Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2026-2034

Logistics Market Outlook:

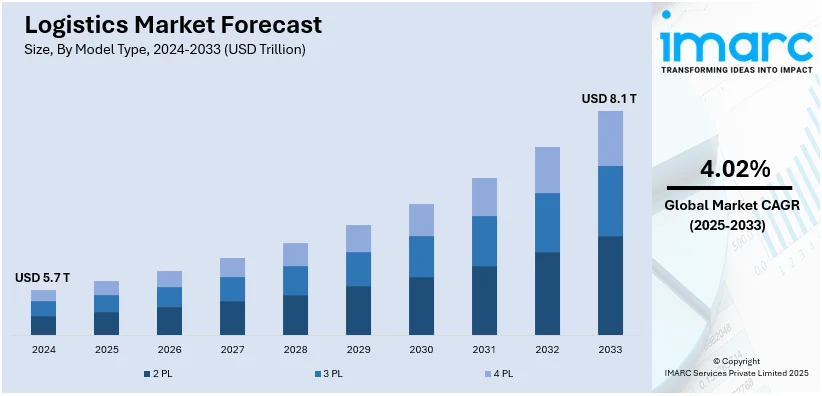

The global logistics market size was valued at USD 5.65 Trillion in 2025. Looking forward, the industry is projected to reach USD 8.07 Trillion by 2034, exhibiting a CAGR of 4.02% during 2026-2034. The market growth is attributed to the rise in online shopping, the increasing demand for faster delivery services, advancements in technologies like IoT and AI, a stronger push for eco-friendly transport, and improvements in logistics infrastructure such as roads, ports, and warehouses.

Market Insights:

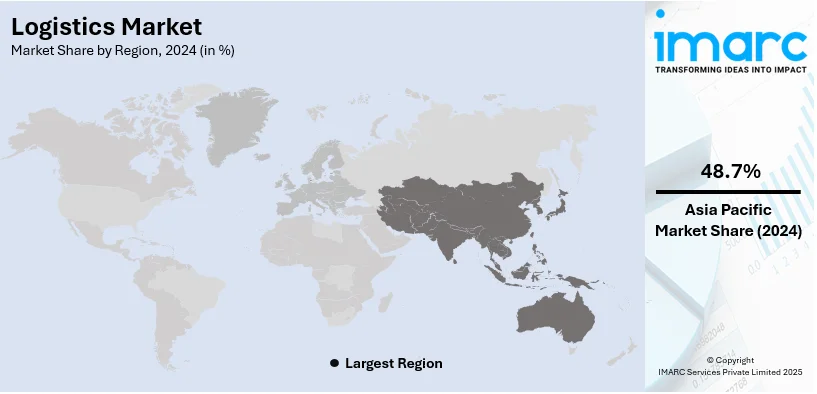

- Asia Pacific emerged as the leading region in 2024, accounting for over 48.7% of the market share.

- By model type, the 3PL (Third-Party Logistics) segment leads the market, with a share of 56.3%, driven by the demand for cost-effective and flexible logistics solutions.

- By transportation mode, roadways dominate the market, contributing 59.2% of the share due to their flexibility, low cost, and extensive network.

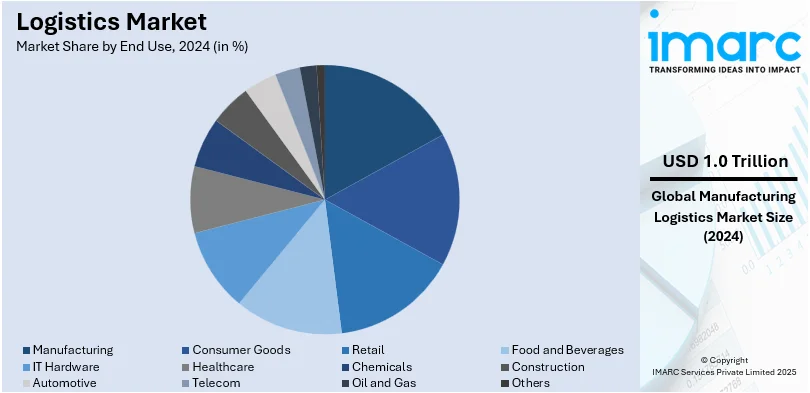

- By end use, the manufacturing sector holds 16.8% of the market share, driven by the need for effective supply chains and inventory management.

