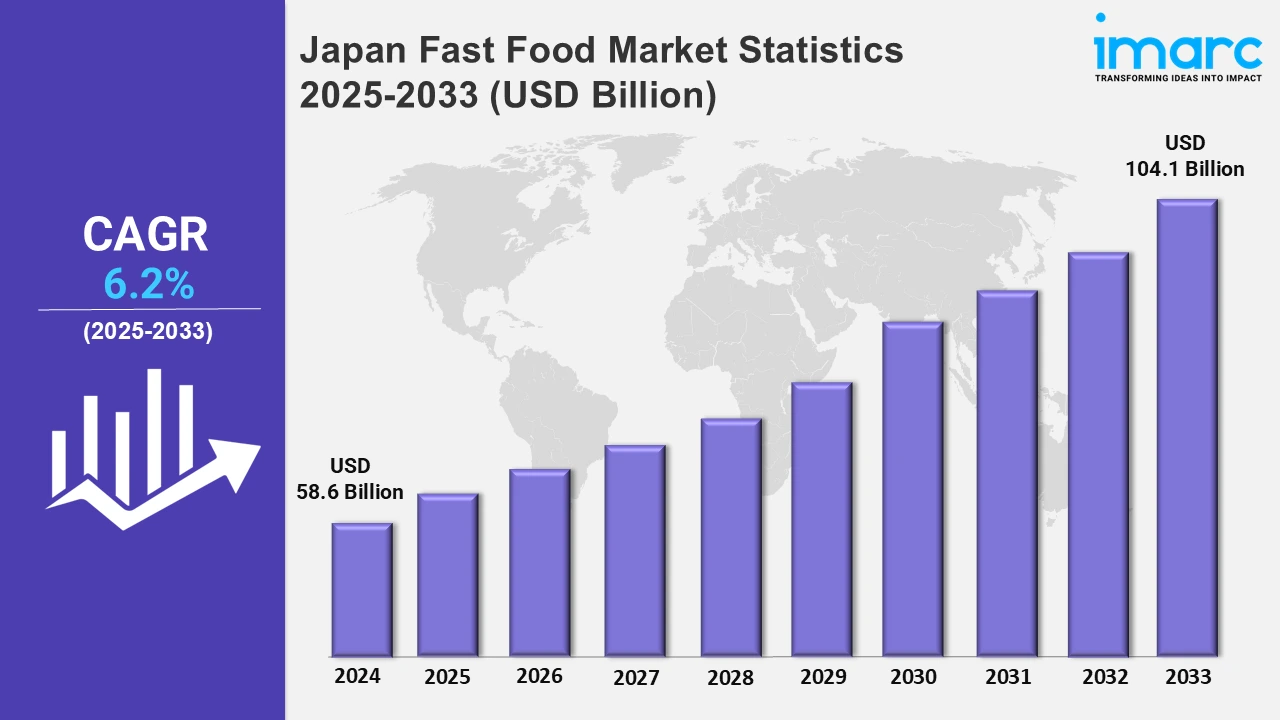

Japan Fast Food Market Expected to Reach USD 104.1 Billion by 2033 - IMARC Group

Japan Fast Food Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan fast food market size was valued at USD 58.6 Billion in 2024, and it is expected to reach USD 104.1 Billion by 2033, exhibiting a growth rate (CAGR) of 6.2% from 2025 to 2033.

To get more information on this market, Request Sample

Convenience-focused dining prioritizes fresh and ready-to-eat meals, appealing to busy consumers looking for quality and quick alternatives. This strategy prioritizes convenience and efficiency, increasing profitability while reintroducing how on-the-go meals fit into modern lifestyles. For example, in August 2024, Seven & i Holdings converted Japan's 7-Eleven outlets into popular food hubs that provide fresh sandwiches, rice balls, etc. This technique produced 27% operational profit margin throughout its network of around 21,000 outlets.

Moreover, food and pop culture collaborations are providing customers with exclusive and limited-edition tastes. By blending exclusivity with creative inspirations from worldwide cuisines, these projects appeal to a wide range of preferences while increasing customer engagement through new collaborations and special releases. For instance, McDonald's, in July 2024, introduced its Special Grade Garlic Sauce, that was drawn from Japan's Black Garlic Sauce. The limited edition is only available through the app and is part of a collaboration with the anime Jujutsu Kaisen. Furthermore, the Japan fast food industry is constantly developing as vendors adapt to fulfill consumer demand for healthier and more diversified meal alternatives. This shift aligns with the growing understanding of balanced diets and the ease of ready-to-eat options. Additionally, Japan's fast food industry has great potential for development due to increased demand for regionally inspired menu alternatives and fusion cuisines. Also, people are turning toward high-quality fast food options, preferring flavor and nutritional value over typical fast food alternatives. For example, the increasing popularity of fast food restaurants that include Japanese cuisine, such as rice burgers and sushi wraps, shows the market's transformation. Major companies such as Mos Burger and CoCo Ichibanya are diversifying their menus to include new foods that appeal to both local and foreign palates, focusing on quality and authenticity while leveraging Japan's culinary legacy.

