struggled with fraudulent claims which not only result in financial losses but also erode trust within the industry. According to data from the Insurance Fraud Organisation, American consumers are defrauded of at least USD 308.6 Billion yearly by insurance fraud. Around 10% of property-casualty insurance losses happen because of fraud. The annual cost of Medicare fraud is estimated to be USD 60 Billion. Insurtech companies are deploying AI-driven algorithms to detect and prevent fraudulent activities more effectively. These algorithms analyze vast datasets and patterns to identify suspicious claims and behaviors enabling insurers to take timely action. By leveraging AI insurers can reduce fraudulent payouts, lower operational costs associated with manual fraud detection and maintain the integrity of their insurance portfolios. As highlighted by insurtech industry trends, the integration of AI technologies is revolutionizing fraud detection processes, enabling insurers to enhance efficiency and safeguard their financial assets.

Insurtech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Insurtech market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, service, and technology.

Analysis by Type:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

Health leads the market with around 25.7% of market share in 2024. The health insurance sector is primarily driven by the increasing cost of healthcare and the move toward preventive care. Insurers are concentrating on wellness programs, telemedicine services and data-driven insights to reduce healthcare costs and improve customer health outcomes. The cost of healthcare services such as doctor visits, hospitalization, surgeries, prescription drugs and diagnostic tests is steadily increasing across the globe. These increasing costs are attributed to a number of factors, including the high price of medical technology, pharmaceuticals and the rising complexity of health care delivery. The healthcare systems of many countries have become more privatized or less publicly funded leaving individuals to shoulder more of the financial burden for their healthcare needs. As a result, more people are seeking health insurance to help offset these rising costs.

Analysis by Service:

- Consulting

- Support and Maintenance

- Managed Services

Managed services lead the market with around 25.7% of insurtech market share in 2024. The demand for managed services has been steadily growing across industries driven by the increasing complexity of business operations, the need for cost-efficiency and the rapid pace of technological advancements. Managed services refer to the practice of outsourcing the management and responsibility of specific IT functions, systems, or processes to third-party service providers. This model enables organizations to focus on their core competencies while outsourcing critical infrastructure, software, security, and other IT-related services to experts. The growing frequency and sophistication of cyberattacks are also a major driver for the increased demand for managed services. With the advent of digital transformation businesses are becoming increasingly dependent on digital systems and online platforms which makes them more susceptible to cybersecurity threats. Cyberattacks such as data breaches, ransomware attacks and phishing campaigns are becoming increasingly common and have the potential to cause significant financial and reputational damage.

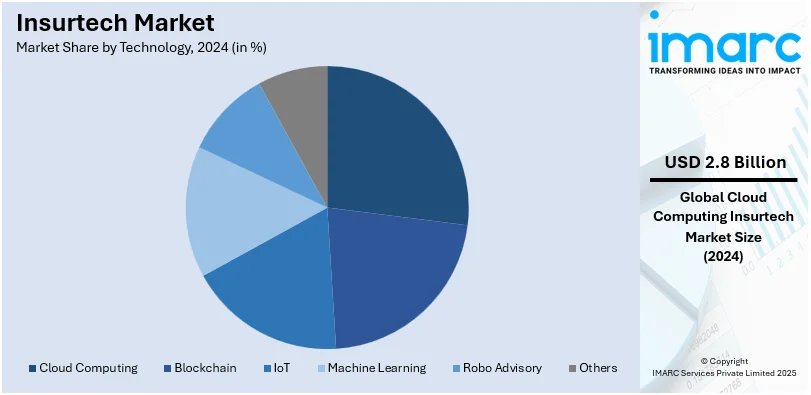

Analysis by Technology:

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

Cloud computing leads the market with around 26.8% of market share in 2024. Scalability is one of the most important advantages of cloud computing in the insurtech space. Insurance companies face fluctuating demand due to seasonal trends, regulatory changes, or sudden spikes because of unforeseen events such as natural disasters. Cloud platforms enable insurers to scale up or down their IT resources easily according to changing demands without making heavy upfront investments in physical infrastructure. Legacy systems in traditional insurance companies are expensive to maintain, upgrade and scale. Cloud computing does not require a business to invest in expensive hardware and data centers. Insurers can use a pay-as-you-go or subscription-based model through cloud solutions where they pay only for the resources they consume and not commit to large capital expenditures.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest insurtech market share of over 38.7%. The North American market is driven by the increasing adoption of Insurtech solutions driven by its advanced technological infrastructure and a customer base increasingly demanding digital experience. The rise of IoT devices especially in the United States and Canada has enabled insurers to make use of real-time data to achieve more accurate underwriting and claims processing. The collaboration of traditional insurance majors with Insurtech startups is driving the growth of the market thereby creating innovative solutions. The insurtech market is gaining significant investment as venture capitalists and private equity firms are realizing growth potential in this sector. Substantial funding for insurtech startups allows them to scale up their operations, develop innovative solutions and increase their customer base. The area of interest among investors is about the startups focused on the use of technology to disrupt traditional insurance models and improve the overall experience for insurance. In 2024, Broker Insights, which is a Dundee-based Insurtech offering a platform to brokers for better understanding of their business aspects and communication with insurers was launched in the US.