Market Size & Forecast:

- 2024 Market Size: USD 5.65 Trillion

- 2033 Projected Market Size: USD 8.07 Trillion

- CAGR (2025-2033): 4.02%

- Asia Pacific: Largest market in 2024.

The growth in global trade is positively impacting the logistics market expansion. It is raising the need for better-connected logistics systems that can handle international deliveries seamlessly. As a result, several countries, particularly Asia and Latin America, are investing heavily in improved roads, ports, and airports to facilitate increasing transport demands. These advancements are crucial for handling the volume of goods in transit, especially in rapidly growing economies that rely on efficient logistics infrastructure to support manufacturing and exports. Also, there's a greater push towards environmental-friendly practices, with businesses beginning to employ electrically powered delivery trucks, renewable power, and sustainable packaging to mitigate pollution. This shift is creating new opportunities in the logistics sector, where companies are adopting electric vehicles (EVs) and other green alternatives to meet sustainability goals and align with global environmental standards. Further, positive government regulations, favorable trade policies, and growing public-private partnerships are also supporting the expansion of the logistics sector geographically. Governments are introducing favorable trade policies to encourage international logistics, and public-private collaborations are further boosting investment in logistics infrastructure, including cold-chain systems for sensitive goods.

To get more information on this market, Request Sample

The United States emerges as a major market for logistics due to improvements in transport infrastructure. Ongoing improvement of ports, roads, and rail connections is making it simpler and swift to move commodities across the nation. The introduction of smart infrastructure such as automated warehouses and autonomous delivery systems is further enhancing the efficiency of logistics operations, enabling faster delivery times and reducing operational costs. As per logistics market insights, the increasing requirement for on-demand shipping and changing customers' preferences to receive quick deliveries are forcing logistics providers to invest in state-of-the-art technologies like intelligent delivery systems and automated warehouses. Advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and real-time tracking systems are enhancing the speed and accuracy of deliveries, enabling companies to respond better to shifting consumer demands. Moreover, the strong growth within industries like healthcare, e-commerce, and retail is leading to a high need for reliable and effective supply chain solutions within the region. The healthcare industry's increasing reliance on rapid and secure transportation of medical goods, including pharmaceuticals and vaccines, is driving demand for specialized logistics solutions that ensure product integrity during transit.

Logistics Market Trends:

Impact of Technological Advancements

Technology developments are transforming the logistics sector by making processes more efficient, faster, and accurate. Artificial intelligence (AI) and machine learning (ML) are used to enable predictive analytics to enhance demand forecasting, routing optimization, and inventory management. According to industry reports, nearly 78% of supply chain leaders say they have achieved tremendous operational advantages through AI-based logistics solutions.

According to the logistics market forecast, blockchain technology is increasingly adopted for secure, transparent, and real-time tracking of shipments across borders. Further, the deployment of Internet of Things (IoT) devices in warehouses as well as vehicles enables real-time tracking of goods, thereby increasing end-to-end visibility down the supply chain. These technologies are facilitating improved decision-making and reduced reaction times, thereby increasing the scalability and reliability of logistics companies.

Expansion of E-commerce

The growth of the e-commerce sector is one of the major drivers expanding the logistics market share. Consumers are looking for fast and guaranteed delivery, hence logistics operators are adopting flexible and quicker delivery solutions to fulfill customer requirements. Apart from this, retailers and e-commerce platforms are investing in last-mile delivery networks to make sure that products are delivered to customers promptly.

According to the logistics market research report, the growth of online shopping also drives demand for robust warehousing solutions and inventory management systems to handle higher volumes of goods. For instance, the estimate of United States retail e-commerce sales for the Q1 of 2025 totalled USD 275.8 Billion. The e-commerce boom has created new opportunities in the logistics sector, prompting the development of specialized delivery solutions to address the specific needs of online retailers.

