Japan Confectionery Market Expected to Reach USD 44.1 Billion by 2033 - IMARC Group

Japan Confectionery Market Statistics, Outlook and Regional Analysis 2025-2033

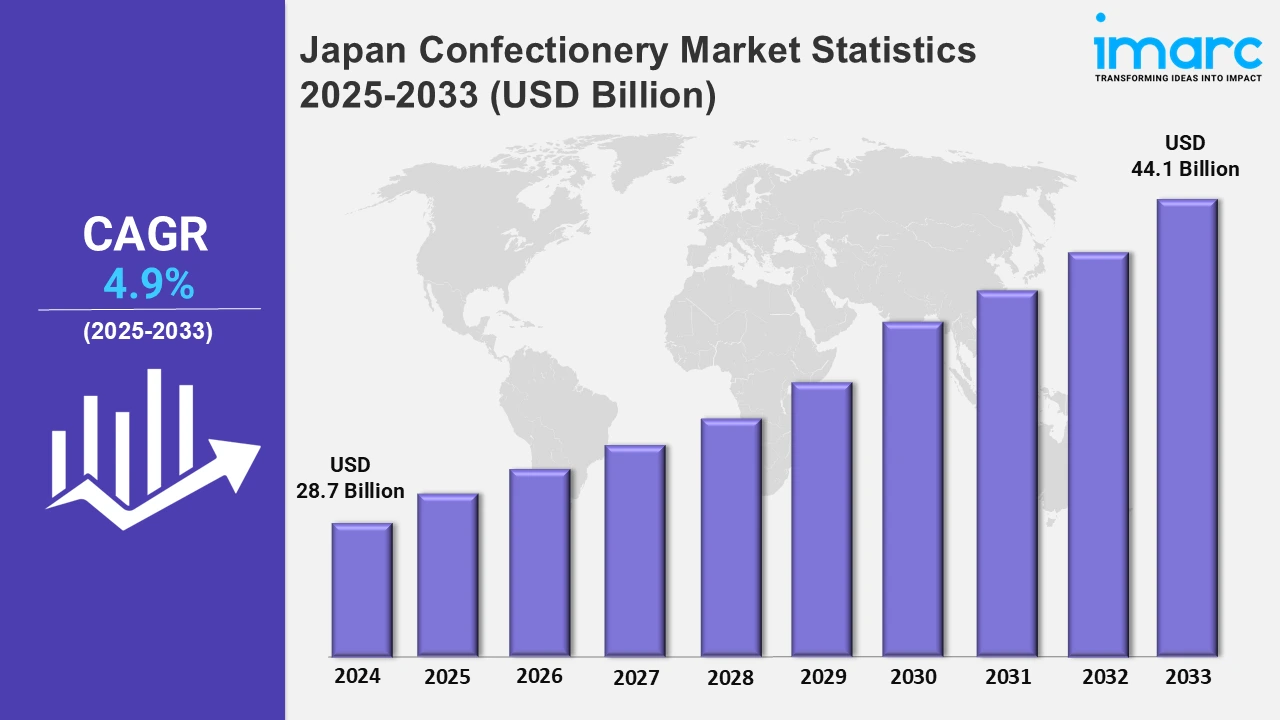

The Japan confectionery market size was valued at USD 28.7 Billion in 2024, and it is expected to reach USD 44.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.9% from 2025 to 2033.

To get more information on this market, Request Sample

Japan's confectionery market encourages modern versions of traditional sweets, combining classic flavors with innovative designs. This approach revitalizes heritage desserts, thereby appealing to both traditionalists and younger consumers seeking unique and culturally rooted treats with a fresh, as well as contemporary twist. For instance, in November 2024, Family Mart, a convenience store chain based in Japan, launched Neo Wagashi. This innovative new offering reimagines two of the country's most beloved traditional sweets, dorayaki and Fluffy Nama Daifuku.

Additionally, innovative sweets are becoming popular in Japan, mixing renowned character themes with delicious treats. New product releases feature creatively packaged desserts that appeal to both collectors and dessert enthusiasts, offering visually striking products that enhance the culinary experience while tapping into consumer desires for novelty and nostalgia. For instance, in June 2024, Tokyo Banana unveiled a new Pikachu-themed treat, namely the Pokémon Tokyo banana overflowing chocolate cookie sandwich in a special edition can. This collectible canister offers a unique dessert experience for fans and sweet enthusiasts, further accelerating the market expansion. Besides this, with an increasing emphasis on wellness, consumers are opting for products with lower sugar content and natural ingredients, like snacks enriched with vitamins or probiotics. The shift towards better-for-you confectionery, including gluten-free, vegan, and low-calorie options, is opening new growth opportunities, thereby catering to more health-conscious consumers without compromising on taste.