Key Regional Takeaways:

United States Insurtech Market Analysis

The United States holds 86.90% of the market share in the North America. The United States leads the insurtech market because of its highly advanced digital infrastructure and tech-savvy population. Mobile-based insurance options are increasingly gaining popularity, as by 2024, over 92% of people will have a smartphone, as per an industry report. Big data analytics, the Internet of Things, and AI have enabled the generation of customized insurance plans and fast-tracked the claims process. For instance, IoT-based telematics have fueled usage-based insurance policies, particularly in the vehicle insurance industry, where a significant number of coverages are expected to be usage-based by 2025.

Regulatory support further accelerates innovation, such as that provided by the Department of Treasury's sandbox initiatives. The increasing incidence of cyber threats is also driving the demand for cyber insurance solutions; between 2023 and 2024, more than 6 billion records were compromised in 2,741 incidents that were publicly disclosed, as reported by IT Governance USA. Robust market momentum is shown by venture capital investments in insurtech businesses, which reached USD 7 Billion in 2022 globally, according to reports.

Europe Insurtech Market Analysis

The main drivers of the insurtech market in Europe are tight regulations, digital transformation, and a high internet penetration rate (around 90% as per industrial reports) throughout the area. Laws like the General Data Protection Regulation (GDPR) that guarantee openness and consumer confidence encourage more use of digital insurance solutions. With nations like Germany and the UK leading the way in telematics-based motor insurance, pay-as-you-go insurance is becoming increasingly popular, especially in the mobility and travel sectors. In 2023, in terms of insurance telematics coverage, the German market has expanded recently and is currently the third largest in Europe. Additionally, a considerable percentage of European insurers are likely to adopt AI-based solutions by 2023, reflecting the growing usage of AI for fraud detection. Aging population and demographic change, which involve approximately 20% of the population 65 and above, is driving demand for senior-specific health and life insurance products. Cross-border collaborations have also helped push cutting-edge insurtech platforms to expand rapidly within the Nordic region.

Asia Pacific Insurtech Market Analysis

With more than 65% of the Asia-Pacific population having internet penetration as of 2023 according to reports, its large uninsured population and exponentially growing internet connectivity are contributing to an exponential rise in insurtech usage. With smartphone penetration at 78% in China and more than 70% in India, mobile-first initiatives are on the rise. Governments are taking a central role in innovation through schemes such as China's Insurtech Development Plan and India's IRDA sandbox program. Microinsurance to low-income and rural areas is one of the strongest forces in the region, particularly in India and Southeast Asia. According to IRDAI data, 2.26 crore health insurance policies in 2022–2023 insured 55 crore lives by general and health insurance companies. Moreover, the growth of digital ecosystems in markets like South Korea and Japan supports embedded insurance solutions, which are incorporated into platforms like ride-hailing applications and e-commerce. Another factor is the digitalisation of health insurance; from 2020 to 2023, purchases of digital health insurance increased significantly due to awareness created by the pandemic.

Latin America Insurtech Market Analysis

Growing financial inclusion and increasing smartphone penetration, which has already reached over 60% of the population in 2023, as per industrial reports are driving the insurtech market in Latin America. The region's governments, which include Brazil and Mexico among others, are heavily advocating for digital innovation in finance, making it a rather conducive environment for the advancement of insurtech. Microinsurance is fast-growing, targeting the under-banked. To this effect, Nubank Brazilian digital banking platform has maintained 2 million active contracts in Brazil through its engagement with Chubb. Blockchain technology is being used by startups to process claims more quickly and transparently, especially in the life and health insurance markets. With growth rates in this market growing significantly, the rise of gig economies and freelance labour in nations like Argentina is also fuelling demand for on-demand insurance solutions.

Middle East and Africa Insurtech Market Analysis

Reports show that smartphone usage in the Middle East and Africa area is growing, reaching above 75% in the GCC countries and more than 50% in Sub-Saharan Africa. Insurtech solutions are seamlessly integrating into the region as more people embrace digital wallets and mobile payments, with increases of over 30% per year. The government initiative like the UAE's Vision 2030, which focuses especially on health and vehicle insurance, promotes digital transformation. Takaful, or Islamic insurance, has become popular, especially in the GCC countries, where it is estimated to be 20% of the entire market.