Globalization of Trade

Globalization of trade continues to be a major factor shaping the logistics market trends. As businesses expand internationally, logistics providers are required to manage more complex supply chains and navigate varying regulatory environments. The globalization trend drives the demand for efficient customs management, freight forwarding, and cross-border transportation services. International trade agreements, such as those facilitated by the World Trade Organization (WTO), have also simplified border procedures, enabling quicker movement of goods. For instance, on May 6, 2025, India and the United Kingdom concluded a comprehensive Free Trade Agreement (FTA), marking a significant milestone in bilateral economic relations. The FTA eliminates tariffs on approximately 99% of Indian exports, enhancing market access for key sectors such as textiles, engineering goods, and services, including IT and finance.

In addition to this, the global connectivity offered by advanced logistics networks has increased trade between emerging markets and developed economies, and this interconnectedness fosters competition, ultimately improving the efficiency and scale of logistics operations. Moreover, the rising need for warehousing facilities in strategic international hubs has expanded logistics infrastructure on a global scale.

Increasing Consumer Demand for Faster Delivery

Consumer demand for faster delivery is a key trend reshaping the logistics market. With the rise of e-commerce and increasing expectations for convenience, consumers now expect their products to arrive at their doorsteps in shorter time frames. This shift in consumer behavior has led logistics companies to adopt faster shipping solutions, including same-day and next-day delivery. For instance, on May 7, 2025, Amazon announced a significant expansion of its Same-Day Delivery service across Europe. The company plans to introduce this service in 20 additional European locations within the next 12 months.

Companies are optimizing last-mile delivery networks by using smaller, more agile vehicles and leveraging technology to plan the fastest routes. The demand for speed is also prompting increased collaboration between retailers and logistics service providers to ensure the timely delivery of goods. This trend has intensified competition among logistics firms, encouraging innovation and efficiency improvements to meet consumer expectations.

Environmental Concerns

Environmental concerns are increasingly influencing the market, prompting companies to adopt more sustainable practices. The European Environment Agency predicts that, by 2050, global logistics could account for 40% of worldwide carbon emissions unless effective measures are implemented. This has led to an increased pressure to reduce the environmental footprint of transportation and warehousing. Companies are transitioning to eco-friendly delivery options, such as electric vehicles (EVs) and alternative fuels, to lower carbon emissions.

Additionally, there is a growing trend towards optimizing supply chains to minimize waste and improve energy efficiency. Logistics companies are also adopting green warehouse technologies, such as solar-powered systems and energy-efficient lighting, to reduce their environmental impact further. With consumers becoming more environmentally conscious, businesses are responding to market demand for greener logistics solutions. Regulatory pressures and incentives, such as carbon taxes and sustainability certifications, are driving the adoption of sustainable practices across the logistics sector.

Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global logistics market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on model type, transportation mode, and end use.

Analysis by Model Type:

- 2 PL

- 3 PL

- 4 PL

The 3PL (Third-Party Logistics) model holds the largest segment in the logistics market with a share of 56.3%. The need for cost-effective and flexible logistics services is fostering the rapid growth of the 3PL (Third-Party Logistics) segment. Most companies are opting to outsource logistics requirements so they can concentrate on their core business. Third-party logistics services offer experience in aspects such as warehousing, transport, and stock management. Due to the increased expansion of e-commerce, firms require streamlined and efficient delivery processes to fulfill customer demands, thus fueling the need for 3PL services higher.

Besides that, ongoing technological improvements are also enhancing 3PL services. Solutions such as cloud systems, real-time monitoring, and automation enable providers to manage processes more efficiently and deliver quicker. With businesses venturing into international markets, they require solid logistics support from one country to another. Third-party logistics companies are fulfilling this requirement by providing more intelligent, technology-enabled services that facilitate easier international shipping and supply chain activities.

Additionally, 3PL providers are increasingly offering value-added services like packaging, custom clearance, and last-mile delivery optimization, which help improve overall operational efficiency for businesses. The integration of artificial intelligence (AI) and machine learning in predictive analytics for demand forecasting, along with enhanced route optimization, further streamlines operations and lowers costs for companies. With the rise of on-demand services and the shift to global e-commerce markets, 3PLs are providing essential flexibility, adaptability, and scalability for businesses, driving their dominance in the logistics sector.