Japan Confectionery Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. Continuous innovations are encouraging companies to frequently launch new and unique products, thereby elevating the market expansion.

Kanto Region Confectionery Market Trends:

There is a growing demand for premium snacks in Kanto, which is elevating the market. Various confectioners across the region are focusing on producing high-quality ingredients. For instance, Tokyo's famous cookies 'Shiroi Kobito, are becoming popular for their refined taste. Besides this, consumers across this region prefer fine treats, such as limited-edition products.

Kansai/Kinki Region Confectionery Market Trends:

In Kansai/Kinki, especially in Osaka and Kyoto, traditional sweets (wagashi) are becoming popular. Confectioners are mixing old recipes with new techniques to attract younger people. For example, Kyoto's yatsuhashi and Osaka's takoyaki-flavored snacks have been updated with modern flavors. This trend keeps the culture alive while making the sweets more appealing to today’s tastes, thereby balancing tradition with innovations.

Central/Chubu Region Confectionery Market Trends:

The Central/Chubu region is known for special sweets made with local flavors. In Nagoya, there is Uiro, a steamed rice cake with matcha and red bean paste. The city also made Tenmusu famous, which is a rice ball with shrimp tempura. There are also sweets inspired by Nagoya’s red miso, giving a savory twist to traditional sweets.

Kyushu-Okinawa Region Confectionery Market Trends:

The Kyushu-Okinawa region is famous for sweets made with tropical fruits. They use local ingredients like Okinawan brown sugar, sweet potatoes, and citrus fruits. For example, Okinawa’s “Beni Imo” cake made with sweet potato and Kyushu's “Chinsuko” cookies are becoming popular across the region. These sweets often have a tropical twist, which attracts customers.

Tohoku Region Confectionery Market Trends:

In Tohoku, sweets often use seasonal ingredients and local products. For example, Ichigo Daifuku, a strawberry rice cake made with local strawberries, is popular in spring. Tohoku is known for its high-quality fruits and other ingredients, like apples, which are used in sweets like apple cakes. Moreover, confectioners in this region focus on using fresh and local ingredients to make high-quality sweets all year.

Chugoku Region Confectionery Market Trends:

In the Chugoku region, especially in Hiroshima, rice-based sweets like Kibi Dango (rice flour candies) and Akashi Yaki are popular. The region’s focus on rice farming is reflected in its sweets, showing rice as an important food. Besides this, Hiroshima's Momiji Manju, a maple leaf-shaped bun filled with red bean paste, uses local ingredients in a traditional way, thereby accelerating the region’s growth.

Hokkaido Region Confectionery Market Trends:

The rising production of high-quality dairy products in the Hokkaido region is driving the market expansion. The area is known for Japan's best milk, butter, and cheese. These products are widely used in the creation of Shiroi Koibito and Hokkaido's cheesecakes. Besides this, various ice cream manufacturers are also offering unique flavors like melon, which is bolstering the market in the region.

Shikoku Region Confectionery Market Trends:

In Shikoku, citrus fruits like yuzu, sudachi, and kabosu are used in sweets, giving them a fresh taste. For example, Shikoku is famous for "Yuzu Manju," a steamed bun filled with yuzu-flavored sweet paste, showing the region’s citrus-growing tradition. These bright citrus flavors attract people who want a reviving change from regular sweets.

Top Companies Leading in the Japan Confectionery Industry

Prominent businesses in the country focus on introducing novel product launches. For instance, in January 2025, Nestlé Japan unveiled limited-edition chocolate bars, namely KitKat Little Twins. Moreover, GC Brands, in December 2024, secured a deal to range the Japanese confectionery in 7-Eleven stores in the nation. Apart from this, in April 2024, Lotte introduced the Korea-Japan joint dessert venture in Tokyo.

Japan Confectionery Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others. Hard-boiled sweets are traditional candies typically made from sugar. Moreover, mints are popular for their refreshing and cooling sensation. Furthermore, gums and jellies are widely enjoyed for their chewy textures.

- Based on the age group, the market has been bifurcated into children, adult, and geriatric. Children are generally attracted to chewy candies, gummies, and chocolates. Moreover, adults look for premium chocolates or limited-edition treats.

- On the basis of the price point, the market has been bifurcated into economy, mid-range, and luxury. Economy confectionery products cater to budget-conscious consumers seeking affordable sweets. In contrast, mid-range confectionery products target consumers looking for quality at an affordable price.

- Based on the distribution channel, the market has been bifurcated into supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others. Supermarkets and hypermarkets offer bulk products and value packs. Moreover, convenience stores offer a quick option for consumers looking to purchase snacks and other sweet treats. The need for on-the-go options augments other channels.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 28.7 Billion |

| Market Forecast in 2033 | USD 44.1 Billion |

| Market Growth Rate 2025-2033 | 4.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Confectionery Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)