Japan Vending Machine Market Report by Type (Food Products Vending Machine, Beverages Products Vending Machine, Tobacco Vending Machine, and Others), Technology (Automatic Machine, Semi-Automatic Machine, Smart Machine), Application (Corporate Offices, Shopping Malls and Retail Stores, Educational Institutions, Hotels and Restaurants, and Others), and Region 2026-2034

Japan Vending Machine Market:

Japan vending machine market size reached USD 1,325.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,963.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.47% during 2026-2034. The increasing adoption of cashless payment options, the expansion of vending machines beyond traditional products to offer a wider range of goods such as fresh food and cosmetics, and the integration of smart technology for enhanced user experience and operational efficiency are some of the key factors driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,325.5 Million |

|

Market Forecast in 2034

|

USD 1,963.9 Million |

| Market Growth Rate 2026-2034 | 4.47% |

Japan Vending Machine Market Analysis:

- Major Market Drivers: One of the significant factors propelling the growth of the market is the convenience offered by vending machines, as they offer 24*7 access to a wide range of products, eliminating the need for traditional retail store hours. In addition to this, cultural acceptance of convenience shopping through automated retail solutions is also contributing to the market growth.

- Key Market Trends: The integration of advanced technologies to improve the capabilities and functionalities of vending machines is one of the prominent trends catalyzing the market growth. Furthermore, the integration of touch screens and interactive displays that provide seamless user experience is also contributing to the market growth.

- Challenges and Opportunities: The Japan vending machine market faces numerous challenges, such as increasing competition, especially from online retailers, and the need to adapt to changing consumer preferences and demands for healthier options. However, opportunities include innovation, such as incorporating cashless payment options, offering customizable product selections, and expanding into new markets or locations.

Japan Vending Machine Market Trends:

Increasing Preference for On-The-Go Snacks

Growing demand for on-the-go snacks, food, and drinks due to the changing lifestyle of the urban populations is primarily driving the growth of the market. For instance, an increase in demand for convenient on-the-go food options was justified by a 10.22% growth in fast-food orders in 2022. Moreover, with approximately 3.8 million international visitors in 2022, the preference toward on-the-go snacking options was higher, leading to the expansion of vending machines offering ready-to-eat snacks and beverages in Japan. Moreover, in Japan, there is one vending machine for every 23 people, the highest ratio of vending machines per person in the world. In addition to this, in June 2023, a lineup of vending machines was installed on the Meitetsu Nagoya Railway Line at Meitetsu Nagoya Station. The vending machines sell popular products from Kinokuniya, Loft, and Seijo Ishii, three of the country’s most well-known chains. Such an increasing establishments of vending machines in Japan is projected to propel the Japan vending machine market’s price in the coming years.

Technological Advancements

The integration of advanced technologies has transformed traditional vending machines into smart, interactive devices. Cashless payment systems, such as contactless cards, mobile wallets, and digital currencies, offer convenience and security to consumers. Moreover, with the increasing demand for contactless payments, numerous vending machine manufacturers are introducing new and improved machines, which is positively impacting the Japanese vending machine market. For instance, in September 2023, Barista launched an automated coffee vending machine called the Root C at Tokyo's Shimbashi Station. The machine lets users order via the app and specify pickup time slots, allowing customers to have their drinks ready in advance. Root C offers 16 different drinks, including hot and iced varieties, all made with specialty beans. The app includes a seven-item questionnaire designed by baristas to help customers decide, asking about what aromas they like and what other drinks they enjoy.

Urbanization and Smart City Development

The elevating levels of urbanization in the country are creating a high footfall environment conducive to vending machine deployment, maximizing potential sales opportunities. For instance, in the past decade, Japan's degree of urbanization has leveled off at around 91.9%. Furthermore, the government authorities of Japan are increasingly focusing on developing smart cities and investing in the development of technologically advanced airports and railways, comprising of smart vending machines, which is creating a positive outlook for the overall market. For instance, Society 5.0, also known as the Super Smart Society, is a concept for a future society created through a new industrial revolution introduced by the Japanese government in 2016. The plan proposes integrating smart devices and technologies, such as AI-integrated vending machines, more effectively into society. Such innovations are anticipated to bolster the Japan vending machine market size in the coming years.