Analysis by Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

The roadways segment leads the market with 59.2% of the logistics market share due to its flexibility, low cost, and wide network across regions. It facilitates the transportation of products across short and far distances, with door-to-door delivery, which is vital in ensuring timely and effective distribution. The need for last-mile delivery services, particularly from e-commerce firms, continues to drive road transport growth even further.

Technological advancements in fleet management, including GPS tracking, route planning software, and other intelligent fleet management systems, assist in reducing delivery times and costs. Governments and private investors are also investing in improved roads and highways. With the increasing demand for quick and smooth deliveries, road transport is likely to continue as a dominant segment in the logistics sector.

The adoption of electric and autonomous vehicles within road transport is further enhancing efficiency and sustainability. As environmental regulations tighten and consumer demand for eco-friendly services increases, logistics providers are making the transition to low-emission and self-driving trucks, which will reduce operational costs and improve delivery speeds. Additionally, the continuous development of smart infrastructure, such as connected roadways and advanced traffic management systems, is optimizing road transport, enabling smoother and faster movement of goods. With increasing urbanization and the growth of e-commerce, road transport will remain crucial for effective logistics solutions, further solidifying its dominance in the logistics market.

Analysis by End Use:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The manufacturing market accounts for 16.8% of the logistics market share. It is driven by the requirements for a more effective and reliable supply chain to meet schedules of production. Manufacturers often rely on the logistics provider to source raw materials, manage inventory, and get finished products to the right distributors. With the rise of just-in-time inventory and lean manufacturing, there's growing pressure to avoid delays and keep operations running smoothly. This is increasing the need for well-organized logistics support.

Many factories are utilizing the internet of things (IoT) and automation, which is placing demands for more complex kinds of logistics services such as real-time tracking and prediction analytics. The continued expansion of global supply chains, along with the growing complexity of production processes, ensures that the need for logistics services in manufacturing will remain strong in the coming years.

As manufacturers increasingly adopt Industry 4.0 technologies, including robotics and AI in production lines, the demand for advanced logistics solutions that can provide real-time data on inventory and production schedules will surge. Additionally, the growing shift towards on-demand manufacturing and shorter product life cycles is putting more pressure on manufacturers to optimize their logistics networks to ensure faster time-to-market. The incorporation of predictive analytics in the logistics processes also supports the growing complexity of manufacturing, helping companies to proactively address potential disruptions and optimize supply chain performance.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia Pacific commands the highest logistics market share, with a significant percentage of 48.7%. Sustained industrial growth, urbanization, and a rapidly expanding e-commerce industry are increasing the need for logistics services in the Asia Pacific. The region is known to be home to nine of the busiest container ports in the world, and its surface freight transport moves more than 40% of the total global volume, highlighting its pivotal role in world supply chains. In addition, regional freight demand will nearly triple by 2050 due to increasing manufacturing, retail, and online shopping. Regional governments are also encouraging environmentally friendly logistics practices with different policies, which are leading to the uptake of sustainable options such as electric vehicles, green energy, and streamlined supply chains. Major logistics firms are making investments in the region, contributing further to logistics market growth. Hence, Asia Pacific will be the dominant player in the world's logistics Industry.

The rapid development of smart cities and infrastructure projects in Asia Pacific is also facilitating better logistics performance, enabling faster and more efficient transportation networks. The rise of the middle class in countries such as China, India, and Indonesia is driving increased domestic consumption, leading to a boost in regional trade and logistics needs. In addition, the ongoing shift towards automation and digitalization of logistics services, including the use of robotics in warehouses and autonomous delivery vehicles, is helping to address labor shortages and improve operational efficiency. With the ongoing demand for more efficient and sustainable logistics solutions, Asia Pacific's logistics market is set to continue its growth and dominance in the global landscape.

Key Regional Takeaways:

Logistics Industry Analysis in the United States

In 2024, the United States accounted for over 82.60% of the logistics market in North America, propelled by strong infrastructure and technological advancements. The sector is growing as businesses incorporate automation and artificial intelligence (AI) to streamline supply chain operations. These technologies are assisting in error reduction, speeding up processes, and enhancing cost-effectiveness in logistics processes. Technological advances are also changing last-mile delivery, which is an important aspect of the supply chain. The application of autonomous delivery vehicles and drones is assisting companies in making faster deliveries and reducing operational costs.