Competitive Landscape:

In the dynamic global Insurtech market, key players are actively engaged in a range of strategic initiatives aimed at capitalizing on market opportunities and addressing industry challenges. Established insurance giants are increasingly partnering with Insurtech startups to harness technological innovations and streamline their operations. These collaborations result in the development of cutting-edge solutions that enhance customer experiences, improve underwriting accuracy, and drive operational efficiency. Additionally, major players are investing heavily in data analytics and artificial intelligence (AI) technologies to harness the power of real-time data and deliver personalized insurance offerings. This approach enables insurers to tailor policies and pricing based on individual behaviors and needs, ultimately boosting customer satisfaction and loyalty. Moreover, key market players are expanding their geographical presence, particularly in regions with untapped Insurtech potential, such as Asia-Pacific and Latin America. These expansion efforts help them tap into new customer bases and diversify their portfolios. For instance, in 0224, FlyEasy, in collaboration with Blink Parametric and Zurich Edge, has begun operations in the Asia-Pacific area. Through this partnership, FlyEasy's cutting-edge travel solutions-which emphasise parametric insurance to improve client experiences—are brought to the area. Travellers will immediately benefit from the partnership's goal of automating and streamlining claims procedures for flight interruptions.

The report provides a comprehensive analysis of the competitive landscape in the Insurtech market with detailed profiles of all major companies, including:

- Clover Health LLC

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Majesco (Aurum PropTech Limited)

- Oscar Insurance Corporation

- Quantemplate

- Shift Technology

- Travelers Companies, Inc.

- Wipro

- ZhongAn Online P&C Insurance Co. Ltd.

Latest News and Developments:

- January 2025: Peak3 and Lazada announced a joint venture to create a digital insurance ecosystem in Southeast Asia. Utilizing Peak3's SaaS insurance orchestration platform, the partnership integrates insurance products into Lazada's platform, offering property, health, and travel coverage.

- January 2025: An insurtech company, Jove, launched a Pan-European Business Liability Insurance tailored for small businesses across 30 EU countries. It offers comprehensive global coverage, including the USA and Canada, with flexible subscription plans and a new broker portal for streamlined policy issuance. The initiative aims to enhance accessibility and efficiency in the European insurance market.

- December 2024: Thailand Post partnered with an insurtech firm to launch an embedded online motor insurance service. Customers can purchase competitively priced insurance and receive instant policy delivery via email.

- November 2024: A Swiss insurance provider, Helvetia, collaborated with Coinnect, a cyber risk platform, to launch a Cyber Insurtech platform. This collaboration uses AI for advanced cyber risk assessments and continuous threat monitoring, empowering clients with improved security and favorable insurance terms.

- November 2024: An Indian insurance broking firm, Ideal Insurance, collaborated with an insurtech platform, Riskcovry, to introduce a digital insurance distribution platform. This platform offers instant access to multiple insurers and products, with robust tools for real-time business tracking and streamlined workflows. The collaboration aims to enhance customer service through speed, convenience, and digital efficiency.

- December 2024: Moody's RMS and Cytora have teamed up to improve the insurance sector's disaster risk management. The partnership gives insurers cutting-edge capabilities to more effectively evaluate and manage risks associated with natural disasters by fusing Moody's RMS expertise in catastrophe modelling with Cytora's risk processing platform. Through this collaboration, underwriting accuracy will be increased, operations will be streamlined, and resilience to the increasing environmental threats will be strengthened.

- December 2024: In its Series C fundraising round, Bolttech has raised $100 million to boost its international insurtech expansion. The company's quick expansion and creative insurance technology solutions are highlighted by the funding. With this investment, Bolttech hopes to solidify its position as a leader in digital insurance ecosystems by expanding its platform capabilities and fortifying its presence in important areas.

Insurtech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Clover Health LLC, Damco Group, DXC Technology Company, Insurance Technology Services, Majesco (Aurum PropTech Limited), Oscar Insurance Corporation, Quantemplate, Shift Technology, Travelers Companies, Inc., Wipro, ZhongAn Online P&C Insurance Co. Ltd. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Insurtech market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global Insurtech market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Insurtech refers to the integration of technology into the insurance industry to improve efficiency, customer experience, and reduce costs. It involves the use of digital tools such as artificial intelligence (AI), machine learning (ML), blockchain, and Internet of Things (IoT) to innovate and streamline insurance processes like underwriting, claims processing, and fraud detection.

The global Insurtech market was valued at USD 10.3 Billion in 2024.

IMARC estimates the global Insurtech market to exhibit a CAGR of 31.51% during 2025-2033.

Key factors driving the Insurtech market include the increasing adoption of digital technologies, changing customer expectations for seamless digital experiences, the rise of IoT devices, and the need to combat insurance fraud with AI and data analytics.

In 2024, the health insurance segment represented the largest segment by market share, driven by rising healthcare costs and the growing demand for preventative care solutions.

Managed services lead the market by share due to the increasing complexity of business operations, cost-efficiency needs, and heightened cybersecurity threats.

Cloud computing is the leading segment by market share, driven by its scalability, cost-efficiency, and the ability to meet fluctuating demand in the insurance industry.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Insurtech market include Clover Health LLC, Damco Group, DXC Technology Company, Insurance Technology Services, Majesco (Aurum PropTech Limited), Oscar Insurance Corporation, Quantemplate, Shift Technology, Travelers Companies, Inc., Wipro, ZhongAn Online P&C Insurance Co. Ltd. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)