Japan Vending Machine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, technology, and application.

Breakup by Type:

- Food Products Vending Machine

- Beverages Products Vending Machine

- Tobacco Vending Machine

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes food products vending machine, beverages products vending machine, tobacco vending machine, and others.

Beverages are a universally consumed product category, appealing to a wide range of consumers across various demographics. People rely on beverages to quench their thirst, boost their energy levels, and provide refreshments throughout the day. Moreover, refrigerated vending machine products with diverse characteristics are being introduced by specialty retailers, attracting customers and moving the market forward. As per Japan vending machine market forecast, tea and coffee are the most consumed beverages in the country. For instance, according to the All-Japan Coffee Association, Japanese people downed 462,000 tons of coffee in 2015, a record for the country and its fourth consecutive annual increase. AJCA also reported in 2012 that Japan ranked third globally in coffee consumption among importing countries. Such a significant increase in coffee consumption is augmenting the market for beverage products vending machines.

Breakup by Technology:

- Automatic Machine

- Semi-Automatic Machine

- Smart Machine

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes automatic machine, semi-automatic machine, and smart machine.

Automatic vending machines offer a high level of convenience and ease of use for both operators and consumers. They incorporate features such as touch screens, digital interfaces, and cashless payment systems, providing a seamless and interactive purchasing experience. Consumers can simply make their selections and complete transactions without the need for manual assistance, enhancing the overall user experience. Smart vending machines are automated retail units equipped with advanced technology such as touchscreens, cashless payment systems, and data analytics capabilities. They offer benefits such as enhanced user experience through interactive interfaces, optimized inventory management, real-time sales tracking, and personalized marketing opportunities based on consumer preferences.

Breakup by Application:

- Corporate Offices

- Shopping Malls and Retail Stores

- Educational Institutions

- Hotels and Restaurants

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes corporate offices, shopping malls and retail stores, educational institutions, hotels and restaurants, and others.

Vending machines are increasingly being used in commercial places and corporate offices to enhance the accessibility of products and maintain the place's cleanliness and aesthetics. As these systems are automated, they significantly reduce the time it takes to get a product. Moreover, the rising number of malls and retail stores across the country is also bolstering the adoption of vending machines. For instance, in 2022, over three thousand shopping centers were in operation, out of which 36 were new openings. Additionally, various government authorities are installing milk and coffee vending machines in schools and colleges, which is also creating a positive outlook for the overall market.