In addition to this, rapid urbanization is playing a significant role in reshaping logistics needs across the region. According to the Central Intelligence Agency (CIA), 83.3% of the U.S. population was urbanized in 2023, which continues to shape demand for smart logistics networks and city-based distribution planning. Furthermore, the region's broad transportation system of road, railway, and aviation routes, as well as further investments in its infrastructure, further puts the region solidly in front of the market.

The rising popularity of online shopping is another major factor creating a positive logistics market outlook. Data from the United States Department of Agriculture (USDA) shows that in 2022, about 19.3% of frequent grocery shoppers purchased items online within 30 days. Responding to this need, e-commerce giants like Amazon and Walmart are investing in more responsive logistics operations. According to industry report, Amazon’s North American segment alone recorded a 13% year-over-year growth in 2022, reaching a consolidated value of USD 315.9 Billion.

Logistics Industry Analysis in Europe

The logistics market in Europe continues to benefit from efforts to improve cross-border connectivity. Among the most significant developments is the Trans-European Transport Network (TEN-T), which allows for the free flow of goods across the continent. Europe's robust trade alliances and geographical location also enhance the need for efficient and integrated transport networks. The growth of e-commerce and greater cross-border trade are fueling the demand for quicker, more affordable logistics services.

The use of online platforms and Internet of Things (IoT) solutions is gaining popularity in logistics operations throughout Europe. The technologies are assisting firms in tracking deliveries in real-time, fleet efficiency monitoring, and supply chain management. The integration of smart technologies, coupled with regulatory support and customer pressure, continues to sustain the market's consistent growth. Automation and robotics are incorporated into dispatch and storage systems for increased speed, accuracy, and labor productivity.

Sustainability is an emerging concern in the European logistics market. Firms are concentrating on minimizing waste, employing alternative fuels, and optimizing package use to achieve environmental objectives. The green logistics drive goes together with Europe's overall aim to reduce carbon emissions in general across industries. Furthermore, stringent European Union control regarding carbon emissions results in a higher number of freight transport operations with electric and hybrid trucks. In 2022, as per the European Commission (EU), emissions decreased by 1.3% or 42 Million Tons of CO2.

Logistics Industry Analysis in Asia Pacific

The logistics market in the Asia-Pacific region is growing quickly, driven largely by the expanding e-commerce sector. As more consumers shift to online shopping, companies are focusing on strengthening last-mile delivery to meet rising demand. According to the India Brand Equity Foundation (IBEF), the e-commerce gross merchandise value (GMV) in India reached USD 60 Billion in the fiscal year 2023, marking a 22% increase from USD 49 Billion in fiscal year 2022. This growth reflects the region’s increasing reliance on digital commerce and the need for fast, reliable logistics support.

Governments across Asia-Pacific are making substantial investments to support logistics development. These include the construction of smart ports, modernized rail systems, and upgraded transport corridors to address growing supply chain requirements. Improved infrastructure is helping reduce delivery times, support international trade, and accommodate the logistics needs of high-growth industries. These projects are essential in enhancing regional connectivity and improving the overall efficiency of freight movement.

The region is also advancing in technology use across logistics operations. Blockchain technology is being adopted to improve transparency and security within supply chains, ensuring more reliable tracking and reducing fraud risks. At the same time, innovations in cold chain logistics are supporting sectors such as pharmaceuticals, where temperature-controlled transport is critical. According to IBEF, India’s pharmaceutical industry recorded a compound annual growth rate (CAGR) of 6–8% between fiscal year 2018 and fiscal year 2023, with exports rising by 8% and the domestic market growing by 6%. These trends highlight the increasing requirements for specialized logistics services in Asia-Pacific.

Logistics Industry Analysis in Latin America

The logistics market in Latin America is undergoing major changes due to increased investments in infrastructure. Governments across Latin America are prioritizing the improvement of roadways, railroads, and ports so that trade can happen faster and more reliably. These upgrades are particularly crucial for high-volume industries like farming and mining that are heavily dependent on efficient logistics networks. Increased connectivity is reducing delays, costs, and access to domestic and foreign markets.

