Isophthalic Acid Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Isophthalic Acid Price Trend, Index and Forecast

Track real-time and historical isophthalic acid prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Isophthalic Acid Prices February 2026

| Region | Price (USD/KG) | Latest Movement |

|---|---|---|

| Northeast Asia | 1.07 | -4.5% ↓ Down |

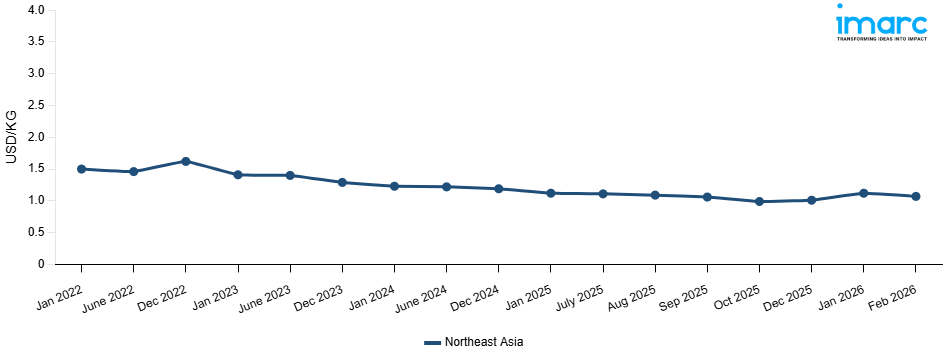

Isophthalic Acid Price Index (USD/KG):

The chart below highlights monthly isophthalic acid prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q4 Ending December 2025

Northeast Asia: The isophthalic acid prices in Northeast Asia reached 1.03 USD/KG in December 2025. The upward pricing movement registered between September and December 2025 was 3.6%. Firm upstream meta xylene feedstock costs, which increased production costs for regional manufacturers throughout the quarter, were the main cause of the minor price appreciation. Amid steady downstream consumption in beverage packaging, automotive, and marine coatings industries, strong procurement activity was sustained by the unsaturated polyester resin and PET copolymer production sectors. Excess market volumes were avoided by maintaining balanced supply availability through controlled manufacturing output from large oxidation facilities. Strong off take fundamentals were also maintained by consistent consumption in the corrosion resistant resin and specialty coating segments, while procurement competitiveness was heightened by tightening supply conditions resulting from planned maintenance shutdowns at specific production facilities.

Market Overview Q3 Ending September 2025

Northeast Asia: The price decline was influenced by a combination of moderate downstream demand and stable production output from key manufacturers in China, South Korea, and Japan. On the demand side, the polyester and polyethylene terephthalate (PET) industries, major consumers of isophthalic acid, experienced a seasonal slowdown and lower order volumes, reducing immediate procurement pressure. Supply-side factors included sustained domestic production capacities, minimal disruptions in logistics, and steady import volumes, which together alleviated supply constraints. Cost components such as international shipping, port handling, and customs duties remained largely stable, while currency fluctuations had minimal impact due to effective hedging practices by major importers.

Isophthalic Acid Price Trend, Market Analysis, and News

IMARC's latest publication, “Isophthalic Acid Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the isophthalic acid market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of isophthalic acid at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed isophthalic acid prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting isophthalic acid pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Isophthalic Acid Industry Analysis

The global isophthalic acid industry size reached USD 3.3 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 5.1 Billion, at a projected CAGR of 4.84% during 2026-2034. The market is driven by the rising demand in polyester resins and PET production, the expansion of packaging and textile industries, increasing adoption in coatings and adhesives, and investments in high performance polymer applications across emerging markets.

Latest developments in the Isophthalic Acid Industry:

- September 2025: A novel coordination polymer, {[Co(MTIA)(H2O)]⋅H2O}n (Co-MTIA), was successfully synthesized using the multidentate ligand 5-(3-methyl-1H-1,2,4-triazol-1-yl), isophthalic acid (H2MTIA), and Co(NO3)2·6H2O under thermal conditions. Single-crystal X-ray diffraction revealed a tightly stacked 3D framework with binuclear [Co2(COO)2] subunits and MTIA2− linkers. Magnetic studies showed antiferromagnetic coupling in the binuclear units, with no significant dynamic magnetic relaxation observed.

- February 2024: Eastman, in collaboration with Rumpke Waste & Recycling, marked a step in the process of tackling the plastic waste crisis by collecting and sorting hard-to-recycle colored PET packaging waste for Eastman's molecular recycling system which produces virgin quality polyesters. Through this first-of-its-kind partnership, unrecycled plastics are addressed and thus, circularity is created for diverse kinds of consumer products, and waste is prevented from being used as fuel or for disposal in landfills.

- April 2024: Mitsui Chemicals' new affiliate, Mitsui Chemicals ICT Materia (ICTM), launched, focusing on film solutions for the ICT sector. Specializing in film and sheet products for semiconductor, electronic component, and photovoltaic panel manufacturing, ICTM aims to enhance innovation and competitiveness through an integrated setup, leveraging the Mitsui Chemicals Group's comprehensive strength from base resins to processing.

- February 2021: LOTTE Chemical introduced Korea's first 'PIA (Purified Isophthalic Acid) added semi-nonflammable insulation material,' reducing fire spread and smoke by 30%. Verified for formaldehyde absence by KOTITI, certified as semi-nonflammable at KCL, with an annual production of 520,000 tons, the largest globally. Insulators installed at Dongtan Station LOTTE Shopping Town Front Castle and LOTTE Academy in Osan, anticipating increased demand due to stricter safety standards.

Product Description

Isophthalic acid is the most important source of the organic compound that serves as the basis of such products as polyester resins, coating, and fiber production. It is a pure, crystalline organic white compound with the molecular formula of C8H6O4. Isophthalic acid is normally obtained through the oxidation of meta-xylene or ortho-xylene in the presence of catalysts at a high temperature, reacting to form terephthalic acid, further processed into isophthalic acid. The methoxylation of isomers of xylene usually starts with an oxidative catalyst that, after purification, ends up with isophthalic acid. Its wide range of applications covers the manufacturing process of corrosion-resistant coatings, strong and high-temperature-resistant fibers, and durable plastics. Besides, unsaturated phthalic acid can be utilized in the manufacturing of unsaturated polyester resin, which is in turn used in the construction, automotive, marine, and aerospace industries. This is why polystyrene is recognized as a multi-purpose component that makes for a wide range of stronger and superior synthetic materials and as a consequence contributes to developing products of improved characteristics.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Isophthalic Acid |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Isophthalic Acid Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of isophthalic acid pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting isophthalic acid price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The isophthalic acid price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The isophthalic acid price in February 2026 was 1.07 USD/Kg in Northeast Asia.

The isophthalic acid pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for isophthalic acid prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)