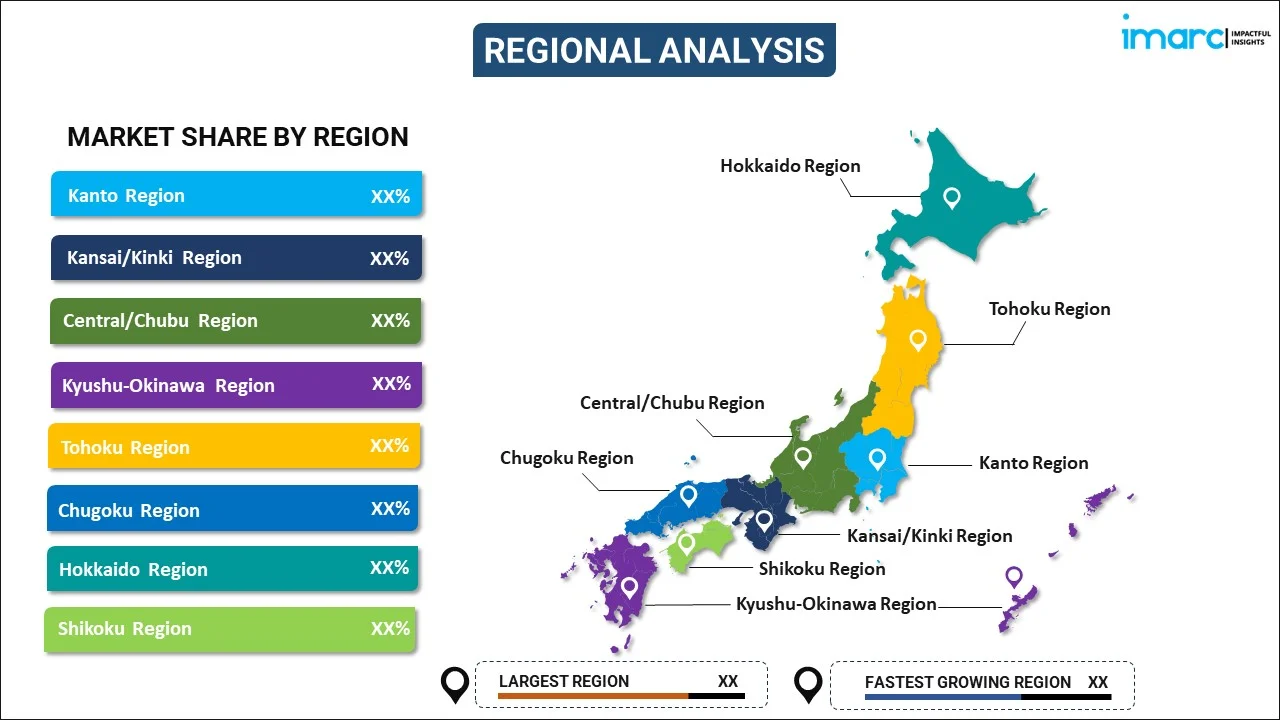

Breakup by Region:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

The demand for vending machines in Japan remains robust. This can be attributed to country's high population density, fast-paced lifestyle, and cultural acceptance of vending machine convenience. Japan has one of the highest densities of vending machines globally, with machines offering a wide range of products from beverages and snacks to daily essentials and even electronics. Moreover, technological advancements such as cashless payment options, touchscreen interfaces, and IoT integration continue to enhance the functionality and appeal of vending machines, contributing to sustained demand across various locations including urban centers, transportation hubs, and tourist attractions.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Coca-Cola Bottlers Japan Inc.

- DyDo Group Holdings Inc.

- Fuji Electric Co. Ltd.

- Otsuka Wellness Vending Co. Ltd.

- Pokka Sapporo Food & Beverage Ltd.

- Suntory Holdings Limited.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Japan Vending Machine Market News:

- September 2023: Barista launched an automated coffee vending machine called the Root C at Tokyo's Shimbashi Station. The machine lets users order via the app and specify pickup time slots, allowing customers to have their drinks ready in advance.

- June 2023: A lineup of vending machines was installed on the Meitetsu Nagoya Railway Line at Meitetsu Nagoya Station. The vending machines sell popular products from Kinokuniya, Loft, and Seijo Ishii, three of the country's most well-known chains.

- June 2023: Japan launched two new vending machines that unlock automatically in the event of a natural disaster. The machines will automatically offer free food if an earthquake hits.

Japan Vending Machine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Food Products Vending Machine, Beverages Products Vending Machine, Tobacco Vending Machine, Others |

| Technologies Covered | Automatic Machine, Semi-Automatic Machine, Smart Machine |

| Applications Covered | Corporate Offices, Shopping Malls and Retail Stores, Educational Institutions, Hotels and Restaurants, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | Coca-Cola Bottlers Japan Inc., DyDo Group Holdings Inc., Fuji Electric Co. Ltd., Otsuka Wellness Vending Co. Ltd., Pokka Sapporo Food & Beverage Ltd., Suntory Holdings Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan vending machine market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan vending machine market?

- What is the breakup of the Japan vending machine market on the basis of type?

- What is the breakup of the Japan vending machine market on the basis of technology?

- What is the breakup of the Japan vending machine market on the basis of application?

- What are the various stages in the value chain of the Japan vending machine market?

- What are the key driving factors and challenges in the Japan vending machine?

- What is the structure of the Japan vending machine market and who are the key players?

- What is the degree of competition in the Japan vending machine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan vending machine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan vending machine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan vending machine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)