The growth of e-commerce is also at the forefront of determining logistics trends in the region. With more frequent online purchases, logistics companies are using new technologies to provide services to remote and rural locations. Drone deliveries and mobile applications are being researched as methods to enhance last-mile delivery. E-commerce is rapidly expanding in Brazil. According to the International Trade Administration (ITA), Brazil recorded an e-commerce growth rate of around 14.3%, reflecting its strong market position in the region.

An expanding manufacturing base and growth in regional trade are also driving logistic market demand in Latin America. Investments in port modernization and transport network expansion are enhancing overall efficiency. Regional cooperation and trade agreements are streamlining cross-border logistics, allowing businesses to transport goods across borders easily. Moreover, growing consumer spending and supply chain technology adoption are propelling better market performance throughout the region.

Logistics Industry Analysis in the Middle East and Africa

Middle East and African logistics firms are investing heavily in cutting-edge technologies to make their operations more robust. Robotics and artificial intelligence (AI) are integrated into supply chain functions to enhance efficiency, accuracy, and responsiveness. The technologies are aiding in streamlining logistics operations, making them more agile and responsive to meet increased demands, particularly from the booming e-commerce market in the region.

The area is experiencing rapid expansion in cross-border trade, which is driving major infrastructure investments. Intelligent ports and logistics centers are being developed to facilitate the quick movement of cargo and prevent congestion. Countries such as the United Arab Emirates and Saudi Arabia are spearheading the efforts by constructing world-class logistics parks and positioning themselves as global logistics hubs. As per industry reports, the UAE logistics and freight market is projected to be worth USD 27 Billion by 2029, indicating the magnitude of investments being made.

Sustainable growth of the Middle East and African logistics market is being fueled by quick urbanization, increased trade volumes, and enhanced infrastructure. The geographical location of the region, with major ports within the UAE and Egypt, positions it as a critical transportation hub for global trade routes. Government efforts to improve transportation infrastructure and create free trade zones are also supporting market growth, enabling the region to cope with growing need and enhance competitiveness in international logistics.

Logistics Market Key Challenges:

The industry is constantly confronted with problems such as expensive fuel, broken supply chains, driver shortages, and inefficient last-mile delivery. A lack of proper infrastructure in emerging economies and unforeseen disruptions such as geopolitical tensions or harsh weather further worsen the challenges. Also, poor coordination between stakeholders tends to lead to delayed shipments and higher operating costs.

However, to address these issues, businesses are increasingly spending money on digital logistics platforms that provide real-time monitoring, route planning, and data-driven decision-making. The integration of IoT sensors, AI-powered predictive analytics, and automated warehouses can optimize operations, delay reduction, and increase transparency. In addition, coordination among logistics service providers, technology players, and policymakers is crucial to creating more resilient and responsive supply chains.

Top Companies in the Logistics Market:

The market is highly competitive, with market players taking several endeavors to dominate the market. Most of the activities include transportation management, where companies create the most efficient routes using GPS tracking and route plan software to reduce costs. The companies also ensure effective deliveries on time. Besides this, warehousing is another important core function, and logistics firms rely on inventory management that can be automated and checked in real time to ensure smooth work.

Significant investments are made in last-mile delivery solutions to satisfy the increasing consumer demand for rapid, flexible, and affordable services. Moreover, several logistics providers are embracing sustainability initiatives, such as using green transportation options and environmentally friendly packaging, to lower the environmental impact. Partnerships and collaborations with e-commerce businesses are becoming more common, especially as logistics players strive to streamline supply chains and enhance customer experience, particularly amidst the growing trend of online shopping.

The report provides a comprehensive analysis of the top logistics companies in the market with detailed profiles of all major companies, including:

- J.B. Hunt Transport Services

- C.H. Robinson Worldwide, Inc.

- Ceva Holdings LLC

- FedEx Corp.

- United Parcel Service, Inc.

- Expeditors International of Washington Inc.

- XPO Logistics Inc.

- Kenco Group

- Deutsche Post DHL Group

- Americold Logistics, LLC

- DSV Air & Sea Inc.

