Latin America Sports and Energy Drinks Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033

Market Overview:

The Latin America sports and energy drinks market size reached USD 8.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 16.4 Billion by 2033, exhibiting a growth rate (CAGR) of 7.1% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.8 Billion |

|

Market Forecast in 2033

|

USD 16.4 Billion |

| Market Growth Rate (2025-2033) | 7.1% |

Sports and energy drinks replenish carbohydrates and electrolytes in the body lost while engaging in fitness and sports activities. These drinks are consumed by sports enthusiasts and athletes as they are rich in sodium, calcium, potassium and chlorides. They can be both aerated and non-aerated and may contain amino acids, caffeine, sweeteners and herbal extracts. At present, energy drinks are gaining immense popularity, particularly among young consumers, as they offer an instant boost of energy.

Rapid urbanization, inflating income levels and the increasing middle-class population, particularly in Brazil and Chile, are among the major factors positively influencing the growth of the sports and energy drinks market in Latin America. Apart from this, the growing consumer awareness about the benefits of consuming energy drinks and improving their health profile as well as lifestyle is driving the sales further. However, the market is facing disruptions in the supply chain due to the coronavirus disease (COVID-19) outbreak and lockdown restrictions imposed by governing agencies of different countries. The market is anticipated to recover once normalcy is introduced and lockdown restrictions are uplifted.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Latin America sports and energy drinks market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on product type, packaging type, distribution channel, type, and target consumer.

Sports Drink Market

Breakup by Product Type:

- Isotonic

- Hypertonic

- Hypotonic

Breakup by Packaging Type:

- Bottle (Pet/Glass)

- Can

- Others

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

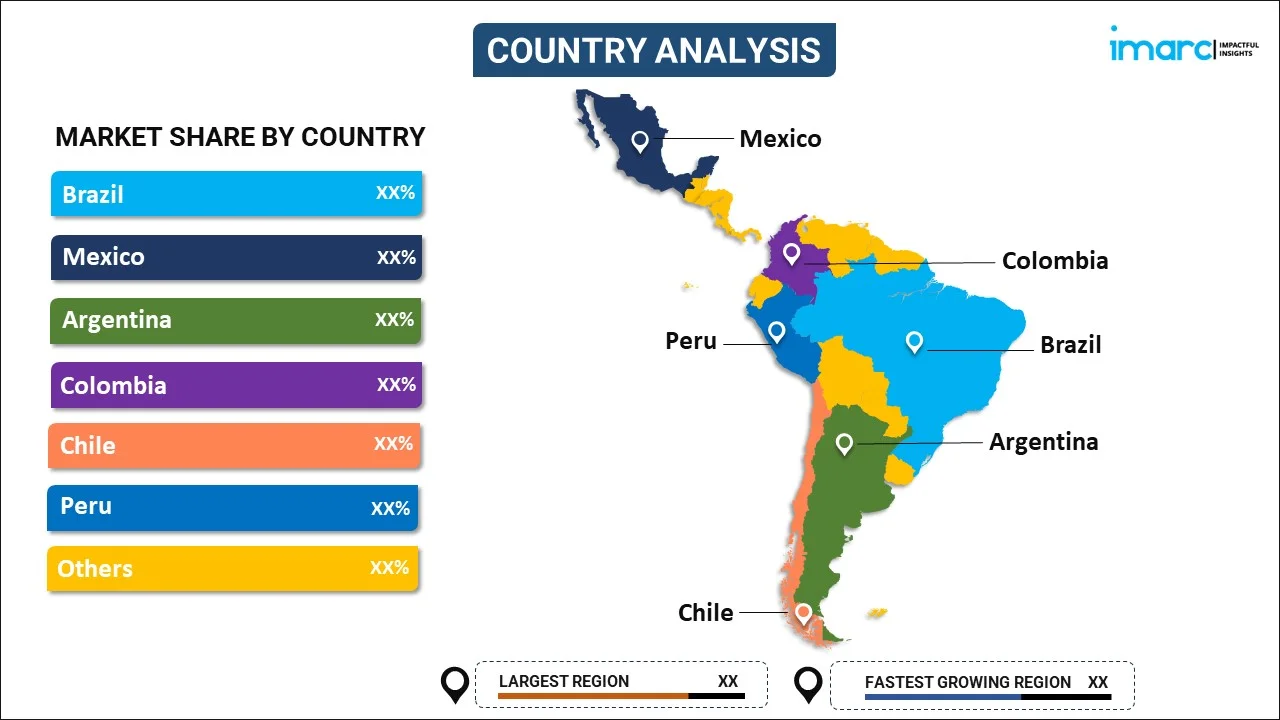

Breakup by Country:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Energy Drink Market

Breakup by Product:

- Alcoholic

- Non-Alcoholic

Breakup by Type:

- Non-Organic

- Organic

Breakup by Packaging Type:

- Bottle (Pet/Glass)

- Can

- Others

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Breakup by Target Consumer:

- Teenagers

- Adults

- Geriatric Population

Breakup by Country:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key Questions Answered in This Report:

- How has the Latin America sports and energy drinks market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Latin America sports and energy drinks market?

- What are the key regional markets?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the packaging type?

- What is the breakup of the market based on the distribution channel?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the target consumer?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the Latin America sports and energy drinks market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)