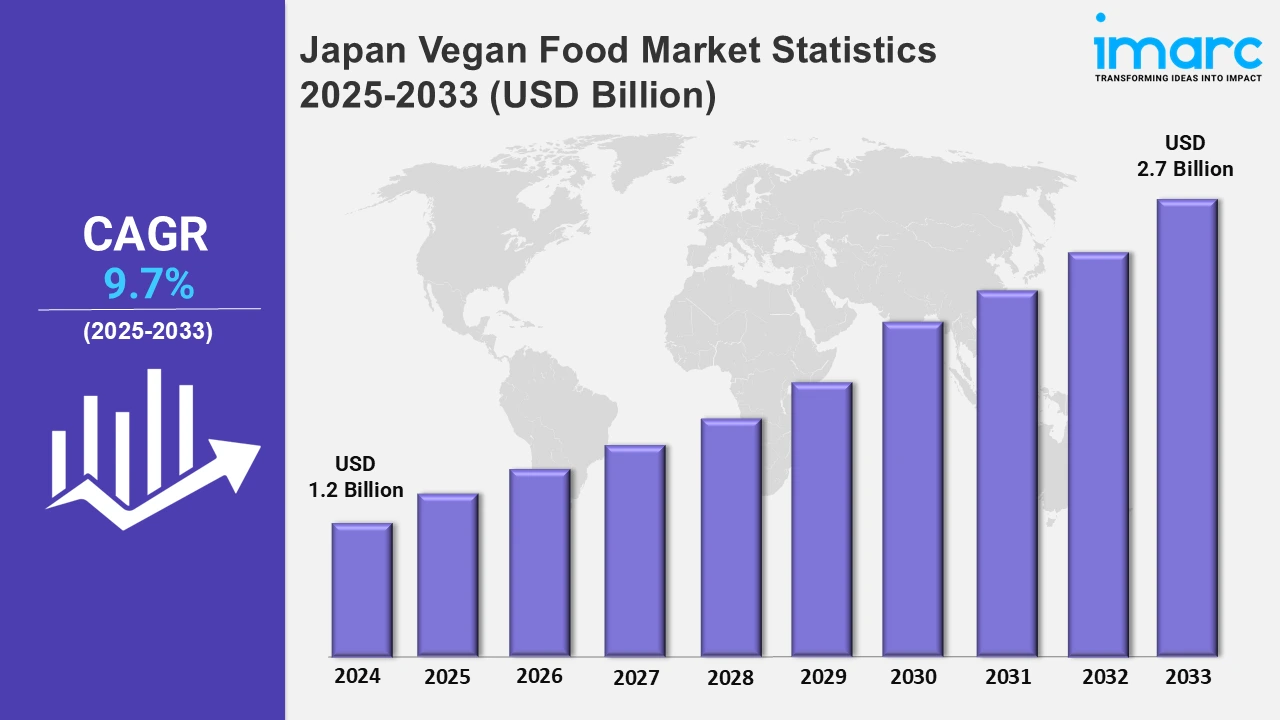

Japan Vegan Food Market Expected to Reach USD 2.7 Billion by 2033 - IMARC Group

Japan Vegan Food Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan vegan food market size was valued at USD 1.2 Billion in 2024, and it is expected to reach USD 2.7 Billion by 2033, exhibiting a growth rate (CAGR) of 9.7% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing demand for plant-based food alternatives in Japan is positively impacting the vegan food market. Growing ethical concerns regarding animal welfare, environmental sustainability, and consumer awareness of health benefits, are major factors contributing to this change. Furthermore, the growing number of flexitarians and people cutting back on meat intake has urged food producers to create a variety of vegan products. In response to these trends, key players in Japan are actively investing in product innovation and expanding plant-based options. For example, Haneda Airport introduced Diversity Diner HND in July 2024, a fully vegan-certified restaurant in Terminal 3. The restaurant offers popular Japanese dishes such as tempura soba and katsu curry. This initiative aligns with the broader movement toward accommodating plant-based preferences, particularly among travelers seeking ethical and sustainable food options.

Also, government support and corporate investments are accelerating the growth of the alternative protein sector in Japan. In January 2024, the Japanese government provided USD 27.7 million in funding to companies developing plant-based and cultivated proteins. Umami United is utilizing this investment to create plant-based eggs using konjac, soy, and mushrooms, while IntegriCulture is advancing cultivated foie gras and chicken. These investments reflect Japan’s strategic focus on food security and reducing reliance on traditional livestock farming. Additionally, the market for plant-based seafood is gaining traction, with companies introducing innovative products to address marine sustainability concerns. In March 2024, Azuma Foods launched Future Fish, a plant-based seafood range featuring vegan tuna, salmon, and squid. Made from konjac and locust bean gum, these products replicate the texture of real seafood and have received certification from Veggie Project Japan. This development caters to the increasing demand for ethical and sustainable seafood alternatives. Traditional Japanese dining establishments incorporate vegan options to meet the growing interest in premium plant-based cuisine. In April 2024, Ryotei Nicho introduced a premium vegan kaiseki course in Takamatsu, highlighting seasonal ingredients and traditional preparation techniques. The menu includes vegetable sushi, udon, and plant-based oden, reinforcing Japan’s shift toward high-quality vegan gastronomy. This initiative follows Ryotei Nicho’s catering for a G7 event, emphasizing the increasing acceptance of plant-based dining in Japan’s fine dining sector.

Japan Vegan Food Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The market is growing due to rising veganism, innovative products, diverse food availability in restaurants and stores, and the strong influence of celebrities and social media.