Latest News and Developments:

- March 2025: APL Logistics inaugurated its first-of-its-kind Marunda Flow Center in North Jakarta’s KBN Marunda Industrial Zone, strengthening Indonesia’s logistics infrastructure. Spanning 32,000 square meters, the facility features advanced automation, high-speed scanning, and a 20,000 CBM capacity, supporting seamless cargo movement. With LEED Silver certification, solar power integration, and future plans for barge services, the center reinforces Indonesia’s sustainable trade growth.

- March 2025: DB Schenker announced that its FUSO eCanter electric trucks successfully operated in Finland for one year, enduring temperatures as low as -30°C. Primarily used for local and regional deliveries, these high-speed electric vehicles proved reliable even in the extreme conditions of Lapland. This initiative highlights DB Schenker’s leadership in sustainable logistics and decarbonized transport.

- May 2025: DHL Group announced a global partnership with Shopify to integrate DHL’s shipping services directly into the Shopify Shipping platform. This move enables millions of Shopify merchants worldwide to access DHL’s global logistics network with streamlined cross-border shipping and simplified customs processes. Currently live in the U.S. and Germany, the service will expand globally throughout 2025 and 2026.

- August 2024: To support D2C brands, new-age logistics provider Delhivery has introduced dark stores. The micro-warehousing facilities will be shared, this means companies can share the same for efficient delivery within a rapid two-to-four-hour window.

- October 2024: Industrial & Logistics Parks by the TVS group has assured an investment of INR 200 crore (USD 24 Million) in making a world-class logistics hub in Pithampur, Madhya Pradesh, spread over 20 acres acquired from the Madhya Pradesh Industrial Development Corporation. 25 km from Indore, the new logistics hub will be located in high demand for premium warehousing solutions in the region.

- December 2024: Sumadhura Group has launched a high-tech warehousing facility for Zepto, India's leading quick commerce company, and NX Logistics India, global logistics leader, at Bengaluru's largest Grade-A+ warehousing hub - Sumadhura Logistics Park. This strategic development creates one of Zepto's most advanced logistics centers, engineered to enhance its supply chain efficiency and support its fast-growing operations in the region.

- December 2024: Amazon has used its experience in logistics to provide seamless solutions to businesses all over India. These services include transparent pricing and easy integration and are both B2B and B2C for companies of all sizes.

- March 5, 2025: UPS, a global logistics company, announced an agreement with Dubai South to establish a new facility within its Logistics District. This strategic initiative aims to bolster UPS's expansion efforts in the Middle East and Africa region. The facility is expected to enhance trade connectivity by leveraging Dubai South's multimodal transport infrastructure.

- March 11, 2025: DPD UK declared that foreign delivery services would now be available at all UK Post Office locations. Through this program, consumers may send packages overseas using DPD from 3,600 participating Post Office locations, increasing ease and opening up international shipping options. The collaboration facilitates international logistics by using a reliable national network to serve both individual and small business clients.

Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Trillion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Companies Covered | J.B. Hunt Transport Services, C.H. Robinson Worldwide, Inc., Ceva Holdings LLC, FedEx Corp., United Parcel Service, Inc., Expeditors International of Washington Inc., XPO Logistics Inc., Kenco Group, Deutsche Post DHL Group, Americold Logistics, LLC, DSV Air & Sea Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the logistics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The logistics market was valued at USD 5.65 Trillion in 2024.

The logistics market is projected to exhibit a CAGR of 4.02% during 2025-2033, reaching a value of USD 8.07 Trillion by 2033.

The global market is majorly driven by e-commerce growth, continual advancements in technology like IoT and automation, rapid globalization of trade, and infrastructure development. Additionally, increasing demand for sustainable solutions and consumer expectations for faster, more efficient delivery services further fuel the market's expansion.

Asia Pacific currently dominates the logistics market, accounting for a share exceeding 48.7%. This dominance is fueled by rapid industrialization, e-commerce growth, and strategic infrastructure investments.

Some of the major players in the logistics market include J.B. Hunt Transport Services, C.H. Robinson Worldwide, Inc., Ceva Holdings LLC, FedEx Corp., United Parcel Service, Inc., Expeditors International of Washington Inc., XPO Logistics Inc., Kenco Group, Deutsche Post DHL Group, Americold Logistics, LLC, and DSV Air & Sea Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)