Japan Fast Food Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. Rapid urbanization and the adoption of modern and fast-paced lifestyles in various regions of Japan are significantly driving the growth of the market.

Kanto Region Fast Food Market Trends:

Fusion cuisine is quite popular in the Kanto region. For instance, Lotteria has produced products like shrimp burgers with teriyaki sauce, which combine Japanese and Western cuisines. Tokyo's diversified cuisine culture fuels this desire, making inventive menu selections a major attraction. These options cater to a broad population, keeping fast food exciting and enticing in one of Japan's busiest places.

Kinki Region Fast Food Market Trends:

The Kinki region, centered around Osaka, is experiencing an increase in plant-based fast food. For example, Mos Burger has introduced a range of vegan burgers to fulfill the growing demand for sustainable dining. With Osaka's status as a major food spot, this change shows the region's willingness to embrace healthier and more ecologically friendly options, catering to a rising community of health-conscious customers.

Central/Chubu Region Fast Food Market Trends:

Seasonal dinners are a popular trend in the Central/Chubu regions. McDonald's restaurants in Nagoya regularly serve limited-edition products, such as the miso-katsu burger influenced by regional tastes. By infusing local culinary traditions into fast food, companies maintain their offerings as fresh and culturally relevant, attracting locals as well as tourists seeking to try new dishes.

Kyushu-Okinawa Region Fast Food Market Trends:

The Kyushu-Okinawa region promotes the use of locally obtained ingredients in fast food. A&W Okinawa's specialty burgers use regional pork and veggies, emphasizing on the region's agricultural resources. This method appeals to both localites and tourists looking for unique regional cuisines, while also supporting local farmers and producers, which strengthens community bonds.

Tohoku Region Fast Food Market Trends:

Comfort meals are the most popular on fast food menus in Tohoku. Sukiya and other chains serve warm foods like gyudon bowls with locally produced beef, which are suited for the region's chilly temperature. These rich and fulfilling meals appeal to residents who want comfort and warmth in their eating experiences, particularly during harsh winters.

Chugoku Region Fast Food Market Trends:

The Chugoku region takes advantage of its coastline position by emphasizing seafood offerings. Kura Sushi features locally caught seafood in seasonal sushi rolls, highlighting the region's abundant marine resources. This emphasis on fresh and high-quality seafood appeals to customers seeking quick yet genuine eating experiences, attracting both residents and tourists.

Hokkaido Region Fast Food Market Trends:

Hokkaido, renowned for its dairy products, incorporates its abundant resources into fast food offerings. Domino's Pizza in Sapporo serves a four-cheese pizza made entirely using Hokkaido-produced cheeses. This local touch emphasizes the region's dairy superiority, which appeals to customers who value freshness and regional authenticity in their meals.

Shikoku Region Fast Food Market Trends:

Shikoku's fast food menus commonly use traditional foods. Yoshinoya outlets in the region provide unique udon bowls made with sanuki udon, a Shikoku delicacy. By incorporating these traditional characteristics, fast food restaurants maintain local culinary traditions while also offering customers with a modern and easy method to experience popular regional meals.

Top Companies Leading in the Japan Fast Food Industry

Some of the leading Japan fast food market companies have been included in the report. The report provides an in-depth competitive analysis, examining the market structure, the positioning of key players, leading strategies for success, a competitive overview dashboard, and an evaluation quadrant for assessing company performance. For example, in October 2024, Watami, a Tokyo-based izakaya chain, acquired Subway Japan and signed a ten-year franchise contract with Subway International. Subway Japan, a wholly owned subsidiary of Watami, intends to significantly expand its stores, representing a strategic diversification move by the Japanese-style pub operator.

Japan Fast Food Market Segmentation Coverage

- Based on the product type, the market has been classified into pizza/pasta, burger/sandwich, chicken, Asia/Latin American food, seafood, and others. Pizza/pasta is popular among youngsters, although burger/sandwich is a classic choice owing to convenience. Chicken remains popular, particularly during holidays such as Christmas. Asia/Latin American food, which includes distinct tastes, is gaining popularity among experimental diners. Seafood-based fast food, which draws on Japan's culinary proficiency, highlights freshness and appeals to health-conscious customers.

- Based on the end user, the market has been categorized into food-service restaurants, quick service restaurants, caterings, and others. Food-service restaurants prioritize exceptional eating experiences, combining convenience and exquisiteness. Quick service restaurants thrive with low-cost and fast selections designed for busy lifestyles. Catering services focus on parties and gatherings, providing customized menus to accommodate varied interests.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 58.6 Billion |

| Market Forecast in 2033 | USD 104.1 Billion |

| Market Growth Rate 2025-2033 | 6.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Pizza/Pasta, Burger/Sandwich, Chicken, Asia/Latin American Food, Seafood, Others |

| End Users Covered | Food-Service Restaurants, Quick Service Restaurants, Caterings, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Fast Food Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)