Kanto Region Vegan Food Market Trends:

Kanto is a major hub for plant-based innovation, driven by Tokyo’s growing demand for sustainable dining and alternative proteins. The October 2024 launch of Wayback Burgers Asia’s ‘Next Restaurant’ in Tokyo reflects the region’s shift toward convenient vegan options. Operating through a shared kitchen model, it offers vegan bento, burgers, and gluten-free meals. Tokyo is cementing its position as a leader in Japan’s plant-based food industry with a second outlet planned in Kumamoto and international franchising underway.

Kinki Region Vegan Food Market Trends:

Kinki is seeing a surge in plant-based food development, largely influenced by increasing tourism and corporate investment. Osaka’s role in the Osaka-Kansai Expo 2025 is accelerating the adoption of vegan and halal-friendly innovations. In April 2024, Fuji Oil, Amano Enzyme, and Nissin Foods Holdings ranked among the top 20 patent filers for alternative proteins. Osaka is emerging as a leader in Japan’s alternative protein ecosystem with rising demand for sustainable dining.

Central/Chubu Region Vegan Food Market Trends:

Central/Chubu’s vegan food market is expanding due to regional preferences for health-conscious cuisine and an increase in plant-based tourism. In 2024, Nagano’s Donabe Ramen Takesan in Obuse introduced a broader range of vegan options, responding to shifting consumer preferences. This expansion is attracting both domestic and international visitors. Chubu is becoming a key region for plant-based dining innovations in Japan’s evolving food sector with a strong focus on locally sourced ingredients and artisanal preparation.

Kyushu-Okinawa Region Vegan Food Market Trends:

In the Kyushu-Okinawa region, Fukuoka’s food scene now includes soy-based tonkotsu ramen, responding to plant-based consumer trends. Okinawa’s traditional longevity diet promotes vegan alternatives to goya champuru. Kumamoto farmers are increasing organic soy production, supporting plant-based protein markets. Miyazaki’s tourism sector is expanding vegan dining options. Kagoshima confectioners are modernizing karukan, a yam-based sweet, with plant-based fillings. Vegan izakayas across Kyushu offer tofu karaage, appealing to health-conscious and sustainability-focused customers.

Tohoku Region Vegan Food Market Trends:

Sendai chefs in the Tohoku region are crafting plant-based versions of gyutan don, replacing beef tongue with mushrooms. Akita’s kiritanpo, a traditional rice skewer, now has vegan variations. Yamagata soba restaurants offer fish-free dipping sauces, appealing to plant-based eaters. Aomori’s apple farms are supporting dairy-free pastry innovations. Fukushima’s miso producers are developing plant-based ramen broths. Iwate’s tofu industry is expanding, with local companies offering organic soy-based protein alternatives for vegan markets.

Chugoku Region Vegan Food Market Trends:

In the Chugoku region, Hiroshima’s okonomiyaki vendors now serve egg-free batter and soy-based fillings. Okayama’s peach farmers collaborate with local businesses to create dairy-free fruit parfaits. Yamaguchi’s plant-based seafood market is growing, with konjac fugu gaining popularity. Tottori’s organic farms supply ingredients for vegan bento deliveries. Shimane’s vegan-friendly guesthouses provide locally sourced plant-based meals, appealing to eco-conscious travelers. Small businesses across the region are innovating with tofu-based desserts and plant-based baked goods.

Hokkaido Region Vegan Food Market Trends:

Hokkaido region’s cold climate encourages demand for hearty vegan meals like tofu nabe (hot pot). Local companies produce oat-based dairy alternatives, reducing reliance on imported plant milk. Asahikawa’s miso ramen is now available in plant-based variations and Hokkaido-grown potatoes are a key ingredient in vegan soup curry, a regional favorite. Kushiro’s fishing industry explores alternative seafood. Dairy-free soy ice cream, using regional soybeans, is expanding in supermarkets and specialty shops.

Shikoku Region Vegan Food Market Trends:

Shikoku is positioning itself as a center for soy-free plant-based alternatives, with a strong focus on locally grown ingredients. In August 2024, Fujiya introduced Nikugoe, a vegan-certified meat alternative in Tokushima and Kagawa, made from locally sourced sorghum. Featuring reduced sodium and fat content, it caters to health-conscious consumers. Fujiya’s expansion plans include reinforcing Shikoku’s growing influence in Japan’s alternative protein and plant-based food sector.

Top Companies Leading in the Japanese Vegan Food Industry

Japan’s plant-based food market is evolving, with Fuji Oil and FamilyMart driving innovation. The report provides an extended analysis of the competitive landscape, covering industry structure, positioning of key players, top strategies, and company portfolios. In December 2024, FamilyMart expanded its vegan offerings with the Blue Green plant-based line, including keema curry and Mont Blanc, reflecting increasing consumer interest in dietary inclusivity. Also, in August 2024, Fuji Oil introduced MIRA-Dashi, developed using MIRACORE technology, a plant-based soup stock range replicating bonito, pork bone, beef, and chicken flavors.

Japan Vegan Food Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into dairy alternatives (cheese, dessert, snacks, and others), meat substitutes (tofu, texturized vegetable protein (TVP), seiten, Quorn, and others), and others. These products are expanding in vegan food, and cater to ethical, health-conscious, and environmentally aware consumers, driving demand for sustainable, nutritious, and diverse food choices.

- Based on the source, the market is categorized into almond, soy, oats, wheat, and others. These sources provide plant-based proteins, fiber, and essential nutrients and enhance dairy-free beverages, meat analogs, and baked goods, supporting clean-label formulations and sustainable food systems.

- On the basis of the distribution channel, the market has been divided into supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others. These channels are expanding their vegan food selections, increasing accessibility and variety with rising consumer demand, and retailers offering plant-based dairy, meat substitutes, and snacks.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Market Growth Rate 2025-2033 | 9.7% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Sources Covered | Almond, Soy, Oats, Wheat, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Vegan Food Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)